[ad_1]

OlekStock

Welcome to the November 2023 cobalt miners information.

The previous month noticed flat cobalt costs proceed and a moderately flat month of reports.

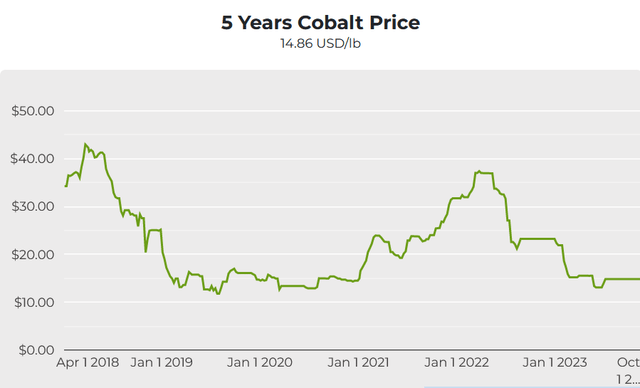

Cobalt value information

As of November 24, the cobalt spot value was at US$14.86/lb, successfully the identical as US$14.85/lb final month. The LME cobalt value is US$32,510/tonne. LME Cobalt stock is 92 tonnes, the identical because the 92 degree from final month. Extra particulars on cobalt pricing (specifically the extra related cobalt sulphate), may be discovered at Benchmark Mineral Intelligence or Quick Markets MB.

Cobalt spot costs – 5-year chart – USD 14.86 (supply)

Mining.com

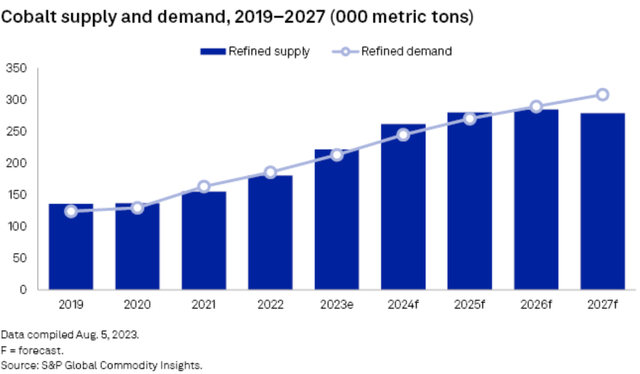

Cobalt demand v provide forecasts

S&P World Intelligence cobalt demand v provide forecast as of Aug. 2023 (deficit in 2027) (supply)

S&P World

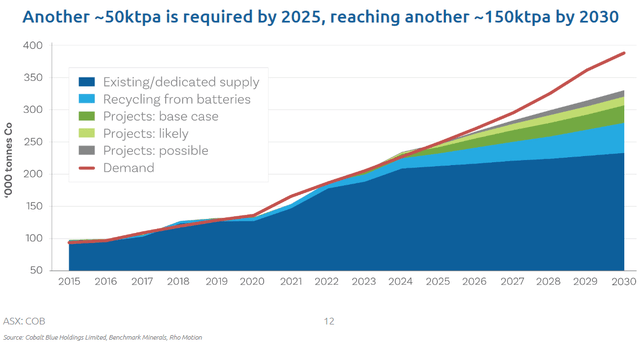

Cobalt provide and demand forecast – Deficits rising from ~2025/26 (forecast as of 2023 by Cobalt Blue, Benchmark Mineral Intelligence, & Rho Movement) (supply)

Cobalt Blue, BMI, Rho Movement

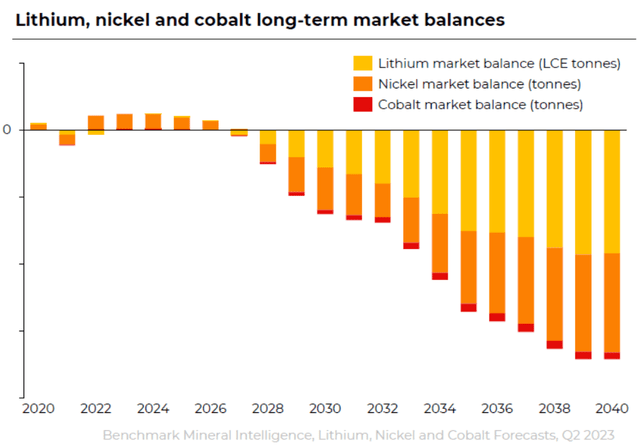

Benchmark Mineral Intelligence forecasts deficits for lithium, nickel & cobalt to extend from 2027 onwards (supply)

BMI

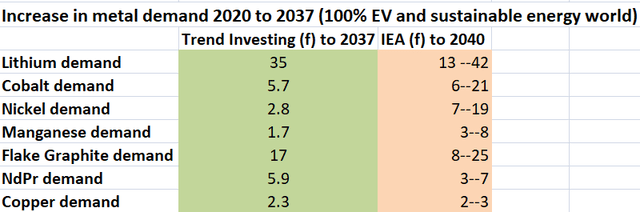

Development Investing v IEA demand forecast for EV metals (IEA)

Development Investing & the IEA

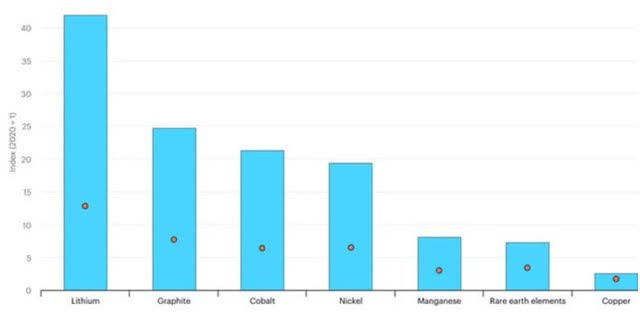

2021 IEA forecast progress in demand for chosen minerals from clear power applied sciences by state of affairs, 2040 relative to 2020 – Will increase Of Lithium 13x to 42x, Graphite 8x to 25x, Cobalt 6x to 21x, Nickel 7x to 19x, Manganese 3x to 8x, Uncommon Earths 3x to 7x, And Copper 2x to 3x

IEA

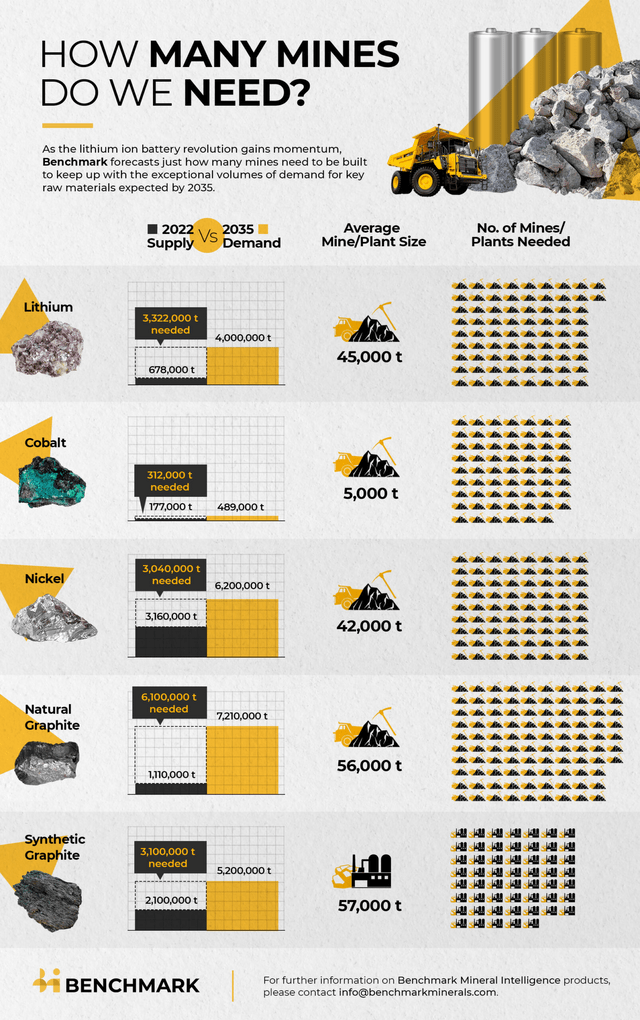

2022 – BMI forecasts we’d like 330+ new EV steel mines from 2022 to 2035 to satisfy surging demand – 62 new 5,000tpa cobalt mines (drops to 38 if embrace recycling)

BMI

Cobalt market information

On October 31, the Authorities of Canada introduced:

Authorities of Canada to boost essential minerals sector with launch of $1.5 billion Infrastructure Fund…The CMIF will tackle key infrastructure gaps to allow sustainable essential minerals manufacturing and to attach assets to markets. With as much as $1.5 billion out there over seven years, the fund will help clear power and transportation initiatives that may allow essential mineral improvement…“Our investments will assist the mining trade develop vital enabling and supporting infrastructure resembling roads and power amenities required previous to building of mines. Canada has a chance to be a considerable world producer of essential minerals. We’re happy to play a task in unlocking essential mineral deposits, that are important for Canada’s transfer to internet zero and financial improvement in northern communities.”

On November 14, Investopedia reported:

Uncommon earth minerals are extra in demand than ever—Listed here are those to know. Demand for uncommon earth minerals and metals has soared over the previous few years, as extra industries and international locations transition to cleaner power sources…China refines 68% of the world’s nickel, 59% of its lithium, and 73% of all cobalt. China additionally handles 85% of uncommon earth processing…Demand for cobalt jumped 70% from 2017 to 2022, and continues to rise as clear power functions for cobalt rose to 40% over the identical interval…The Democratic Republic of the Congo is the main producer of cobalt, and made up greater than 70% of the world’s cobalt manufacturing in 2022. Indonesia is one other high producer of cobalt, and tripled its cobalt manufacturing in 2022.

On November 23, Steel Tech Information reported:

Cobalt crashes – will it rise once more?…The August 2022 U.S. Inflation Discount Act (IRA) has additionally impacted the worldwide cobalt provide chain, with neither of the foremost suppliers – the DRC nor Indonesia – are in any place to provide cobalt compliant the tax and different IRA incentives within the close to future…New battery chemistries proceed to extend in effectivity, requiring much less and fewer cobalt. Tesla and different automotive producers and customers are trying to shift to cobalt-free chemistries like lithium iron phosphate and lithium manganese oxide for his or her EVs the place doable. “We count on additional draw back for cobalt costs within the close to time period as demand from the EV battery sector wanes whereas rising world manufacturing retains inventories wholesome,” market analyst Fitch Options mentioned in a latest report.

Cobalt firm information

Glencore [HK:805] [LSE:GLEN] (OTCPK:GLCNF)

On October 30, Glencore introduced:

Third quarter 2023 manufacturing report…Personal sourced cobalt manufacturing of 32,500 tonnes was according to the comparable 2022 interval…

CMOC Group Restricted [HKSE:3993] [SHE:603993] (OTCPK:CMCLF) (previously China Molybdenum)

On October 27, CMOC Group introduced: “2023 third quarterly monetary report…”

Zheijiang Huayou Cobalt [SHA:603799]

On November 7, Zheijiang Huayou Cobalt introduced:

Income and earnings each emerge tenth place. On November 1st, Zhejiang Enterprise Journal launched the total listing of income and revenue rankings for A-share listed firms in Zhejiang for the primary three quarters of 2023, with a complete of 691 firms on the listing. Huayou Cobalt achieved a formidable milestone, rating tenth with a income of 51.091 billion CNY and a internet revenue of three.013 billion CNY, demonstrating our dedication to main high-quality improvement with high-level openness…

Jinchuan Group Worldwide Sources [HK:2362]

On November 16, Jinchuan Group Worldwide Sources introduced:

Operational replace for the 9 months ended 30 September 2023…Throughout the Interval, the Group’s mining operations produced…1,672 tonnes of cobalt content material included in cobalt hydroxide (9 months ended 30 September 2022: 3,468 tonnes). Throughout the Interval, the Group’s mining operations offered…1,067 tonnes of cobalt (9 months ended 30 September 2022: 3,194 tonnes), representing a lower of roughly 67% year-on-year in comparison with the corresponding interval in 2022…generated income from gross sales of cobalt of roughly US$15.4 million (9 months ended 30 September 2022: roughly US$129.1 million), representing roughly 88% year-on-year lower in comparison with the corresponding interval in 2022. Furthermore, the income generated from buying and selling of externally sourced mineral and steel merchandise amounted to roughly US$147.4 million (9 months ended 30 September 2022: roughly US$210.5 million), representing a lower of roughly 30% as in comparison with the corresponding interval in 2022…

Chemaf (subsidiary of Shalina Sources)

On October 27, Reuters reported:

Trafigura’s Congo companion Chemaf may search patrons amid money crunch…The privately-owned copper and cobalt miner has requested for gives to wholly purchase the corporate, it mentioned within the Sept. 8 doc that invitations potential buyers to bid. A Chemaf spokesperson declined to remark. Chemaf mentioned within the doc that it has $690 million in debt and about $590 million of the borrowings had been organized by Trafigura.

On November 7, Chemaf introduced:

Strategic evaluation replace…To this point, over US$570 million has been invested within the improvement of Etoile Section 2 and Mutoshi with roughly US$250-300 million required to convey Etoile Section 2 and Mutoshi to manufacturing. In August 2023, CRL commenced a strategic evaluation course of in respect of Chemaf with a view to securing funding to convey Etoile Section 2 and Mutoshi to manufacturing as rapidly as doable given the importance of those initiatives to the DRC and its folks. CRL’s strategic evaluation course of is being led by CRL’s strategic advisor, Jeremy Meynert. As a part of this course of, CRL is evaluating all doable funding alternate options with respect to Chemaf.

GEM Co Ltd [SHE:002340]

No cobalt information for the month.

Eurasian Sources Group (“ERG”) – non-public

ERG personal the Metalkol facility within the DRC the place ERG processes cobalt and copper tailings with a capability of as much as 24,000 tonnes of cobalt pa.

No information for the month.

Umicore SA [Brussels:UMI] (OTCPK:UMICY)

On October 31 Umicore SA introduced:

Umicore and Ignitis Renewables enter into long-term PPA to provide renewable electrical energy to Umicore’s EV battery supplies plant in Poland…

Sumitomo Steel Mining Co. (TYO:5713) (Sumitomo Steel Mining Co., Ltd. (OTCPK:STMNF) Inventory Worth At this time, Quote & Information)

On November 8, Sumitomo Steel Mining Co. introduced:

FY2023 Capital Expenditure and Whole Funding Plan. Sumitomo Steel Mining Co., Ltd. plans a complete 193.4billion yen of capital expenditures on a consolidated foundation in the course of the fiscal 12 months 2023 (April 1, 2023 — March 31, 2024). The whole funding represents a 37% improve from that of FY2022.

On November 8, Sumitomo Steel Mining Co. introduced: “Consolidated monetary outcomes for the second quarter ended September 30, 2023…”

On November 16, Sumitomo Steel Mining Co. introduced:

FY2023 2nd quarter progress of Enterprise Technique…Decline in steel costs put stress on earnings. Market surroundings surrounding the supplies enterprise continues to stagnate. Whereas the influence of hovering power and different costs has been easing and working price worsened, earnings declined by 115.3 billion yen.

MMC Norilsk Nickel [LSX:MNOD] [GR:NNIC] (OTC:NILSY)

On November 3, MMC Norilsk Nickel introduced: “Nornickel’s Board of Administrators approves 2030 Socially Sustainable Growth Technique…”

On November 13, MMC Norilsk Nickel introduced: “Nornickel and Rosatom to look into nuclear energy potential in Norilsk…”

Sherritt Worldwide [TSX:S] (OTCPK:SHERF)

On November 1, Sherritt Worldwide introduced: “Sherritt stories third quarter 2023 outcomes.” Highlights embrace:

“Bought roughly 97% of the full 2,082 tonnes of cobalt acquired below the Cobalt Swap settlement; remaining cobalt anticipated to be offered and all money to be acquired by finish of 12 months. Accessible liquidity in Canada was $104.2 million. Sherritt’s share of completed nickel and cobalt manufacturing on the Moa JV was 3,841 tonnes and 410 tonnes in comparison with 4,443 tonnes and 419 tonnes in Q3 2022, respectively. Internet direct money price (NDCC)(1) was US$7.24/lb in comparison with US$6.76/lb in Q3 2022 primarily because of the influence of decrease nickel gross sales volumes, decrease fertilizer by-product credit and better upkeep prices, partly offset by greater cobalt by-product credit. Internet loss from persevering with operations was $24.8 million, or $(0.06) per share in Q3 2023, in comparison with a internet loss from persevering with operations of $26.9 million, or $(0.07) per share, in Q3 2022. Adjusted EBITDA(1) was $(9.1) million in comparison with $37.4 million in Q3 2022 primarily on account of delayed nickel gross sales, decrease fertilizer gross sales volumes and decrease cobalt and fertilizer average-realized costs(1)…. Primarily based on its outcomes up to now, Sherritt has offered updates to its 2023 steering.”

Nickel 28 [TSXV:NKL] [GR:3JC] (OTCPK:CONXF)

On November 8, Nickel 28 introduced: “Nickel 28 releases Ramu Q3 2023 working efficiency.” Highlights embrace:

“Ramu Q3 2023 manufacturing of 851 tonnes of contained cobalt in MHP, in comparison with 759 tonnes in Q3 2022. Quick Markets common cobalt value of US$16.58/lb. in Q3 2023, a 37% lower from the identical interval final 12 months. The typical 2023 YTD Quick Markets cobalt value was $16.50/lb., in comparison with a mean Quick Markets cobalt value of $33.35/lb. for similar interval 2022.”

Electra Battery Supplies [TSXV:ELBM] (ELBM)

On November 16, Electra Battery Supplies introduced: “Electra stories Q3 2023 outcomes and supplies replace on Battery Materials Refinery Venture.” Highlights embrace:

Electra Q3 2023 Highlights and Developments

“Closed concurrent brokered and non-brokered non-public placements for mixture gross proceeds of $21.5 million. Underneath the phrases of the fairness financings, the Firm issued 19,545,454 items in mixture, at a value of $1.10 per unit with every unit consisting of 1 frequent share and one frequent share buy warrant….. Held money and marketable securities of $15.7 million as at September 30, 2023, up from $7.4 million as at June 30, 2023… Internet loss for the quarter was $9.2 million or $0.20 per share… Working loss for Q3 2023 was $4.2 million, down from $4.8 million for Q3 2022. The decline was primarily pushed by decrease exploration prices for Iron Creek, Electra’s exploration property in Idaho. Progressed with the primary plant-scale recycling of black mass materials in North America utilizing Electra’s proprietary hydrometallurgical course of. Progress in Q3 was marked by recoveries of essential metals, together with lithium, nickel, cobalt, copper, manganese, and graphite, wanted for the EV battery provide chain, and the manufacturing of high-quality nickel-cobalt combined hydroxide, graphite, and lithium carbonate merchandise. Made the primary buyer cargo of nickel-cobalt combined hydroxide precipitate (MHP) produced on the Firm’s refinery advanced north of Toronto from recycled battery materials. To this point, Electra has shipped roughly 20 tonnes of nickel-cobalt MHP to clients. Prolonged and expanded the phrases of its battery-grade cobalt provide settlement with LG Vitality Resolution whereby Electra will now provide as much as 19,000 tonnes of contained cobalt in sulfate over a five-year interval starting in 2025, up from 7,000 tonnes over a three-year interval when the provision settlement was first introduced in September 2022… Introduced receipt of a discover from The Nasdaq Inventory Market LLC (“Nasdaq”) stating that the Firm isn’t in compliance with the minimal bid value requirement of US$1.00 per share below Nasdaq’s Itemizing Rule 5550(a)(2) primarily based upon the closing bid value of the Firm’s frequent shares for the 30 consecutive enterprise days previous to the date of the Discover, September 21, 2023. The Firm has 180 calendar days from the date of the Discover, or till March 19, 2024, to regain compliance with the Minimal Bid Requirement, throughout which period the Firm’s frequent shares will proceed to commerce on Nasdaq.”

Highlights Subsequent to Quarter Finish

“Prolonged the processing of black mass materials at its refinery advanced primarily based on the successes of its battery recycling trial, which have included improved recoveries of high-value components, greater steel content material in saleable merchandise produced, and decreased use of reagents. Further MHP product deliveries to clients are anticipated in This fall. Acquired US$5 million in long-lead, essential gear, together with stress vessels, tanks, and structural metal, wanted for completion of the Firm’s cobalt sulfate refinery. Set up of the gear delivered at website will happen as Electra secures capital funding necessities for its refinery mission.”

Potential mid-term producers (2025 onwards)

Jervois World Restricted [ASX:JRV] [TSXV: JRV] (OTCQX:JRVMF) [FRA: IHS] (previously Jervois Mining)

On October 26, Jervois World Restricted introduced: “Jervois World Restricted quarterly actions report back to 30 September 2023.” Highlights embrace:

Jervois Finland:

“Adjusted EBITDA1 of US$0.5 million and US$8.2 million money circulate from operations of within the quarter. Q3 2023 cobalt gross sales of 1,216 metric tonnes.”

Idaho Cobalt Operations (“ICO”), United States (“U.S.”):

“Exploration drilling commenced at Sunshine deposit at ICO, totally refundable below US$15.0 million Division of Protection (“DoD”) Protection Manufacturing Act Title III funding settlement. U.S. cobalt refinery website choice course of commenced and AFRY USA LLC appointed to undertake Fundamental Engineering and Bankable Feasibility Examine (“BFS”). BFS scope is a 6,000 metric tonne each year contained cobalt greenfield U.S. refinery to supply cobalt sulphate for the U.S. auto trade. Web site choice and BFS prices totally refundable below funding settlement with DoD.”

São Miguel Paulista (“SMP”) nickel and cobalt refinery, Brazil:

“Engagement with events on companion financing advancing, with intention to conclude the method by finish of 2023.”

Company:

“US$50.0 million capital increase closed in July/August 2023. Finish September 2023 quarter money stability of US$54.9 million, US$44.5 million bodily cobalt inventories and drawn senior debt of US$148.9 million.”

On November 20, Jervois World Restricted introduced: “Jervois commences U.S. government-funded useful resource extension programme at ICO’s RAM deposit.”

Upcoming catalysts embrace:

Any bulletins concerning Jervois World’s ATVM mortgage software to the U.S. Division of Vitality. Restart of ultimate building at ICO. Any information concerning the refinancing of the restart of the São Miguel Paulista Refinery.

Dawn Vitality Metals Restricted [ASX:SRL] (OTCQX:SREMF) (previously Clear TeQ)

Dawn Vitality Metals has 132kt contained cobalt at their Dawn mission.

On October 26, Dawn Vitality Metals Restricted introduced: “Quarterly actions report.” Highlights embrace:

“The Firm continues to progress discussions with potential fairness funding and offtake companions for the Dawn Battery Supplies Complicated (‘Dawn Venture’). As a part of latest and ongoing engagement with US auto producers and numerous US authorities businesses, the Firm is evaluating the choice of finding the Dawn Venture’s nickel and cobalt refinery in the US: A US-based refinery will doubtlessly open up alternatives for grant funding pursuant to quite a lot of US Authorities applications, in addition to doable involvement by US-based strategic buyers. The Firm plans to undertake the analysis in live performance with US counterparties, and to that finish has engaged a US-based advisor to help with financing choices. Ongoing work streams to advance the totally built-in Dawn Venture continued with actions focussed on: Advancing work on {the electrical} transmission line (ETL) work scope. Energy programs research which can be required as a part of the ETL connection settlement have commenced. Work continues to advance on the design and planning of civil and overhead companies modifications required alongside the outsized transport route. Subject exploration actions continued to advance in the course of the quarter with a deal with increasing our understanding of the geological potential of our giant tenement package deal within the Macquarie Arc, New South Wales.”

Ardea Sources [ASX:ARL] (OTCPK:ARRRF)

In complete, Ardea has 6.1Mt of contained nickel and 386,000t of contained cobalt at their KNP Venture close to Kalgoorlie in Western Australia. Ardea can be exploring for gold and nickel sulphide on their >5,100 km2 of 100% managed tenements within the Jap Goldfields area of Western Australia.

On October 30, Ardea Sources introduced: “Quarterly operations report for the quarter ended 30 September 2023.” Highlights embrace:

“…Evaluation of the environmental approval’s pathway schedule. Finalising the environmental baseline research, notably spring season flora. Planning and preparation for the DFS, together with the event of: Venture operations procedures. Examine and mission execution schedules replace. Precedent authorized paperwork; and Scopes of Companies. Refining DFS metallurgical testwork applications. Growing an in depth mine plan Scope of Work. Refining the Measured Useful resource seven 12 months manufacturing profile, together with infill drill gap spacing and metres to be drilled for the DFS.”

On November 6, Ardea Sources introduced: “Retraction of Peer Comparability chart.”

Upcoming catalysts embrace:

2023/24 – Potential off-take companion settlement from Japanese consortium (MOU already signed) and funding for the GNCP Venture. Additional potential exploration outcomes together with additionally for lithium, uncommon earths, and nickel sulphide.

Cobalt Blue Holdings [ASX:COB] (OTCPK:CBBHF)

Cobalt Blue has 81.1kt of contained cobalt at their 100% owned Damaged Hill Cobalt Venture [BHCP] (previously Thackaringa Cobalt Venture) in NSW, Australia. LG Worldwide is an fairness strategic companion.

On October 31, Cobalt Blue Holdings introduced: “September 2023 quarterly actions report.” Highlights embrace:

Damaged Hill Cobalt Venture (BHCP) Actions

“Definitive Feasibility Examine replace. Demonstration Plant operations. Useful resource replace. Geotechnical Investigations. Environmental Assessments. Mining Lease Software

Refinery Growth Program

“Technique. Refinery Accomplice. Value Examine. Piloting Program. Allowing….”

Australian Mines [ASX:AUZ] (OTCPK:AMSLF)

On October 27, Australian Mines introduced: “Quarterly actions report for interval ended 30 September 2023.” Highlights embrace:

Sconi Battery Minerals Venture:

“Granting of ML 10368: Australian Mines’ wholly owned subsidiary Sconi Mining Operations Pty Ltd was granted Mining Lease 10368 for the Greenvale mining space by the Queensland Authorities Division of Sources on 4 July 2023. This mining lease, mixed with the Lucknow and Kokomo mining leases, accommodates the essential battery minerals assets for the Sconi Nickel-Cobalt-Scandium Venture in North Queensland. Environmental Impression Assertion: A call by the Federal Authorities’s Division of Local weather Change, Surroundings, Vitality and Water (DCCEEW) on the Environmental Safety and Biodiversity Conservation (EPBC) referral was made on 24 July 2023. which: Categorised the Sconi mission is a “managed motion” and consideration is required of the potential impacts on listed threatened species and communities and the surroundings… Allowing: On 29 September 2023, AUZ lodged an software with the Queensland Division of Sources for the 5 lease areas for infrastructure and haul street connections on the Sconi Venture space. These extra permits will kind a part of the better Sconi Battery Minerals Venture space. Exploration: Subject-based floor rock and soil sampling exploration actions had been performed on potential floor beforehand recognized by an impartial evaluation on the Sconi mining and exploration leases to doubtlessly establish extra nickel, cobalt and scandium mineral deposits. Drill applications and schedules are being developed to additional check this floor for potential useful resource addition. Software to Queensland Essential Minerals and Battery Expertise Fund… Strategic Collaborative Accomplice: AUZ continues discussions to safe a Strategic Collaborative Accomplice to help in driving the mission deliverables as we work in direction of our purpose of FID by the top of 2025/early 2026…”

Upcoming catalysts embrace:

Finish of 2025/early 2026 – FID for the Sconi Venture.

Havilah Sources [ASX:HAV] [GR:FWL] (OTCPK:HAVRF)

Havilah 100% personal the Mutooroo copper-cobalt mission about 60km west of Damaged Hill in South Australia. Additionally they have the close by Kalkaroo copper-gold-cobalt mission (optioned to Oz Minerals – now owned by BHP Group), in addition to a doubtlessly giant iron ore mission at Grants. Havilah’s 100% owned Kalkaroo copper-gold-cobalt deposit accommodates JORC Mineral Sources of 1.1 million tonnes of copper, 3.1 million ounces of gold and 23,200 tonnes of cobalt.

On October 30, Havilah Sources introduced:

Annual report 2023…This 12 months Havilah was concerned in a copper exploration and improvement alliance on its Curnamona Province tenements, firstly with OZ Minerals, after which with BHP subsequent to the takeover. This profitable, cooperative alliance offered funding for work on each the Kalkaroo copper-gold-cobalt deposit (‘Kalkaroo’) and on a number of copper prospects within the surrounding space, which has considerably benefited Havilah…

Upcoming catalysts embrace:

2023 – Progress in direction of the OZ Minerals (now owned by BHP Group) choice to purchase Kalkaroo. Mutooroo exploration outcomes.

Aeon Metals [ASX:AML] (OTC:AEOMF)

Aeon Metals 100% personal their Walford Creek copper-cobalt mission in Queensland Australia.

On October 27, Aeon Metals introduced: “Quarterly actions report.” Highlights embrace:

“Discussions with Waanyi Folks in relation to new Cultural Heritage and Monitoring Settlement progressing. Opinions of exploration information units undertaken for all tenements with a view to prioritizing future drilling and associated actions. Seek for potential companions in Walford Creek Venture continues. Analysis of recent mission alternatives on-going.”

Alliance Nickel Restricted [ASX:AXN] (OTC:GMRSF) (Previously GME Sources)

Alliance Nickel personal the NiWest Nickel-Cobalt Venture situated adjoining to Glencore’s Murrin Murrin Nickel operations within the North Jap Goldfields of Western Australia. The NiWest Venture which has an estimated 830,000 tonnes of nickel steel and 52,000 tonnes of cobalt.

On October 31, Alliance Nickel Restricted introduced: “Quarterly actions report September 2023.” Highlights embrace:

“Stellantis receives FIRB approval for Tranche 2 of strategic placement, new fairness proceeds of $2.3 million acquired. Export Finance Australia [EFA] supplies a conditional Letter of Help in direction of offering financing for the NiWest Nickel-Cobalt Venture. Value optimisation engineering throughout main capital and working price estimates continued and worldwide tender pricing continues for the acid plant, a cloth part of Venture capital expenditure. Water drilling applications have been accomplished on the Firm’s Mt Kilkenny tenements and on the Firm’s different licenced areas. Metallurgical testwork applications continued to evaluate the acid digestion variability of the NiWest ores to additional refine working prices related to heap leaching actions, in addition to progress the shopper pattern era by a pilot scale processing marketing campaign. Geometallurgical testing continued to help within the early dedication of nickel restoration and acid consumption for mine planning functions. Discussions continued to advance with logistics suppliers for the import and transport of sulphur by the Port of Esperance. EPA formal approval has been lodged, step one for environmental approval for building and operation of the Venture. Discussions continued with the Nyalpa Pirniku Native Title Group in relation to heritage and present native title agreements. Discussions with strategic offtake companions continued positively.”

On November 14, Alliance Nickel Restricted introduced: “NiWest Nickel-Cobalt Venture Mineral Useful resource Estimate improve.” Highlights embrace:

“…The replace has resulted in a 9.6% improve within the world NiWest Useful resource Estimate to 93.4Mt at 1.04% Ni and 0.07% Co3. Roughly 83% (805,000 tonnes of contained nickel) of the worldwide MRE is now within the Measured & Indicated JORC class. Whole steel tonnes improve to 971,000 tonnes contained nickel (beforehand 878,000 tonnes) and 65,000 tonnes contained cobalt (beforehand 55,000 tonnes) representing an 11% and 18% improve respectively. Inclusion of the brand new drill outcomes has considerably improved confidence within the Mt Kilkenny MRE with a rise of 26% within the Measured and Indicated Useful resource for this residue. The rise in MRE materially extends the primary stage of the mine plan at Mt Kilkenny, bettering lifetime of mine working prices and deferring sustaining capital expenditure. A common goal lease has been granted at Mt Kilkenny that completes the Venture licensing necessities for building, commissioning and operations.”

World Vitality Metals Corp. [TSXV:GEMC][GR:5GE1] (OTCQB:GBLEF)

On October 25, World Vitality Metals Corp. introduced:

World Vitality Metals pronounces investee firm Excessive-Tech Metals pronounces completion of drilling at Ontario-Primarily based Werner Lake Venture…All HTM samples have been despatched to the Firm’s lab companies supplier (ALS), with assay outcomes anticipated to begin arriving in roughly 2-4 weeks’ time. This follows the numerous outcomes achieved by the Ni-Cu-Co lithogeochemical sampling programme totalling 209 samples collected in the course of the 2023 subject season at Werner Lake Venture (Werner Lake, or the Venture) situated in northwestern Ontario (refer ASX launch dated 30 August 2023). The outcomes are extraordinarily encouraging for Werner Lake and make sure the Cu-Co potential of the Venture, in addition to the invention of high-grade nickel sulphide at floor. Of the 209 samples taken as a part of this system, twelve samples exceeded grades of greater than 1% cobalt or 1% copper and three samples returned outcomes better than 1% Ni.

Giga Metals Corp. [TSXV:GIGA][FSE: BRR2] (OTCQX:GIGGF) Turnagain Nickel-Cobalt Venture is now held through the JV firm Onerous Creek Nickel Company [TSXV:HNC] (HNCKF) (85% Giga Metals: 15% Mitsubishi Corp.)

On November 1, Giga Metals Corp. introduced:

Giga Metals engages the Armchair Dealer…The Armchair Dealer will present promoting to extend consciousness of the issuer by editorial content material, interviews, occasions, podcasts and information protection. The Armchair Dealer doesn’t present Investor Relations or Market Making companies. The settlement was signed November 1st, 2023, and the marketing campaign will price CDN $30,000 for 7 months. The Armchair Dealer at present holds no securities in Giga Metals.

The Metals Firm (TMC)

On October 31, The Metals Firm introduced: “The Metals Firm releases second annual influence report.” Highlights embrace:

“TMC’s second annual Impression Report outlines the Firm’s imaginative and prescient to create a rigorously managed, reusable steel commons, beginning with unlocking the planet’s largest undeveloped supply of battery metals, because the world seeks to handle the local weather disaster. The Firm outlines its impacts up to now in addition to the anticipated impacts and mitigation measures for the gathering of polymetallic nodules from the Clarion Clipperton Zone [CCZ] of the Pacific Ocean…”

On November 8, The Metals Firm introduced: “Researchers to return to the location of NORI’s Nodule Assortment System Take a look at to evaluate seafloor ecosystem operate a 12 months after the check.”

On November 9, The Metals Firm introduced: “The Metals Firm supplies third quarter 2023 company replace.” Highlights embrace:

“Internet lack of $12.5 million and internet loss per share of $0.04 for the quarter ended September 30, 2023. Whole money of roughly $22.5 million at September 30, 2023. Whole liquidity of roughly $56 million at September 30, 2023 inclusive of present money, $9 million anticipated extra closings from ERAS Capital LLC within the beforehand introduced Registered Direct Providing, and the undrawn $25 million unsecured credit score facility from an affiliate of Allseas Group SA.”

On November 9, The Metals Firm introduced:

TMC and PAMCO signal binding MOU to finish feasibility examine to course of polymetallic nodules into battery steel feedstocks…The events are working in direction of finalizing definitive processing agreements in Q3 2024…

On November 21, The Metals Firm introduced:

U.S. Senators push for UNCLOS ratification as members of congress name for ISA to undertake seafloor mining rules…

Chilean Cobalt Corp. (OTCQB:COBA)

Chilean Cobalt Corp. (“C3”) is a essential minerals exploration and improvement firm targeted on the La Cobaltera Venture situated in Chile’s historic San Juan cobalt district.

No information for the month.

Conclusion

November noticed cobalt spot costs flat and LME stock flat.

Highlights for the month had been:

Authorities of Canada to boost essential minerals sector with launch of $1.5 billion Essential Minerals Infrastructure Fund. Investopedia – “Demand for cobalt jumped 70% from 2017 to 2022, and continues to rise as clear power functions for cobalt rose to 40% over the identical interval.” Fitch Options – “We count on additional draw back for cobalt costs within the close to time period as demand from the EV battery sector wanes whereas rising world manufacturing retains inventories wholesome.” Glencore personal sourced cobalt manufacturing of 32,500 tonnes was according to the comparable 2022 interval. Trafigura’s Congo companion Chemaf may search patrons amid money crunch. Jervois World commences U.S. government-funded useful resource extension programme at ICO’s RAM deposit. Dawn Vitality Metals is evaluating the choice of finding the Dawn Venture’s nickel and cobalt refinery in the US. Alliance Nickel Useful resource replace has resulted in a 9.6% improve within the world NiWest Useful resource Estimate to 93.4Mt at 1.04% Ni and 0.07% Co. The Metals Firm (“TMC”) and PAMCO signal binding MOU to finish FS to course of polymetallic nodules into battery steel feedstocks. U.S. Senators push for UNCLOS ratification as members of congress name for ISA to undertake seafloor mining rules.

As regular all feedback are welcome.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please pay attention to the dangers related to these shares.

[ad_2]

Source link