[ad_1]

PM Photographs

Written by Nick Ackerman.

For some background on this month-to-month publication, right here is my view on dividend progress shares:

Dividend progress shares aren’t at all times probably the most thrilling investments on the market. They typically aren’t grabbing the headlines, and so they aren’t the shares working up a whole bunch of percentages in a yr. Actually, they’re typically a number of the least thrilling shares. And that’s exactly their strongest promoting level. With such an enormous world of dividend progress shares accessible on the market, it is very important display screen by to see if there are any worthwhile investments to discover.

They’re shares that present rising wealth over time to earnings buyers. Dividend growers are sometimes bigger (not at all times), extra financially steady firms that may pay out dependable money flows to buyers. Some are slower growers than others. Some are going to be cyclical that require a powerful economic system. Some are going to be secular, which does not usually depend on a extra strong economic system.

Dividend progress can promote share value appreciation. In fact, that’s if these firms are rising their earnings to help such dividend progress within the first place. Belief me. There are yield traps on the market – I’ve owned a number of that I am not notably happy with.

I like to consider investing in dividend shares as a perpetual mortgage of kinds. Primarily, each dividend is a compensation of your unique capital. Finally, holding lengthy sufficient, you could have the place “paid off.” It’s all returned again into your pocket from that time ahead.

All of this being stated, it is very important perceive my method to dividend shares and why screening dividend shares could be essential for earnings buyers. As with all preliminary screening, that is simply an preliminary dive – extra due diligence can be needed earlier than pulling the set off.

The Parameters For Screening

I will be utilizing some useful options that Looking for Alpha supplies proper right here on their web site for this display screen. Particularly, I will probably be screening using their quant grades in dividend security, dividend progress and dividend consistency.

Dividend Security is comparatively self-explanatory. These will probably be shares that SA quants present cheap security in comparison with the remainder of their varied sectors. The grade considers many various elements, however earnings payout ratios, debt and free money stream are amongst these. This class will probably be shares with A+ to B- scores.

For the dividend progress class, we’ve got elements such because the CAGR of varied intervals relative to different shares in the identical sector. Moreover, the quants additionally have a look at earnings, income and EBITDA progress. As we’ll see, this doesn’t suggest that each inventory with a better grade has the expansion we’re searching for. This simply elements in that the dividend has grown or earnings are rising to help dividend progress presumably. For these, the grades can even be A+ by B- grades.

Lastly, for dividend consistency, we would like shares that will probably be paying dependable dividends to us for a really very long time. Particularly, hopefully, they’re elevating yearly, although that is not an specific requirement. We can even embody shares with a basic uptrend in dividend funds, which suggests there may have been intervals the place they paused will increase for a yr or two.

After taking a look at these elements alone, we’re left with 414 shares presently from the 397 listed final month. I am going to hyperlink the display screen right here, although it’s a dynamic record that always updates usually. When viewing this text, there could possibly be kind of when going to the hyperlink.

From there, I needed to slender down the record much more. I then sorted the record by ahead dividend yield, from highest to lowest. Since these will probably be safer dividend shares within the first place, screening for these among the many greater payers should not harm.

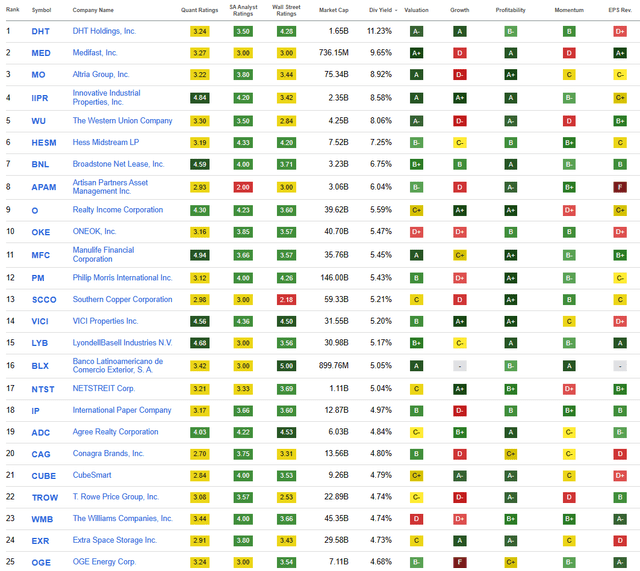

I’ll share the highest 25 that confirmed up as of 12/04/2023.

Prime 25 Display (Looking for Alpha)

DHT Holdings (DHT) is an unfamiliar title to me, and it is available in on the prime of the record this month. Nevertheless, the dividend coverage there seems variable. Whereas it has been rising year-over-year, it is not the kind of consistency that I am searching for on this month-to-month piece. Likewise, that’s the reason we have not touched on Artisan Companions Asset Administration (APAM) in earlier iterations of this text. Southern Copper Company (SCCO) additionally appeared to have a variable dividend coverage, but it surely has been steady in the previous few quarters.

Medifast (MED), Modern Industrial Properties (IIPR), Hess Midstream LP (HESM), Broadstone Web Lease (BNL), Realty Revenue (O), ONEOK (OKE) and VICI Properties (VICI) have been all names we touched on lately, so we’ll skip over them for this month. We usually have a good variety of returnees every month, as there’s solely a lot volatility from month to month. Nevertheless, this month, it appeared there have been even fewer adjustments than ordinary.

Moreover, The Western Union Firm (WU) was a reputation that I had beforehand coated on this piece on a number of events. Nevertheless, after holding its dividend flat for practically three years now on account of important aggressive pressures hitting earnings, it additionally would not meet the spirit of what this piece is making an attempt to spotlight. Just like DHT, APAM and SCCO, they could possibly be nice firms and carry out amazingly sooner or later, however that’s not what this piece is seeking to spotlight.

With all that being stated, listed below are the 5 names we’re going to try at present that could possibly be value exploring additional: Altria (MO), Manulife Monetary Corp. (MFC), Philip Morris Worldwide (PM), LyondellBasell Industries N.V. (LYB) and NETSTREIT (NTST).

Altria 9.20% Yield

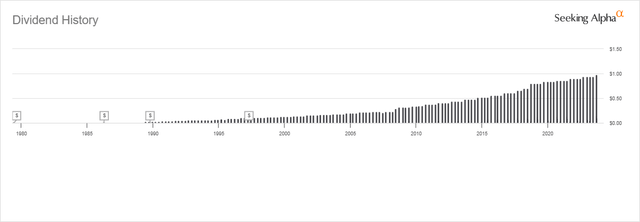

Altria is sporting a monster 9%+ yield with an envious monitor file of 53 years of accelerating its dividend. Quickly to be 54 years, given they raised their payout as soon as once more previously quarter. That is a streak that gives it the crown of the “dividend king” title.

MO Dividend Historical past (Looking for Alpha)

This can be a title that’s no stranger to this month-to-month dividend progress screening piece, and the final time we touched on the title was in August 2023. The corporate delivered earnings that upset in mid-October. The shares dropped fairly promptly upon each the miss of the highest and backside traces. That being stated, the earnings miss was primarily in-line with the outcomes missed by solely a hair.

As ordinary, cigarette cargo quantity fell, and this time, so did web revenues because it will get tougher to exchange these decrease shipments with merely rising costs. I consider this stays the important thing danger for MO going ahead, which is what different classes they’ll transfer into. Whereas I’m a shareholder, they’ve didn’t impress me on what’s going to drive this firm ahead into the long run.

That being stated, by November’s rally, MO recovered practically the complete drop that it skilled post-earnings. Analysts are additionally nonetheless anticipating some earnings progress going ahead, even with flat to barely down revenues.

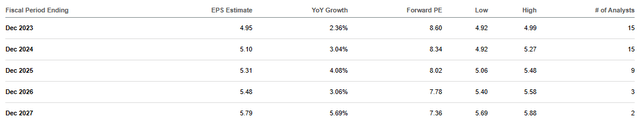

MO Earnings Estimates (Looking for Alpha)

Moreover, MO is not priced to perfection both, with its ahead P/E at 8.6x. Based on the corporate’s historic honest worth vary, it’s buying and selling on the cheaper finish. Nevertheless, there’s an admittedly wide selection right here, one of many widest I’ve seen.

MO Honest Worth Vary (Portfolio Perception)

Manulife Monetary Company 5.45% Yield

After shifting down the above record fairly a number of names, we lastly arrived on the eleventh ranked title on the record, and that’s MFC. This can be a new title that exhibits up for the primary time this month. New names are at all times thrilling for this record, however this is not an unfamiliar title. This can be a life and medical health insurance big out of Canada. With a market cap of practically $36 billion, that is no small operation.

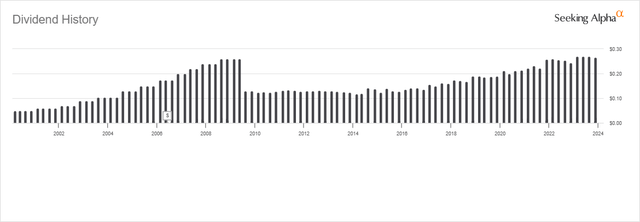

MFC has delivered dividend progress for the final decade and paid dividends for 23 consecutive years. Whereas it could seem that the dividend is variable, it’s truly the CAD to USD change price that’s making it appear that means. We coated various Canadian firms beforehand, primarily within the pipeline area and a few banks, so it is not that uncommon.

As fluctuations within the currencies occur between the 2, there are of course going to be completely different exchanges. It goes each methods; generally, it’s a useful change, and generally it hurts what one is receiving. Nevertheless, in the long run, it appears to steadiness out as each the U.S. and Canadian currencies are pretty steady.

MFC Dividend Historical past (Looking for Alpha)

They minimize their dividend throughout the international monetary disaster, as many monetary firms had finished. They then maintained their payout for a number of years earlier than elevating it beginning in 2014 and have been elevating it ever since. With the newest dividend representing the fourth quarter in a row of CAD$0.365, we anticipate one other bump quickly. Given the robust core EPS dividend protection and analysts anticipating earnings to proceed to develop, it appears all of the extra doubtless.

MFC is buying and selling on the decrease finish of its honest worth vary as effectively, although that appears to have been the case from about 2019 onward. This firm additionally has a reasonably wide selection, however not as extensive as MO, that we highlighted above.

MFC Honest Worth Vary (Portfolio Perception)

Philip Morris Worldwide 5.43% Yield

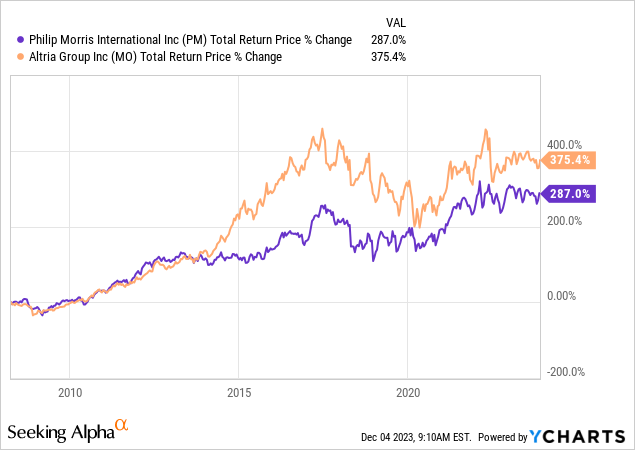

With PM on this record, we come into the second large tobacco play for this month, which additionally wants little introduction. Actually, at one level in civilization’s historical past, these two have been one. The divorce occurred in 2008, and PM was given the world whereas MO targeted on the U.S. It Seems MO appeared to profit probably the most when it comes to whole return since that cut up.

YCharts

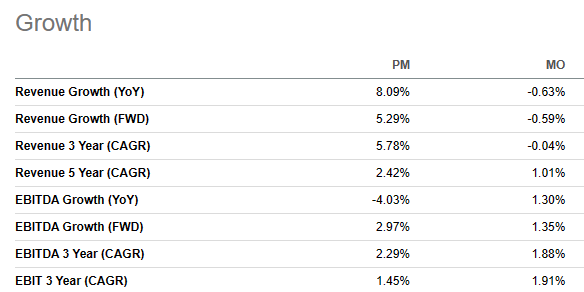

Nevertheless, extra resilient smoking charges in sure international locations relative to the U.S. could possibly be trigger for concern. The U.S. is extra middle-of-the-road when it comes to smoking charges. Development when it comes to income and EBITDA appear to favor PM going ahead, which ought to put them in a doubtlessly higher spot when it comes to potential appreciation.

PM Vs. MO Development Metrics (Looking for Alpha)

With MO, you get a better dividend, however with an absence of progress prospects sooner or later, even the yield could possibly be suspect sooner or later. Nevertheless, effectively coated at this level and rising quicker, comparatively talking.

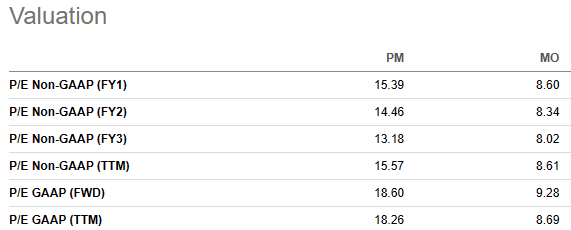

However, on the valuation entrance, MO can be the cheaper of the 2 on most P/E measurements. Because of this PM can be comparatively the richer priced of the 2 tobacco giants and, subsequently, is priced accordingly to its higher progress prospects.

PM Vs. MO Valuation Metrics (Looking for Alpha)

LyondellBasell Industries N.V. 5.24% Yield

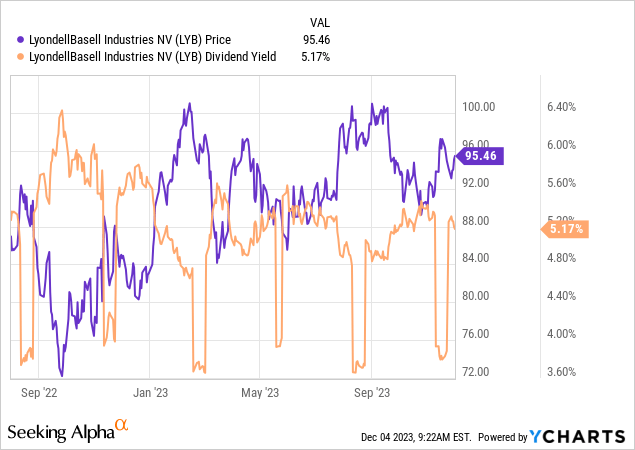

This isn’t the primary time that LYB has made the record for dialogue on this month-to-month article. Nevertheless, it had been fairly a while since we touched on it; we might have to return to August 2022 – effectively over a yr in the past as we’re getting near closing the 2023 chapter. It is not that it hasn’t popped up on this screening, but it surely’s been towards the decrease facet of the screening because the yield itself has stayed comparatively low in comparison with the opposite names which have populated the record.

This is not all unhealthy information, and it is principally as a result of the inventory’s share value has remained pretty elevated after taking a swift drop decrease towards the latter elements of 2022. In fact, that drop was merely the general market taking a nosedive because it moved deeper into bear territory at the moment.

YCharts

Right this moment, we’re protecting it primarily as a result of we bumped into so lots of the similar names greater on this record. That is quantity 15 on this screening at present; for some context, it got here in at quantity 11 final month when its yield then was the same 5.26%.

LYB stays by myself private watchlist, and so they’ve delivered dividend progress for happening a decade now. Final yr, they even paid out an enormous particular dividend to buyers.

Tags: DecembersDividendgrowthStocksYields

Tags: DecembersDividendgrowthStocksYields