[ad_1]

Bloomberg/Bloomberg through Getty Pictures

Expedia Group, Inc. (NASDAQ:EXPE) launched the This fall 2023 earnings on February 8, 2024, and reported robust progress in room evening bookings, gross bookings, and income, however skilled a year-over-year drop in internet earnings. Nevertheless, the yearly numbers present enchancment in internet earnings and earnings per share. This text discusses the earnings consequence and supplies the technical evaluation of Expedia to seek out the subsequent path of the inventory worth and funding alternatives. It’s noticed that the inventory worth stays throughout the robust uptrend and the current worth correction presents a robust shopping for alternative for long-term buyers.

Earnings, Development, and Future Prospects

The This fall 2023 earnings information present a constructive development in client curiosity, with the 9% year-over-year improve in room evening bookings. It’s noticed that 77.4 million nights have been booked in This fall 2023 as in comparison with 70.8 million in This fall 2022. This robust efficiency was additionally noticed for the complete yr 2023, whereby 350.9 million of room nights have been booked in 2023 as in comparison with 312 million in 2022. The robust progress in room nights bookings was additionally mirrored within the gross bookings with a ten% improve in 2023. Nevertheless, this progress in gross bookings is decrease than the robust progress noticed in 2021 and 2022 with a rise of 97% and 31%, respectively. Regardless of the decrease charge of progress in gross bookings for 2023, the robust numbers current the robust client demand.

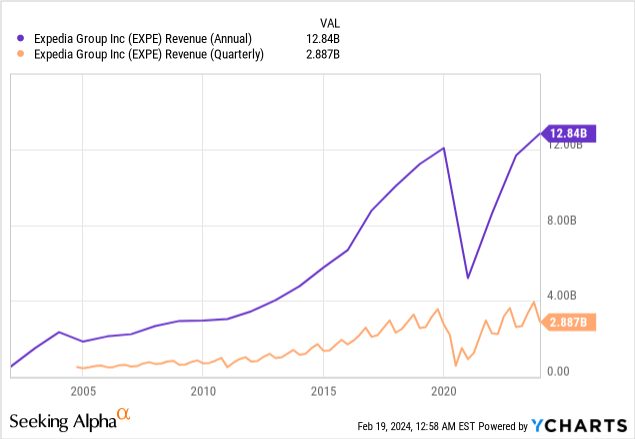

The quarterly and yearly income additionally exhibits a robust constructive development, however the charge of improve of income in 2023 is decrease than that in 2021 and 2022 as proven within the chart beneath. The income for 2023 was elevated by 10% as in comparison with the increment of 97% and 36% in 2021 and 2022. This sharp improve in these years was because of the robust restoration within the monetary circumstances after the Covid-19 disaster which triggered a major downturn in monetary efficiency in 2020 on account of journey restrictions, lockdowns and discount in journey demand.

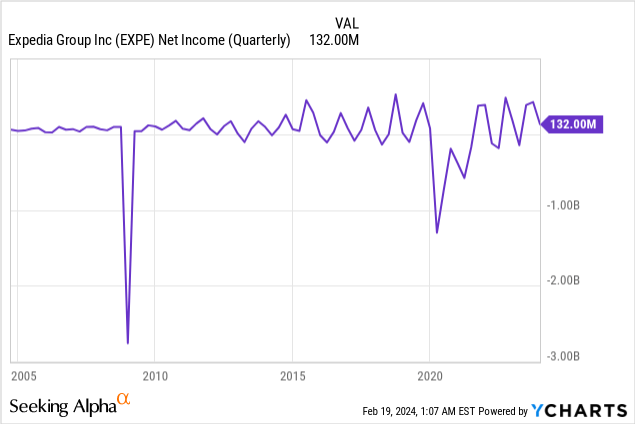

Then again, the online earnings for This fall 2023 was $132 million, as in comparison with $177 million in This fall 2022. This 25% drop in internet earnings was prolonged to diluted earnings per share, which was decreased by 17% to $0.92. Regardless of the This fall drop, the corporate reported a robust year-over-year progress of 127% in internet earnings and 144% in diluted earnings per share for full yr 2023. The annual progress in internet earnings and earnings per share for 2023 signifies robust monetary restoration and operational effectivity.

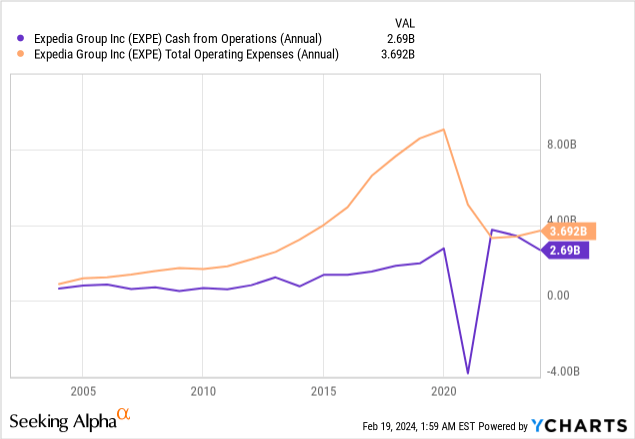

Furthermore, the money from operations decreased by 22% to $2.69 billion in full yr 2023, however the chart beneath presents robust restoration and constructive momentum after the 2020 drop. This presents the corporate’s capacity to generate constructive operational money move momentum throughout difficult instances. The drop in money from operations could also be on account of greater prices of operations, as the overall working bills jumped to $3.692 billion in 2023.

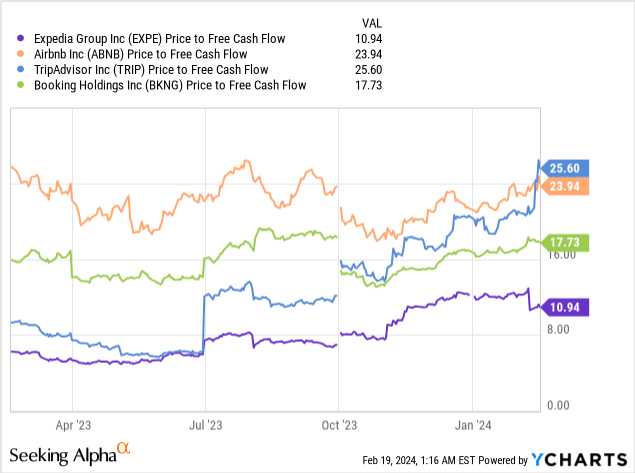

The chart beneath presents the value to free money move ratio for Expedia, Reserving Holdings Inc. (BKNG), Airbnb, Inc. (ABNB) and Tripadvisor, Inc. (TRIP). The low ratio amongst its opponents signifies that the corporate is undervalued relative to its friends. The decrease ratio could also be a wonderful alternative for buyers to purchase the inventory at an inexpensive worth as the corporate exhibits robust profitability potential. Furthermore, the corporate additionally introduced Ariane Gorin as the brand new CEO on Could 13, 2023. Arian Gorin has achieved important achievements because the President of Expedia. This management change might enhance investor confidence within the firm’s strategic path.

General, the robust progress in room evening bookings, gross bookings and income signifies a robust market demand. Furthermore, the robust progress in internet earnings and earnings per share in 2023 highlights the corporate’s power and operational effectivity. The corporate’s undervalued place as in comparison with its opponents suggests robust progress potential and a gorgeous funding alternative for long-term buyers.

Lengthy-Time period Technical Image

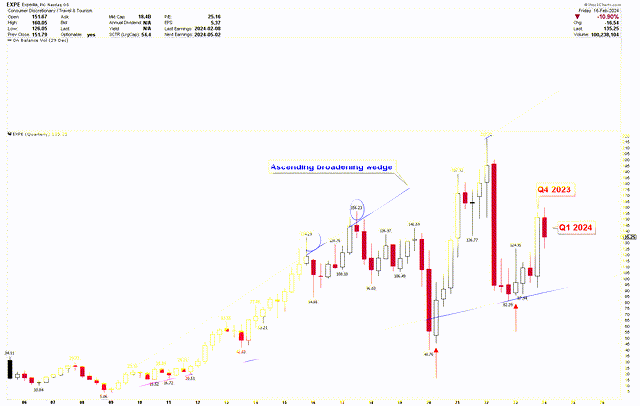

The technical outlook for Expedia is strongly bullish, as illustrated within the quarterly chart beneath. The inventory worth has been in a bullish development since hitting the low of $5.06 in 2008 and reaching file highs in 2022 at $217.72. Nevertheless, robust volatility is noticed with the emergence of ascending broadening wedge. This wedge exhibits that the most important drop in worth was noticed in 2020 because of the journey restrictions, lockdowns and drop in journey demand when the value produced a backside at $40.76. This case impacted the monetary efficiency of Expedia and resulted in a robust worth drop. Nevertheless, the robust technical oversold circumstances resulted in a robust worth rebound which was supported by the gradual easing of journey restrictions which contributed to a lift in journey demand.

Expedia Quarterly Chart (stockcharts.com)

Based mostly on the quarterly chart, the inventory worth hit the ascending broadening wedge after which reversed greater to hit the higher resistance of this wedge at $217.72. The robust worth fluctuations inside this wedge spotlight the robust volatility. Just lately, the inventory worth rebounded once more from the assist of this wedge sample and highlighting worth power. The robust constructive candle for This fall 2023 after the rebound from assist signifies that the inventory worth is able to surge greater in coming quarters. Due to this fact, any worth correction inside this quarter is taken into account a robust shopping for alternative for buyers.

Understanding the important thing ranges

To delve deeper into the constructive outlook, the month-to-month chart beneath illustrates the important thing ranges of assist and resistance. These key ranges are measured by making use of the Fibonacci retracement instrument from the 2008 low of $5.06 to the 2022 excessive of $217.72. The worth correction from the file highs has reached the 61.8% Fibonacci retracement at $86.30 which is taken into account a robust assist. It’s fascinating to watch that this assist stage coincides with the assist of the ascending broadening wedge, which is marked by the crimson dotted development traces within the month-to-month chart.

Expedia Month-to-month Chart (stockcharts.com)

After a number of consolidations at this long-term assist, the inventory worth rallied and closed above 38.2% Fibonacci retracement in December 2023. The robust correction in February 2024 is taking the inventory worth again to this stage round $136.48 which is taken into account an entry level for buyers. The RSI has additionally closed above the mid-level which signifies funding alternatives. General, the Fibonacci ranges of $86.30, $111.39 and $136.48 are the robust market assist and entry factors for buyers.

Key Motion for Traders

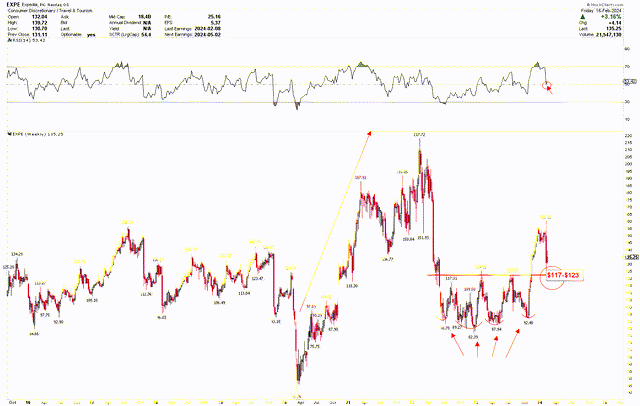

For the reason that long-term development stays robust and the inventory worth is at present buying and selling close to the short-term assist, this correction gives an entry level for buyers. To additional make clear this entry level, the weekly chart beneath presents the a number of key reversals from the underside, as marked by the crimson arrows. The inventory worth has hit the robust assist area of $117-$123 marked by the crimson line. As a result of a number of key reversals within the weekly chart, the inventory worth is predicted to rebound from the assist line.

Expedia Weekly Chart (stockcharts.com)

Moreover, the RSI is rebounding from the mid-line, which introduced robust assist for Expedia. Traders might contemplate shopping for on the present stage and add extra positions if the inventory worth drops to decrease assist ranges of $111.39 and $86.30.

Danger Components

The lower in internet earnings and diluted earnings per share in This fall 2023 highlights the potential fluctuations in profitability. These fluctuations point out that the corporate must navigate the challenges of sustaining profitability. The corporate exhibits robust progress in 2021 and 2022 because of the robust restoration from the pandemic. Nevertheless, the slowdown within the charge of improve in income and gross reserving signifies potential saturation within the journey market, elevated competitors or adjustments in client conduct. These elements might have an effect on the corporate’s capacity to take care of excessive progress charges. The corporate might proceed to innovate and adapt to altering market circumstances to take care of progress momentum primarily based on evolving client preferences and aggressive pressures. Then again, Expedia presents robust volatility throughout the ascending broadening wedge. The robust volatility might provoke robust worth fluctuations in each instructions. Nevertheless, the current worth correction has taken the value to robust assist ranges. A month-to-month and quarterly shut beneath $86.30 will negate the bullish outlook and provoke a robust worth drop.

Backside Line

In conclusion, Expedia’s This fall 2023 earnings reveal robust progress and resilience in the long run, regardless of a short-term drop in internet earnings for This fall 2023. The spectacular progress in room evening bookings, gross bookings and income presents robust client demand, whereas the numerous enchancment in internet earnings and earnings per share for the complete yr 2023 displays operational effectivity. The appointment of Ariane Gorin as CEO might additional enhance investor confidence.

From the technical perspective, the inventory worth stays inside a robust bullish development however presents heavy volatility. Regardless of heavy volatility, the robust rebound from the important thing ranges adopted by the robust bullish quarterly candle, highlights the shopping for potential. For the reason that inventory worth is affordable and at present buying and selling at robust assist, buyers can contemplate shopping for the inventory at present ranges to profit from the constructive momentum. The important thing ranges of assist stay $136.48, $111.39, and $86.30.

[ad_2]

Source link