[ad_1]

DNY59

The Fed’s pivot to chopping charges has been placed on pause, with some warning of renewed price will increase: e.g., Larry Summers just lately cited a 15% chance charges can be bumped up resulting from entrenched inflation. If charges keep elevated for longer, what corporations may profit or be minimally broken? P&C insurer CNA Monetary (NYSE:CNA) is an organization that qualifies and presents a 3.8% dividend yield. As final 12 months confirmed, CNA’s web curiosity revenue (NII) was capable of profit from greater rates of interest. And if charges do drop, administration ably navigated decrease charges throughout the 15 years that adopted the GFC. Importantly for revenue traders, CNA has been capable of pay particular dividends to shareholders yearly since 2014, along with rising its common dividend at a 7.4% price throughout the decade. The insurer’s underlying fundamentals and inventory efficiency suggests CNA is a purchase for its rising dividend, supplemented by particular dividends, in addition to potential share value appreciation.

Loews Function within the Previous that Continues At this time

There aren’t many publicly traded shares an investor buys with 92% of the float owned by a $17B conglomerate, however, that’s the case for CNA Monetary. In 1974, Loews Company (L) “rescued” an almost bankrupt CNA by shopping for 56% of CNA’s inventory after the prior 12 months’s merger with Gulf Oil fell aside. Gulf had really agreed to accumulate CNA in October of 1973. On the time, Gulf reasoned they wanted to diversify into non-energy property to minimize its dependence on oil income susceptible to Mid-East battle. For CNA, a associate was a necessity after an acquisition binge begun in 1966 had eroded the corporate’s profitability. When Gulf aborted the settlement, CNA was ripe for a takeover and Loews noticed a possibility. By the top of 1974, billionaire CEO, Laurence Tisch, had elevated Lowe’s stake in CNA to 83% stake.

Loews was pivotal to CNA’s turnaround within the Seventies, shortly chopping prices, promoting unprofitable non-insurance acquisitions, eliminating money-losing insurance coverage traces and putting in new administration. By 1983, CNA had divested, discontinued, or written off practically all of its non-insurance operations; and by the top of Nineteen Nineties, the corporate had offered off most of its private insurance coverage divisions (auto, owners, and life reinsurance). Consequently, the stage was set for at the moment’s sole deal with industrial P&C insurance coverage traces. For CNA shareholders, Loews 92% management over CNA’s float means vulnerability to the conglomerate’s capital allocation choices. Nevertheless, Feb fifth feedback by President & CEO, James Tisch, point out CNA’s vested curiosity in Loews and the inherent assist the conglomerate presents:

“Given the energy of CNA’s enterprise, I proceed to search out the market’s valuation of CNA perplexing. As I mentioned final quarter, the corporate has grown considerably and has grow to be markedly extra worthwhile. Nonetheless, the corporate’s share value is sort of 20% decrease at the moment than it was in the beginning of 2018. Our view is that CNA is a compelling worth, and for that motive, we bought 4.5 million shares of CNA widespread inventory for about $178 million in 2023. We proceed to be bullish on the outlook for CNA’s enterprise.”

Loews brings supportive energy to CNA and its shareholders. It is simply too necessary to the conglomerate for CNA to not carry out properly. By means of the years, Loews has bought CNA’s inventory when thought of too low, modified administration when wanted and equipped money infusions when surprising underwriting danger has materialized. In a way, Loews might be seen as an insurance coverage coverage for CNA’s shareholders, or no less than a ‘watch canine’ guarding in opposition to components that might jeopardize the inventory’s efficiency and dividend technology.

CNA’s Sample of Outperforming Loews’ Inventory

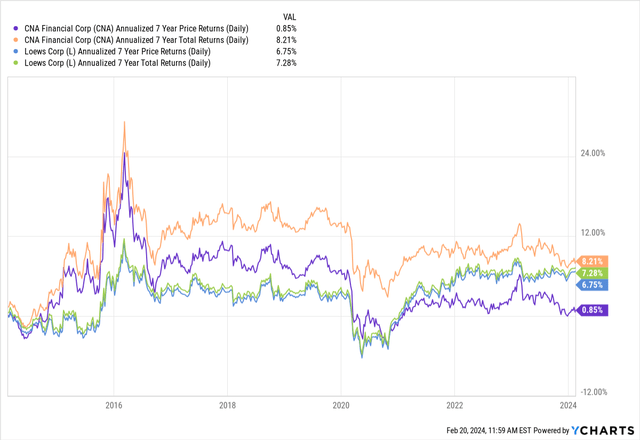

CNA’s and Loews’ shares have displayed a sample over longer time intervals that may be instructive. The graph beneath exhibits the price-only return, in addition to the full return, when annualized over the previous 7 years. On a purely value foundation, CNA was flat however its complete return was 8% because of the dividend, representing a 1% outperformance of Loews over the previous 7 years. Long run, CNA’s outperformance of Loews is extra stark: the 20-yr annualized complete return for CNA is 6.7% in comparison with Lowe’s 3.1% over the previous twenty years.

Ycharts.com

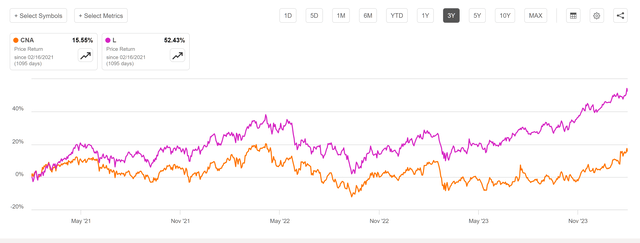

Not too long ago, nonetheless, the sample of CNA besting its main shareholder has not been the case. Beneath is a graph depicting Loews cumulative outperformance of its subsidiary by 37% since Feb of 2021. Sure, Loews purchased again 6% of its excellent float in 2023 and the conglomerate owns a pipeline enterprise and lodges. However, Loews greatest supply of revenues and earnings comes from CNA, who’s accountable for over 70% of the conglomerate’s market cap. CNA’s significance to Loews explains, partly, the 2 shares’ relationship. If CNA’s returns to its sample of surpassing Loews, it’s cheap to count on the insurer will catch up and erase the 37% discrepancy. It is not an arbitrage scenario per se, however, it’s a hopeful consideration for CNA shareholders.

In search of Alpha

CNA’s Revenues and Profitability Soared in 2023

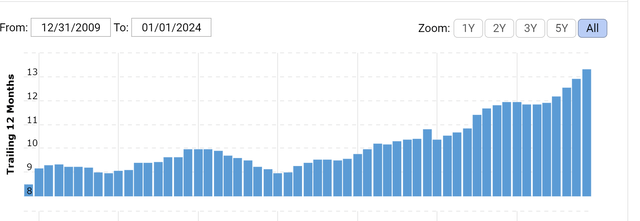

Placing apart Loews vested curiosity in CNA’s success, the P&C insurer had a powerful 2023. Revenues have been on a trajectory greater since 2016 and final 12 months CNA’s income progress of 12% continued the pattern. Robust consumer retention, in addition to new enterprise and shrewd pricing, have helped gross sales. The desk beneath exhibits the long run income image for the reason that 2009 GFC interval.

Macrotrends.com

As for income, P&C insurers generate their earnings in two related methods: the underwriting premiums (web of claims and bills) and the revenue earned from investing these premiums–the ever necessary NII. In 2023, each modalities mixed to extend CNA’s total web revenue by 77%. Validating the thesis that CNA can profit from higher-for-longer charges, the corporate elevated its NII some 25% in 2023. Internet funding revenue represents the cash earned from prospects’ premium funds previous to any outflow to settle claims. With short-term charges so excessive, CNA was capable of generate important revenue on this so-called “float.” Administration expects improved NII to proceed, together with the worthwhile underwriting wanted for the float’s dimension to be sufficient for vigorous NII. CNA’s underwriting talent is usually measured by the trade’s metric known as the “mixed ratio.” In easy phrases, this conveys how a lot of the premium is retained by the corporate after paying claims and different bills. In accordance with the corporate’s CFO, final 12 months’s underlying mixed ratio was 90.9%, that means $9.10 of each $100 {dollars} of premium was retained. Robust NII and worthwhile underwriting prolonged CNA’s EPS progress price of 8.3% since 2019.

Wholesome Money Stream to Cowl the Dividend

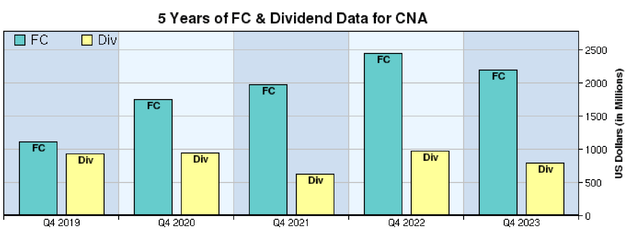

An organization’s money stream relative to the dividend paid is a crucial gauge for assessing the dividend’s sustainability and progress potential. As proven within the graphic that follows, CNA skill to cowl the dividend with FCF has been wholesome.

Mclean Fairness Analysis

With a payout ratio round 36%, CNA’s dedication to dividend technology and progress are cheap expectations. Furthermore, the corporate’s decade-long streak of paying particular dividends speaks to ample money stream, in addition to a shareholder pleasant administration. Not too long ago, one other $2.00 particular dividend was introduced on prime of CNA’s common dividend of 44 cents. In 7 out of the previous 10 years, $2.00 has been the quantity of the particular dividend. The opposite years averaged ~$1.00 of complement dividend revenue. Combing the particular dividend and common payout equates to a 8% yield going ahead in 2024.

A Inventory Value with 20% Upside Potential

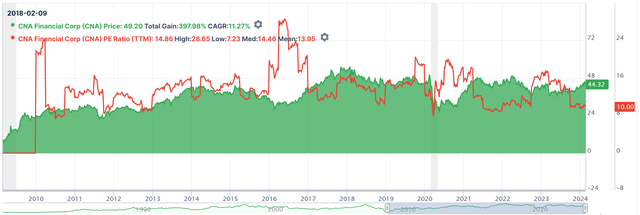

CNA’s inventory value relative to its P/E ratio over the previous 15 years is proven beneath. At this time, CNA trades at a P/E round 10x earnings. Making use of its 15-year common P/E of 13.9x suggests a 40% undervaluation and implies a inventory value round $62 per share. Shorter time period, CNA’s 5-yr common of 13.3x suggests a inventory value of $59/share. The P/E vary over these 15 years has seen CNA’s commerce as excessive as 28x earnings and as little as 7x earnings. I agree with Loews administration evaluation that CNA is undervalued by 20%, implying a 12x P/E and a inventory value over $50/share in comparison with at the moment’s $44 value.

GuruFocus.com

When CNA’s inventory dropped to the $36 value degree final July (the same value level seen when March’s banking disaster sunk most monetary service shares), Loews began shopping for its subsidiary’s inventory across the $39/share value level. At this time, CNA trades round $44/share, roughly the midpoint between final 12 months’s lows and the conglomerates cited value goal of $50/share. On Feb fifteenth, the inventory traded as excessive as $47/share however has dropped over the previous week. The decline in CNA could proceed however final 12 months’s lows appear to be a degree that pulls patrons (e.g., worth traders like Donald Smith and Joel Greenblatt, along with Loews). At at the moment’s value of ~$44/share, traders can think about incremental purchases, watching to see if higher value factors current themselves. Regardless, CNA’s inventory ought to provide income-oriented traders with a rising dividend stream, supplemented by particular dividends.

Last Ideas

Overshadowed by fear over banks and different lenders, the energy of insurers like CNA has been missed. Final 12 months’s success might be traced, partly, to greater curiosity that helped the insurer’s web funding revenue. With altering rate of interest expectations underway within the early months of 2024, CNA’s skill to learn from higher-for-longer charges continues. This, together with disciplined underwriting, bode properly for the P&C insurer fundamentals. Importantly for revenue traders, CNA has grown its dividend at 7.4% for the previous decade, supplementing this common dividend with particular ones. With Loews 92% possession of the inventory, shareholders have a ‘guard canine’ watching over the corporate, important to the conglomerate. For the house owners of the remaining 8% of excellent shares, CNA presents traders a rising dividend that yields near 4%, in addition to a low-beta inventory with 20% upside potential and restricted draw back because of the protecting position Loews can play.

[ad_2]

Source link