[ad_1]

Sadi Maria/iStock Editorial through Getty Photos

We’re formally three months into the existence of spot Bitcoin (BTC-USD) ETFs in america market. With roughly every week remaining till Bitcoin’s subsequent block reward halving, I believe it is price taking a chicken’s eye view of how Bitcoin is definitely being adopted to date in 2024. On this put up, we’ll take a look at US ETF flows, the state of the Lightning Community, and why Bitcoiners might need to contemplate the Bitwise Bitcoin ETF (NYSEARCA:BITB).

Bitcoin vs Gold ETF Flows

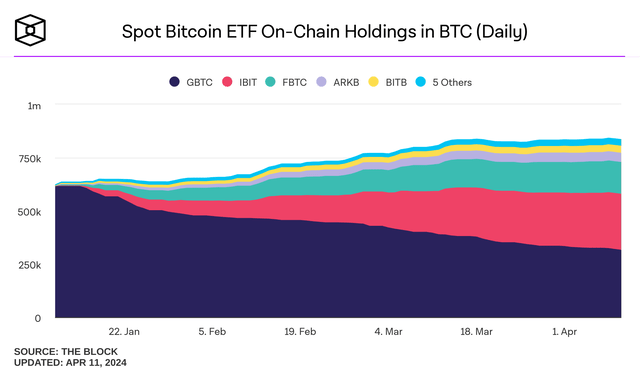

From an asset below administration standpoint, I do not assume there might be a lot debate that these merchandise have been an unlimited success to date for in bringing BTC publicity to the broader funding group:

BTC ETF Cumulative Internet Stream (The Block)

Even when adjusting for the 49% BTC-denominated AUM puke from the Grayscale Bitcoin Belief ETF (GBTC) since ETF conversion, the cumulative web move of BTC into US-based spot ETFs is over 220k BTC. At a $71k Bitcoin worth, the web move of property below administration represented by these funds is nearly $16 billion. This contrasts with Gold (XAUUSD:CUR) ETFs which have seen roughly 113 tonnes come out of the funding merchandise because the begin of the 12 months:

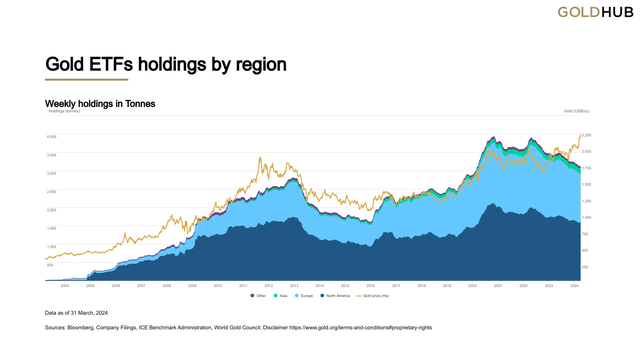

International Gold ETF Stream vs Gold Worth (World Gold Council)

There was an comprehensible conflation amongst some within the Bitcoin group that Bitcoin ETF influx has someway come on the expense of Gold ETF outflow. For my part, this relationship has been exaggerated and I spent a while dissecting what I imagine is admittedly occurring in a latest article for Looking for Alpha overlaying the Sprott Bodily Gold Belief (PHYS).

Particularly, Gold began leaving ETFs shortly following US/EU monetary sanctions on Russia as international central banks have begun to attenuate their publicity to the US debt debacle. Coupled with the concept that there are extra claims on Gold than can really bodily be delivered, it should not be a shock that the value of Gold is doing what it is doing. That is what I stated on my private weblog in early April:

There are 7.5 billion ounces of Gold above floor. When Gold was $2,000/oz manner again in February, the worth of all of the yellow steel was $15 trillion. As of market shut right now, Gold’s above floor market capitalization is slightly below $17.5 trillion. Bitcoin’s market cap is a little bit over $1.3 trillion. That means Gold simply grew by about two Bitcoin market caps in a matter of some weeks.

This, I believe, gives context on the magnitude of what’s occurring proper now. And whereas it is thrilling to see the “quantity go up” positive factors in Bitcoin from all of this optimistic BTC web move over the past 3 months, I do assume it is price declaring that BTC wasn’t designed for this sort of “adoption.” And the long-promised scaling the community on L2s has merely not lived as much as the hype.

Lightning Community

For as a lot promise because the Lightning Community appeared to have, I do not assume we are able to realistically say it has achieved what many throughout the group have hoped it could – myself included. Whereas I am not on Nostr, I’ve used a couple of functions that make the most of Lightning on the again finish. In my private opinion, the UE continues to be not nice. And albeit, excessive base layer charges problem the utility of Lightning as a result of the scaling layer nonetheless requires opening and shutting channels on Bitcoin. Moreover, batching transactions that value nearly nothing is not a worthwhile endeavor when base layer charges get excessive.

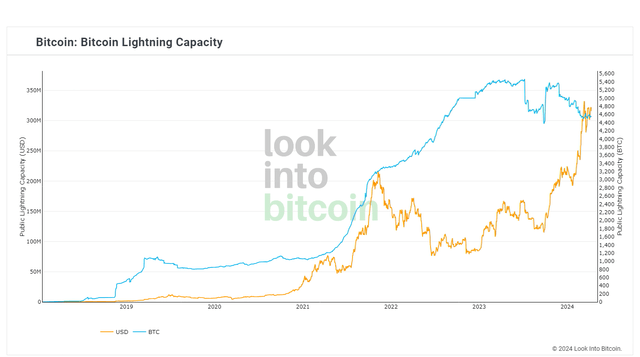

Lightning Capability (LookIntoBitcoin)

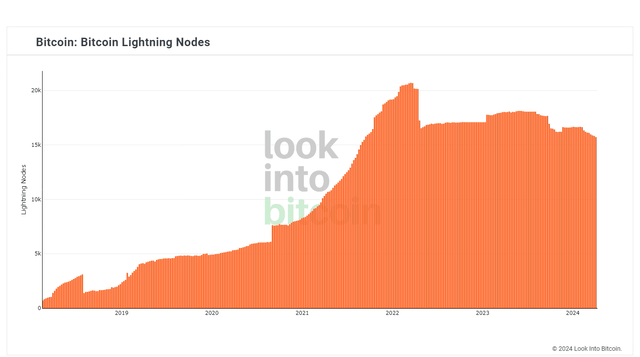

However do not even take my very own opinion for it, capability development on Lightning measured in BTC peaked 9 months in the past. Regardless of Lightning Community being in growth for years, there’s actually extra BTC on Arbitrum (ARB-USD) through Wrapped Bitcoin (WBTC-USD) than on Lightning. Nodes have been dropping as nicely and that pattern really peaked two full years in the past:

Lightning Nodes (LookIntoBitcoin)

Every of those metrics had been rising main as much as the final halving in 2020 and that is merely not the case this time round. Between Lightning, Liquid, and Merlin – every of that are thought of “L2” networks – we get a complete of roughly 35k BTC on Bitcoin scaling networks. That is clearly dwarfed by the 220k BTC that has flowed to US-based ETFs. In the end, it is all in regards to the charges and it simply is not value efficient to have small quantities of Bitcoin on the bottom layer any longer.

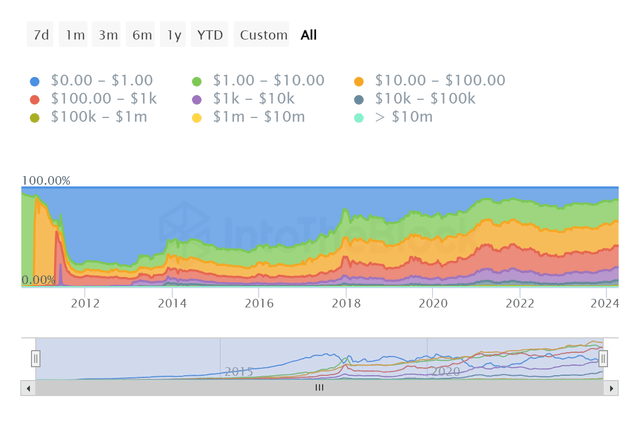

Deal with breakout (IntoTheBlock)

Contemplate this: on April tenth, the common Bitcoin transaction charge was $9. At that quantity, about 34% of the 51.5 million non-zero steadiness addresses haven’t got sufficient BTC to pay to maneuver it. That may be a vital downside for a community that was initially designed for peer to look transactions and it explains the narrative pivot to “retailer of worth” throughout and following the block dimension battle. It additionally clearly reveals the basic concern with onboarding to Lightning; it is not economical for the form of customers who profit from L2s to truly get to them from the first layer.

All of this isn’t meant to dunk on Bitcoin or its extra diehard supporters. I am nonetheless very a lot rooting for the success of Bitcoin personally and keep fairly a little bit of publicity to the coin. However in my opinion we’ve got to have a look at these networks with out blinders on and settle for that Travis Kling’s evaluation of this trade is probably not all that far off at this time limit. The excellent news is it would not must be this manner.

Funding Growth through Bitwise’s Bitcoin ETF

The scaling points that the Bitcoin community presently has might be addressed. For my part, actual on-chain adoption by way of utilization can solely additional strengthen the worth proposition of the community. The Bitwise Bitcoin ETF is one in every of two ETFs that presently plans to fund Bitcoin growth by way of the charges that the ETF holders pay the corporate. Per Bitwise’s press launch asserting this intention:

The donations don’t have any strings hooked up and will probably be made yearly for at the very least the subsequent 10 years.

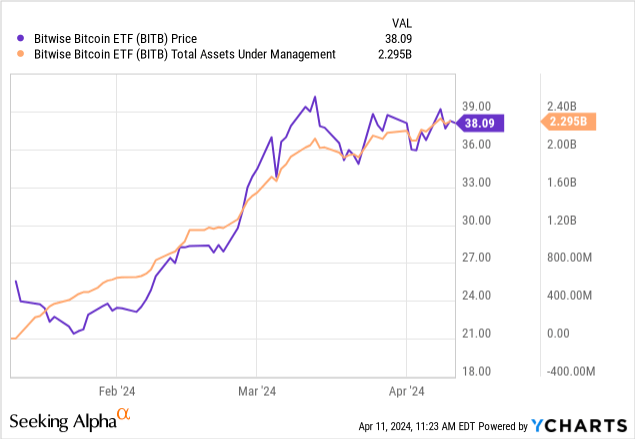

For BITB holders, 10% of Bitwise’s income have been dedicated to funding three totally different non-profit builders. These recipients are Brink, OpenSats, and Human Rights Basis. Initially, Bitwise waived the BITB administration charge for both 6 months or $1 billion in AUM:

Because the fund is now nicely forward of that $1 billion AUM determine, the expense ratio for BITB shares is 0.20% and BITB holders at the moment are not directly funding non-profit Bitcoin growth. Along with funding growth, 0.2% is without doubt one of the best charges out there.

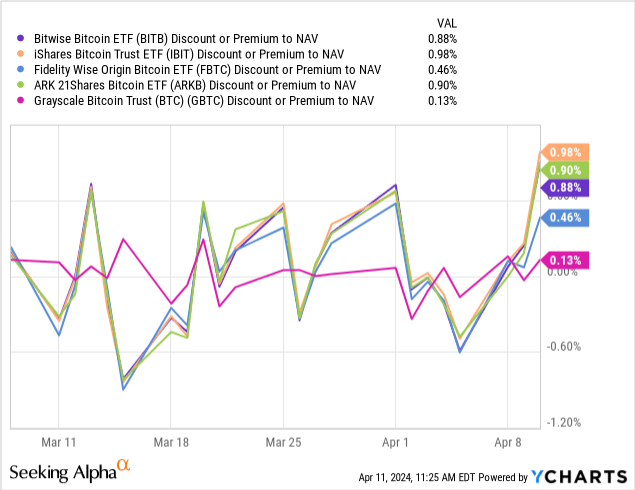

BITB does sometimes commerce at a small premium to web asset worth and that is one other potential issue to contemplate. Although it is from the one fund that’s presently buying and selling barely above the BTC worth underlying the shares.

Dangers

Digital property will not be tangible. For my part, there is a cause why actual Gold is flowing out of ETFs whereas “digital gold” is flowing into them. That stated, there’s a super quantity of religion, vitality, and {hardware} backing Bitcoin that I believe goes to be exceedingly tough to interrupt. On the earth of public blockchain networks, Bitcoin is by far essentially the most decentralized community and thus carries a component of “security” that lots of the different blockchain networks possible lack. Nevertheless, that notion of security might definitely change as US regulators and authorities actors seem like getting extra aggressive in combating this trade. And that brings us to the true cause so many nonetheless swear by Bitcoin regardless of its flaws.

Abstract

In the end, Bitcoin stays largely an anti-fiat commerce. And regardless of there being an unlimited quantity of competitors within the anti-fiat realm each out and in of crypto, BTC and its many proxies are most likely nonetheless the quickest horses in that race. If one can settle for holding Bitcoin with at least three layers of intermediaries, than BITB could be one of many extra principled choices out there as the corporate will probably be funding non-profit builders not named Blockstream.

The halving occasion is a crucial reminder that the community is secured by entities that require incentives to proceed securing that community. At a sure level, miner income from transactions goes to must develop into a extra significant portion of complete income for these operators. I’d argue transaction share development due solely to a shrinking complete reward pie is the mistaken solution to incentivize that safety. Issues for the longer term, maybe. For now, “quantity go up” and “greenback down” are nonetheless adequate causes to hoard cash in 2024 in my opinion.

[ad_2]

Source link