[ad_1]

IgorSPb/iStock through Getty Pictures

Shares of Costamare (NYSE:CMRE) have rebounded notably in latest weeks. This may be attributable to the corporate’s dry bulk and containership fleets, that are seemingly set to profit notably from the continuing questions of safety within the Purple Sea, averting vessel passage within the Suez Canal. Nonetheless, I consider that the market has not priced the advantages of this ongoing disruption absolutely into the inventory.

However first, let me present some context to this story.

Except you’ve gotten been residing below a rock these days, over the previous few weeks, Yemen’s Houthi rebels haven’t simply been disturbing vessels making an attempt to enter the Suez Canal but additionally straight-up firing rockets. Final month, they even boarded Bahamas-flagged Galaxy Chief, a car provider. Wanting on the footage was like these Somali Pirate movies on steroids.

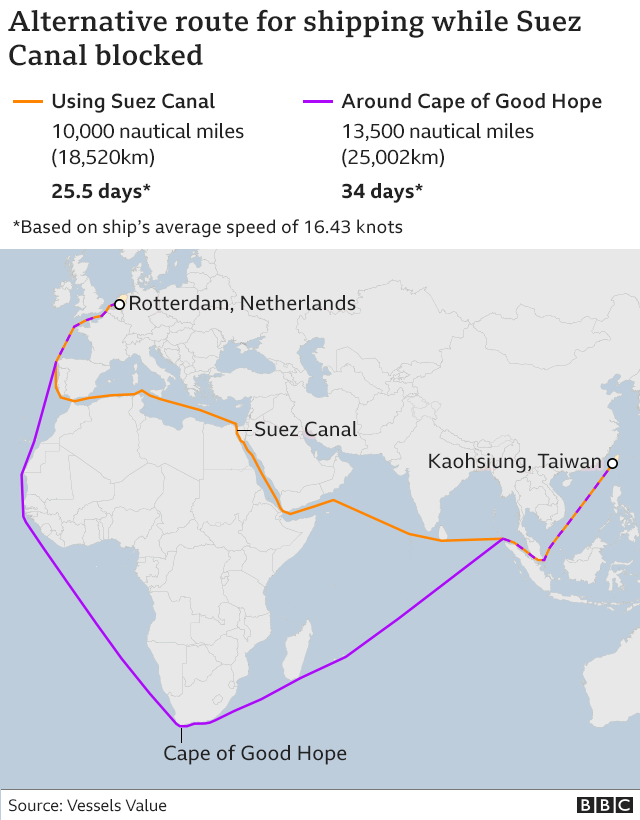

With assaults intensifying week after week, outstanding delivery corporations, resembling Mediterranean Delivery Firm, Maersk (AMKBY), Hapag-Lloyd (OTCPK:HPGLY), and the oil firm BP (BP) have all said they’re rerouting vessels away from the Purple Sea. Buying and selling from Asia to Europe now has to happen by means of vessels going all the best way round by means of the Cape of Good Hope.

Different Route To Suez Canal (BBC)

As a result of an ever-riskier maritime setting, this implies increased gasoline prices, longer journeys, and better insurance coverage prices. The end result? Greater charges. If somebody is benefiting from this example, it is the vessel homeowners, like Costamare.

What’s price noting right here is that we’re not used to any such scenario, and subsequently, we might intuitively really feel that it’s going to get resolved quickly. For many years, motion by means of the Suez Canal has been protected. Thus, the common individual seemingly thinks this example will likely be resolved in the end. Initiatives to revive order, resembling Operation Prosperity Guardian led by the U.S., actually alludes to that narrative.

Nonetheless, the truth is much totally different.

Operation Prosperity Guardian failed earlier than it even started. It shortly collapsed, with Italy, Spain, and France refusing to function below U.S. command. Who can blame them? It is just too dangerous. Certain, navy vessels can shoot down a number of drones attacking business vessels.

However what number of of them can they shoot down, and the way costly is that? Warships carry a restricted variety of missiles, and so they price loads. Houthis can ship an “limitless” quantity of assault drones for chip change. A missile prices a few million {dollars}. A drone prices a number of thousand {dollars}. It is merely “not a very good enterprise” to be within the suicide drone interception business lately.

Subsequently, whereas you might even see some liners resuming operations within the Purple Sea, resembling Maersk, that is solely as a consequence of a few of their vessels having the posh of being accompanied by U.S. warships. This does not apply to most vessels nonetheless compelled to go round South Africa.

I count on that even present U.S. assist will fade within the space as it’s ineffective. You can’t patrol and accompany each single vessel endlessly. It is simply unattainable. Thus, the present scenario is destined to final for a very long time. There’s simply no method to cease these assaults, and there’s no incentive for the Houthis to cease so long as their calls for will not be met.

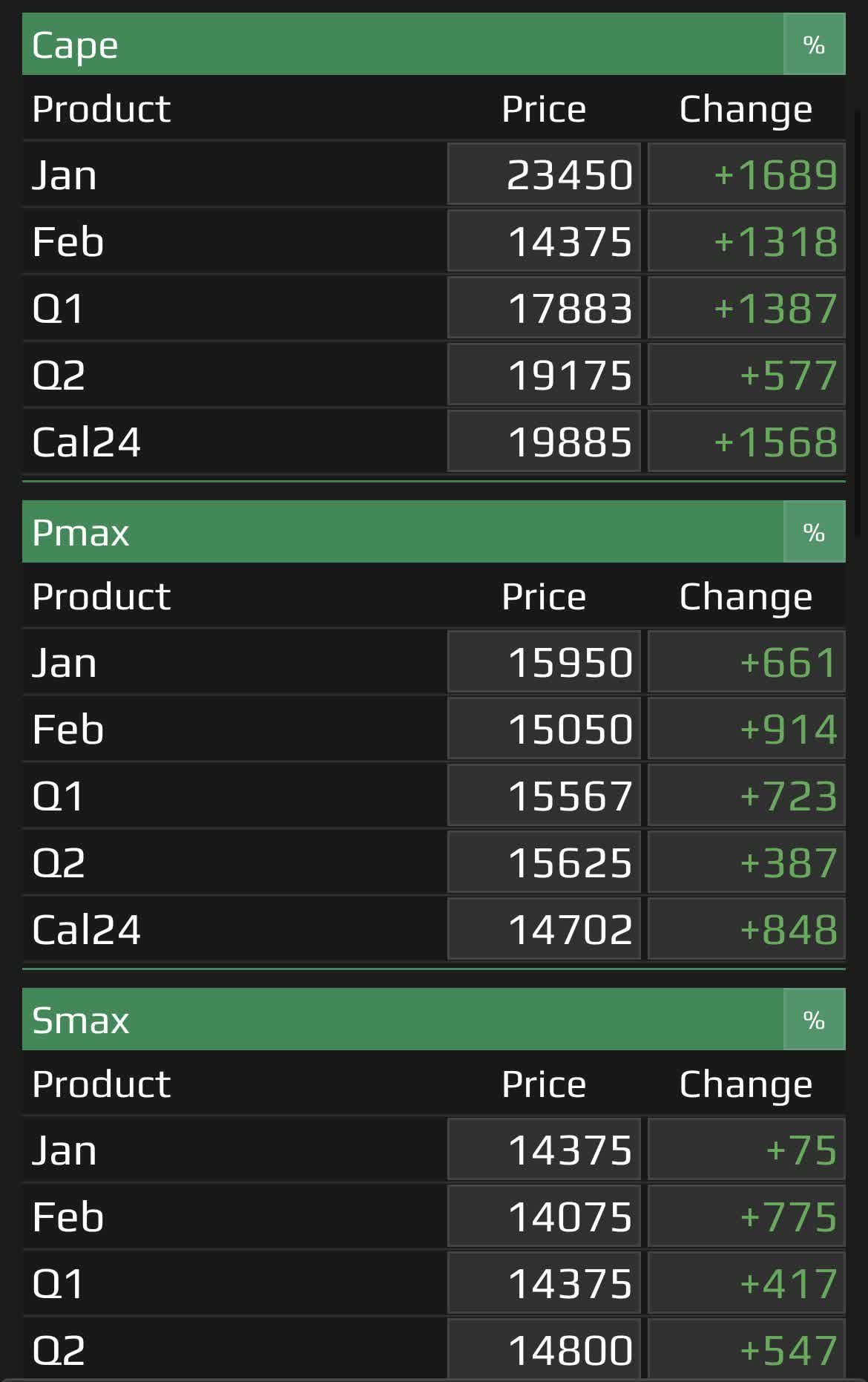

Delivery traders perceive this. Evidently, spot charges throughout most delivery asset courses have skyrocketed. Let’s check out the dry bulk first. Listed here are the FFAs as of December twenty eighth.

January Capes above $23K and Cal24 simply $20K are tremendous worthwhile charges.

Dry bulk FFAs (braemarscreen.com)

I consider that Costamare will profit considerably from the surge in dry bulk charges. On the finish of Q3, their 34 Newcastlemax/Capesize vessels had a mean tenor of 1.1 years, whereas their 14 Kamsarmax/Panamax vessels had a mean tenor of 0.4 years.

These are very quick tenures, as is frequent within the dry bulk house, that means that Costamare will need to have already began renewing a lot of its charters at a lot increased charges than the beforehand depressed ranges.

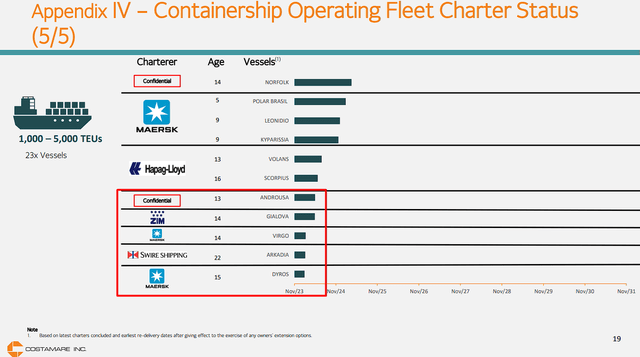

Within the meantime, the corporate’s containerships, which boasts a contract backlog of about $2.7 billion with a TEU-weighted period of three.7 years, is about to maintain producing resilient money flows within the coming years, as has been the case quarter after quarter these days.

As quickly as a number of the firm’s containerships begin popping out of their current charters, like Dyros, Arkadia, and Virgo, as proven beneath, it is fairly seemingly that Costamare may have the chance to resume their employment at increased charges.

Containerships With Charters Ending Quickly (Costamare Investor Presentation)

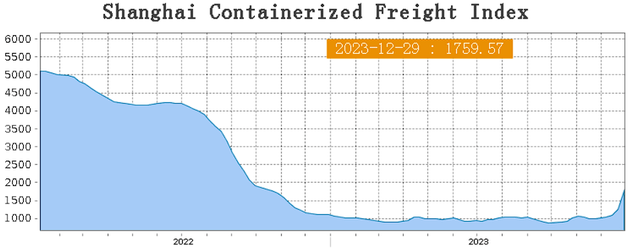

As you may see, the Shanghai Export Containerized Freight Index jumped by 40.2% week-over-week to 1,759.57 on December 29.

Shanghai Containerized Freight Index (en.sse.web.cn)

This pattern is prone to be sustained as an growing variety of containerships proceed to keep away from the Purple Sea.

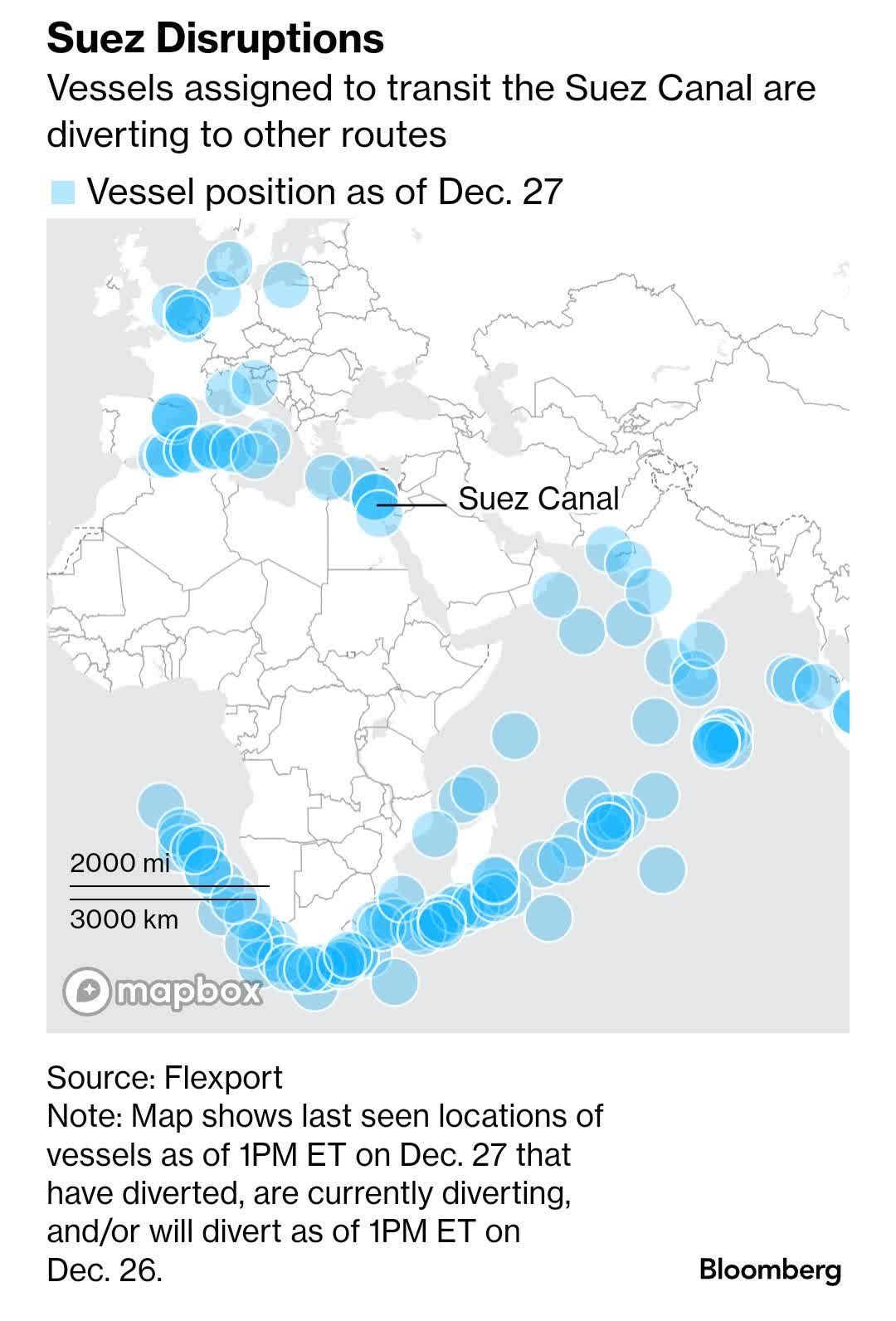

Evidently, Flexport Inc.’s newest information signifies a major change in sea routes. About 299 ships, with a complete capability of 4.3 million containers, have both modified course or are planning on doing so-double the quantity from only a week in the past, making up roughly 18% of worldwide delivery capability.

Suez Disruptions (Flexport/Bloomberg)

These new routes round Africa can take as much as 25% extra time than the standard shortcut by means of the Suez Canal. In accordance with Flexport, this implies increased delivery prices, which might result in elevated costs for shoppers throughout varied items, from sneakers to meals and oil, if these longer journeys proceed.

I need to spotlight once more that I do not consider this will likely be a short-term problem. As just lately as this previous Friday (Dec. twenty ninth), Mitsui O.S.Okay. Traces (OTCPK:MSLOY) and Nippon Yusen (OTCPK:NPNYY), Japan’s largest delivery corporations, additionally said their vessels with hyperlinks to Israel have been avoiding the Purple Sea space.

Hapag-Lloyd additionally affirmed that they may proceed to reroute vessels across the Suez Canal for safety causes.

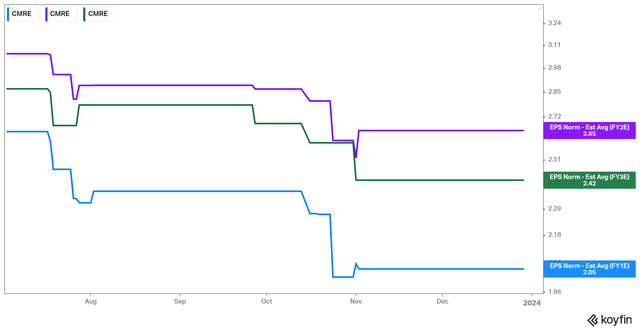

Regardless of these tailwinds for charges, ahead EPS estimates for Costamare haven’t been revised upward. Wall Road appears to be largely sleeping on the continuing Purple Sea scenario and the underlying profit on firm earnings which were the results of the continuing disruption.

Costamare Ahead EPS Estimates (Koyfin)

Subsequently, the inventory is at the moment buying and selling at about 5 occasions this yr’s anticipated EPS and at about 4 occasions subsequent yr’s anticipated on what are moderately pessimistic estimates, in my opinion.

Concurrently, Costamare has $996.9 million in liquidity, which equals about 79% of its present market cap, and no vital mortgage/lease maturities till 2026. Company leverage on a Market Values foundation stays beneath 37% as properly.

The mixture of:

A wholesome steadiness sheet with ample firepower for additional growth, an aligned administration workforce with 64% insider/household possession that has re-invested $149 million through Costamare’s DRIP program, non-dilutive financing with ongoing buybacks ($60M over the previous 12 months or 5% of present market cap, low-cost present and ahead valuation multiples, and ongoing Purple Sea-related tailwinds which are seemingly not priced into the inventory,

kinds a compelling funding case, in my opinion. Accordingly, I stay bullish on CMRE inventory.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please pay attention to the dangers related to these shares.

[ad_2]

Source link