[ad_1]

Funtap/iStock through Getty Photos

Introduction

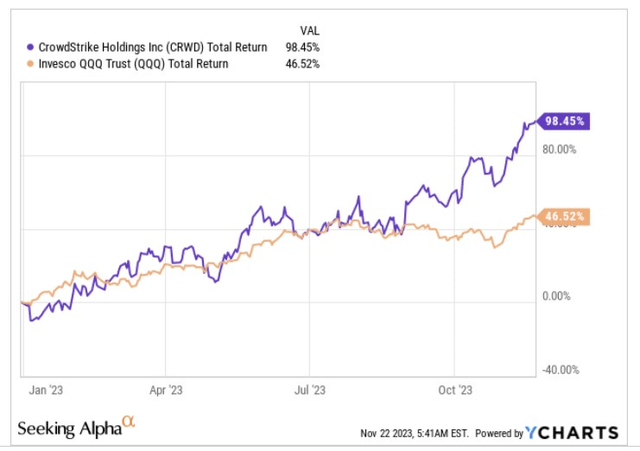

Again in August, once we final lined the cybersecurity specialist- CrowdStrike (NASDAQ:CRWD), the inventory was up by 40% on a YTD foundation, round 500bps greater than the tech-heavy Nasdaq. Within the ensuing months, we’ve seen a lot stronger momentum by CRWD, a lot in order that the relative return differential with the benchmark is now over 2x, and the inventory can also be on the cusp of doubling its share worth from what was seen at first of the 12 months!

YCharts

In lower than per week, we may have one other catalyst that might doubtlessly stimulate one other leg greater, or immediate some revenue reserving at greater ranges; we’re basically referring to CrowdStrike’s Q3 occasion which is because of happen on the twenty eighth of November. Listed below are a few of the main speaking factors forward of the occasion.

Earnings Issues

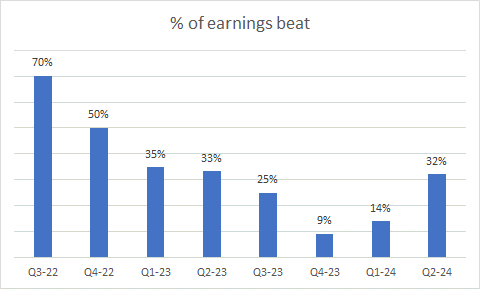

On the outset, let or not it’s recognized that CRWD has maintained fairly a stellar observe file throughout earnings season for a very long time now. It has overwhelmed backside line road estimates for 18 successive quarters on the trot, and extra not too long ago, during the last couple of years, the common backside line beat per quarter has labored out to a powerful 34%.

Searching for Alpha

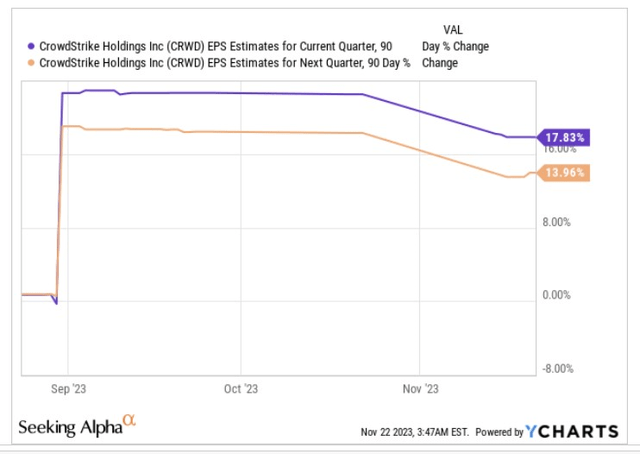

It’s questionable if CRWD will proceed to ship the identical magnitude of beat seen in Q2 (32%) as during the last 3 months, CRWD has already seen upward revisions to its Q3 EPS by fairly a wholesome margin of 18% (even This autumn estimates have been dialed up by 14%).

YCharts

Consensus expectations on the adjusted EPS degree for Q3 now level to a determine of $0.74. That might be on par with what was seen in Q2 however symbolize slower YoY development of 85% (versus 106% YoY in Q2).

One of many highlights this 12 months has been how CRWD has inched its means in the direction of GAAP profitability, after a number of durations of losses and that is one thing that can persist in Q3 as nicely with an anticipated GAAP EPS of $0.04.

With ongoing upselling and additional consolidation on the Falcon platform, the topline continues to be anticipated to be resilient, coming in on the +700m mark for the second successive quarter ( anticipated Q3 income determine of $778m), though the tempo of YoY development may decline marginally from the 37% ranges seen in Q2 to 34%. These numbers are to not be scoffed at while you have a look at the broader image; Take into account one thing just like the endpoint safety terrain, the place CRWD has constructed a reputation for itself. It’s slightly evident that CRWD is taking share right here, because the market per se is barely rising at round 10% or so.

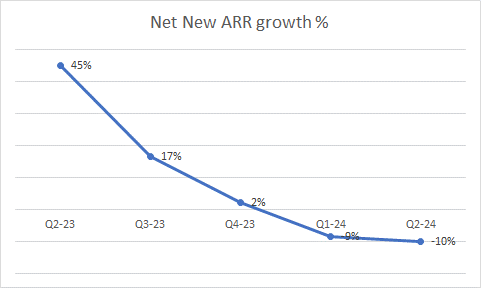

One metric the place traders can maybe count on a marked enchancment from Q2 is CRWD’s web new ARR (annual recurring income). Notice that in H1, the YoY development has been slightly underwhelming, declining by -9% on common, however this sometimes tends to select up in H2, and in addition to Q3 gained’t fairly must take care of the identical steep base impact seen in Q2 (In Q2-23, web new ARR had hit file highs of $218m, whereas in Q3-23 this had dropped to $198.1m). On the Q2-24 name, administration steered that web new ARR development may probably witness double-digit development by way of H2. In the event that they ship as anticipated, administration nonetheless deserves a pat on the again because the deal atmosphere and gross sales cycle aren’t notably straightforward at this juncture.

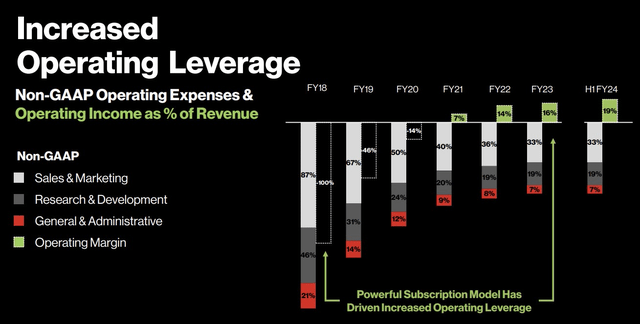

Earnings press launch/Creator’s calculations

Nonetheless, with over 90% of CRWD’s topline coming from subscription-related gross sales, CRWD can also be within the midst of witnessing a wholesome drop-through on the working degree, a lot in order that varied elements of the OPEX, starting from gross sales& advertising and marketing, analysis & growth, and many others. are leaving a much less onerous mark. In Q2, CRWD’s non-GAAP working margin got here in at 21% and it’ll probably linger on the 20-22% degree even in Q3/This autumn (that is by the way the corporate’s long-term goal mannequin vary) as H2 sometimes doesn’t endure from the step-up in payroll taxes or annual advertising and marketing occasions.

Investor Presentation

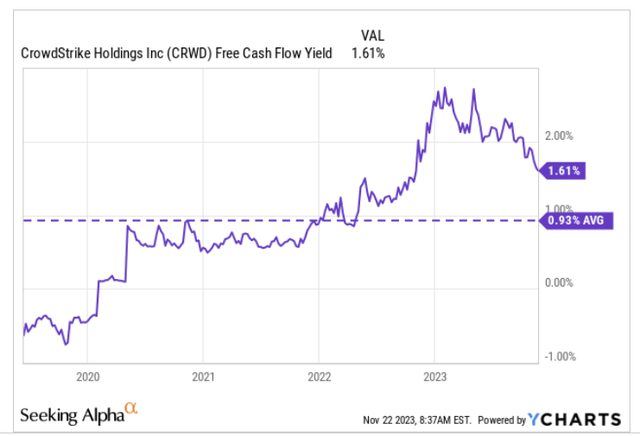

In Q2, CRWD’s FCF margin had declined sequentially to 26%, however that is primarily on account of some timing-related points. In Q3, it’s affordable to suppose that one can count on higher conversion, as administration’s forecast for the FY is for a a lot greater FCF margin of 30-32%.

Even when the conversion had taken a again seat, do contemplate that this can be a enterprise that’s now rising its FCF yearly at a powerful tempo of 42% (H1 development). Thus, notice that though we’ve seen a marked growth within the market-cap of CRWD these previous few months, the inventory continues to be yielding an FCF determine that’s round 70bps greater than the long-term common.

YCharts

We’ve famous beforehand how CrowdStrike’s total money stability had been making a relentless surge throughout the years, and thus places it in a more healthy place to doubtlessly interact in deeper inorganic development with out unnecessarily leveraging the stability sheet. In Q2 the corporate’s money stability lastly crossed the $3bn mark for the primary time in its historical past, however we wouldn’t be overly shocked to see this step down a bit in Q3, because the acquisition of ASPM specialist (Software Safety Posture Administration)- Bionic, would probably have closed in Q3.

On the earnings name, count on CRWD administration to probably speak up how Bionic enhances their total scope, notably the competence it affords in securing purposes throughout the whole lifecycle from code to cloud. The truth that it will also be deployed on serverless infrastructure is a helpful edge.

Closing Ideas

We’ve written beforehand on why CRWD is a tremendous enterprise and it could nicely find yourself delivering yet one more stable quarter in Q3 as nicely. Nonetheless, it’s price pondering if that is probably the most optimum level to kickstart an extended place within the inventory. We don’t imagine it’s.

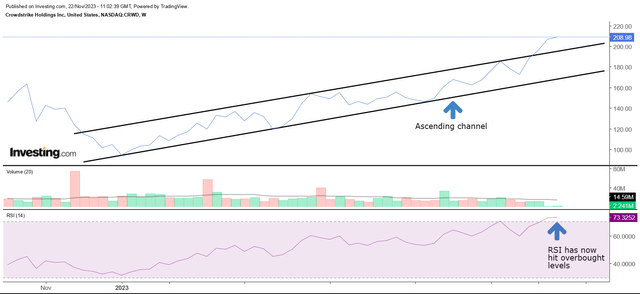

Investing

The picture above supplies some context about CRWD’s weekly worth imprints all by way of this 12 months. For the reason that flip of 2023, we’ve seen the value pattern greater inside the form of a wholesome ascending channel, providing helpful pullbacks once in a while.

Nonetheless, over the previous few weeks, the value motion has been notably sturdy, breaking previous the higher boundary of the channel. Additionally contemplate that the 14-period RSI indicator has now hit overbought ranges.

In the meantime, in case you had been in search of rotational alternatives inside the cybersecurity universe, the picture beneath means that CRWD wouldn’t symbolize probably the most optimum wager, with the relative energy ratio buying and selling round 33% greater than the mid-point of the long-term vary.

StockCharts

All in all, the technicals recommend that it wouldn’t be a considered deployment of sources to pursue the CRWD inventory till the inventory drops again into the previous channel, or at the least construct a base and flattens outdoors the channel.

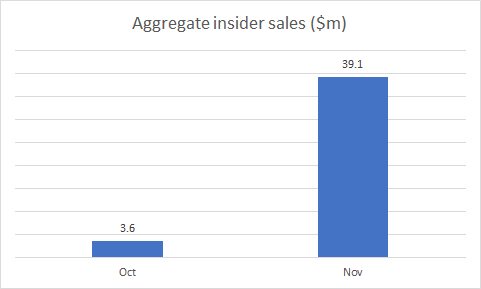

Maybe, one can even take just a few cues from latest insider exercise. Relative to the extent of insider gross sales seen all by way of October, this month, when the uptrend has been slightly agency, the extent of combination promoting has been fairly elevated, equating to $39m, nicely over 10x of what was seen beforehand.

Barcharts

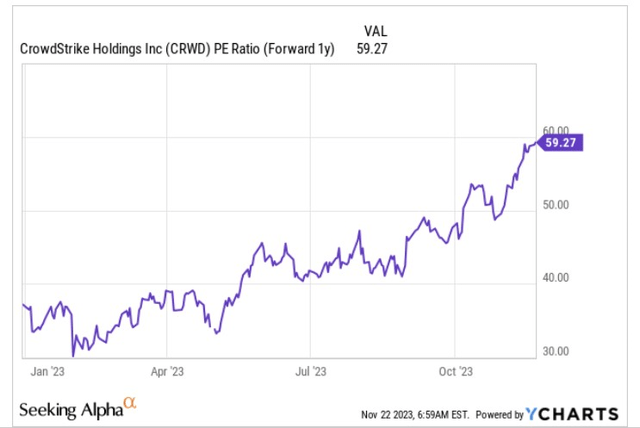

Lastly, it is encouraging to notice that henceforth, CRWD will ship optimistic GAAP EPS numbers on an annual foundation, however contemplating subsequent 12 months’s EPS, we are able to see that ahead P/E ranges have already doubled from what was seen earlier this 12 months. Moreover contemplating the annual EPS consensus from Jan-24-Jan-26, it appears like you can solely be getting 26% earnings CAGR for a P/E of virtually 60x.

YCharts

To conclude, CRWD is a HOLD at these ranges.

[ad_2]

Source link

Add comment