[ad_1]

Shares fell sharply yesterday, forward of Jay Powell’s immediately. It might be nice if Powell acknowledged how a lot monetary situations have eased and that easing situations might undermine the Fed coverage path and, extra critically, delay future fee cuts.

It might undoubtedly make yesterday’s value motion in danger property appear tame. As a result of the rally in risk-assets actually places the Fed’s goal for inflation in danger. Let’s face details: rising asset costs are inflation.

Credit score spreads have melted decrease following the December FOMC assembly. Given how a lot spreads have contracted, you’d suppose the Fed had already lower charges.

That is in all probability why there is no such thing as a want for the Fed to chop charges at this level. The extra credit score spreads the simpler monetary situations get.

Possibly the inventory market acquired a bit anxious and thought if it went down a bit the day earlier than Powell was as a result of converse, he may take it a bit simpler.

Possibly he’ll; I’ve no clue what he’ll say. But when Atlanta Fed’s Bostic is a information, Powell could also be speaking in regards to the potential to chop charges later this yr, in sluggish and methodical tempo, if the information permits it.

What appears stunning to me is that there are nonetheless individuals on TV who suppose the Fed will lower charges 6 to 7 instances this yr.

I’m unsure what planet they’re residing on, but when continues to be rising at a nominal fee of about 5%, and the Fed is struggling to get inflation again to 2%, why ought to the Fed lower in any respect?

Within the meantime, created a mere 9% bearish engulfing sample on the day, I can’t say I’ve ever seen one thing that spectacular.

Stuff like that is in all probability a great cause why Bitcoin won’t ever have anywhere as a “actual” forex on this planet.

Additionally, the fell by round 1% on the day and managed to bounce proper off the 5,060 degree, which has held now a number of instances and is a degree not breached since Nvidia’s outcomes again on February 22.

Talking of Nvidia (NASDAQ:), it managed to rise 1.5% within the final half-hour of buying and selling to complete up on the day.

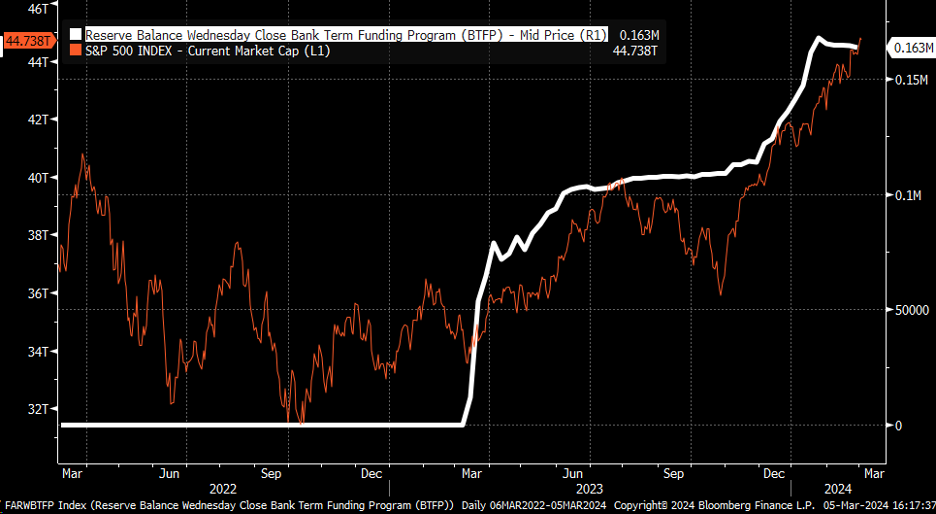

Lastly, we’ve only a few extra days till the Financial institution Time period Funding Program is retired. This system allowed banks to make use of the Treasury as collateral at par with the Fed in trade for money for one yr.

So between now and someday round April 5, I think about we see the balances in this system shrink by round $80 billion, whereas the remaining stays till the first anniversary date.

I suppose that we should always see reserves shrink by that $80 billion and the Fed Stability sheet shrink as soon as the unwind begins.

Some individuals have speculated that shares have risen due to this program, however I’m a bit extra skeptical. I don’t see how $160 billion in expanded reserve balances interprets right into a $10 trillion enhance within the S&P 500 market cap.

I actually would hope there may be not that a lot leverage deployed. When trying on the comparisons of the charts, I can see why somebody may suppose that means.

I suppose we are going to solely discover out if the market begins to drop prefer it rose. If that occurs, maybe that little program the Fed created had way more affect than I believed.

Unique Put up

[ad_2]

Source link