[ad_1]

Shares completed decrease as risk-off gave the impression to be a theme yesterday, with costs slumping beneath $70. Oil has been a harbinger of all issues as of late, and the most effective factor that may occur with oil, at the very least over the subsequent 6 to 12 months, is to do nothing. Rising oil may stoke extra whereas falling oil suggests world development is an actual concern. Oil above $70 and beneath $90 can be perfect, however sadly, that’s not taking place.

If oil is in a retracement of the rally from the 2020 lows, it may nonetheless have extra to fall because it completes a wave “C” down; at the very least, that’s what it seems to be like. I had been bullish on oil for a while, however after it fell beneath $83, it appeared just like the 70s have been a chance, and now it seems to be prefer it may go decrease into the $50s.

The opposite piece is that is getting walloped after attempting to interrupt out. When copper and oil fall, it tells us that the market is nervous about slowing world development.

5-12 months Inflation Breakevens yesterday fell sharply to a brand new cycle low, dropping to 2.07%, a stage not seen since early 2021. It may very well be nothing, however that is one thing to look at as a result of if oil retains falling, then inflation expectations will hold falling. Falling inflation expectations aren’t simply a sign of inflation falling but in addition an indication of development slowing.

China CSI 300 Falls to Pre-Pandemic Ranges

I suppose that the decline in China to ranges not seen since earlier than the COVID pandemic isn’t serving to the matter and will even be driving a few of these considerations.

Greenback Index Continues to Rise

Moreover, we’re seeing the proceed to push larger and thru that 104 stage, which units up a possible take a look at of resistance at 104.50; after that, the may run to round 105.60.

Volatility Will increase Considerably

1-week 50 delta choices have seen implied volatility improve considerably over the previous few days, rising over 12 from round 8. So quietly, on the floor short-dated, implied volatility has risen. It may merely be as a result of jobs report on Friday. It’s onerous to say, however it has been rising for a couple of days, and that has been telling me, at the very least, that the rally in equities was prone to wrestle.

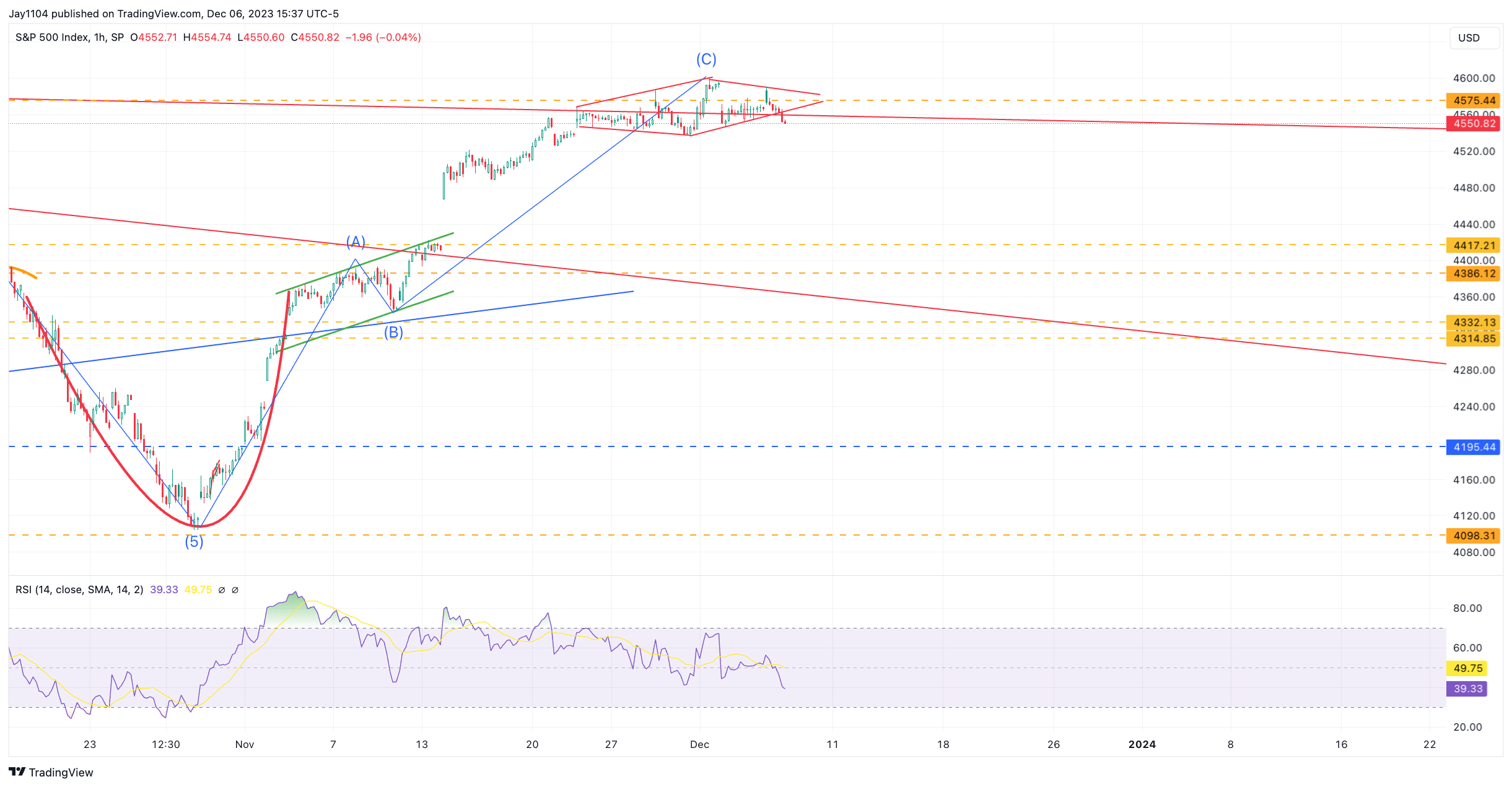

S&P 500 Breaks Decrease

Within the meantime, I’ve used this actual wave rely for a while, and yesterday, it appeared just like the diamond reversal sample shaped over the previous few days broke decrease this afternoon.

Once more, as I’ve famous, the dynamics that took the market larger off the 4,100 stage in late October are the identical dynamics that would now take the S&P 500 again to 4,100. The rally off the low was resulting from a short-gamma squeeze, which boosted the index larger and compelled systematic funds that have been quick to cowl after which go outright lengthy. Primarily based on my analysis and readings, these dynamics are in place if the index begins to float beneath 4,500.

For the reason that S&P 500 by no means handed the July highs, it’s fairly attainable that what we’ve got witnessed from July to October was wave one down, and the rally since October was wave 2, and if this wave three down, then the lows of October low won’t solely be reached however undercut.

Authentic Publish

[ad_2]

Source link