[ad_1]

The rivalry between Chinese language EV maker BYD (OTC:) and its US counterpart Tesla (NASDAQ:) stands out for its depth.

Tesla and BYD, often called the biggest EV producers globally, are fiercely competing, significantly in China.

Information reveals that BYD outpaced Tesla in hybrid car gross sales in 2022 and likewise took the lead in all-battery electrical car gross sales within the final quarter of the yr.

Finally, Tesla needed to announce manufacturing cuts at its factories in Berlin and Shanghai within the first quarter.

Alternatively, the Lunar New Yr vacation in China together with client expectations for worth reductions and new fashions impacted BYD’s gross sales in the identical interval.

This flip of occasions has made positive that the battle between the 2 EV makers is as fierce as ever.

In the meantime, because the Chinese language EV maker appears to take the lead over Tesla, InvestingPro’s highly effective instruments will help acquire insights into the corporate’s efficiency.

This enables us to evaluate potential alternatives and speculate on the corporate’s trajectory in 2024.

With InvestingPro, You may determine successful shares early on. Subscribe now and by no means miss out once more!

Tesla Fails to Match BYD’s Value Cuts

BYD’s dominance within the EV market has been pushed by aggressive worth cuts. Though Tesla additionally slashed costs all year long, it could not match BYD’s pricing technique, permitting BYD to take the lead swiftly.

As Tesla prepares to halt its worth cuts and a few incentives, BYD is on the point of opening its first EV manufacturing facility outdoors China, indicating it is in a stronger place than Tesla because it continues to take a position.

Nevertheless, the value competitors has adversely affected the shares of each firms. TSLA witnessed a decline of as much as 30% within the first quarter of 2024.

Equally, BYDDF skilled a downward pattern, shedding almost 40% of its worth from July to January final yr.

But, with the expectation of recent investments and gross sales progress, BYDDF started to recuperate from February onwards, signaling a constructive outlook for the corporate.

BYD Development Potential Larger Than Tesla

BYD surpassed its gross sales goal final yr, hitting over 3 million in full-year gross sales, whereas Tesla met its purpose of 1.81 million. This yr, BYD, backed by state assist and aggressive pricing, is poised to take care of its lead within the electrical car sector. Nevertheless, the impression of its pricing technique on the corporate’s inventory stays unsure.

In the meantime, Tesla continues to dominate the US market, the place BYD hasn’t entered but. Regardless of shedding its prime spot in gross sales final yr, Tesla’s greater car costs give it an edge in income. Moreover, anticipated rate of interest cuts within the US may enhance Tesla’s gross sales choices in 2024.

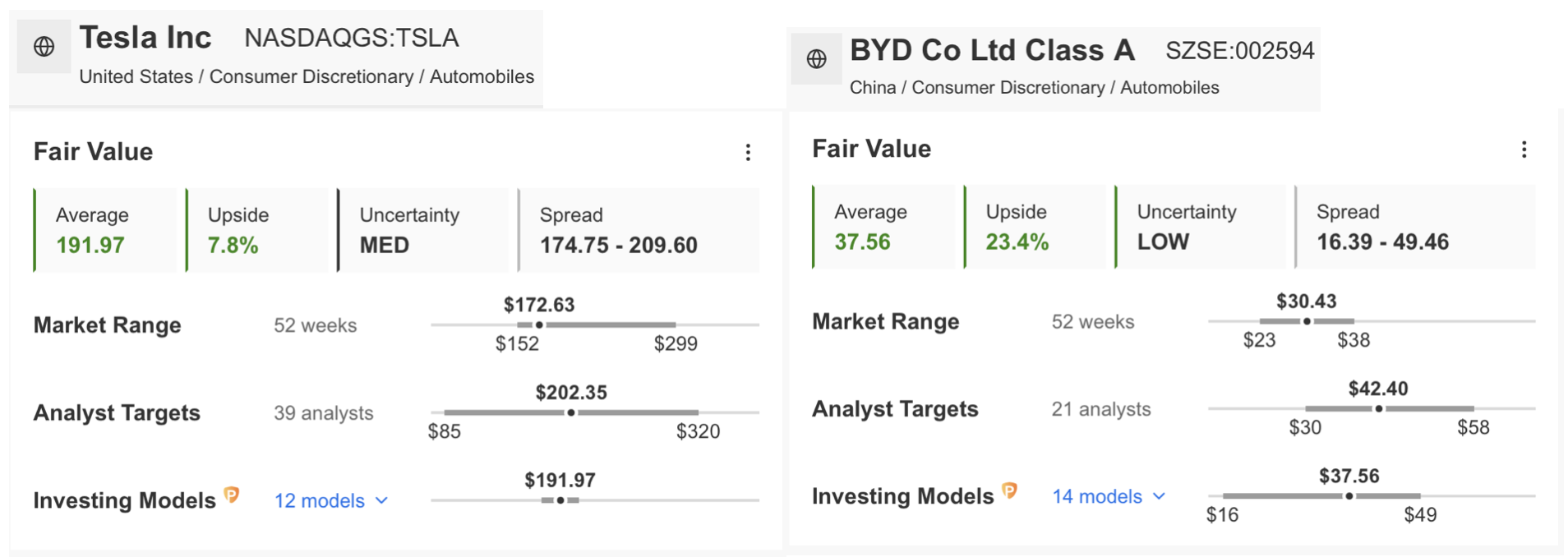

In monetary phrases, BYD seems to have extra potential for progress in comparison with Tesla this yr. InvestingPro’s truthful worth evaluation predicts a possible improve of round 25% for BYD, whereas Tesla is predicted to rise by 7.7%.

Supply: InvestingPro

BYD in Higher Monetary Form Than Tesla

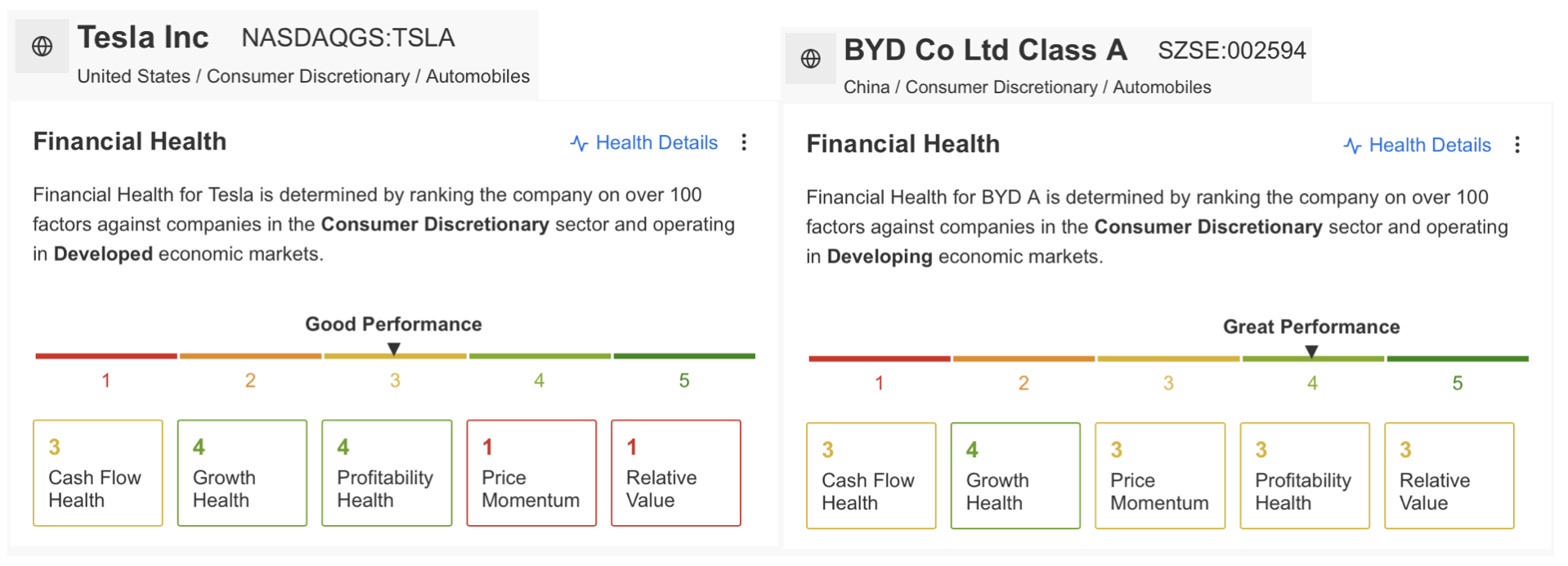

BYD is in a more healthy monetary place. BYD, which scored 4 factors out of 5 within the InvestingPro monetary well being abstract, will be stated to be in a greater place in comparison with Tesla’s 3 factors.

Nevertheless, when the small print of economic well being are examined, it’s seen that Tesla’s ranking is pushed by worth momentum as a result of share worth, which has seen critical corrections in current months.

Alternatively, the corporate is in an excellent place when it comes to money circulate, progress well being, and profitability. BYD, then again, has a extra balanced monetary construction however nonetheless appears more healthy.

Supply: InvestingPro

After we evaluate the ProTips abstract of the 2 firms, we are able to see that BYD has extra issues than Tesla when it comes to fundamentals.

Supply: InvestingPro

Tesla exhibits that it’s resilient to a attainable recession or short-term disaster by holding additional cash than debt on its steadiness sheet.

Nevertheless, the most recent quarterly figures present that Tesla will battle with some issues within the brief time period. Analysts have lowered their earnings expectations for the primary quarter at Tesla. Whereas the corporate’s gross revenue margins weakened and its P/E and P/B ratios remained excessive, this may be seen as a sign that the correction part could proceed on this inventory.

Alternatively, BYD is a dividend-paying firm in comparison with Tesla and has a low FCF in comparison with its short-term revenue.

The corporate doesn’t appear to have an issue when it comes to money circulate, and its newest financials present necessary proof that it’s going to proceed to develop in 2024.

Supply: InvestingPro

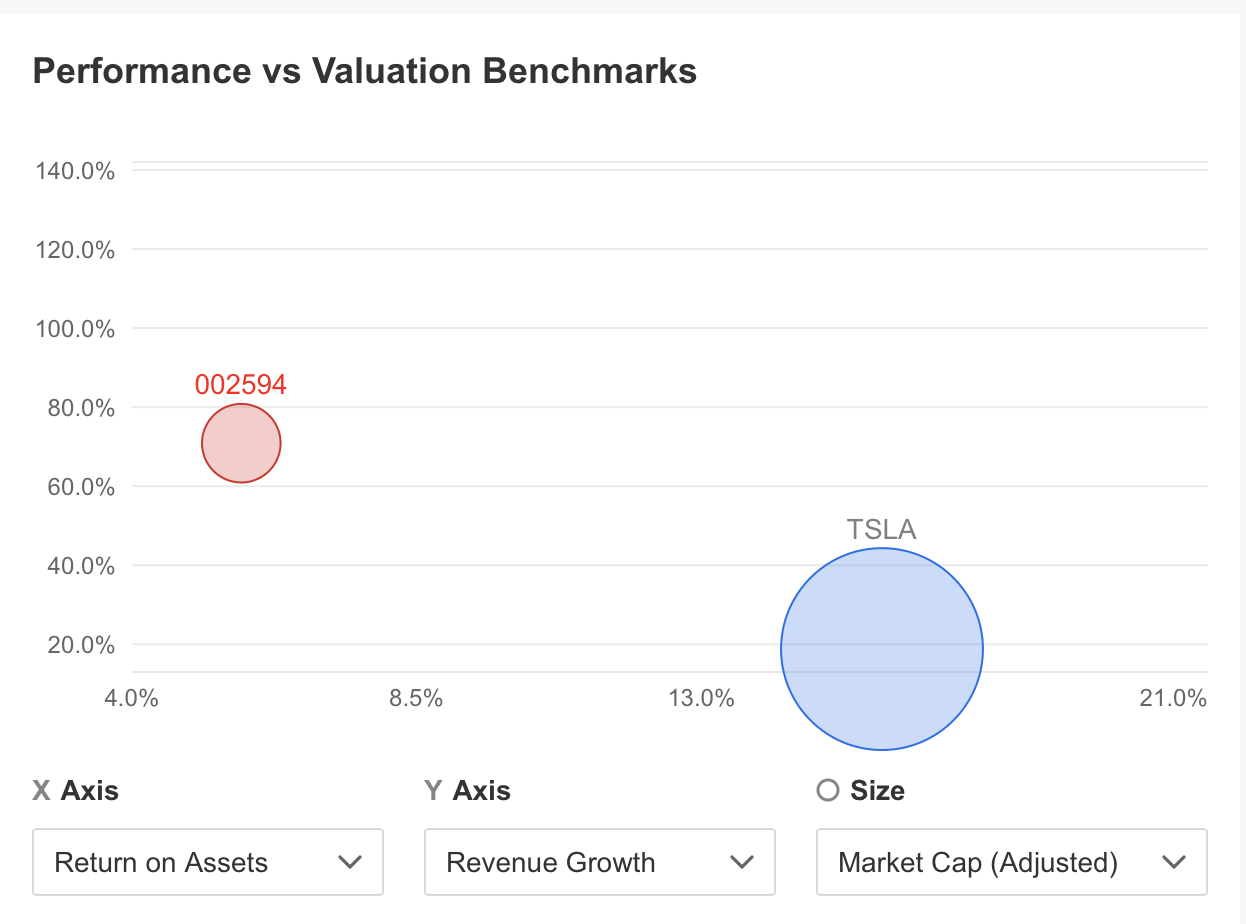

If we evaluate BYD and Tesla based mostly on income and return on property standards, Tesla’s return on property of 15.8% is in a great place in comparison with BYD’s 5.7%.

As well as, BYD’s income progress charge of 70.9% within the final one yr is considerably greater than Tesla’s income progress charge of 18.8%. As will be seen within the chart, Tesla, with a market capitalization of near $550 billion, is in critical competitors with BYD, which has a market capitalization of $83.3 billion.

Present figures and gross sales methods present that the 2 firms could face one another many occasions in 2024. Whereas BYD continues its battle to extend its market share with its aggressive pricing coverage, Tesla’s steps to reclaim its management within the electrical car market will probably be keenly watched.

***

Take your investing recreation to the following stage in 2024 with ProPicks

Establishments and billionaire buyers worldwide are already properly forward of the sport with regards to AI-powered investing, extensively utilizing, customizing, and creating it to bulk up their returns and decrease losses.

Now, InvestingPro customers can do exactly the identical from the consolation of their very own properties with our new flagship AI-powered stock-picking device: ProPicks.

With our six methods, together with the flagship “Tech Titans,” which outperformed the market by a lofty 1,745% during the last decade, buyers have the perfect choice of shares out there on the tip of their fingers each month.

Subscribe right here and by no means miss a bull market once more!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, or advice to take a position as such it isn’t meant to incentivize the acquisition of property in any approach. I wish to remind you that any sort of asset, is evaluated from a number of factors of view and is extremely dangerous and subsequently, any funding choice and the related threat stays with the investor.

[ad_2]

Source link