[ad_1]

It was a type of days; as quickly as I awakened, I knew it could possibly be a protracted day as a result of the was up in all probability greater than it ought to have been for flat futures.

If it appears like Deja Vu, it’s in all probability as a result of I wrote one thing related, not that lengthy, okay.

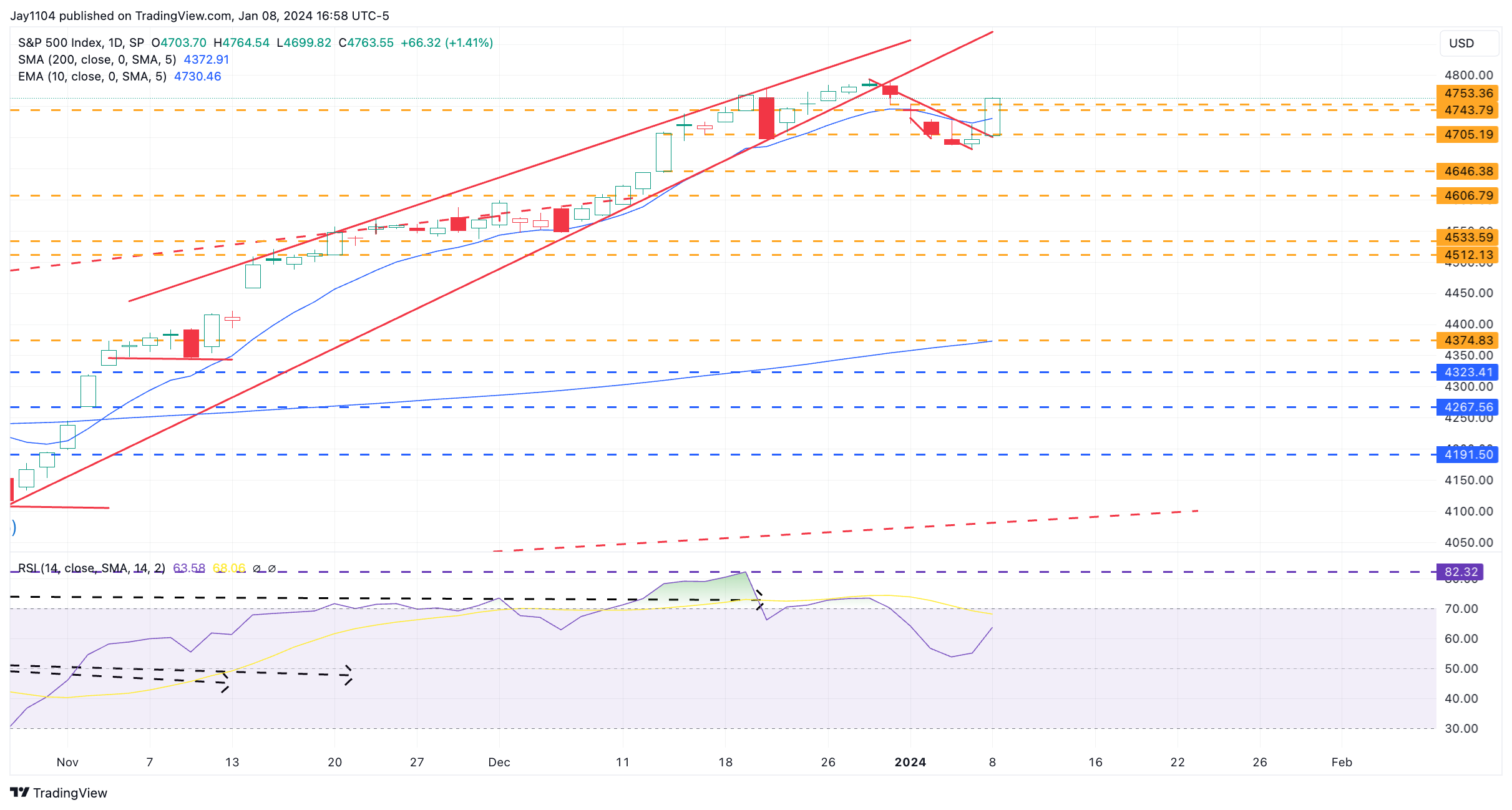

Anyway, the one victory for the bulls is that, at the least based mostly on the gamma ranges this morning, the index managed to shut again in a constructive gamma regime, which signifies that the constructive results of gamma will probably be volatility dampening.

And that signifies that if we proceed to maneuver greater, it can return to extra of a grind.

The constructive is that we broke a downtrend within the and likewise managed to shut above the 10-day exponential transferring common, which had served as resistance.

After all, that may must be confirmed right this moment, and if there was a reversal of development, that 10-day EMA ought to act as help.

Elsewhere: Charges Battle to Rise, US Greenback Unchanged, Oil Heads Decrease

In the meantime, charges hardly moved yesterday; initially, they had been decrease however completed down simply two bps on the Treasury.

Primarily based on this, I’d assume the transfer within the fairness market was separate from any transfer witnessed within the bond market, and Fed coverage had little to do with any developments from the Fed.

Charges would have been impacted extra if there had been Fed-related information. For now, the struggles to recover from the 200-day transferring common.

The was hardly modified as nicely.

This goes extra to the purpose that the transfer greater yesterday within the S&P 500 was an implied volatility transfer greater, and I feel it had little to do with anything.

Extra to the purpose, was down greater than 4% each day because the Saudis minimize costs resulting from weak demand.

Nvidia Surges Increased: Might the Rally Maintain?

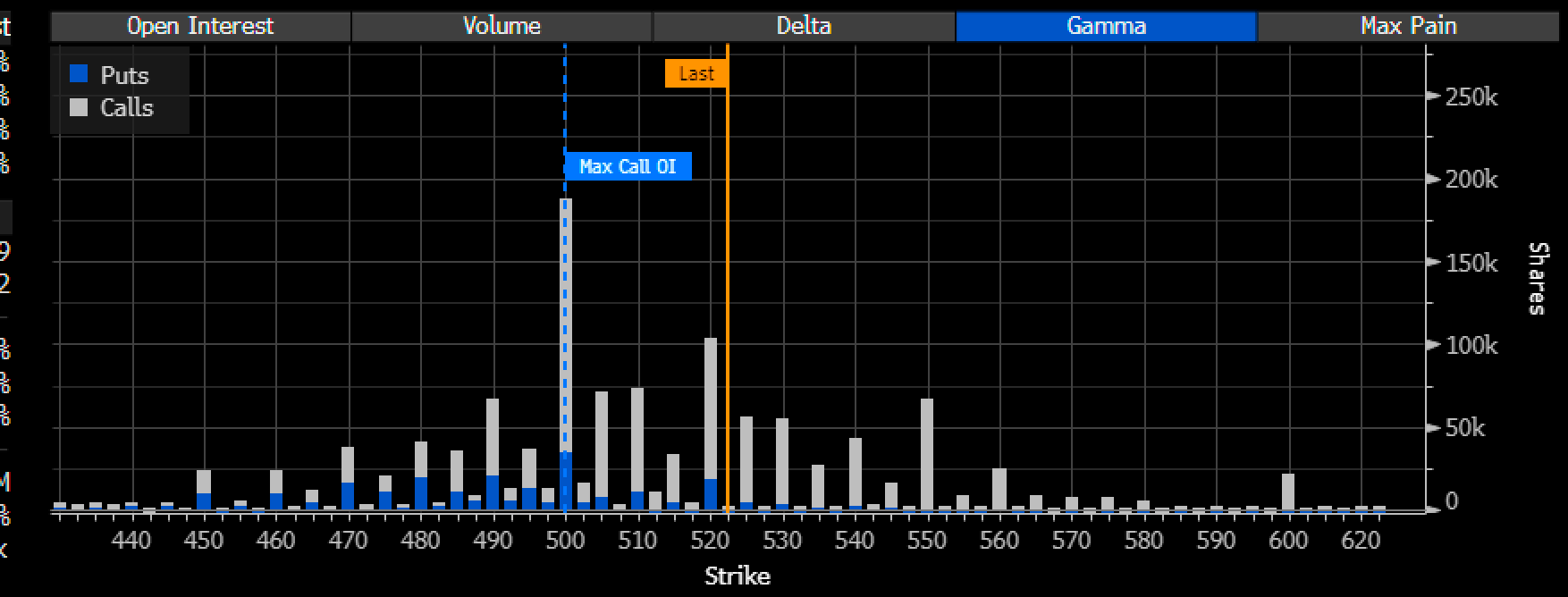

Nvidia (NASDAQ:) was additionally an enormous a part of the transfer, permitting that large tech part of the market to work on information of a China-compliant chip and extra AI mania forward of this 12 months’s CES.

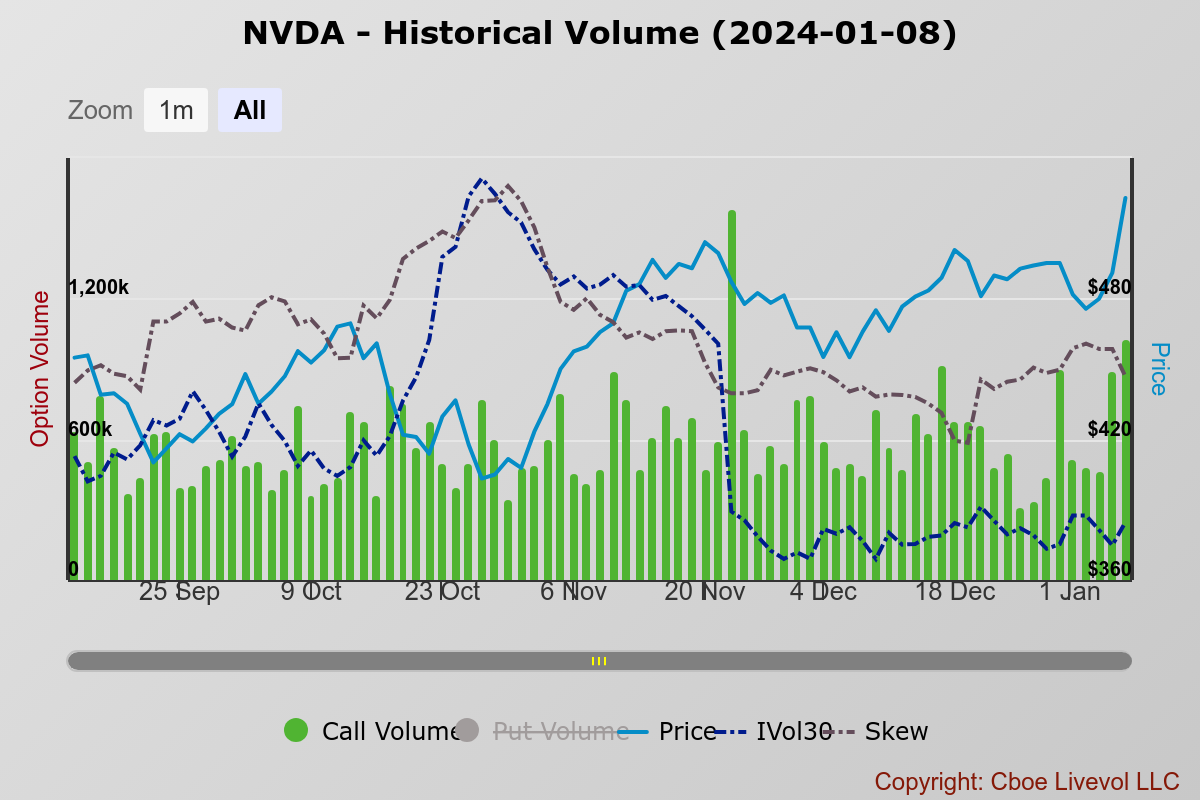

The transfer has the signature marks of a gamma squeeze, with Skew falling, IV rising, and name quantity surging. How far the rally can go depends upon how lengthy the gamma squeeze can begin.

There’s additionally some respectable gamma degree at $520, $525, and $530, which is why the inventory in all probability stalled out slightly below that a lot of the day.

What can maintain this inventory working greater would be the choices market, but when calls grow to be too costly, the rally will fade away shortly.

The skew is already slanted to the calls, which signifies that calls are already dearer. That isn’t to say they will’t grow to be dearer, however that’s what seems to have occurred yesterday.

Please watch my newest YouTube Video:

Authentic Publish

[ad_2]

Source link