[ad_1]

by Fintech Information Singapore

December 20, 2023

Purchase now, pay later (BNPL) preparations, a kind of short-term financing that permits clients to make purchases and pay for them in month-to-month installments, are rising strongly all over the world, selecting up steam amongst each clients and retailers. However regardless of elevated adoption of those novel fee strategies, BNPL profitability stays a problem, hampered by excessive fastened prices, growing funding bills and elevated delinquency charges, a brand new report by the Financial institution for Worldwide Settlements (BIS) says.

The report, titled “Purchase now, pay later: a cross-country evaluation” and launched by BIS, seems to be at completely different BNPL fee schemes, offering an outline of their enterprise fashions, discussing the advantages and prices for every agent, and mapping the standard profile of customers using these merchandise.

In response to the report, adoption of BNPL preparations is rising significantly quick amongst youthful grownup generations, who’re having fun with the benefits of instant purchases with deferred funds at no added price. Retailers, in the meantime, are benefiting from elevated conversion charges, a broadened buyer base, and better common transaction worth by providing BNPL fee choices.

Between 2019 and 2023, world BNPL exercise, measured by gross merchandise worth (GMV), elevated over sixfold, hovering from about US$50 billion to surpass US$350 billion, the report reveals. In the course of the interval, the same progress sample in BNPL app use was noticed, which grew from just a bit over 250k each day energetic customers in early 2019 to 2.5 million in 2023.

The rise of purchase now, pay later (BNPL), Supply: Purchase now, pay later: a cross-country evaluation, Financial institution for Worldwide Settlements, Dec 2023

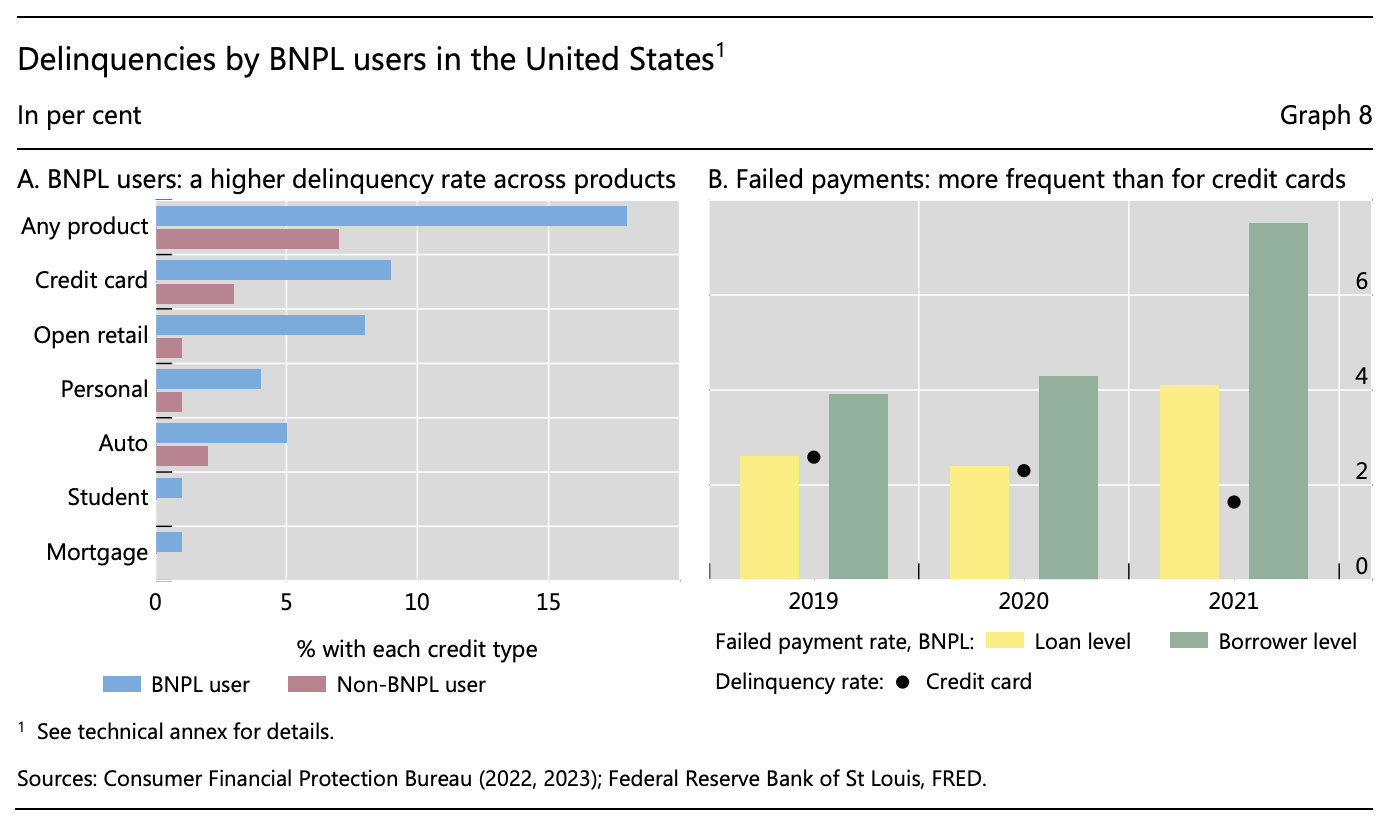

Taking a look at customers’ profiles, the report says that BNPL clients are typically usually youthful, with much less training. There may be additionally proof within the US that BNPL customers are inclined to have a riskier credit score profile than these of conventional shopper credit score merchandise.

BNPL is widespread with younger, lower-income and less-educated adults, Supply: Purchase now, pay later: a cross-country evaluation, Financial institution for Worldwide Settlements, Dec 2023

A 2022 report by the US Client Monetary Safety Bureau (CFPB) discovered that, on common, BNPL debtors are more likely to be extremely indebted, revolve on their bank cards, have delinquencies in conventional credit score merchandise and use high-interest monetary providers resembling payday, pawn, and overdraft in comparison with non-BNPL debtors.

These shoppers are additionally extra prone to have conventional credit score merchandise like credit score and retail playing cards, private loans, and pupil loans, however have decrease liquidity and financial savings in comparison with non-BNPL debtors. These findings counsel that BNPL preparations are most interesting to people who’re financially susceptible, posing dangers resembling accumulating debt and late charges.

Delinquencies by BNPL customers within the USA, Supply: Purchase now, pay later: a cross-country evaluation, Financial institution for Worldwide Settlements, Dec 2023

Elevated service provider adoption

Adoption of BNPL can also be growing amongst retailers, that are benefiting from elevated conversion, an expanded buyer base and elevated common ticket measurement. BNPL choices can scale back hesitation, encourage instant buying choices and lead clients to spend extra per transaction. These preparations may also appeal to a broader buyer base and provides retailers a aggressive edge.

Lastly, since BNPL platforms assume the credit score and fraud dangers related to the transactions, retailers are protected against potential monetary losses attributable to non-payment or fraudulent actions.

Service provider adoption of BNPL varies throughout jurisdictions, the report says, standing at a excessive of a 50% penetration charge within the Czech Republic to a low of about 10% in India.

Retailers extensively undertake BNPL options, Supply: Purchase now, pay later: a cross-country evaluation, Financial institution for Worldwide Settlements, Dec 2023

BNPL is a kind of installment mortgage that entails a buyer, a service provider and a BNPL platform. When a buyer chooses a BNPL choice in the course of the checkout course of, they undergo a fast utility course of. The BNPL platform then assesses their creditworthiness via a smooth credit score verify. As soon as the platform approves the credit score line, it pays the service provider the total quantity of the products bought, thus taking over the client’s credit score danger. Clients pay the primary installment upfront to the platform, whereas the residual quantity is often due in weekly installments.

BNPL preparations differ from conventional shopper credit score in that they’re prolonged on the idea of much less data. Additionally, BNPL credit score is often not communicated to credit score bureaus and, consequently, doesn’t have an effect on a shopper’s credit score rating. As well as, late funds will not be recorded, however extreme delinquencies might be.

Are BNPL corporations worthwhile?

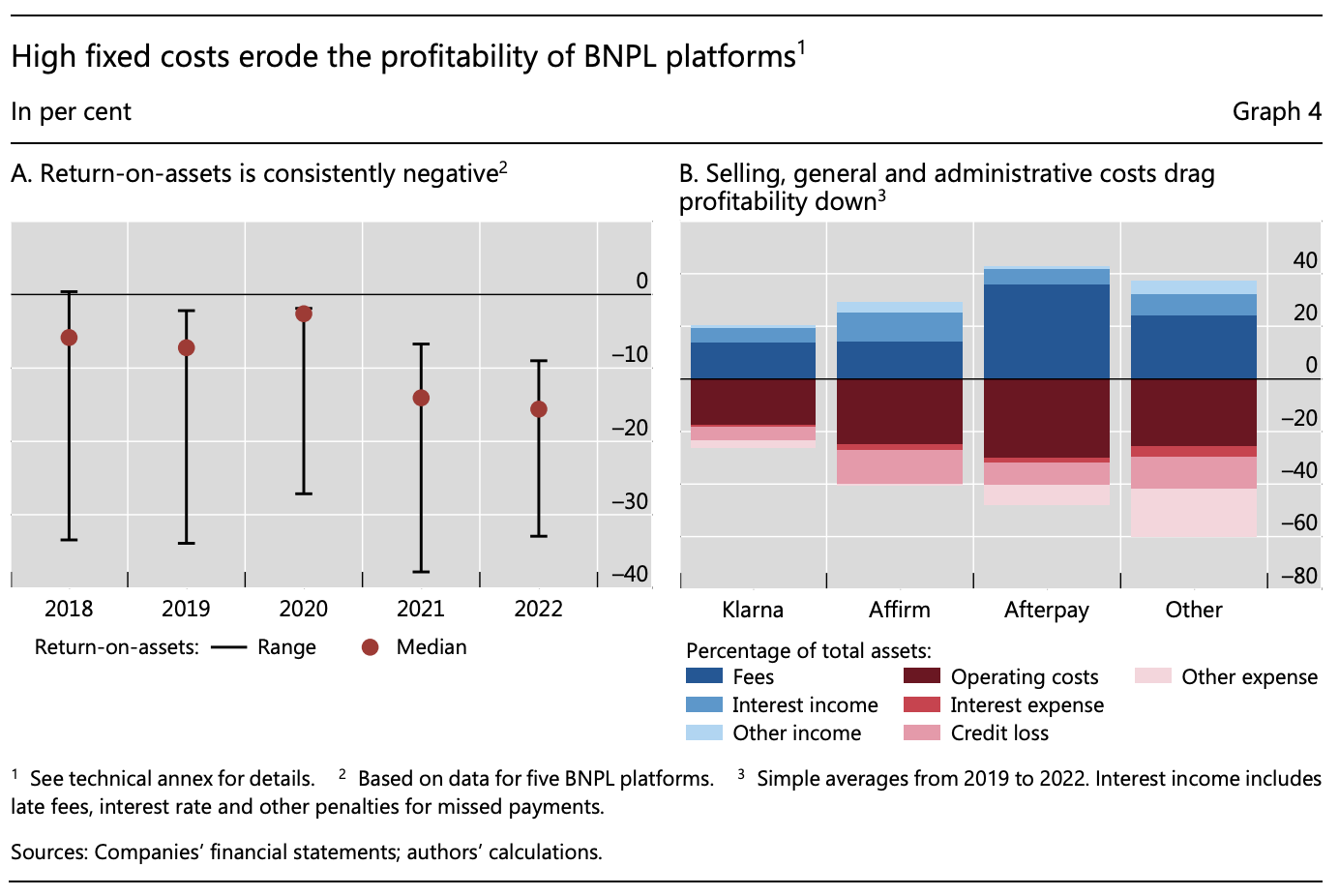

However regardless of elevated adoption amongst each shoppers and retailers, BNPL profitability stays difficult attributable to excessive working prices for advertising and marketing, administrative and expertise bills, which have prevented them from breaking even since 2018, the report says. As well as, BNPL companies are struggling to generate earnings from their property due to rising credit score losses and intensified competitors from neobanks and bigtechs getting into the BNPL market.

Excessive fastened prices erode the profitability of BNPL platforms, Supply: Purchase now, pay later: a cross-country evaluation, Financial institution for Worldwide Settlements, Dec 2023

Though these findings corroborate with what has been noticed out there, BNPL platforms have dedicated to reducing prices, bettering monetary performances and specializing in profitability.

Swedish BNPL chief Klarna reported in November its first quarterly revenue in 4 years, posting an working revenue of SEK 130 million (US$12.7 million) in Q3 2023 in contrast with a lack of SEK 2.1 billion (US$205 million) a 12 months earlier. These sturdy performances had been attributed to diminished credit score losses and enhancements in underwriting precision and accuracy.

Now that Klarna’s outcomes are seemingly on the right track, the corporate is reportedly getting ready for a doable inventory market itemizing.

Equally, American BNPL agency, which went public in 2021, reported its second straight quarter of profitability in Q3 2023, producing US$60 million in adjusted working revenue, versus a US$19 million loss in Q3 2022. Adjusted working margin stood at 12% in the course of the interval in comparison with -5% throughout Q3 2022.

Featured picture credit score: Edited from freepik

[ad_2]

Source link