[ad_1]

ArtistGNDphotography/E+ by way of Getty Photographs

By Peter C. Earle

The annual ritual often called Black Friday takes on renewed significance in 2023. This 12 months’s procuring extravaganza will function a litmus check for the energy of the American shopper and, consequently, the broader well being of the US economic system.

As residents proceed to grapple with inflationary pressures amid rising rates of interest, rising unemployment, and declining private monetary well being, shopper spending is among the many few sources of present financial growth.

Inflation has turn into the defining characteristic of the patron panorama of the previous few years. The financial shadow solid by financial coverage interventionism within the face of the COVID pandemic.

It saps customers’ buying energy, undermines retailers’ pricing methods, and roils each financial calculation and monetary administration. A lot has been stated at AIER in regards to the more and more questionable state of spending capability over the previous quarter or so.

Though Black Friday is a day of reductions, rebates, and different gross sales promotions, analyzing the worth modifications within the most-marketed merchandise classes might present some insights as to what customers face this 12 months.

Empirically, the classes of products which might be probably the most incessantly discounted on Black Friday embrace the next:

Audio Tools Cable Satellite tv for pc and Stay Streaming TV Providers Shopper Home equipment Cosmetics, Fragrance, Bathtub, Nail Preparations and Implements Footwear Furnishings and Bedding Hair, Dental, Shaving, and Miscellaneous Private Care Merchandise Family Tools and Furnishings Jewellery And Watches Males’s and Boys’ Attire Private Computer systems and Peripheral Tools Sports activities Tools Sports activities Autos Together with Bicycles Phone {Hardware}, Calculators, and Different Shopper Data Objects Televisions Instruments {Hardware} and Provides Toys Video Tools Video Recreation {Hardware}, Software program, and Equipment Ladies’s and Ladies’ Attire

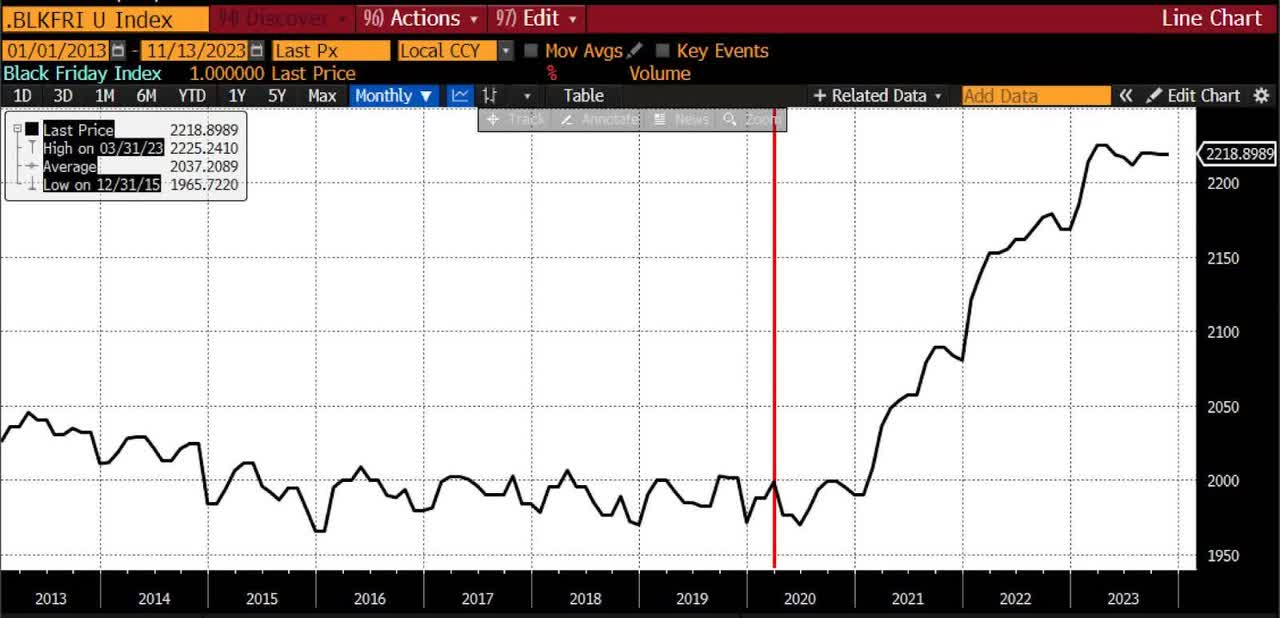

An index composed of the costs of these items during the last decade would monitor as follows.

(Supply: Bloomberg Finance, LP)

A number of parts are clear from the chart. First is the excessive diploma of seasonality within the mixture elements.

Second is the mildly deflationary pattern from 2013 by way of 2019, owing to the predominance of shopper applied sciences among the many Black Friday basket constituents.

And naturally, the fast rise in costs beginning in late 2020 is pushed by financial coverage (crimson vertical line) and financial stimulus. The modifications are proven within the desk beneath.

Black Friday Finish interval Basket Change (YoY) 11/13/2023 2218.899 2.30% 12/30/2022 2169.025 4.27% 12/31/2021 2080.27 4.60% 12/31/2020 1989.766 0.97% 12/31/2019 1970.916 0.08% 12/31/2018 1969.308 -0.74% 12/29/2017 1983.95 0.21% 12/30/2016 1979.687 0.71% 12/31/2015 1965.722 -0.91% 12/31/2014 1983.765 -1.35% 12/31/2013 2010.967 -0.45% Click on to enlarge

The costs of the mixed Black Friday items basket rose 4.6 p.c in 2021 and 4.27 p.c in 2022, whereas the typical inflation charge (CPI) in the USA was 4.70 p.c in 2021 and eight p.c in 2022.

Warning must be taken in inference drawn, nonetheless, as the worth modifications in particular classes of products have different and are smoothed by aggregation. The general improve on this basket of products is 12.53 p.c since 2019.

Black Friday is understood for little, in addition to reductions and melees. However the mixture of inflation (as depicted by the basket), the more and more beleaguered nature of the patron, and retailers’ tactic of elevating costs within the weeks and months earlier than Black Friday to recoup a lot of the pending reductions might lead to each decrease gross sales and shallower financial savings this 12 months.

(The rising adoption of restocking charges by retailers provides a brand new supply of expense to the patron expertise.)

Shopper spending accounts for roughly 70 p.c of GDP calculations, and is, for monitoring US enterprise cycles, an analytical crucial.

The American shopper has constantly defied expectations by sustaining sturdy spending patterns all through 2022 and 2023.

However with ongoing inflation eroding buying energy, a declining charge of saving, rising borrowing prices, and a seamless credit score contraction, constraints on potential consumption have gotten more and more formidable.

We aren’t predicting a Black Friday bomb, but it appears prudent to count on a softer spending surroundings going into the final 5 weeks of the 12 months.

On the very least, Black Friday and the 2023 vacation season will present an event to choose up priceless insights into the trajectory of US spending and consequently financial progress going into 2024.

Unique Submit

Editor’s Notice: The abstract bullets for this text have been chosen by Looking for Alpha editors.

[ad_2]

Source link