[ad_1]

Thomas Lohnes

By Sandra Rhouma & John Taylor

Though markets count on each the Fed and the ECB to chop charges in June, macro developments might change that forecast.

As inflation continues to ease throughout the developed world, markets are looking forward to the rate-cutting cycle to start. The US Federal Reserve and European Central Financial institution (ECB) will overview financial coverage at their June conferences, and buyers count on each to begin slicing at that stage. That is a practical central case, in our view, primarily based on printed financial information.

However one other issue might affect the batting order: every central financial institution has its personal particular mandate that determines its coverage response to adjustments within the financial system.

The US financial system – notably labor markets – stays sturdy, prompting issues that US inflation will not fall as quick as anticipated and that the Fed might delay its first reduce, maybe for a while. In these circumstances, would the ECB stand nonetheless?

Various Mandates Create Totally different Motivations

Whereas the Fed’s twin mandate contains each inflation and unemployment targets, the ECB is remitted to focus completely on worth stability, maintaining inflation close to however beneath 2%. So, we predict the ECB would possible reduce charges if the Fed had been to delay the beginning of its slicing cycle, so long as euro-area inflation stays on a sustainable downward course towards the goal.

The ECB’s decision-making ought to comply with three rules. Basically, the governing council should consider: 1) how successfully financial coverage is working to curb inflationary pressures; 2) if the underlying core elements of inflation are falling and; 3) the outlook for inflation, primarily based on obtainable information.

The financial institution has confused that it stays dedicated to evaluating new information as they turn out to be obtainable, and to contemplating potential second-round results in its decision-making. However primarily based on the info we now have now, we predict the way in which can be clear for the ECB to chop first.

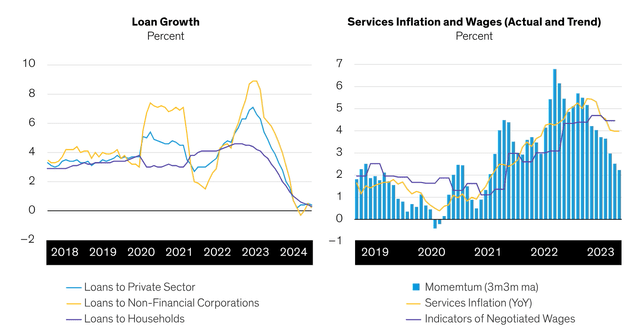

Financial coverage transmission stays efficient, evidenced by tighter credit score circumstances and slower credit score development. Headline inflation has fallen considerably in 2023 and continues to say no sooner than anticipated. And although core inflation – particularly companies inflation – stays barely extra cussed, it is slowly following an analogous downward path regardless of sturdy wage pressures.

Moreover, the ECB’s March forecast and projections confirmed additional falls in inflation forward: headline inflation is anticipated to be 2.0% in 2025 and 1.9% in 2026. Basically, inflation is already at goal within the medium time period, and additional downward revisions are greater than possible in June.

On the hawkish aspect, some members of the ECB governing council stay preoccupied by wage will increase. However we predict the info will allay their fears: wage development slowed barely within the fourth quarter of 2023 and is anticipated to ease additional in 2024 (Show).

Due to this fact, we consider all the mandatory macroeconomic circumstances shall be met within the subsequent few months for the ECB to begin slicing charges in June.

Euro-Space Inflation Alerts Are Pointing Down

Credit score Situations Have Tightened and Core Companies Inflation Is Falling

Present and historic analyses don’t assure future outcomes. As of December 31, 2023 (Negotiated Wages), January 31, 2024 (Credit score Knowledge and Momentum) and February 29, 2024 (Companies Inflation) (Supply: ECB, Haver and AllianceBernstein (AB))

Timing and Development are Essential Elements, too

Whereas inflation metrics are the first drivers for ECB decision-making, the governing council will nonetheless fastidiously take into account the query of timing and the impression of its choices on euro-area financial development.

The ECB might nonetheless postpone its personal determination – however in our view, solely till the July governing council assembly, and pushed solely by home concerns. ECB audio system (from hawks to doves) have talked about June as a probable place to begin. Through the press convention following the March assembly, ECB president Christine Lagarde talked about that the governing council has already began to debate dialing again its restrictive coverage stance. An extra delay can be met with sturdy pushback from the doves and would harm a struggling euro-area financial system, probably risking inflation coming in effectively beneath the two% goal within the medium time period.

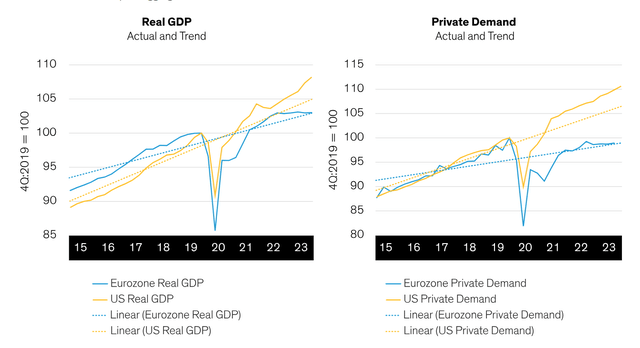

So, sustaining financial development is not a proper ECB goal, however it could be a mistake for the governing council to maintain charges unnecessarily excessive, hurting the financial system and additional widening the efficiency hole with the US. When it comes to actual development, the US has conspicuously outperformed its pre-pandemic development whereas the eurozone has barely recovered from it. The primary drivers: completely different home demand patterns throughout each areas, the place the hole has massively widened for the reason that begin of the pandemic (Show). The identical development is clear throughout consumption and funding.

Development Efficiency Favors Earlier ECB Cuts

The Euro-Space Economic system Is Lagging the US

Historic and present analyses don’t assure future outcomes. As of December 31, 2023 (Supply: BEA, Eurostat and AB)

Whereas the Fed can take its time to ponder inflation information in opposition to the backdrop of a robust home financial system, the ECB is underneath extra stress. Euro-area development is anticipated to select up within the second half of 2024 however stay weak. And Germany, the most important financial system, faces structural challenges that want time to resolve. Given these robust home constraints, we predict the euro-area state of affairs and outlook are shouting for price cuts to begin sooner fairly than later.

Implications for Buyers

After all, this ECB-first situation might not materialize. But when it does, buyers have to be prepared.

If the ECB leads the rate-cutting cycle, buyers will see each decrease euro charges and certain a weaker euro forex than the market at present expects. That has implications for positioning throughout each the yield curve and currencies.

ECB price cuts would immediate falling euro-denominated bond yields, boosting costs. On this situation, buyers ought to profit from holding euro bonds with probably the most sensitivity to adjustments in rates of interest (the longest length). Finally, decrease charges also needs to increase consumption and funding, stimulating development and supporting company issuers.

Whereas euro-denominated bond costs will possible rise, buyers ought to take care that forex losses from a weakening euro do not offset their worth features. For example, US buyers ought to take into account hedging their euro publicity again to US {dollars}.

As ever, it is higher to be forewarned and forearmed.

The views expressed herein don’t represent analysis, funding recommendation or commerce suggestions and don’t essentially signify the views of all AB portfolio-management groups. Views are topic to vary over time.

Authentic Submit

Editor’s Observe: The abstract bullets for this text had been chosen by Looking for Alpha editors.

[ad_2]

Source link