[ad_1]

andresr

The Client Value Index (CPI) Report was revealed on January 11, 2024, at 8:30 AM. The report accommodates details about modifications within the costs (inflation/deflation) of a big selection of products and providers bought by customers within the U.S. throughout the month of December 2023.

On this report, we are going to stroll readers by means of an in depth evaluation of the CPI report. We may also focus on the doubtless implications of the reported information for the U.S. economic system and monetary markets.

Abstract Knowledge and Evaluation

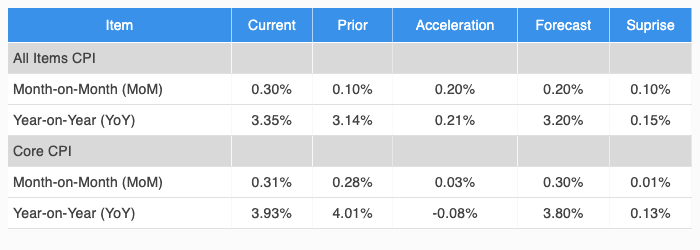

A abstract of key information and evaluation for this month’s CPI report is offered in Determine 1.

Determine 1: Change, Acceleration, Expectations, and Shock

Core & All Objects CPI (BLS & Investor Acumen)

All Objects CPI accelerated and shocked to the upside. Core CPI (+0.31%) primarily held regular and was in keeping with expectations, though it each accelerated and beat expectations barely.

Value Adjustments in Main CPI Parts Over Varied Time Frames

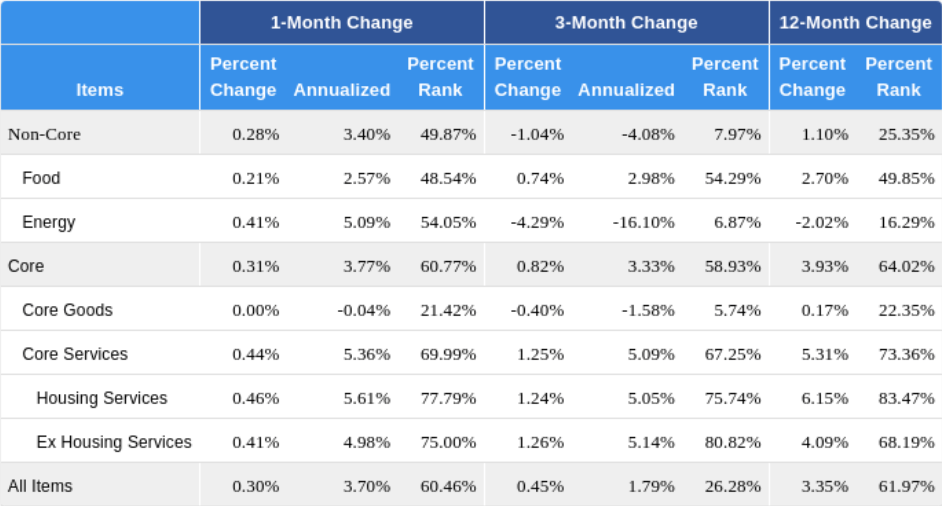

On this part, we concentrate on the expansion charges of main CPI elements over varied time frames. Readers ought to observe the acceleration and/or deceleration of development charges over time, the relative development charges between elements, and the expansion charges of every element in comparison with its personal historical past (% rank).

Determine 2: P.c Change, Annualized Change and P.c Rank: 1, 3 and 12 months

Annualized Inflation Over the Previous 12 Months (BLS & Investor Acumen)

Within the desk above, there are some main divergences. First, when you concentrate on core providers ex-housing — the metric the Fed is watching most intently – you will notice that this metric is operating nicely above the Fed’s 2.0% goal, and stubbornly so. On a 1-month and 3-month foundation, this metric is operating at 4.98% and 5.14% annualized fee, respectively. These are figures that the Fed shall be very uncomfortable with.

In contrast, when you concentrate on core items, there was a fairly dramatic pattern in direction of deflation, with value modifications on this class truly deflating and on the excessive decrease finish of historic averages.

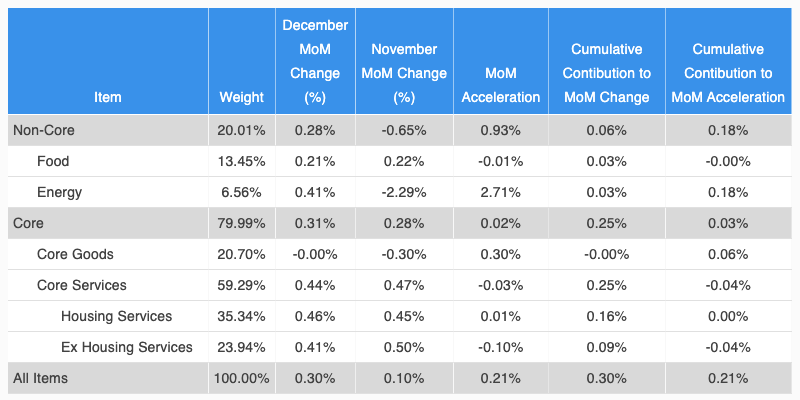

Decomposition Evaluation of Month-to-month Change: Main CPI Parts

In Determine 3, we carry out a decomposition evaluation of change and acceleration, breaking CPI down into Non-Core and Core elements. We additional decompose the expansion of non-core CPI into two subcomponents and decompose the expansion of core CPI into three subcomponents. Though all 5 columns within the desk present necessary data, we advocate that readers pay particular consideration to the rightmost column (Cumulative Contribution to Acceleration) because it reveals precisely what drove the month over month, or MoM, acceleration/deceleration in CPI throughout the present month in comparison with the prior month.

Determine 3: Evaluation of Key Mixture Parts of CPI

Mixture CPI Part Evaluation (BLS & Investor Acumen)

As might be seen within the desk, Power was by far the most important contributor to the acceleration of All Objects CPI. Core Items accelerated whereas Core Companies decelerated.

Core Companies besides Housing – the indicator the Fed is presently paying most consideration to – decelerated in December. Nonetheless this key indicator is nicely above what is appropriate to the Fed.

We now proceed to research the CPI report in even better depth. For extra detailed data on how you can learn and interpret the tables and graphs on this article, please see the next Searching for Alpha weblog put up.

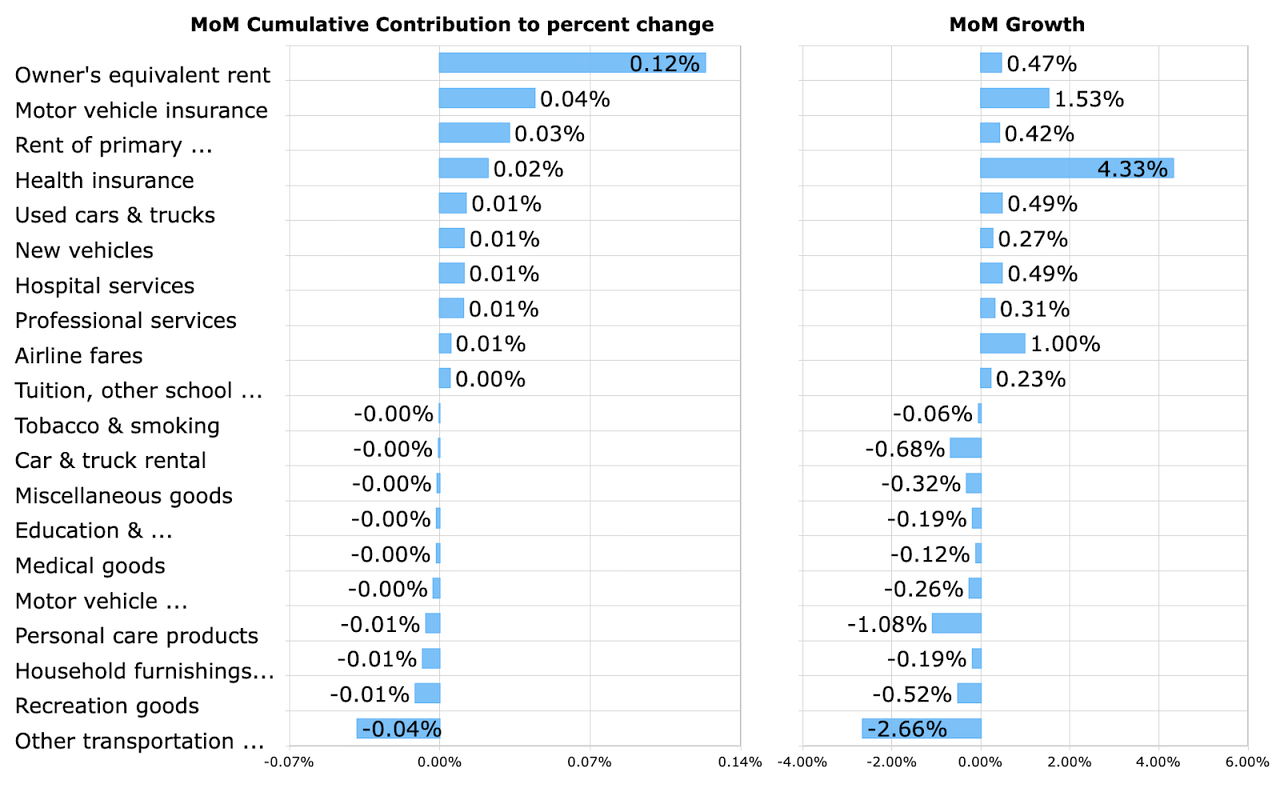

Contributions to Month-to-month Change in Core CPI

In Determine 4, we dig deeper down into the info and current a bar chart that highlights notable constructive and unfavorable contributors to the MoM % change in Core CPI. These contributions bear in mind each the magnitude of the MoM change in every element in addition to the burden of every element in CPI.

Determine 4: High Contributors to MoM P.c Change

High CPI Contributors (BLS & Investor Acumen)

As soon as once more, Proprietor’s Equal Lease was crucial constructive contributor to the month-to-month change in CPI. Motor Automobile Insurance coverage additionally contributed positively to the month-to-month change in CPI.

Housing elements have the most important weight within the CPI (accounting for about 40% of core CPI). On this regard, it is extremely necessary to notice that real-time indicators counsel that there’ll proceed to be vital disinflation within the housing elements of CPI for the second half of 2024. Subsequently, all through the primary half of 2024 there shall be vital downward stress on each All-Objects and Core CPI from the housing element. Nonetheless, declines in CPI which are pushed by this severely lagged element aren’t related for understanding what’s presently happening within the housing markets or within the economic system.

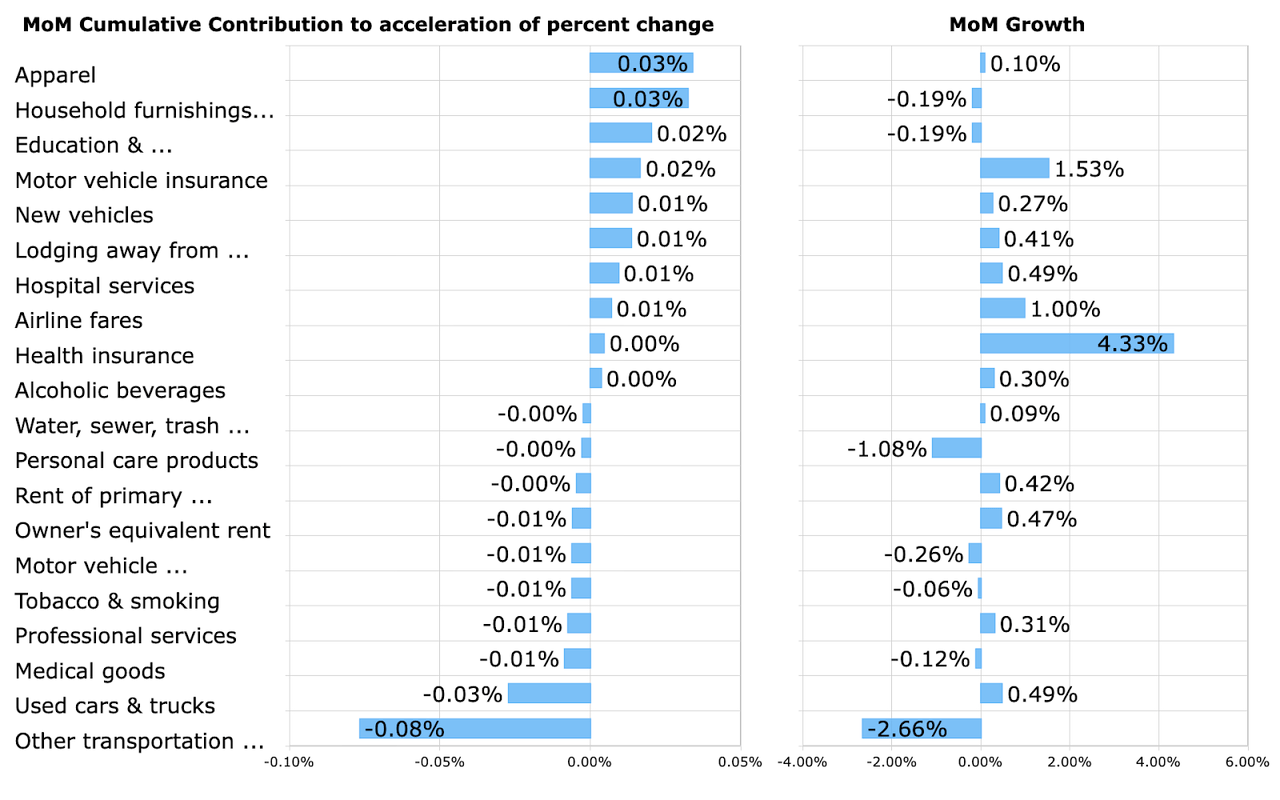

Contributions to Month-to-month Acceleration in Core CPI

In Determine 5, we shift the main target from a decomposition of the speed of change, to a decomposition of the speed of acceleration. The bar chart highlights notable constructive and unfavorable contributors to the MoM acceleration in Core CPI. These contributions bear in mind each the magnitude of the MoM accelerations within the elements in addition to the burden of every element in CPI.

Determine 5: High Contributors to MoM Acceleration of Core CPI

High CPI Acceleration Contributors (BLS & Investor Acumen)

We advocate that readers study this desk fastidiously as it’s more likely to embody most or all the gadgets that precipitated deviations from forecasters’ expectations of Core CPI.

Amongst gadgets that contributed to acceleration of Core CPI, Attire and Family Furnishings had been the most important contributors. Apparently, each of these things imparted main drags on Core CPI final month.

Amongst gadgets that contributed to deceleration of CPI, Different Transportation Companies stands out.

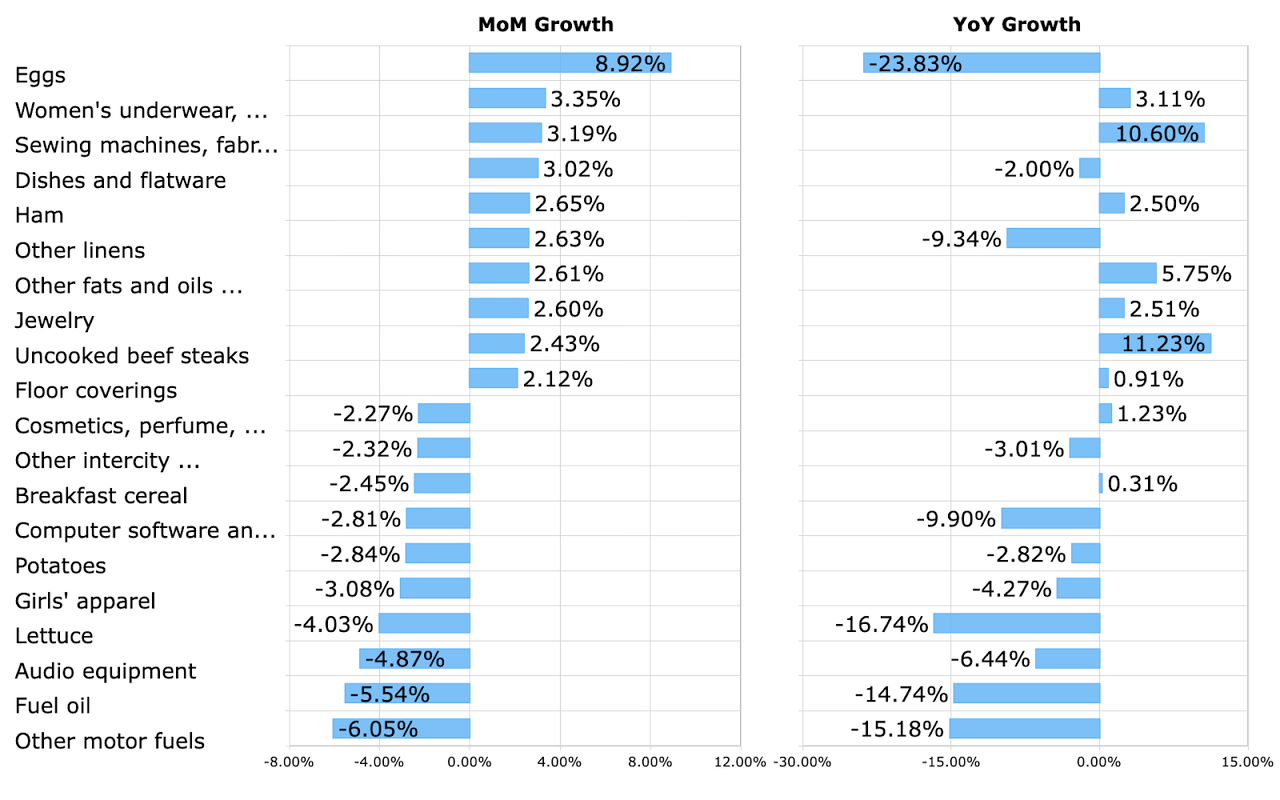

High Movers

In Determine 6, for normal curiosity functions, we spotlight a number of CPI elements (out of over 200) that exhibited the most important constructive and unfavorable change throughout the month. The YoY change in these specific elements is exhibited to the appropriate.

Determine 6: High Movers MoM P.c Change

High CPI Movers (BLS & Investor Acumen)

Gas oil and Different motor fuels exhibited notable declines on this report. Eggs have returned to being the most important MoM improve, though on a YoY foundation it has deflated -23.83%.

Implications for the Financial system

General, as we speak’s CPI report didn’t provide any main surprises. Nonetheless, there have been some problematic points of this report that readers ought to pay attention to.

Initially, core providers ex-housing – the metric most intently watched by the Fed – is operating at a 3-month annualized fee of 5.14% (with the determine having been 4.98% for the previous month), with little indicators of deceleration for the previous 6 months. Inflation on this important class of core providers ex-housing appears to be “caught” at or close to a 5.0% annualized fee – and the Fed needs to be very involved about this.

Second, in our view, WTI crude oil (CL1:COM) is probably going close to an intermediate-term backside. As such, vitality costs presently signify rather more upside danger than draw back danger for CPI, going ahead.

Third, core items costs have been deflating as a result of normalization of provide chains. Nonetheless, this normalization impact might be anticipated to fade (and even reverse) in 2024. At that time, core items costs will cease representing a drag on CPI.

Fourth, housing CPI elements are disinflating and can doubtless proceed all through most or all of 2024. As such, the housing classes needs to be anticipated to proceed to exert downward stress on core CPI for many of 2024. Nonetheless, housing CPI information is severely lagged by round 12-months relative to real-time tendencies. On this context, there’s a danger that the real-time disinflation pattern will reverse throughout 2024, whereas the lagged information is dragging down the CPI, making a false phantasm.

Placing all the above collectively, our view is that the main points of this report do in no way help present market expectations of Fed fee cuts – roughly 125 foundation factors of cuts, beginning in March. Till stubbornly excessive inflation in core providers ex housing – the class most intently watched by the Fed – is lowered considerably, we consider that the Fed goes to have to stay very cautious, protecting rates of interest excessive and liquidity tight within the economic system. Certainly, primarily based on this report, we expect that the Fed could improve the hawkish tone of its communications with a view to dampen expectations relating to the timing and extent of Fed fee cuts in 2024..

Implications for Monetary Markets

Frequent inventory and rate of interest markets have reacted mildly to this report, as Core CPI seemed to be in keeping with expectations and the upside shock in All-Objects CPI was solely gentle.

Nonetheless, the stubbornly excessive inflation in core providers ex-housing could be very troubling, and that is more likely to have penalties within the intermediate time period.

Going ahead, it’s our view that the market could also be confronted with more and more hawkish rhetoric from the Fed. Market expectations for Fed fee cuts presently seem like out of line with what the Fed is more likely to ship, primarily based on the data contained on this CPI report.

Conclusion

For the reason that third quarter of 2022, we emphasised that 2023 could be a yr of disinflation – and it was. However, outdoors of the housing elements (that are lagged by 12 months), we expect that the economic system is presently at an inflection level the place the disinflationary course of could have “paused.” Core inflation ex housing seems to be “caught” at unacceptably excessive ranges. On this context, there may be main danger of a re-acceleration of general inflation, notably if oil costs begin to rise.

Though we count on CPI to proceed decelerate within the subsequent few months, we expect that the chance of a reacceleration of inflation within the U.S. could be very a lot on the desk, beginning within the second half of 2024. At our Investing Group, we shall be actively managing this potential transition from a bullish to bearish inflation surroundings later this yr.

[ad_2]

Source link