[ad_1]

by Fintech Information Singapore

December 14, 2023

There was a major drop in crypto hacks in 2023, with a greater than 50% lower in comparison with the earlier 12 months, in keeping with analysis carried out by blockchain intelligence firm TRM Labs.

Whereas the variety of hacking incidents remained comparatively regular at 160, the whole quantity stolen by cybercriminals by way of November 2023 amounted to US$ 1.7 billion, lower than half of the almost US$ 4 billion misplaced to crypto hacks in 2022.

Cumulative Hack Volumes, 2023 vs. 2022 Supply: TRM Labs

Nevertheless, a number of large-scale crypto hacks in December 2023 might probably impression these figures, however the total development for the 12 months is pointing in the direction of a considerable discount in hack-related losses.

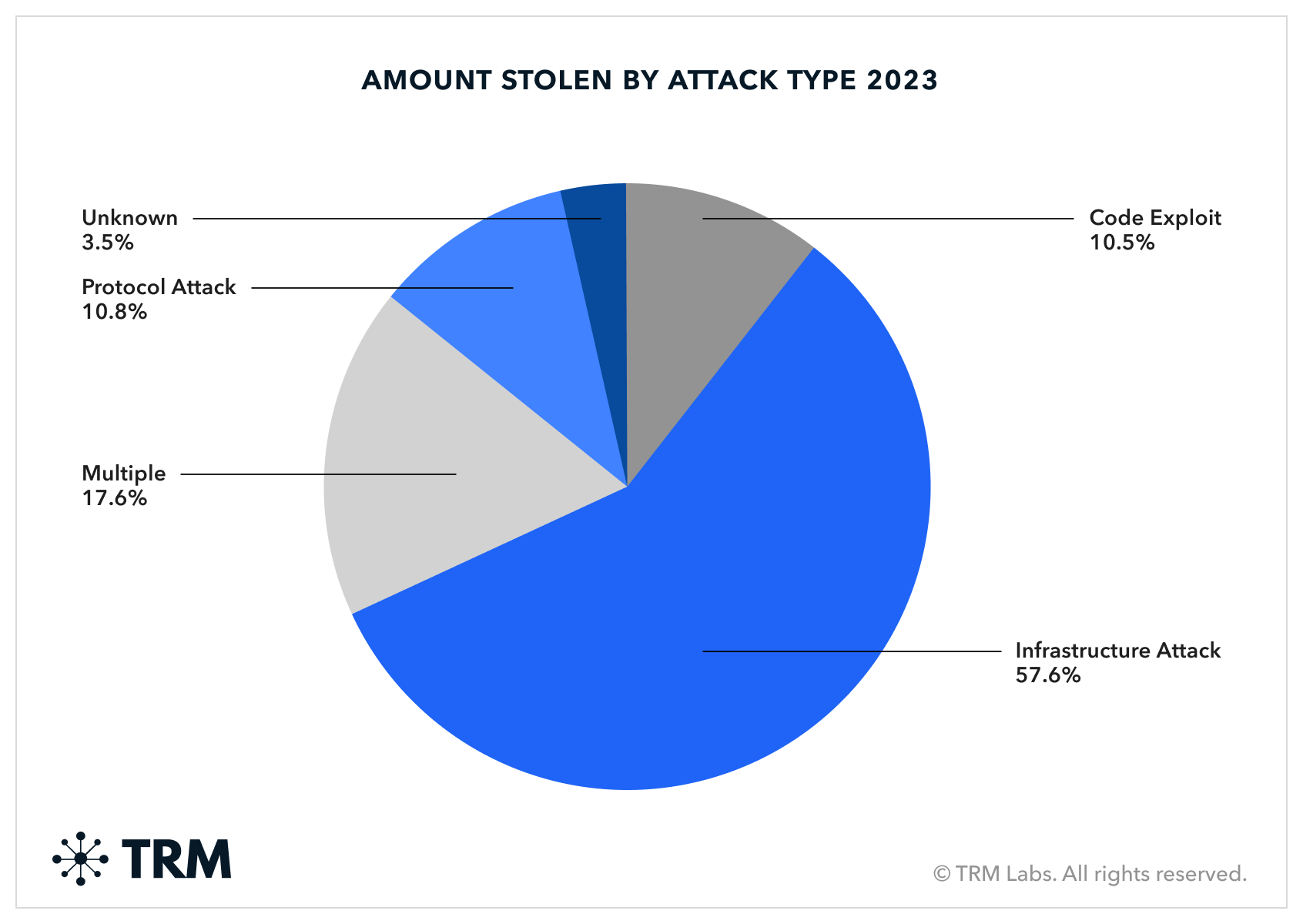

Infrastructure assaults emerged as the first mode of theft, comprising almost 60% of the whole quantity stolen in 2023. Amongst these, non-public key thefts and seed phrase compromises have been notably damaging, permitting hackers to achieve entry to cryptocurrency methods’ elementary infrastructure parts, resembling servers, networks, or software program, enabling them to steal funds or manipulate transactions.

These assaults averaged almost US$ 30 million per incident, considerably larger than protocol assaults and code exploits, which collectively accounted for a fifth of all hacking incidents.

Supply: TRM Labs

Much like the earlier 12 months, a small variety of main hacks have been accountable for almost all of cryptocurrency thefts, with the highest ten hacks representing virtually 70% of all stolen funds.

A number of of those breaches exceeded US$ 100 million, together with assaults towards Euler Finance (near US$200 million in March), Multichain (July), Mixin Community (US$ 200 million in September), and Poloniex (over US$100 million in November).

A number of elements are believed to have contributed to the decline in crypto hack volumes in 2023. Over the previous 12 months, the cryptocurrency trade has carried out sturdy safety protocols, resembling real-time transaction monitoring and anomaly detection methods. These measures bolster the safety of digital wallets and alternate platforms, serving to to establish and forestall potential safety breaches.

Moreover, world legislation enforcement companies have heightened their concentrate on cybercrime involving digital currencies. Enhanced collaboration amongst these companies has led to sooner responses to hacking incidents, facilitating the tracing, freezing, and restoration of stolen belongings. This has deterred potential hackers by rising the chance of detection and prosecution.

Cryptocurrency exchanges, pockets suppliers, and blockchain networks have additionally improved their sharing of knowledge relating to vulnerabilities, threats, and breaches. This collective strategy to safety has created a united entrance towards cybercriminals, making it more difficult for hackers to use systemic weaknesses.

TRM Labs mentioned,

“Regardless of the encouraging information, the hacks panorama stays quickly evolving and inherently unsure: the emergence of a brand new refined risk might shortly reverse the decline in hack volumes. Vigilance and adaptableness stay essential because the trade and legislation enforcement try to take care of this optimistic trajectory into 2024.”

Featured picture credit score: Edited from Freepik

[ad_2]

Source link

Add comment