[ad_1]

CrowdStrike’s This autumn earnings, due after market shut, could reveal a sturdy outlook given its cloud-based cybersecurity options and up to date buyer progress.

As synthetic intelligence shapes the tech panorama, CrowdStrike’s position in cybersecurity takes middle stage, elevating expectations about leveraging AI just like profitable tech corporations like Nvidia.

A better take a look at CrowdStrike’s This autumn expectations on InvestingPro signifies constructive projections with anticipated revenues of $840 million, constructing on the corporate’s spectacular 149% return up to now 12 months.

In 2024, make investments like the large funds from the consolation of your property with our AI-powered ProPicks inventory choice instrument. Be taught extra right here>>

CrowdStrike (NASDAQ:) is ready to disclose its This autumn earnings right this moment after the market closes. The cloud-based cybersecurity firm is trying to paint a sturdy image for the final quarter of 2023 primarily based on buyer progress and numerous new offers.

The report comes at a time when the fast development of synthetic intelligence has propelled tech corporations like Nvidia Company (NASDAQ:) to important heights, and cybersecurity has by no means been extra essential.

With the rise of malicious actors exploiting evolving know-how, corporations offering cybersecurity options, reminiscent of CrowdStrike, have taken middle stage. This begs the query of whether or not CrowdStrike, like Nvidia, will leverage synthetic intelligence.

As we anticipate wholesome This autumn outcomes for CrowdStrike, InvestingPro’s highly effective instruments may help us acquire insights. This enables us to evaluate potential alternatives and speculate on the corporate’s trajectory in 2024.

CrowdStrike delivered a return of 149% over the previous 12 months. You possibly can establish comparable shares early on utilizing InvestingPro. Subscribe now and by no means miss out once more!

Let’s delve into the expectations for the corporate’s final quarter outcomes utilizing the InvestingPro platform.

Supply: InvestingPro

CrowdStrike is predicted to announce revenues of $840 million within the final quarter. Accordingly, the EPS expectation is $0.82.

Whereas analysts have revised their expectations upwards within the final 3 months, buyers reacted positively to the 2nd and third quarter outcomes of the corporate, which managed to extend its income and EPS above expectations all year long.

Supply: InvestingPro

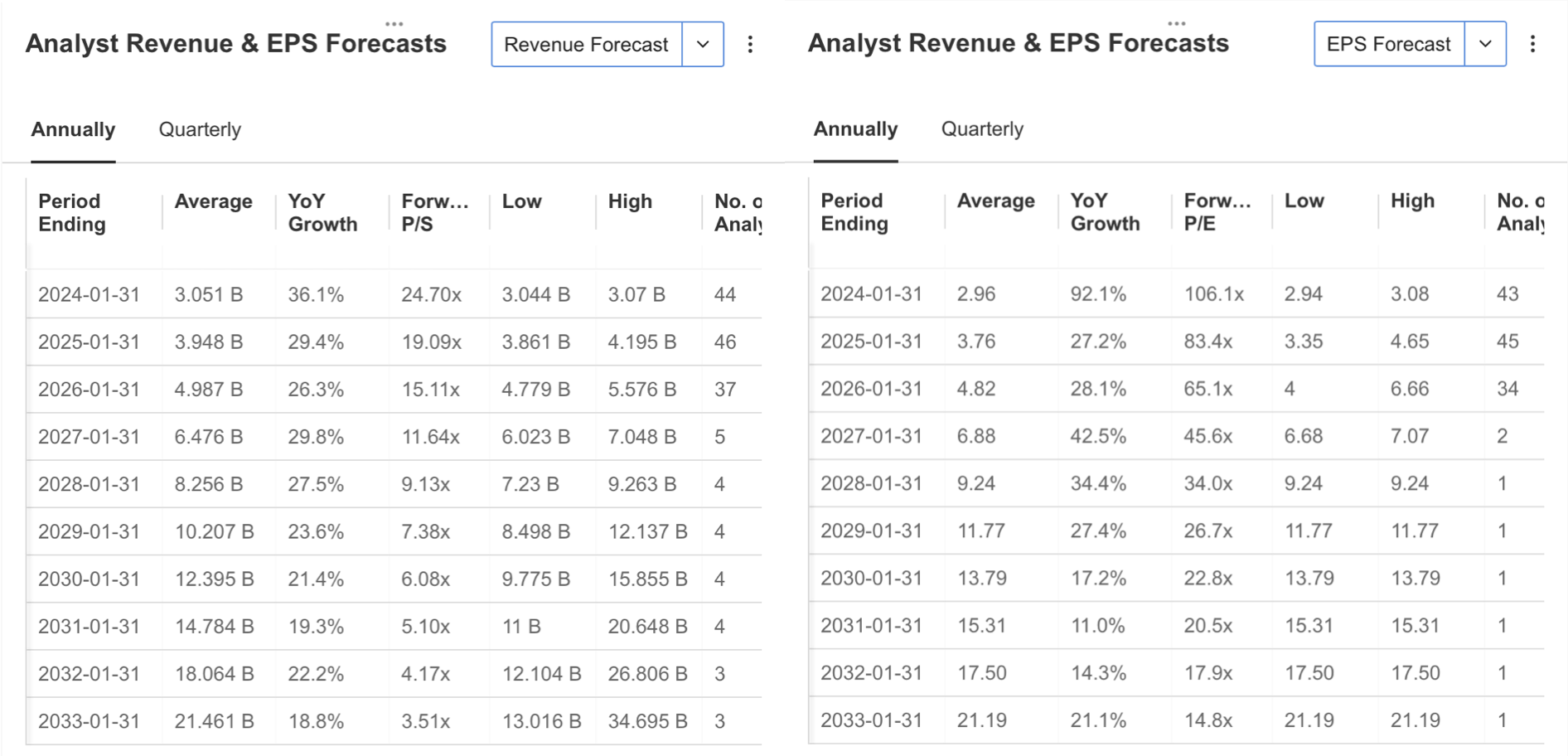

For the entire of 2024, analysts count on the corporate to extend its income by greater than 25% yearly within the coming years, whereas analysts count on income of $3.05 billion, up 36%. In earnings per share estimates, there may be an expectation of a big enhance of 92% this 12 months, whereas CrowdStrike is predicted to stay extra reasonable on an EPS foundation for the following two years.

Supply: InvestingPro

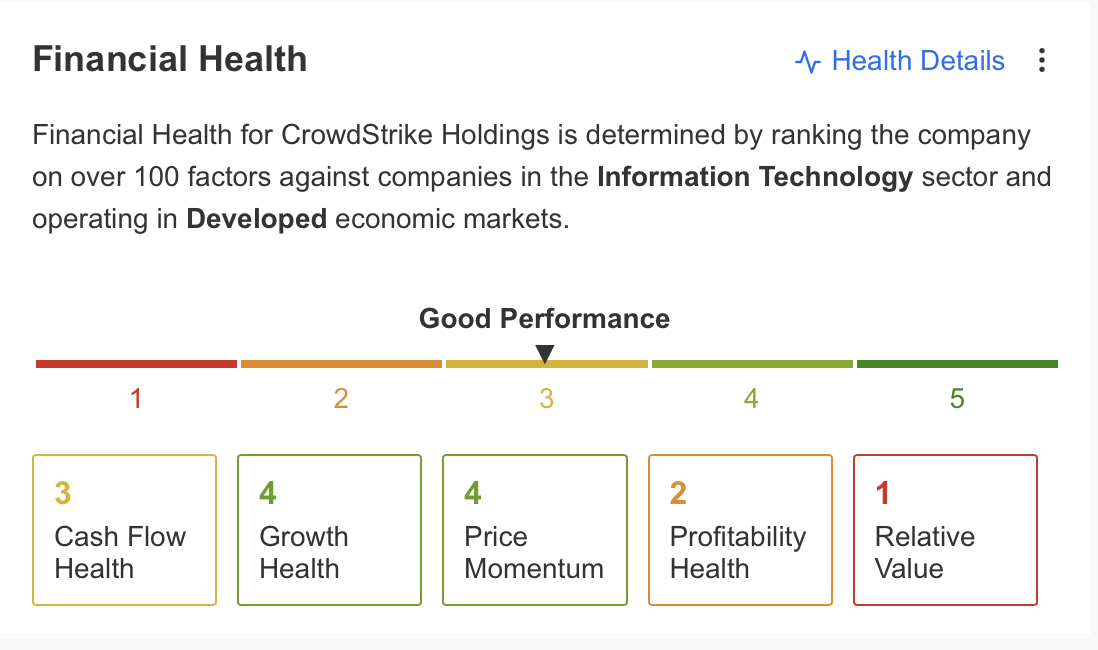

Monetary Well being: How Does CrowdStrike Fare?

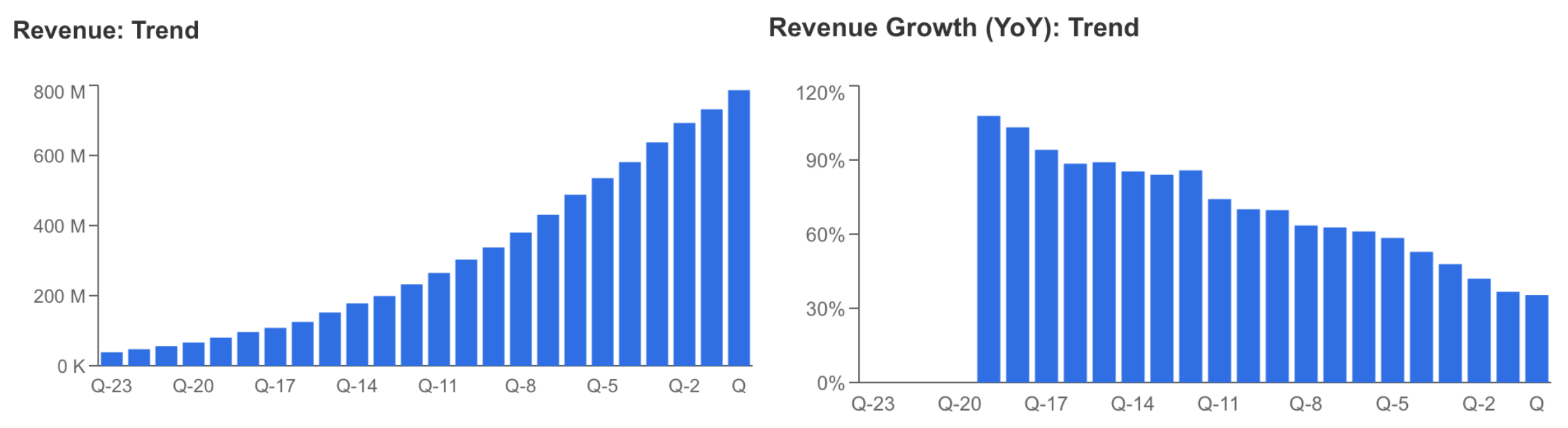

Once we examine the pattern of CrowdStrike’s key monetary gadgets, a downward momentum in income progress is noteworthy regardless of the quarterly enhance in income.

Supply: InvestingPro

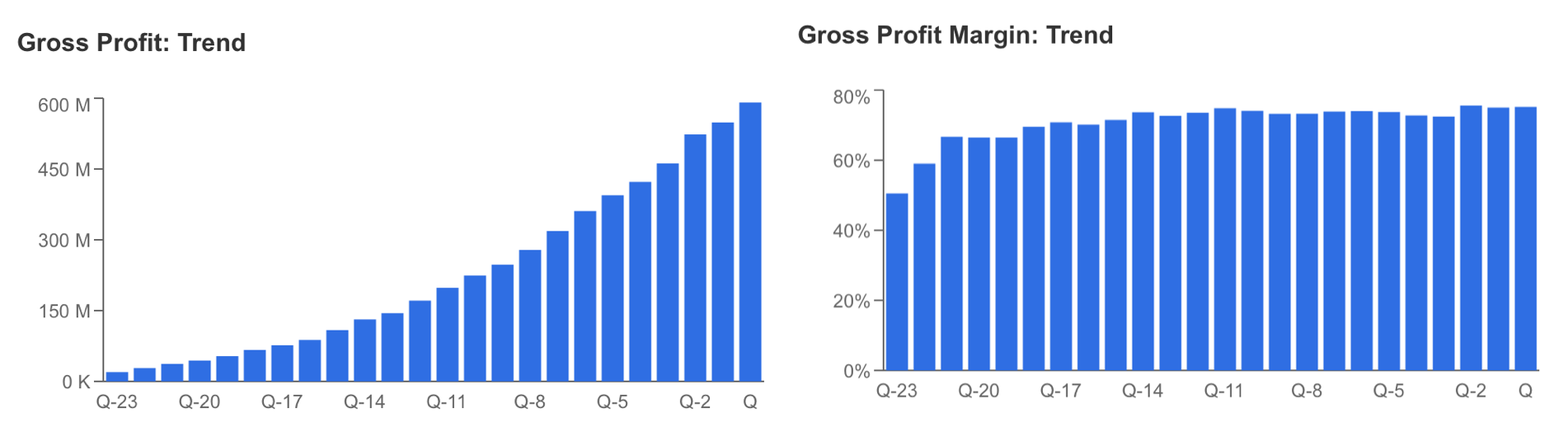

As well as, whereas the corporate manages to maintain the rise in the price of income extra restricted, the corporate continues to take care of its upward pattern in gross revenue with the gross revenue margin maintained at 75%.

Supply: InvestingPro

In This autumn, CrowdStrike, which is predicted to extend its profitability, generated 93% of its revenues from subscription-based gross sales within the earlier quarter. Whereas a rise of greater than 30% in subscription revenues is predicted within the final quarter, it’s prone to proceed to contribute to the present income.

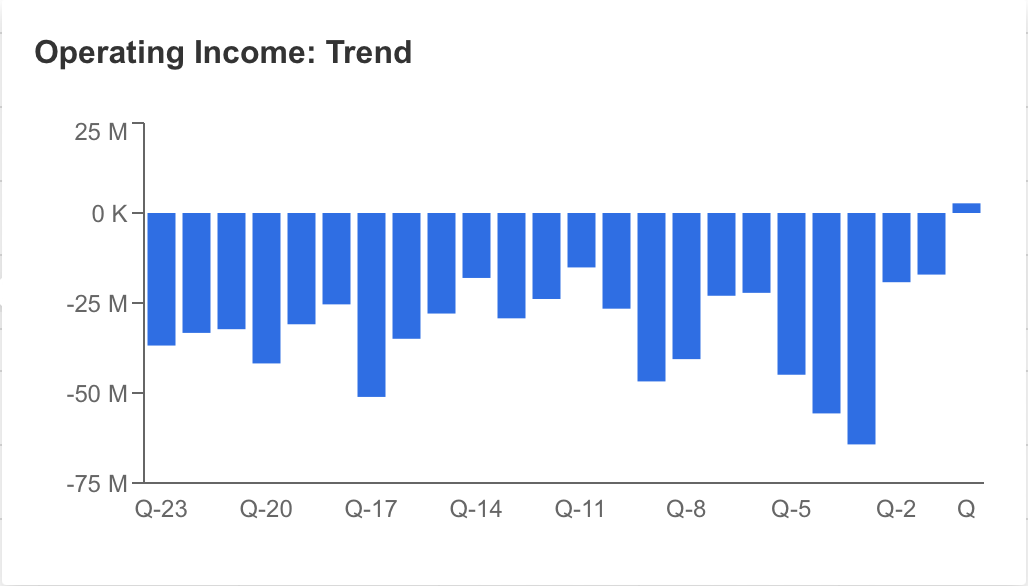

Nonetheless, the upward pattern in CrowdStrike’s working bills stays the most important issue negatively affecting web revenue. Analyzing the basics from the earlier interval, it’s a exceptional improvement that the working revenue, which wrote a loss, become a constructive for the primary time within the third quarter on the stage of two.7 million {dollars}.

The truth that CrowdStrike, which has diminished the adverse outlook in working revenue lately, generated working revenue within the final quarter could be thought of an essential clue for enchancment when it comes to financials.

Supply: InvestingPro

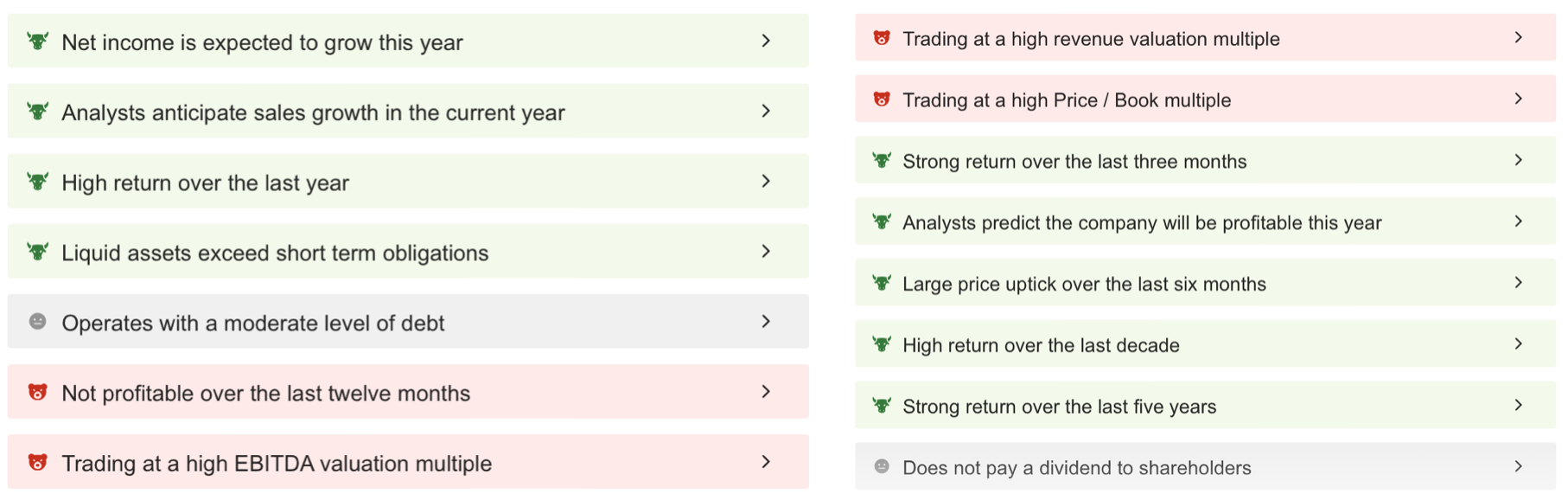

What Does ProTips Say?

The ProTips report on CrowdStrike’s monetary outlook additionally comprises essential clues in regards to the firm.

Supply: InvestingPro

If we summarize CrowdStrike’s strengths; gross sales progress and web revenue progress expectations, the corporate’s excessive returns within the final 12 months, and liquid property remaining above short-term debt obligations. The corporate additionally has a constructive long-term outlook.

Then again, the corporate’s weaknesses are the dearth of profitability within the final 12 months, excessive valuation relative to revenue, and excessive P/B worth. As well as, the truth that it continues at a median debt stage in a excessive interest-rate setting and doesn’t pay dividends may also be thought of a warning signal.

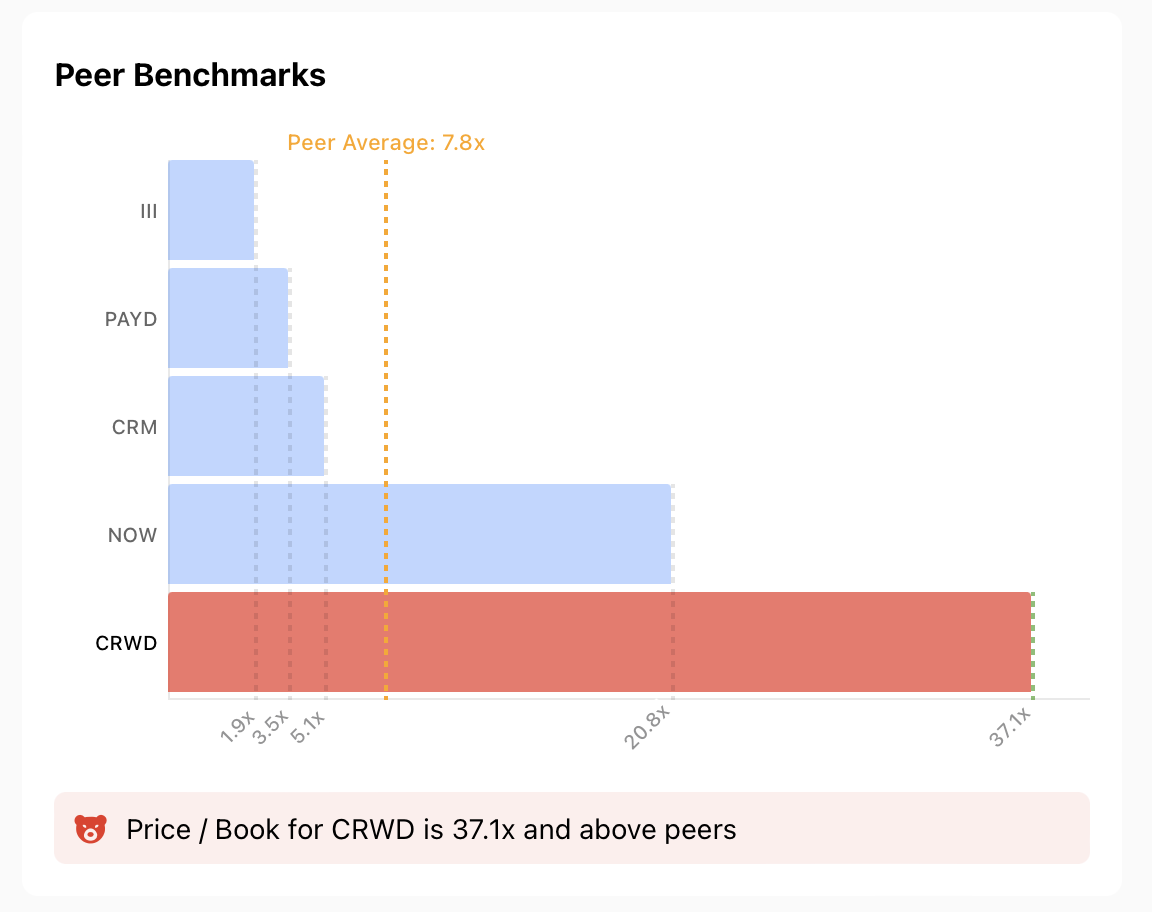

How Does CrowdStrike Fare in Comparability With Friends?

By evaluating the corporate with peer corporations in its sector, we will have extra knowledge on its present scenario.

Once we look at the efficiency and valuation indicator with peer corporations, it’s seen that CrowdStrike is in a greater place when it comes to income progress than Salesforce (NYSE:), which is about 4 occasions bigger when it comes to market capitalization.

When it comes to gross revenue margin, it’s virtually on the similar stage as its friends. This comparability is a very efficient technique to higher perceive whether or not an organization’s inventory is pricey or low cost. By the best way, InvestingPro permits you to examine corporations in the identical trade primarily based on many indicators.

Nvidia, which has achieved vertical progress momentum by leveraging AI in a big means, is effectively forward of CrowdStrike, with annual income progress of greater than 125% and income progress of near 40%. Nonetheless, the potential for elevated demand within the cybersecurity sector might have a really constructive impression on CrowdStrike’s margins. Subsequently, the This autumn financials that the corporate will announce after the shut right this moment could also be indicative of this potential progress.

When it comes to worth efficiency, CRWD has risen practically 150% within the final 12 months, effectively above the S&P, which has risen 26%. This reveals that buyers’ demand for CrowdStrike, which stands out with its synthetic intelligence-supported services and products, is sort of excessive.

Supply: InvestingPro

From this viewpoint, regardless of the corporate’s P/B ratio of 37x, we will point out that buyers don’t pay a lot consideration to this correction-signaling ratio, counting on its bullish potential.

The general well being of the corporate and the inventory’s worth momentum are in superb situation, whereas monetary well being can enhance if profitability and money stream scenario enhance.

Supply: InvestingPro

CrowdStrike: Technical View

Taking a look at CRWD from a technical perspective, it’s seen that the inventory, which recorded a wholesome uptrend all through 2023, continued its present pattern in 2024. CRWD, which broke its final peak within the first days of the 12 months, has not been in a position to break the Fib 1,272 worth of $330 since February.

The inventory, which has been transferring within the resistance zone for the final month, could face one other wave of demand as seen in different quarters if constructive monetary outcomes are introduced right this moment and will transfer in the direction of the following resistance zone at $ 390 above $ 330. Whereas this area is a vital resistance space for CRWD, the breakout might set off the pattern to maneuver towards the $ 500 area.

If a correction comes at this level, it is going to be adopted because the closest help level at $ 280. Under this help, a correction in the direction of $ 240 appears seemingly.

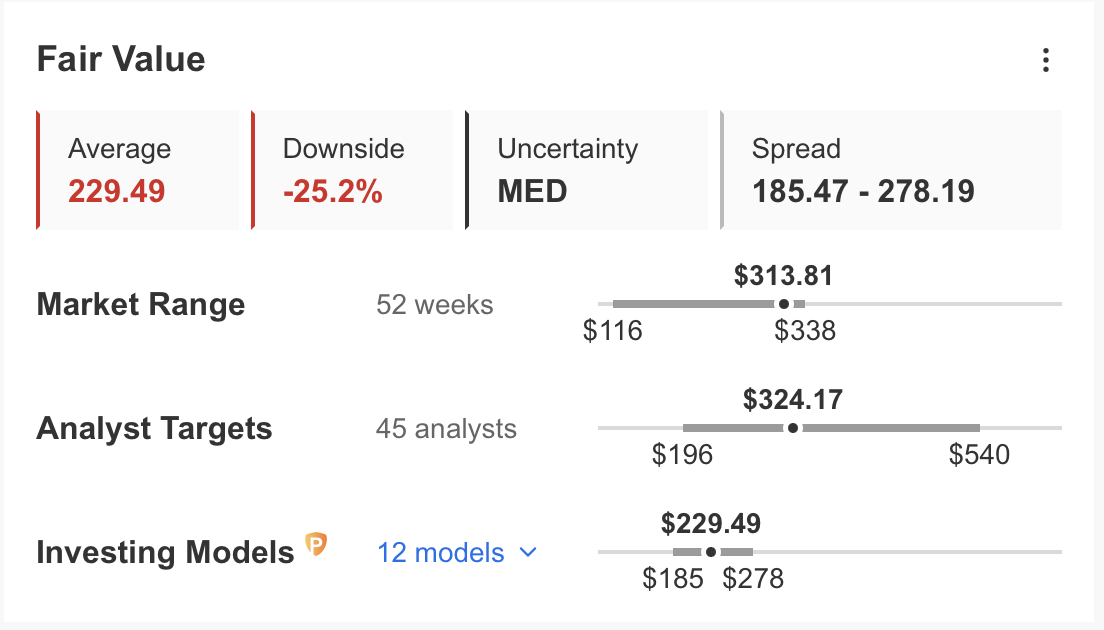

InvestingPro truthful worth evaluation, alternatively, predicts that based on the newest monetary outlook, the inventory might fall 25% for the 12 months and retreat to $230.

***

Take your investing sport to the following stage in 2024 with ProPicks

Establishments and billionaire buyers worldwide are already effectively forward of the sport in terms of AI-powered investing, extensively utilizing, customizing, and growing it to bulk up their returns and decrease losses.

Now, InvestingPro customers can just do the identical from the consolation of their very own properties with our new flagship AI-powered stock-picking instrument: ProPicks.

With our six methods, together with the flagship “Tech Titans,” which outperformed the market by a lofty 1,745% over the past decade, buyers have the very best collection of shares available in the market on the tip of their fingers each month.

Subscribe right here and by no means miss a bull market once more!

Subscribe In the present day!

Remember your free present! Use coupon code INVPROGA24 at checkout for a ten% low cost on all InvestingPro plans.

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, or advice to speculate as such it isn’t meant to incentivize the acquisition of property in any means. I want to remind you that any sort of asset, is evaluated from a number of factors of view and is very dangerous and due to this fact, any funding choice and the related danger stays with the investor.

[ad_2]

Source link