[ad_1]

cemagraphics

Introduction

I have been following US non-lethal weapon maker Byrna Applied sciences (NASDAQ:BYRN) carefully and I’ve written 4 articles about it on SA so far. The newest of them was in July after I stated that the corporate had a robust steadiness sheet and that I anticipated web revenues to enhance over the approaching months attributable to rising worldwide and supplier gross sales.

In October, Byrna secured a $6 million order in Argentina, however I’m involved that gross sales stay depressed attributable to promoting bans. With the market capitalization rising by 52.9% since my earlier article, I now really feel snug with chopping my score on the inventory to promote. I believe the corporate is beginning to look overvalued, and that this may very well be a very good time to take income. Let’s evaluation.

Overview of the current developments

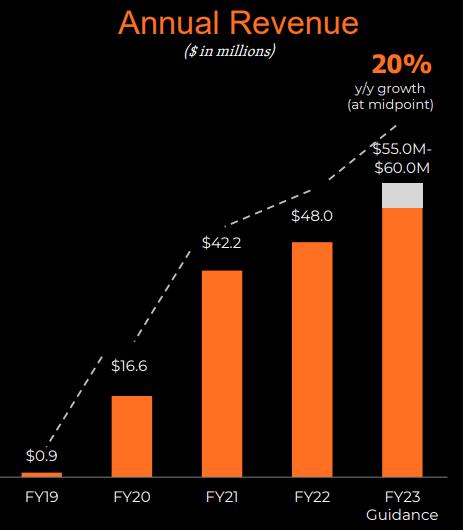

In the event you aren’t conversant in the firm or my earlier protection, this is a brief description of the enterprise. Byrna focuses on the design, manufacturing, and sale of non-lethal self-defense weapons, and ammo and its product providing additionally contains pepper spray, physique armor in addition to private security alarms. The corporate serves each the patron and safety skilled markets and its core merchandise embrace the Byrna SD launcher, the Byrna LE version launcher, and the much less deadly 12-gauge rounds. It has two manufacturing crops – a 30,000 sq. foot facility positioned in Fort Wayne, Indiana, and a 20,000 sq. foot manufacturing facility located within the metropolis of Pretoria in South Africa. As well as, Byrna has a 51:49 three way partnership firm in Uruguay that was created in January 2023 to increase its presence in Latin America. As you possibly can see from the chart under, Byrna’s gross sales have been rising quickly over the previous few years due to an increasing product line and the corporate was anticipating to develop by about 20% in 2023.

Byrna

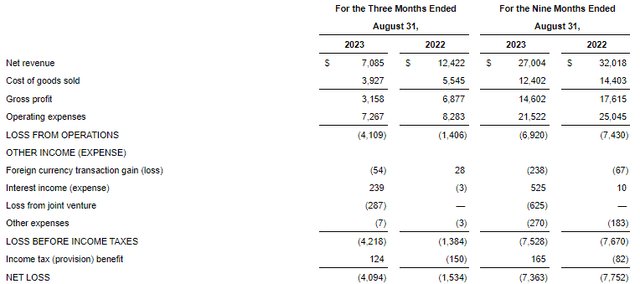

Sadly for traders, FY23 is shaping up as a weak 12 months for the corporate and I believe that web revenues are more likely to fall over 20% in comparison with 2022. In Q1 FY23, gross sales have been negatively affected by provider points and manufacturing issues. And as I defined in my earlier article on the corporate, Q2 financials have been put beneath pressure attributable to an promoting ban by the social media platforms of Meta (META) and Alphabet’s (GOOG GOOGL) Google after they labeled Byrna’s gadgets as contraband merchandise. The bans began in late March and months later, Twitter (now X) additionally banned promoting by the corporate. These three bans led to a big fall in orders and revenues in Q3 FY23. Trying on the monetary outcomes for the quarter, we are able to see that web revenues slumped by 43% 12 months on 12 months to $7.09 million whereas the working loss virtually tripled to $4.11 million. E-commerce gross sales by Byrna’s web site and Amazon (AMZN) went down by $3.3 million to simply $4.8 million (see web page 20 right here). Throughout its Q3 FY23 earnings name, the corporate stated that every day gross sales declined by 20% in comparison with the month of March to simply $44,000. Worldwide gross sales slumped to simply $0.2 million from $2 million a 12 months earlier whereas gross sales to home sellers/distributors decreased to $1.7 million from $1.8 million.

Byrna

Trying on the steadiness sheet, I believe the state of affairs is deteriorating quickly as the web money place was all the way down to $13.7 million on the finish of August in comparison with $20.1 million in November 2022 as free money stream was detrimental $6 million for the primary 9 months of FY23.

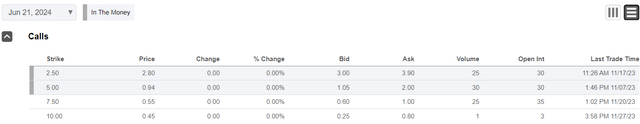

what to anticipate for the long run, I believe that This autumn FY23 web revenues may very well be flat in comparison with a 12 months earlier as common every day gross sales in September rose to $77,500 due to excessive promoting spending. But, this does not appear sustainable in the long term because the return on advert spend (ROAS) was about 2.5x. Byrna’s worldwide gross sales are normally characterised by rare however massive orders and on October 26, the corporate introduced a $6 million order with the Córdoba Provincial Police power in Argentina. This deal contains 4,000 launchers and is the most important order in its historical past. But, this contract accounts for only one eight of FY22 gross sales and I believe it’s unlikely that gross sales development might be again to optimistic territory in FY24 until the promoting bans are lifted. They’ve been in place for a number of months now and there’s no indication if or once they might finish. And even when they have been lifted at present, it will doubtless take at the least two months for e-commerce gross sales to regain momentum. Total, I believe it’s turning into clear that the enterprise of Byrna may very well be unsustainable with out promoting on social media and the valuation of the corporate is beginning to look stretched because the enterprise worth approaches $120 million. For my part, the share value rally over the current months appears unjustified and this may very well be a very good time to take income. As well as, Byrna is beginning to appear to be a very good brief promoting alternative as knowledge from Fintel exhibits that the brief borrow charge charge stands at simply 1.28% as of the time of writing. There are round 900,000 shares out there for brief promoting and shopping for name choices for hedging functions is comparatively low-cost for the time being, with June 2024 choices buying and selling at $0.55.

In search of Alpha

Trying on the upside dangers, I believe that the main one is {that a} elevate of the ban on promoting by any of the three social platforms might present a big short-term enhance for the share value. The market valuation of Byrna might additionally achieve momentum from further worldwide orders and it’s onerous to foretell these as they appear sporadic.

Investor takeaway

Byrna not too long ago secured its largest order, however its gross sales have been weak over the previous two fiscal quarters, and I believe the enterprise seems near nugatory and not using a elevate of the bans on promoting by the main social media platforms. The corporate’s enterprise mannequin depends on e-commerce gross sales and there’s no clear path to profitability with out them rising considerably with a excessive ROAS. Money is diminishing quick and Byrna is beginning to look costly. For my part, risk-averse traders ought to keep away from this inventory.

[ad_2]

Source link

Add comment