[ad_1]

Joe Hendrickson

Funding thesis

Our present funding thesis is:

Burberry has skilled a decade of sentimental development and monetary enchancment, however the latest recruitment of Daniel Lee appears to be like to be a sport changer (Answerable for rising Bottega Veneta quickly at Kering). His first assortment was a lot anticipated given the mammoth model he has taken over. The evaluation was usually constructive and was praised for his return to British Heritage. We consider he might improve Burberry’s trajectory, supported by near-term demand development in China. Margins proceed to enhance, as model power has permits the enterprise to attain spectacular gross sales at premium costs. Relative to its friends and historic common, Burberry appears to be like sturdy whereas being priced attractively.

Firm description

Burberry (OTCPK:BURBY) is a British luxurious trend home based in 1856. The corporate designs, manufactures, and sells clothes, equipment, and sweetness merchandise for males, ladies, and youngsters. Burberry is famend for its iconic trench coats, distinctive test sample, and high-quality craftsmanship. With a robust presence in each retail and wholesale channels, Burberry operates globally and caters to a various buyer base.

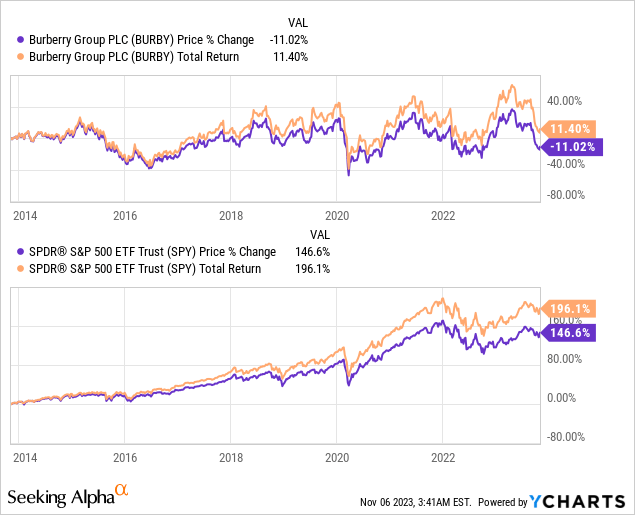

Share value

Burberry’s share value has carried out poorly within the final decade, as delicate development has did not propel the enterprise ahead. Regardless of this, Burberry has remained financially resilient, presenting a chance for improved efficiency.

Monetary evaluation

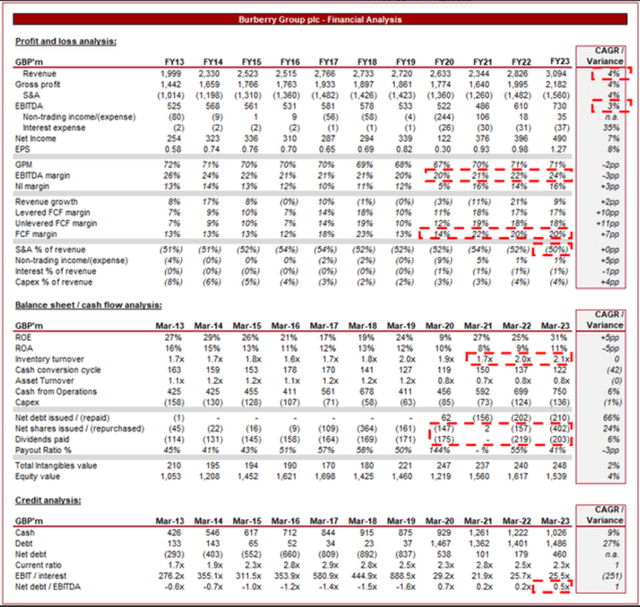

Burberry monetary evaluation (Capital IQ)

Offered above is Burberry’s monetary efficiency for the final decade.

Income & Business Components

Burberry has grown income at a CAGR of 4% throughout the final 10 years, solely marginally above the inflation fee throughout this era. Progress has been comparatively sturdy, when accounting for the FX affect, however has been underwhelming. Importantly, the corporate has recovered from the Covid-19 droop and is on an improved trajectory. The corporate is extremely reliant on a single model in a cyclical business.

Enterprise Mannequin

Burberry gives a variety of luxurious trend objects, together with attire, equipment, footwear, and sweetness merchandise. The model combines basic British aesthetics with modern designs, interesting to fashion-conscious shoppers. The corporate is famed for its Examine and Trench Coats, initially developed for troopers.

Burberry operates its personal retail shops, e-commerce platform, and concessions, offering direct buyer engagement and management over the model expertise. That is crucial for a luxurious model, as shoppers count on a premium in-store expertise and a continuation of the model’s aesthetic. Moreover, the corporate distributes its merchandise via wholesale partnerships, each on-line and in shops.

Burberry is likely one of the oldest manufacturers on the earth, reflecting a profitable mixture of its timeless designs and the flexibility to repeatedly innovate to satisfy altering tastes. Burberry’s wealthy heritage, iconic designs, and distinctive model id are akin to probably the most elite manufacturers, even when development just isn’t essentially at a excessive stage. This supplies some safety to shareholders, because it permits Burberry to take care of sturdy pricing, in addition to a clean income curve. That is crucial within the trend business as tastes can change rapidly, which means manufacturers face durations of recognition and attractiveness over time.

Given this issue, a transparent weak spot of Burberry relative to predominant its trend friends is its reliance on one model. LVMH (OTCPK:LVMHF), for instance, owns all kinds of manufacturers, creating the good thing about diversification and permitting the enterprise to at all times be on the forefront of trend, no matter model.

Burberry’s intensive world presence, together with its personal shops, wholesale partnerships, and on-line platforms, permits it to achieve a large buyer base and seize market alternatives. It is a key success issue as within the luxurious phase, shoppers care extra about seeing a product in particular person, fairly than simply shopping for on-line.

Luxurious Vogue Trade

Luxurious trend manufacturers compete totally on the next elements, model status, product design, high quality, pricing, and buyer expertise.

Burberry faces competitors from different elite luxurious trend manufacturers resembling Gucci (OTCPK:PPRUF), Louis Vuitton, Prada (OTCPK:PRDSY), Dior, and Hermès (OTCPK:HESAY).

The rising recognition of streetwear and informal trend has influenced client preferences and challenged conventional luxurious manufacturers, who traditionally targeted on a cleaner, upmarket look. We consider Burberry transitioned effectively in response to this, led by Riccardo Tisci, its former head designer. The difficulty is {that a} rising tide lifts all and Burberry was unable to achieve a noticeable quantity of market share throughout this era.

Following the Riccardo Tisci interval, Burberry poached the hyped younger designer Daniel Lee, who led Bottega Veneta to substantial development inside Kering. Daniel Lee is already instilling his picture of Burberry, having modified the emblem and present designs, drawing inspiration from a unique time in Burberry’s historical past. It’s too early to guage Daniel Lee’s potential to drive development, however we are able to see take into account how trend journalists are digesting his first assortment.

Lee’s debut was probably the most anticipated for the Autumn/Winter 2023 season. Folks have excessive hopes for Daniel Lee, as a result of he has been chargeable for the spectacular turnaround at Bottega Veneta. His power in leather-based items and purses is one thing that individuals are most enthusiastic about as a result of that is the class that Burberry has been lagging in for years.

It is all strikingly up to date, with motifs borrowed from Burberry’s Nice British heritage.

Some objectively good-looking items are obscured by the maximalist styling, presumably by intent.

I genuinely do like Daniel Lee’s Burberry debut. It is a bit of messy, with extra concepts than curation, however lots enjoyable. Evocative stylistic codes have bled over to Burberry from Lee’s work at Bottega Veneta

Lee’s first assortment wound up a voyage via concepts and beliefs of Burberry

The Home has wanted an “it” bag that the glitterati will clamber for, and Lee delivered a number of to select from.

What stood out probably the most, above all else, was Lee’s potential to acknowledge what actually sells for Burberry.

Among the many whimsical wording of assortment opinions was a basic positivity of Daniel Lee’s first assortment and importantly, the course he is taking the model. Excessive trend is searching for British heritage and Daniel Lee is offering his spin on it. Curiously, we observed a recurring reference to quiet minimalism and up to date designs, among the many eccentric strategy. The style business is seeing hype within the “quiet trend” pattern, with fewer logos and prints, and a higher give attention to tailoring and match.

The direct-to-consumer channel represents a key space of improvement to drive monetary enchancment. with rising strain on manufacturers to market their merchandise, versus “shelf-space” in retailers, we’re seeing manufacturers deliver shoppers in-house, a historic space of power for Luxurious. Presently, Burberry sells 81% of its merchandise via its personal retail footprint, a supreme stage supporting its excessive margins. The goal is to extend this additional, gaining additional management and margins.

China is the most important luxurious market on the earth, forcing manufacturers to adapt to the market via advertising and design affect, so as to win gross sales. Burberry has carried out effectively to seize this market, with 43% of its gross sales to APAC. With China just lately seeing the again of Covid-19, we consider gross sales will decide up within the coming quarters.

Social media influencers and on-line platforms have turn out to be vital drivers of brand name consciousness, buyer engagement, and buying choices. Burberry’s power because the premier British model permits it to entry a spread of celebrities throughout British tradition, together with the likes of Shygirl, Skepta, Naomi Cambell, Stormzy, and Raheem Sterling, all of whom have a robust world following.

Financial & Exterior Consideration

Burberry’s efficiency has been partially unfazed by the present financial weak spot, with successive years of sturdy development. It is a reflection of the monetary power of its core demographic, contributing to resilient demand. We anticipated this to happen after we analyzed LVMH final yr, suggesting luxurious resilience. Since then, LVMH’s share value is up 20% (over 40% at its peak).

Burberry’s most up-to-date monetary outcomes have been extremely spectacular, with comparable retailer gross sales of +18%, pushed by development throughout all geographies, principally from China (+46%). Additional, its product development has been spectacular, with Outerwear up +36% and Leather-based items up +13%. Each implying momentum constructing within the model within the lead as much as Daniel Lee’s entry (Assortment launching in retailer in Sep23).

This could enable Burberry to carry out effectively relative to different industries till financial situations enhance, at which level we count on development to essentially speed up, at the very least within the brief time period.

Margins

Burberry’s margins are unbelievable. The corporate at present has a GPM of 71%, EBITDA-M of 24%, and a NIM of 16%. Margins have improved within the final 5 or so years, reflecting improved pricing energy, effectivity beneficial properties, and diminished operational spending.

Our view is that additional margin enchancment is feasible, particularly because the enterprise transitions to extra DTC gross sales, nevertheless, this is not going to be substantial YoY. The crucial issue is that as a model power, diminished discounting is required, which materially drives margins.

Stability sheet & Money Flows

Burberry is conservatively financed, with a ND/EBITDA ratio of 0.5x. This offers the enterprise flexibility to vary technique if required. Now we have at all times felt an M&A technique might remodel Burberry, buying smaller trend homes as a part of a wider (British solely?) Vogue Group.

Stock turnover has regularly improved for a number of years, implying higher stock management over demand, permitting for an improved CCC.

Given this, alongside the improved profitability, Burberry’s FCF-M has constantly reached 20% within the final 6 years. We consider the corporate ought to normalize at a >18% stage, which is extremely profitable.

Outlook

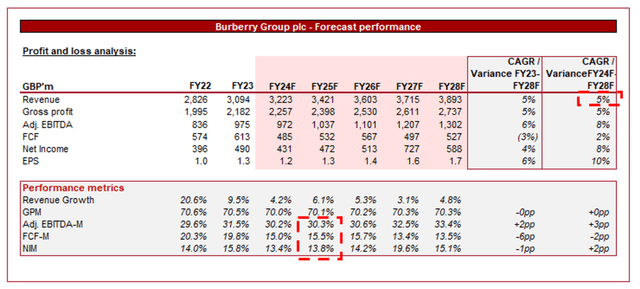

Outlook (Capital IQ)

Offered above is Wall Road’s consensus view on the approaching 5 years.

Analysts are forecasting wholesome development within the coming years, though nothing groundbreaking. Given the monitor document of sentimental development, this seems affordable in our view. We consider FY23-FY25 might exceed this if Daniel Lee’s strategy does materialize within the vein of his time at Bottega.

Margins are additionally anticipated to enhance, as Burberry’s pricing technique and strategy continues to yield profit. This enables for a robust EBITDA trajectory.

Trade evaluation

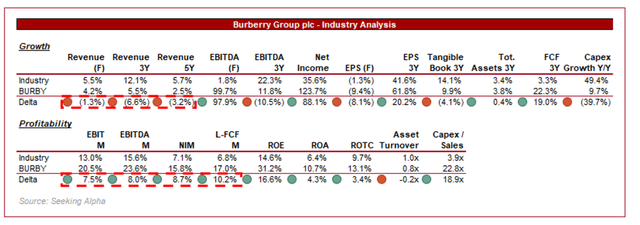

Vogue business (Searching for Alpha)

Offered above is a comparability of Burberry’s development and profitability to the typical of its business, as outlined by Searching for Alpha (33 firms).

Burberry performs effectively relative to the business common in our view. The corporate is considerably increased on a profitability foundation, even when low-performers are eliminated. It is a reflection of the corporate’s model power permitting for aggressive pricing, offsetting any scale drawback.

Progress has lagged behind the market, as it’s closely reliant on its single model, which faces vital competitors from different luxurious homes. We count on the enterprise to enhance within the coming years, though will probably be tough to achieve parity.

Based mostly on the weaker development however offsetting margins, we consider Burberry needs to be buying and selling inside neighborhood of the peer group common valuation multiples.

Valuation

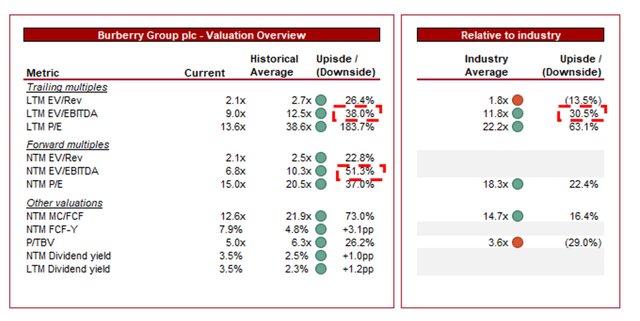

Valuation (Capital IQ)

Burberry is at present buying and selling at 9x LTM EBITDA and 7x NTM EBITDA. It is a low cost to its historic common.

A reduction to its historic common is unjustifiable in our view. Burberry has skilled an enchancment in margins and pricing energy in recent times, in addition to scope for an improved development trajectory. We take into account the previous alone to be a enough sufficient issue. Buyers are seemingly involved that development from China will materially sluggish.

Additional, Burberry is buying and selling at a big low cost to the business. Even when the most important 4 multiples are excluded, Burberry stays at a reduction. As soon as once more, we consider this suggests upside, as Burberry’s sturdy relative efficiency suggests parity or a small low cost is honest.

At a FCF yield of seven.9%, we consider Burberry represents unbelievable worth for shareholders. The model has an extended heritage and a monitor document of incremental enhancements.

Key dangers with our thesis

The important thing dangers to our present thesis are

FX. Burberry generates its revenues and incurs its prices throughout a spread of currencies, which has the potential to materially affect the offered outcomes. With a considerable decline within the USD within the final yr relative to the Sterling, we might see a level of underperformance. Model. Given the only model, cyclical pattern adjustments have to be responded to completely, in any other case Burberry faces falling out of trend. China. A slowdown in development from China, given the heavy weighting towards APAC, might materially derail the enhancements made in recent times.

Remaining ideas

Burberry is a unbelievable enterprise in our view. It has a really world model that has endured over a century, changing into a number one model within the luxurious market. Its development has been underwhelming, nevertheless, the enterprise has financially progressed constantly, and is coming into a brand new period. Beneath Daniel Lee, we’re assured the corporate can progress additional, supported by its margin enchancment, because the model returns to its British Heritage.

With Burberry buying and selling at a reduction to its historic common and friends and a NTM FCF yield of ~8%, we see good upside on the present value.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.

[ad_2]

Source link