[ad_1]

The metals market has seen divergent returns as oversupply has impacted Nickel and Palladium

Alternatively, iron ore and gold costs have fared significantly better, sitting on double-digit YTD positive factors.

Nickel is at present fighting oversupply, whereas Palladium, unaffected by latest sanctions, eyes a possible short-term surge to $1,600.

Seeking to beat the market in 2024? Let our AI-powered ProPicks do the leg give you the results you want, and by no means miss one other bull market once more. Study extra right here

The previous 12 months within the metals market has witnessed divergent value actions. Whereas power and agricultural commodities have skilled constant value declines relative to the start of the 12 months, metals present clear disparities.

On one hand, we observe positive factors within the vary of 11-14% for , whereas and have misplaced 44% and 33%, respectively.

The first motive for such vital declines is the appreciable oversupply of those metals, notably influenced by the automotive business.

What prospects lie forward for Nickel and Palladium within the upcoming 12 months?

Central Financial institution Insurance policies Have Put Costs Below Stress

Central Financial institution insurance policies matter regarding metallic costs. Financial coverage, alongside total demand and provide ranges, is a key issue influencing metallic costs.

In a high-interest charge surroundings, a strengthening , and a weakening financial outlook, the metallic phase is especially weak to cost declines, as noticed in metals generally utilized in industrial functions.

Conversely, easing insurance policies and potential rate of interest cuts make the US greenback theoretically cheaper, favoring demand.

Nevertheless, this assumption could not maintain if charge cuts are a response to a possible recession and financial slowdown, which finally reduces industrial demand.

From this attitude, 2024 seems optimistic. A situation the place each Europe and the US keep away from a deep recession, coupled with deflation and rate of interest cuts, aligns with a smooth touchdown.

Assuming an financial rebound within the second half of the 12 months, world financial insurance policies could assist commodity value progress.

Nickel: Oversupply to Push Costs Even Decrease?

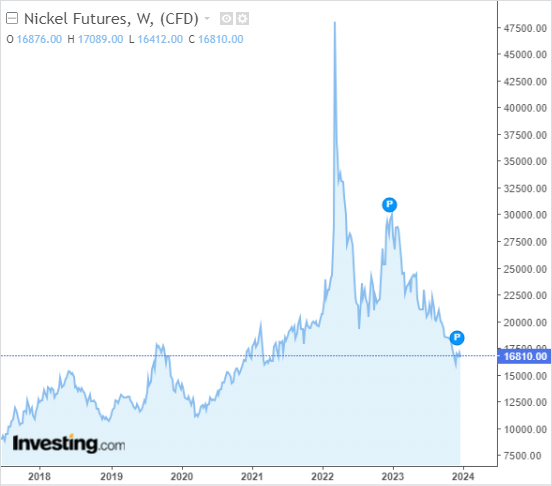

After nickel costs shot up final March following Russia’s aggression towards Ukraine, we’ve got seen a constant downward pattern, which has pushed costs to their lowest ranges because the first quarter of 2021.

Nickel Weekly Chart

The explanations for this are lower-than-expected demand for electrical automobiles primarily in China and a big oversupply of the uncooked materials attributable to a powerful 31% improve in Indonesian output in January-July 2023.

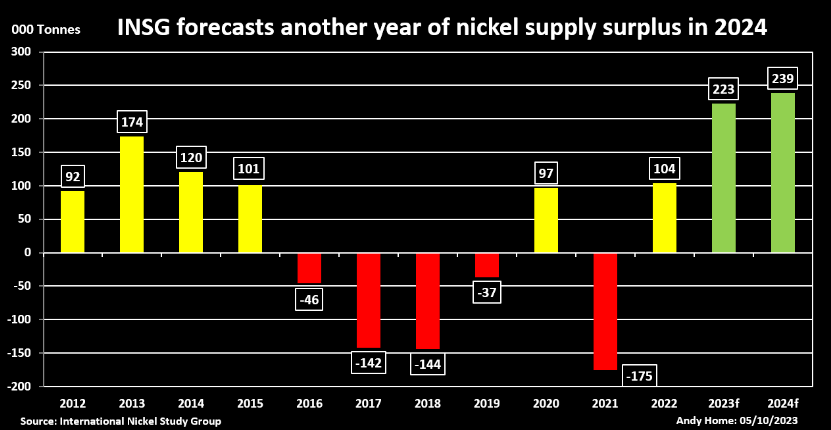

In response to the Worldwide Nickel Examine Group, the excess subsequent 12 months might be as excessive as 239,000 metric tons.

Supply: INSG

Whereas downward strain could proceed over the following a number of months, in the long term from 2025 the demand aspect ought to speed up and steadiness the oversupply.

Palladium: Sanction Loopholes to Enhance Costs

Palladium is without doubt one of the rarest metals, which considerably limits its provide.

On the demand aspect, the primary shopper is the automotive business, which generates greater than 80% of worldwide demand primarily by the manufacturing of catalytic converters.

Counting from the start of the 12 months, Palladium quotations, like Nickel, are dropping, reaching the bottom ranges since 2018.

Palladium Worth Chart

Nevertheless, the upward impulse of the final 5 days, which resulted in a rebound of lower than 25%, attracted consideration.

That is as a result of determination of the UK to impose one other bundle of sanctions on Russia, from which Palladium was particularly excluded.

Below these circumstances, the commodity’s valuation has a great probability of beginning a rally, which from a technical perspective has an opportunity of reaching as excessive as $1,600 within the brief time period.

***

In 2024, let exhausting choices grow to be straightforward with our AI-powered stock-picking device.

Have you ever ever discovered your self confronted with the query: which inventory ought to I purchase subsequent?

Fortunately, this sense is lengthy gone for ProPicks customers.

Utilizing state-of-the-art AI expertise, ProPicks offers six market-beating stock-picking methods, together with the flagship “Tech Titans,” which outperformed the market by 670% over the past decade.

Be part of now and by no means miss one other bull market by not realizing which shares to purchase!

Declare Your Low cost At present!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, or suggestion to take a position as such it isn’t meant to incentivize the acquisition of property in any method. I wish to remind you that any kind of asset, is evaluated from a number of factors of view and is very dangerous and due to this fact, any funding determination and the related threat stays with the investor.

[ad_2]

Source link