[ad_1]

ricardoreitmeyer

Early January this yr, I wrote a bullish article on Blue Owl Capital (NYSE:OWL) establishing a transparent purchase score contemplating the underlying concentrate on non-public credit score house, which reveals secular tailwinds.

One other driver behind the bull thesis right here was the comparatively enticing dividend of ~ 4% that together with resilient and rising asset base contributed to a very attractive purchase.

Because the publication of my article, some issues have modified.

On the one hand, OWL has issued full yr 2023 figures and despatched a number of optimistic alerts pertaining to its progress prospects.

However, the inventory has skilled a notable a number of growth, thereby bringing down the dividend yield and doubtlessly making a much less enticing entry level for traders, who need to go lengthy OWL.

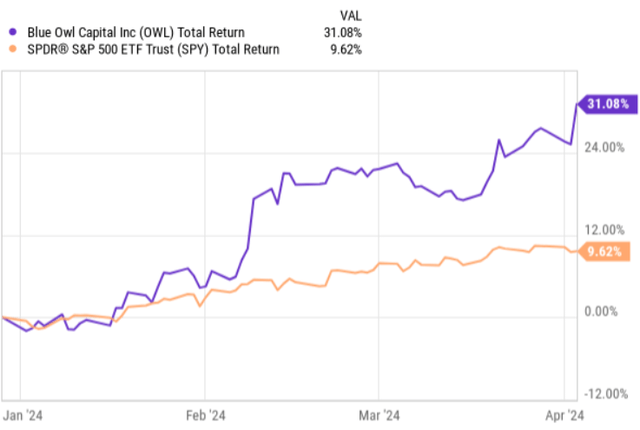

If we have a look at the chart beneath, we will see how OWL actually went ballistics outperforming the S&P 500 by an enormous margin on a YTD foundation.

Ycharts

On account of this, the dividend yield has dropped by greater than 100 foundation factors and on a ahead foundation, factoring within the reality of ~ 29% dividend improve from 2022 degree, the yield now lands at 3.03%.

Looking for Alpha

Let’s now dissect the latest earnings bundle to know what the important thing drivers had been behind this enormous spike within the inventory value, and, extra importantly, whether or not OWL nonetheless stays a sexy funding play on a go ahead foundation.

Thesis assessment

In a nutshell, the market’s response to OWL’s This fall, 2023 earnings bundle and the repricing of the share value have been totally in keeping with the strong dynamics within the underlying consequence.

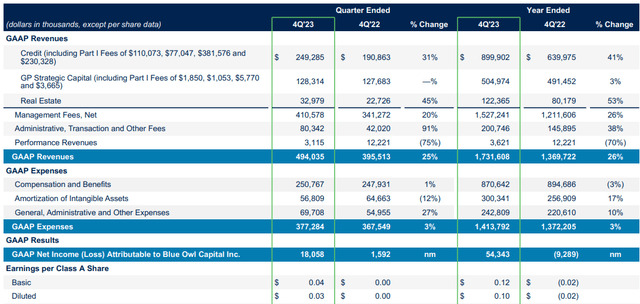

Yr 2023 together with the This fall knowledge have introduced improved outcomes throughout the board. OWL has efficiently managed to develop the asset base in all of its three primary segments: credit score, GP strategic capital and actual property segments. For asset administration companies like OWL having a bigger pool of capital within the portfolio will increase the bottom from which the administration and administrative charges might be charged to the purchasers.

As indicated within the desk beneath, internet administration price element (which is the important thing driver of OWL’s money flows) has continued to tick increased in This fall, 2023, whereas the whole bills have kind of remained flat. This dynamics completely captures the beautify of OWL’s enterprise, the place there are important economies of scale advantages as incremental flows into AuM per definition don’t require a lot increased price base, permitting the top-line (or administration charges) to freely feed into the underside line.

Blue Owl Earnings Deck 12.31.23

One of many main the reason why OWL has been so profitable is the favorable momentum within the non-public credit score house together with OWL’s bias in direction of this specific section. In 2023, the credit score portfolio accounted for ~ 60% of the GAAP revenues (and even increased share if we account for the exposures inside the GP Strategic Capital section).

Blue Owl has been one of many high fundraisers in each the non-traded BDC and rechannels with the gross flows of greater than $1.9 billion throughout the fourth quarter (up by 65% relative to Q1, 2023). These inflows have been roughly six occasions better than redemption requests. This might be deemed as a really optimistic signal contemplating that Q1, 2023 was already primarily based on powerful comparability and likewise taking into the account that the BDC house actually exhibited a growth throughout H1, 2023, when financial institution financing was extra constrained than it’s now.

When it comes to the true property section, OWL has performed it properly as properly by carrying an publicity to actual property sectors that haven’t gone out of vogue. Specifically, a lot of the publicity right here lies in the true property funds which are topic to on-shoring and e-commerce actions (i.e., industrial and manufacturing properties). Plus, OWL places an emphasis on triple internet lease technique, the place the credit score needs to be at investment-grade secured degree, thus avoiding additional the potential issues that at present sit within the general actual property house (e.g., struggling workplace inventory, capital outflows from low high quality REITs that wouldn’t have entry to sound financing and so forth.).

It is usually price highlighting Marc Lipschultz – Co-Chief Govt Officer – commentary in the newest earnings name that reveals some additional positives pertaining to the momentum in the true property section:

And so we’ve got, proper, at this level, our general backlogs are actually working at report highs when it comes to all of the issues in our pipeline, over $10 billion. So we’ve got loads to concentrate on. And naturally, additionally as we proceed to increase that attain into Europe.

With all of this being stated, the query nonetheless stays whether or not the magnitude of Blue OWL’s progress prospects justifies the present valuations. It’s apparent that the prevailing multiples have landed in a comparatively stretched territory and are considerably above the sector common.

But, we’ve got to contextualize this with the longer term progress.

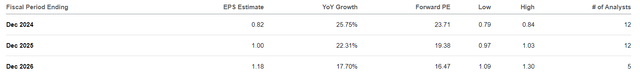

Based on the consensus estimate, the 3-year earnings outlook seems to be fairly sturdy with shut to twenty% in 2024-2026 interval.

Looking for Alpha

Given OWL’s pipeline in actual property and personal credit score segments, delivering such figures appears not that unimaginable. One other nuance that needs to be factored in is the advantages of scale, the place actually every incremental capital that OWL attracts generates increased internet money flows resulting from largely mounted price base.

The problem, nevertheless, might stem from the three following features:

The power to maintain above common administration charges because the competitors in non-public credit score and rising actual property segments tightens. OWL’s success in efficiently attracting massive scale capital flows that with every quarter should be bigger to maneuver the needle when it comes to the EPS technology. Potential slow-down in booming non-public credit score house as soon as the capital markets come again into play and the rates of interest begin to normalize. Throughout occasions of constrained capital markets exercise and excessive SOFR, which accommodates increased yields for personal credit score loans which are often primarily based on variable fee element create very favorable atmosphere for capturing strong returns.

The underside line

In my view, the market’s response to OWL’s This fall, 2023 incomes bundle by sending the inventory value 30% increased on a YTD foundation was largely justified. Whereas the present dividend yield has dropped by ~ 100 foundation factors and the multiples have elevated, the expansion outlook appears sturdy sufficient to warrant strong returns going ahead (e.g., emphasize to favored sectors, sturdy pipeline and the enterprise mannequin that advantages from scale).

Nonetheless, traders have to acknowledge that now there are extra aggressive assumptions baked into the cake that Blue Owl Capital has to satisfy to ship attractive outcomes. This additionally means that there’s a smaller margin of error embedded within the Inventory value, the place if, for instance, the non-public credit score growth begins to decelerate resulting from, say, lowered SOFR or the competitors tightens an excessive amount of inflicting OWL to revisit its above-average price ranges, the outcomes would endure accordingly.

Given the entire above and the ~ 30% Inventory value appreciation, in my view, whereas Blue Owl Capital continues to be an inherently enticing funding case, it’s price de-emphasizing this place by both taking house a part of the earnings and reinvesting elsewhere or not including extra to this place.

[ad_2]

Source link