[ad_1]

Pound Sterling (GBP/USD) Speaking Factors:

GBP/USD has slipped again after two days of beneficial propertiesThe prospect of upper US rates of interest for longer continues to dominateSome as-expected US jobless declare knowledge noticed Sterling losses deepen

Beneficial by David Cottle

Find out how to Commerce GBP/USD

The British Pound made preliminary beneficial properties towards america Greenback in Thursday’s European session, but it surely pared them via the morning and was within the crimson as US markets wound up.

Sterling was maybe nonetheless boosted early by Wednesday’s information that UK home costs rose on the quickest tempo since January final yr in December, and in addition by a basic enchancment in threat urge for food which has seen the Greenback pare beneficial properties towards many main rivals.

Nonetheless, information that US preliminary and persevering with jobless claims knowledge had are available roughly as anticipated noticed the dollar lengthen its lead. Preliminary claims totaled 218,000 within the week to February 3, just under the 220,000 economists anticipated. Persevering with claims within the week of January 27 have been 1,871,000, just under the 1,878,000 predicted. There was nothing right here to recommend that US rates of interest will probably be coming down any earlier than the Might Federal Reserve coverage assembly markets tentatively take note of.

There’s no first-tier financial knowledge from both the US or UK left this week, which can in all probability go away GBP/USD on the mercy of the assorted central financial institution audio system remaining on the calendar. Richmond Fed President Tom Barkin will converse after the European shut on Thursday. He has already stated this week that it ‘is sensible’ to be affected person in chopping rates of interest, and to attend and ensure that inflation is tamed. On this he echoed Chair Jerome Powell’s feedback of final week, which so supported the Greenback.

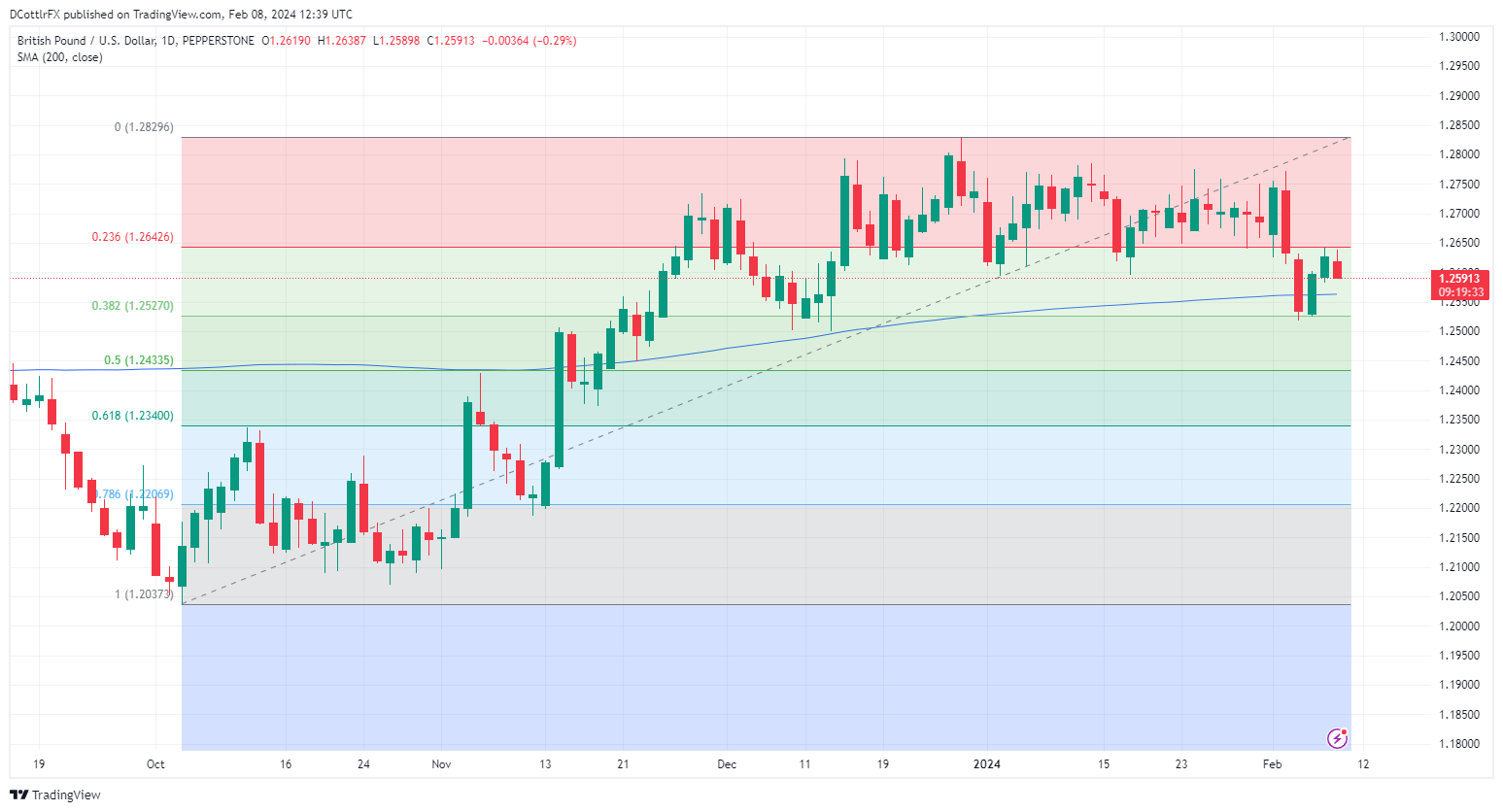

GBP/USD Technical Evaluation

GBP/USD Every day Chart Compiled Utilizing TradingView

Buying and selling is a self-discipline fraught with challenges that may take its toll after some time. Typically a little bit of perspective and self-reflection is required with the intention to regain your confidence:

Beneficial by David Cottle

Constructing Confidence in Buying and selling

GBP/USD was hammered down right into a decrease buying and selling vary by final week’s Fed-inspired bout of vast Greenback power.

It’s now caught between the primary and second Fibonacci retracements of the rise from October’s low to the four-month peak of December 29. They’re 1.284246 and 1.2570, respectively.

A fall although that decrease certain may presage deeper falls as Sterling would then be again to ranges not seen since late November final yr, and with November 14’s low of 1.21851 in focus.

GBP/USD did fall briefly beneath its necessary 200-day transferring common final week, the primary time it’s been beneath there since November 21. Nonetheless, it has recovered some composure above that degree within the final couple of periods. The typical now affords help at 1.2557.

IG’s personal sentiment knowledge finds merchants very bearish on the Pound’s probabilities, with absolutely 75% coming at GBP/USD from the quick aspect. That is fairly excessive and would possibly argue for a contrarian, bullish play.

The uncommitted might wish to wait and see whether or not the pair can stay inside its present buying and selling vary into the week’s finish, with the course of any break doubtless instructive.

–By David Cottle For DailyFX

factor contained in the factor. That is in all probability not what you meant to do!

Load your utility’s JavaScript bundle contained in the factor as an alternative.

[ad_2]

Source link