[ad_1]

alvarez

As we speak, I’m reiterating a “purchase” ranking on Cooper-Customary Holdings (NYSE:CPS) with an preliminary goal worth of $54. The inventory is now buying and selling round $17.27, a rise of 9.44%, because the publishing of my establishing article.

Thesis

Cooper-Customary Holdings continues to realize what I consider is a exceptional business turnaround. The corporate seems to have reached an inflection level with its company restructuring, cost-saving methods, enhanced business agreements, recovering world mild automobile manufacturing charges, and the emergence of recent product choices. In my opinion, the corporate’s achievements within the third quarter have strengthened the bullish thesis. Administration has confidently navigated headwinds just like the United Auto Staff (UAW) strike and the continuation of economic negotiations with suppliers. Optimistic catalysts such because the rise of hybrid electrical and battery electrical automobiles, new merchandise that enhance the corporate’s content material per automobile, and a wholly-owned AI startup that has achieved its first business contract give the firm a chance to comprehend revenues and profitability larger than pre-pandemic ranges.

Thematics

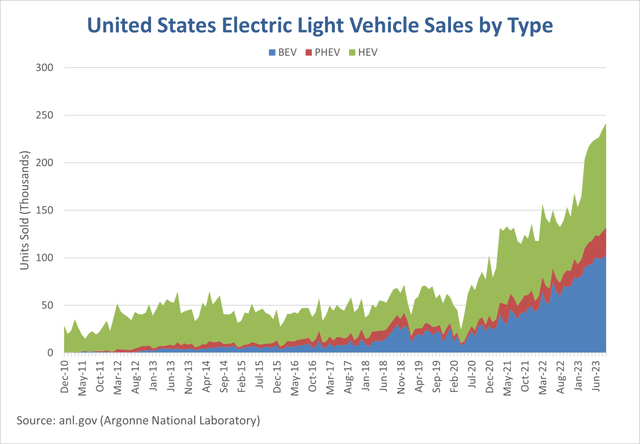

Whereas many forecasts and analyses for Cooper-Customary have centered solely on a restoration to pre-COVID ranges within the mild automobile business, the underlying dynamics have begun to vary markedly. The chart under introduces a brand new theme that would allow Cooper-Customary to capitalize on a big income alternative, ought to manufacturing ranges rebound to these seen earlier than the pandemic.

anl.gov (Argonne Nationwide Laboratory)

For the reason that COVID trough in light-duty automobile (LDV) gross sales, battery electrical (BEV), plug-in hybrid electrical (PHEV), and hybrid electrical (HEV) automobile gross sales have elevated by a staggering 1191%, 1290%, and 669% respectively. With this development within the EV section comes a big income alternative for Cooper-Customary, as these automobiles require extra advanced inner methods like engine, motor, and battery cooling methods, cabin heating, drive inverters, and CPU cooling. As an example, Cooper-Customary provides about 8 elements for a conventional inner combustion engine (ICE) automobile, HEVs require 28 elements, whereas BEVs require 20 elements. In accordance with the corporate, there is a 20% enhance in content material per automobile (CPV) in BEVs versus ICE-based automobiles. These traits start to shine by way of when wanting on the firm’s internet new EV awards totaling roughly $88.4 million to date in 2023.

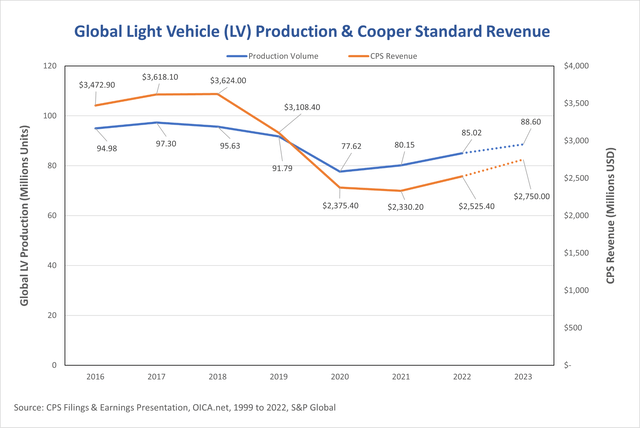

In my opinion, these enhancements to CPV start to shine by way of when taking a look at comparable development charges between Cooper-Customary’s revenues and world mild automobile manufacturing.

CPS Filings & Earnings Shows, OICA.internet 1999 to 2022, S&P World

In FY 2023, Cooper-Customary’s revenues are anticipated to extend roughly 8.89% over FY 2022. That is over double the anticipated development price of worldwide mild automobile (LV) manufacturing for a similar interval. In my opinion, this outperformance in development is a results of the corporate’s strategic efforts to extend its content material per automobile (CPV) by way of progressive merchandise resembling an upcoming built-in fluid system referred to as eCoFlow.

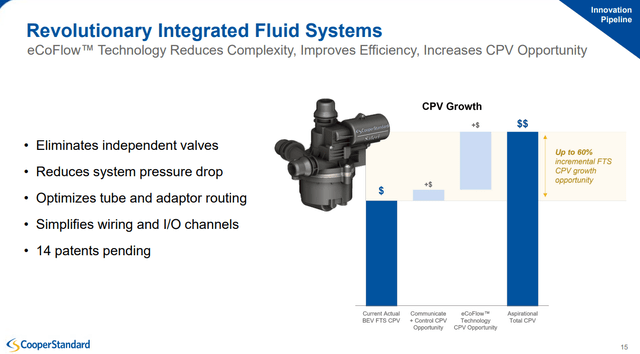

Additional, the corporate has set an aspirational aim of an incremental enhance in CPV of as much as 60% in its Q3 2023 earnings presentation.

Cooper-Customary Q3 2023 Earnings Presentation

Merely put, Cooper-Customary is demonstrating a transparent deal with an innovation pipeline that unlocks important incremental income alternatives per automobile produced. Consequently, I count on the corporate’s income development to proceed to outperform the will increase in world mild automobile manufacturing into and past 2024.

Cooper-Customary’s AI Initiative

The corporate shed some mild on an initiative that the majority traders are absolutely appreciating in the mean time. Liveline Applied sciences achieved a vital business milestone, signing its first exterior contract for Superior Course of Controls (APC). Liveline is a proprietary synthetic intelligence (AI)-based APC that was initially developed for inner use at Cooper-Customary services. Internally, the expertise is getting used on 20 traces in 4 totally different nations. This APC expertise has achieved important effectivity and scrap discount internally, with administration stating a typical controllable scrap discount of fifty%, and “important” realized financial savings. The corporate believes that this expertise has the potential to learn many manufacturing corporations throughout a variety of industries. That brings us to Liveline Applied sciences, a wholly-owned AI startup subsidiary meant to market this product to exterior clients. Although particulars on pricing weren’t given, that is one thing I will probably be watching carefully within the coming quarters because it has the potential to be an fascinating new income alternative for the corporate.

Financials

The corporate has now began to comprehend the total advantages of its prolonged strategy of renegotiating buyer agreements. In Q3, Cooper-Customary reported that almost all of those buyer negotiations have been profitable. The outcomes included sustainable pricing agreements, restoration of elevated prices and inflation, improved fee phrases for commerce receivables, and higher fee situations for tooling owned by clients.

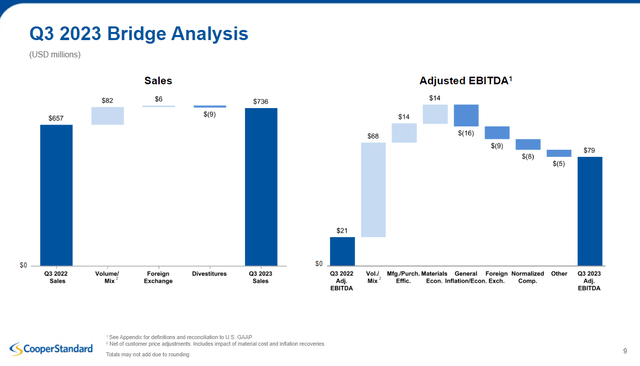

The next bridge evaluation from the corporate’s Q3 earnings presentation underscores the importance of what administration has achieved.

Cooper-Customary Q3 2023 Earnings Presentation

When it comes to each gross sales and adjusted EBITDA, quantity and blend have been the most important contributors to year-over-year enhancements. Along with larger manufacturing volumes and a extra favorable combine of upper content material per automobile (CPV) resembling electrical automobiles (EVs) and hybrid automobiles (HVs), retroactive price recoveries, together with supplies and inflation restoration, additionally contributed roughly $25 million to $30 million between gross sales and adjusted EBITDA.

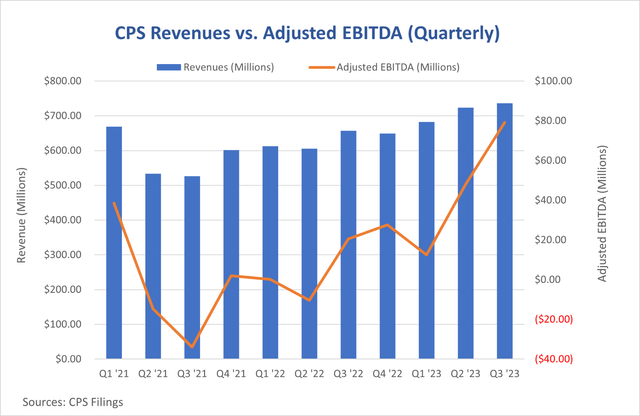

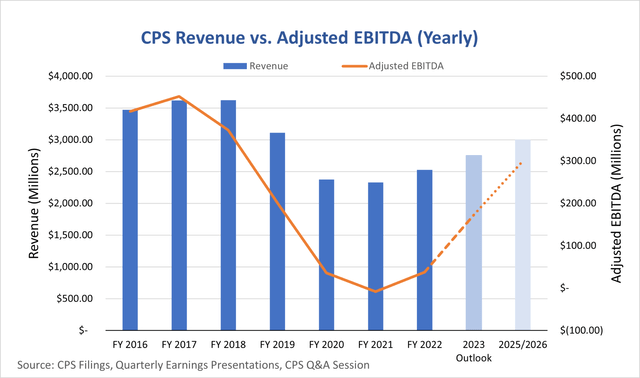

By zooming out a number of years, we will get a greater sense of how far the corporate has come by way of enhancing adjusted EBITDA.

Cooper-Customary Public Filings

Cooper-Customary Public Filings

On each quarterly and yearly timeframes, Cooper-Customary continues to make important progress towards its restoration and subsequent profitability.

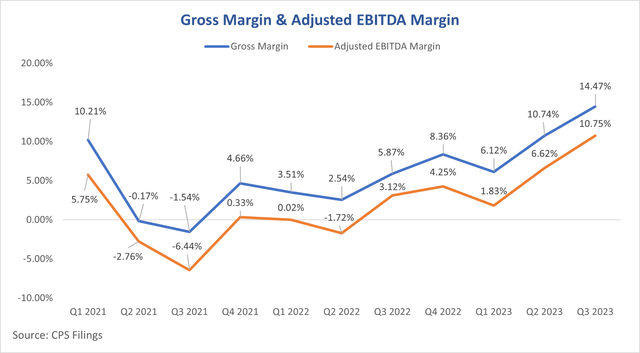

Margin Growth

Cooper-Customary Public Filings

As manufacturing quantity, combine, and Price of Items Bought (COGS) enhance, the corporate continues to realize new highs over a multi-year interval in each gross revenue and adjusted EBITDA margins. In simply two years, the corporate has improved its gross margin from -1.54% to 14.47% and its adjusted EBITDA margin from -6.44% to 10.75%. It seems that we at the moment are inside attain of the corporate’s beforehand said targets of normalized double-digit gross and adjusted EBITDA margins.

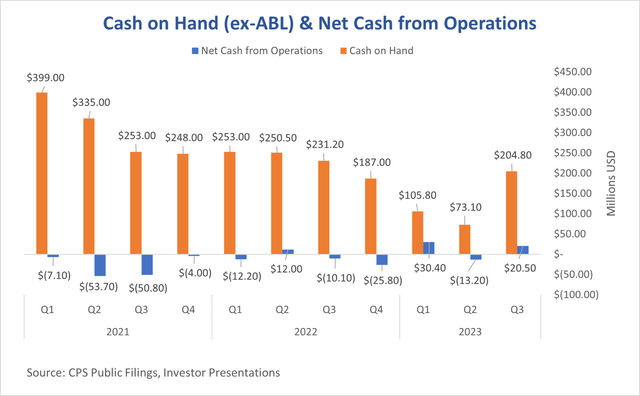

Liquidity

In my opinion, the corporate continues to exhibit sturdy liquidity. Together with its Asset-Primarily based Lending (ABL) facility, Cooper-Customary had a strong complete liquidity of roughly $259 million on the finish of the quarter.

I consider the next quote from CFO Jon Banas on the corporate’s Q3 2023 earnings name highlights their confidence within the present liquidity scenario:

We ended September with a money steadiness of roughly $205 million. This included a draw on our ABL facility of $120 million, which we opted to take previous to quarter finish, as a precautionary measure, because of the uncertainty and anticipation of potential manufacturing disruptions associated to the OEM labor negotiations.

As a result of we had this money readily available from the ABL draw, we didn’t issue our receivables in Europe, as we usually would. And this had the impact of lowering free money circulation within the quarter by roughly $15 million. With $55 million of remaining availability on our ABL, and money on the steadiness sheet, we had strong complete liquidity of roughly $259 million, as of September 30.

With the OEMs and the UAW, having just lately reached tentative labor agreements, which has considerably lowered the chance of additional manufacturing disruptions. We not felt carrying the incremental money from the ABL borrowings was essential. And we repaid the $120 million this morning.

Cooper-Customary Public Filings, Investor Shows

The compensation of the beforehand talked about ABL draw seems to be a transparent signal of administration’s confidence shifting ahead. Along with this decisive transfer, the corporate additionally believes that its current money reserves, anticipated future money flows, and entry to versatile credit score services will furnish ample assets to help ongoing operations. These reserves are anticipated to be additional strengthened by projected constructive money circulation within the fourth quarter.

UAW Impression

Although the United Auto Staff (UAW) strike started within the third quarter, there was a minimal affect of roughly $5 million on Q3 revenues. The corporate expects a This autumn income affect of $30 million and an EBITDA affect of $8-10 million. You will need to observe that the impacts on the corporate’s This autumn outcomes may find yourself being larger or decrease, relying on the re-ramp of OEMs. In my opinion, the worst is behind us, with the UAW putting tentative offers with Stellantis, Ford, and now Common Motors.

Steering

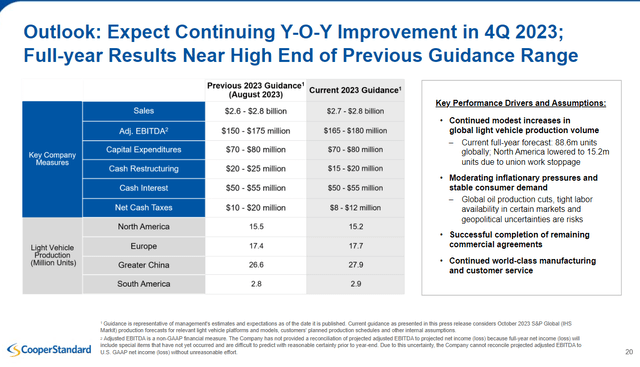

Although it seems that the UAW strike will affect This autumn outcomes, the corporate’s monetary steerage was raised throughout the board.

Cooper-Customary Q3 2023 Earnings Presentation

On this up to date slide from the decision, we will see that the income steerage vary has been tightened upward, and the corporate’s anticipated FY 2023 adjusted EBITDA has been revised upwards. Moreover, money restructuring and internet money tax expectations have been revised downwards. This constructive information comes with the anticipated impacts of the UAW strike already accounted for within the up to date numbers. Even when confronted with short-term headwinds, the corporate’s restoration seems to be unstoppable, for my part.

The corporate’s mild automobile manufacturing expectations have been additionally revised upwards in all areas besides North America, which was impacted by the UAW strike. I consider that is additional proof that world mild automobile manufacturing is effectively on its approach to returning to pre-COVID ranges.

Dangers

There are dangers and uncertainties related to proudly owning Cooper-Customary inventory. Dangers that will problem my bullish thesis on Cooper-Customary embody however will not be restricted to:

Automotive Sector Danger: Delayed automotive manufacturing schedules or a slowing of the manufacturing price restoration as a complete may materially affect Cooper-Customary’s revenues and money flows.

Industrial Agreements: Delays or the lack of administration to proceed securing the rest of their sustainable pricing agreements with clients may pose a menace to the corporate’s backside line, cashflows, and liquidity.

Inventory Volatility: Shares of Cooper-Customary may expertise short- to medium-term volatility. Detrimental information associated to the automotive business may act as a brief opposed catalyst. With the inventory now up ~40% because the firm’s Q3 earnings report, detrimental catalysts like weaker This autumn manufacturing in North America because of the UAW strikes could put stress on the inventory.

These dangers must be monitored diligently, as they’ll have an effect on Cooper-Customary’s efficiency materially.

Conclusion

Cooper-Customary continues to impress traders by delivering “blow-out” quarterly ends in Q3. The convergence of the corporate’s exceptional business turnaround and the immense operational leverage gained from recovering world auto manufacturing charges continues to validate the bullish thesis surrounding the corporate. In my opinion, there’s a very clear path ahead for the corporate; due to this fact, I welcome the volatility that will current itself within the coming quarters, giving traders a chance to purchase a inventory that is valued at a big low cost in comparison with what I consider will probably be incomes on a per-share foundation within the subsequent 1-3 years. Thanks for studying.

[ad_2]

Source link