[ad_1]

Already in early August, see , we warned that per the Elliott Wave Precept (EWP) a significant prime could possibly be forming for the . We adopted up on our forecast frequently, with the market throwing the compulsory and occasional curve ball. However by the tip of October, the index had misplaced 11%. Three weeks in the past, see , we discovered a reversal was seemingly and:

“The Bulls have one final likelihood to succeed in $4800, so long as $4100 shouldn’t be breached. A corrective pullback within the EWP evaluation all the time takes form as an a-b-c construction, whereby the W-a includes three or 5 waves, whereas the c-wave encompasses primarily 5 waves. Subsequently, as a result of the preliminary decline from the July $4607 excessive into the August $4335 low counts finest as three waves, it suggests that is an a-b-c corrective pullback. It units the index up for a rally to ideally $4800 when the pullback completes. Nonetheless, just one (!) kind of sample can begin as a three-wave transfer and can nonetheless full a full 5 waves: the “dreaded” diagonal.”

Quick ahead, and the index bottomed at $4103 on October 27 and staged a robust sufficient rally to provide a Zweig Breadth Thrust. Thus, up to now, the Bulls stick saved it by three (4100 vs 4103) However is it sufficient? Permit me to elucidate utilizing Figures 1 and a pair of beneath.

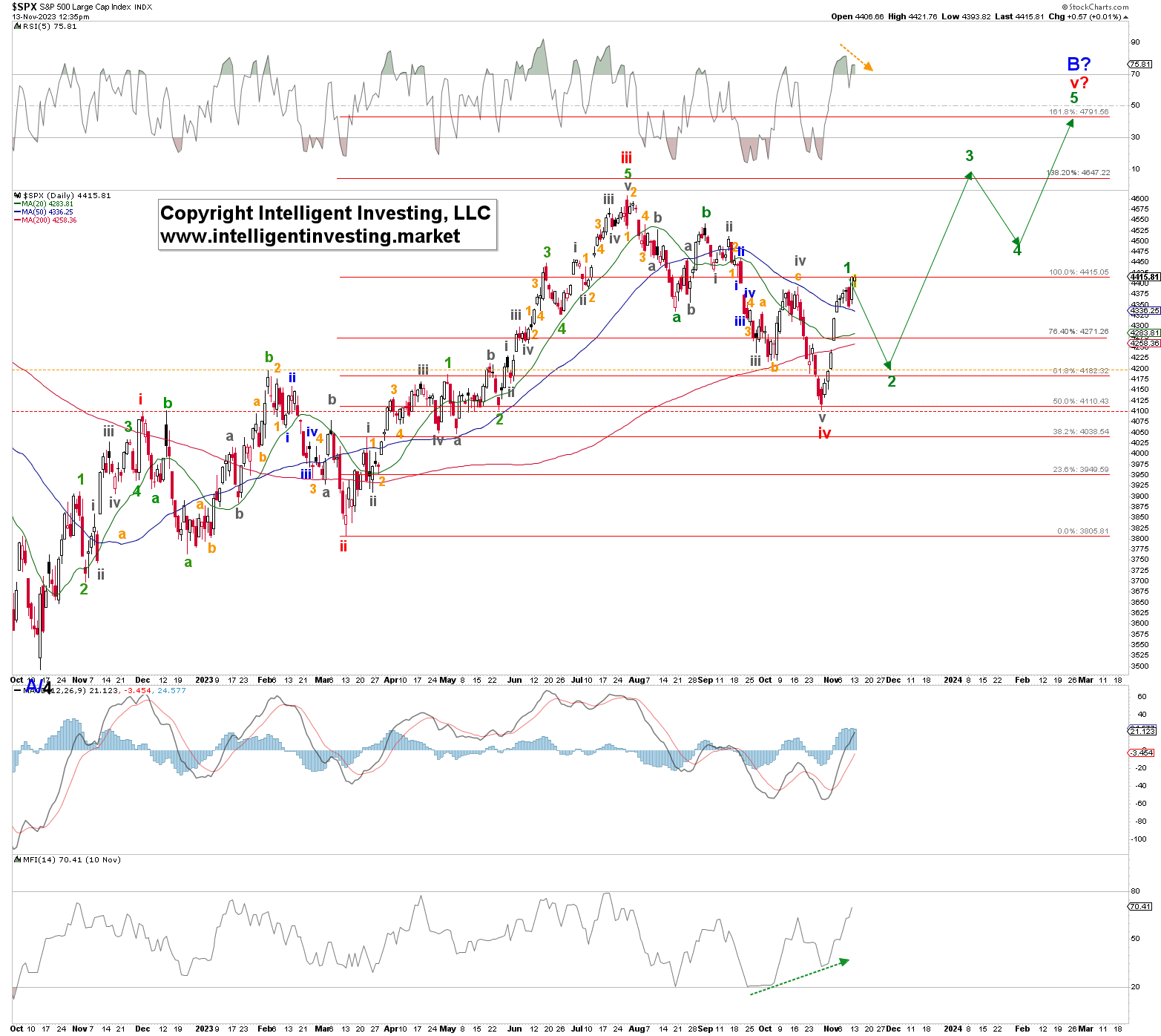

Determine 1. Every day SPX chart with detailed EWP rely and technical indicators

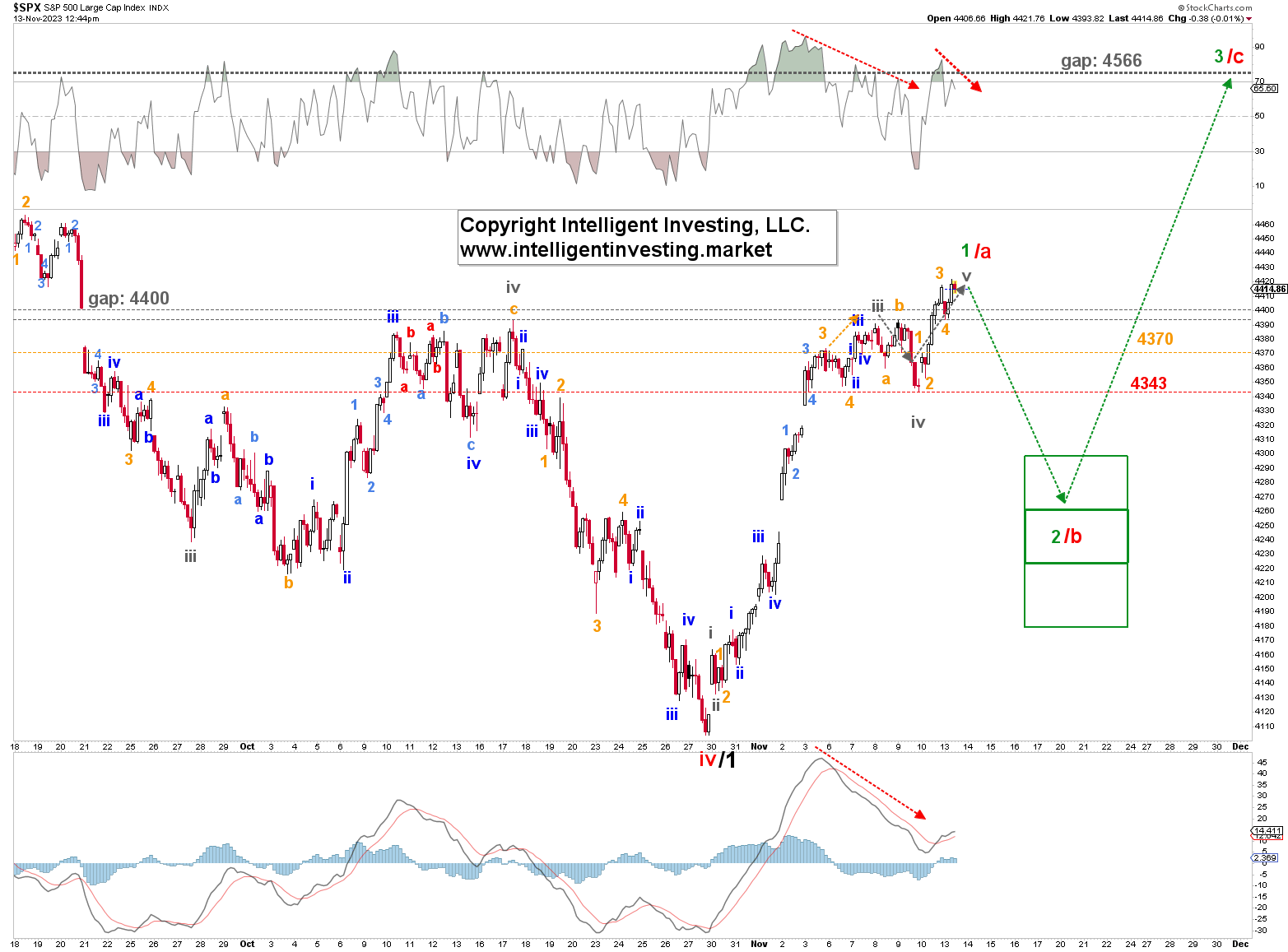

The primary choice, Determine 1, tells us the index bottomed for pink W-iv in October and is in a brand new impulse transfer (inexperienced Wave 1, 2, 3, 4, and 5) greater to the $4800 stage: pink W-v. Primarily based on the short-term EWP rely (See Determine 3), we anticipated inexperienced W-1 to wrap up shortly, after which a quick, multi-day pullback, inexperienced W-2 to ideally $4240+/-20 will kick in. From there, the index can launch in inexperienced W-3 to ideally the $4550ish.

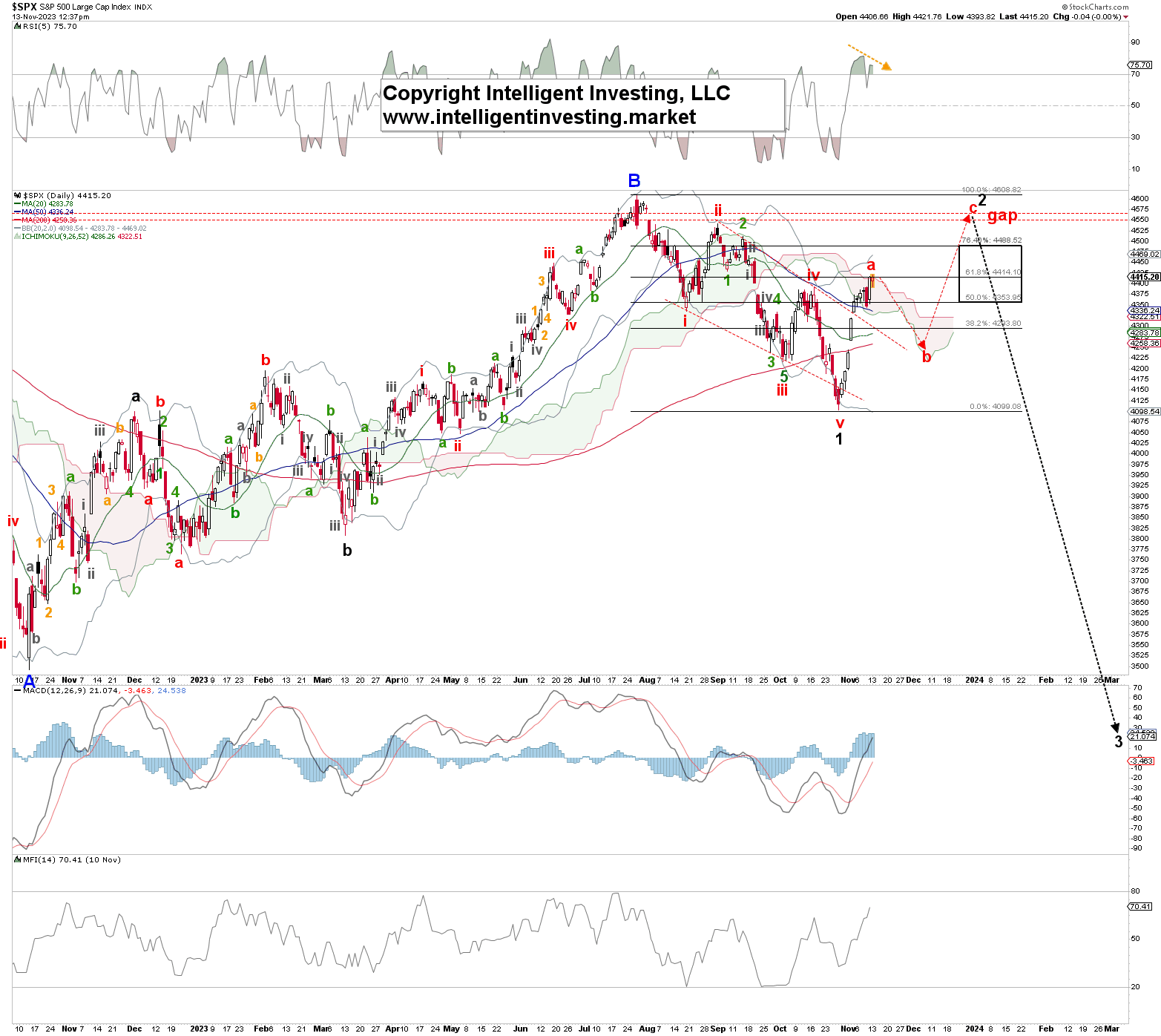

The second choice, Determine 2, follows an analogous path, however the main diagonal (black W-1) bottomed out in October, and a counter-trend rally (black W-2) is now underway. As we realized, counter-trend strikes, aka corrections, comprise three waves, and on this case, based mostly on the short-term EWP rely (See Determine 3), we anticipated the five-wave pink W-a to wrap up shortly after which a quick, multi-day pullback, pink W-b to ideally $4240+/-20 will kick in. From there, the index can launch in pink W-c to ideally the $4560 to shut the August 2n hole down open, the place c=a.

Determine 2. Every day SPX chart with detailed EWP rely and technical indicators

Therefore, within the intermediate time period (over the following few weeks), each choices enable for a similar path ahead, however as soon as the $4550/60 stage is reached, the market can determine to take path 1 or 2. We do not know but. From a threat/reward perspective, please observe that path 1 will result in marginally greater costs ($4800), with the potential of $5000 (+5 to 10%) from the place the following vital pullback could be anticipated. In distinction, path 2 says the following appreciable decline (-50%) will begin there.

Determine 3. Hourly SPX chart with detailed EWP rely and technical indicators

[ad_2]

Source link