[ad_1]

Monetary expertise, generally generally known as fintech, has revolutionized the way in which we deal with monetary transactions and handle our cash. Fintech refers back to the modern use of expertise in delivering monetary companies, making them extra accessible, environment friendly,

and user-friendly. Because of this, conventional banks are going through growing competitors from fintech corporations which can be difficult their dominance within the monetary business.

Globally, fintech has skilled exceptional progress over the previous decade. In response to a report by PwC, international funding in fintech ventures reached $112 billion in 2018 alone. This speedy enlargement is just not restricted to developed economies; rising markets

like Uzbekistan have additionally witnessed important developments of their fintech panorama.

In Uzbekistan particularly, fee corporations have emerged as key gamers throughout the fintech area. These entities supply different strategies for conducting transactions exterior of conventional banking channels resembling money or bodily branches.

Paynet is one oldest and first fee corporations out there. Paynet was one hottest fee strategies in Uzbekistan on the preliminary phases of growth. The corporate enabled funds for cell companies and utilities via its chain kiosks throughout

the nation. Nevertheless, smartphones and web penetration made the corporate transfer in the direction of cell software companies at later phases of progress.

One other distinguished instance is Payme – a number one cell fee platform that facilitates seamless peer-to-peer transfers and on-line funds via smartphones. Payme has gained widespread recognition amongst customers resulting from its comfort and ease of use.

Click on funds system launched the primary USSD funds and peer-to-peer switch out there. It has made important contributions in the direction of reworking Uzbekistan’s fee panorama by providing safe on-line transactions with minimal friction.

These fee corporations pose formidable challenges to conventional banks for a number of causes:

Accessibility: Fintech corporations leverage digital applied sciences resembling cell functions and internet-based platforms that present handy entry anytime and wherever for patrons. This accessibility appeals particularly to youthful generations preferring

utilizing their smartphones slightly than visiting brick-and-mortar financial institution branches.

Enhanced Person Expertise: Fintech corporations place nice emphasis on consumer expertise by designing intuitive platforms which can be straightforward to navigate, clear by way of charges or charges, and customized in accordance with particular person preferences. These customer-centric

approaches have been instrumental in attracting tech-savvy people who worth simplicity and comfort.

Innovation: Fintech corporations constantly introduce modern options that deal with ache factors throughout the conventional banking system. They supply companies resembling digital wallets, on-line lending platforms, funding apps, and robo-advisors which supply

larger flexibility and tailor-made monetary options.

Monetary Inclusion: Fee and fintech entities are instrumental in selling monetary inclusion by reaching underserved populations who could not have entry to conventional banking companies. With simplified account opening procedures and digital fee

options, these entities bridge the hole between unbanked people and formal monetary methods – enhancing their financial alternatives.

Price-efficiency: Conventional banks typically contain increased charges for numerous monetary companies in comparison with fintech corporations which might supply lower-cost alternate options resulting from their streamlined operations and modern enterprise fashions.

Fee and fintech entities problem conventional banks by leveraging expertise, offering superior consumer experiences, providing cost-efficient options, selling monetary inclusion, fostering innovation at a sooner tempo, and presenting alternatives

for collaboration. Because the fintech business continues to develop globally and inside Uzbekistan particularly, conventional banks should adapt their methods to stay aggressive within the quickly altering monetary panorama.

Within the subsequent sections, we’ll delve deeper into the expansion numbers and statistics surrounding fintech in Uzbekistan, discover the components driving this progress, study challenges confronted by these rising gamers, and spotlight potential collaboration alternatives

between banks and fintech corporations.

Fee ecosystem

The fintech ecosystem in Uzbekistan continues to be comparatively nascent in comparison with different international locations. Nevertheless, the federal government has acknowledged the potential of fintech and has taken steps to advertise its progress.

The nation has witnessed an increase in digital fee options. Fee corporations like Payme, Click on, Paynet and others are gaining recognition for his or her ease of use and comfort. These platforms enable customers to make funds, switch cash, and pay totally different

payments.

Fee corporations acquired recognition as a result of, in contrast to the banks out there, they have been the primary to introduce user-friendly functions and strategies to make peer-to-peer transfers and funds to totally different companies. For instance, Click on was one of many first

corporations to introduce p2p switch over USSD. This service acquired recognition amongst prospects, particularly within the areas of the nation the place there have been virtually no web connection. Despite the fact that the web penetration within the nation has considerably

improved since then this was the function that made the Click on one of many main fintech corporations out there.

Payme is one other firm that led the cell funds revolution in Uzbekistan by introducing one of many first cell fee functions. Initially began as p2p transfers and easy funds software the corporate now presents a variety of monetary

and fee companies.

If non-cash P2P transfers gave delivery to the expansion of fintech out there now corporations moved past easy transfers and shifting in the direction of constructing an ecosystem of merchandise or tremendous apps. That is largely as a result of the present tariff panorama leaves fee

service suppliers (PSPs) with ample funds for the speedy growth of digital companies. Because of this, about 60 PSPs are working within the nation, which has essentially remodeled the strategies of transferring C2C and partially C2B funds.

Despite the fact that P2P transfers remained a core function on virtually all of the fee functions corporations didn’t cease on this function solely. At present, main fee functions supply their prospects funds of various utility companies, invoice funds, integrations

with worldwide fee companies, mortgage funds and the flexibility to purchase non-financial companies resembling insurance coverage and others.

After we focus on the fintech business of the market we should point out three essential companies that funds corporations launched to the market that performed a big position within the adoption of non-cash funds.

Click on and Payme have been the primary two fee corporations that launched in-store QR funds and stay leaders on this market phase. The introduction of QR funds was essential not just for finish customers however for retailers too. With the expansion of smartphone

utilization particularly among the many youthful technology QR funds create a big push in the direction of a cashless financial system.

One other essential service that was launched to the market by fee corporations was cell wallets. This service permits prospects to create their cell wallets with fee corporations and the primary benefit of this service is that it doesn’t require prospects

to have financial institution playing cards or accounts. That method this service promotes monetary inclusion and permits any buyer to get entry to monetary and fee companies.

Final however not least funds are leaders in e-commerce integrations the place you will note virtually no banks. Many of the marketplaces and e-commerce web sites combine with Payme and Click on as many of the prospects (mixed 20+ million) use these two fee companies.

We should additionally point out that fee corporations supply not solely B2C companies. These days, many of the native and a few worldwide fee corporations began actively providing b2b fee and service provider companies and one of many driving forces on this path was the

progress in on-line gross sales.

The present fintech ecosystem of Uzbekistan consists of not solely fee corporations. Within the final a number of years banks additionally began actively launching their cell functions and providing funds in addition to digital banking companies. Nevertheless, in contrast to fee

corporations, banks have been late to the market and are considerably behind in UX and providing among the well-liked companies resembling QR funds, digital wallets and non-financial companies.

Progress numbers and statistics

The fintech business in Uzbekistan has witnessed exceptional progress and transformation lately. Let’s take a more in-depth take a look at some key statistics that spotlight the progress and impression of this burgeoning sector.

Analysts be aware a speedy enhance in demand for fee companies from non-banking companies. In response to the Central Financial institution, that is facilitated by beneficial situations for market members.

As of January 1 2023, there have been 47 licensed fee organizations in Uzbekistan, in accordance with the Central Financial institution.

Customers:

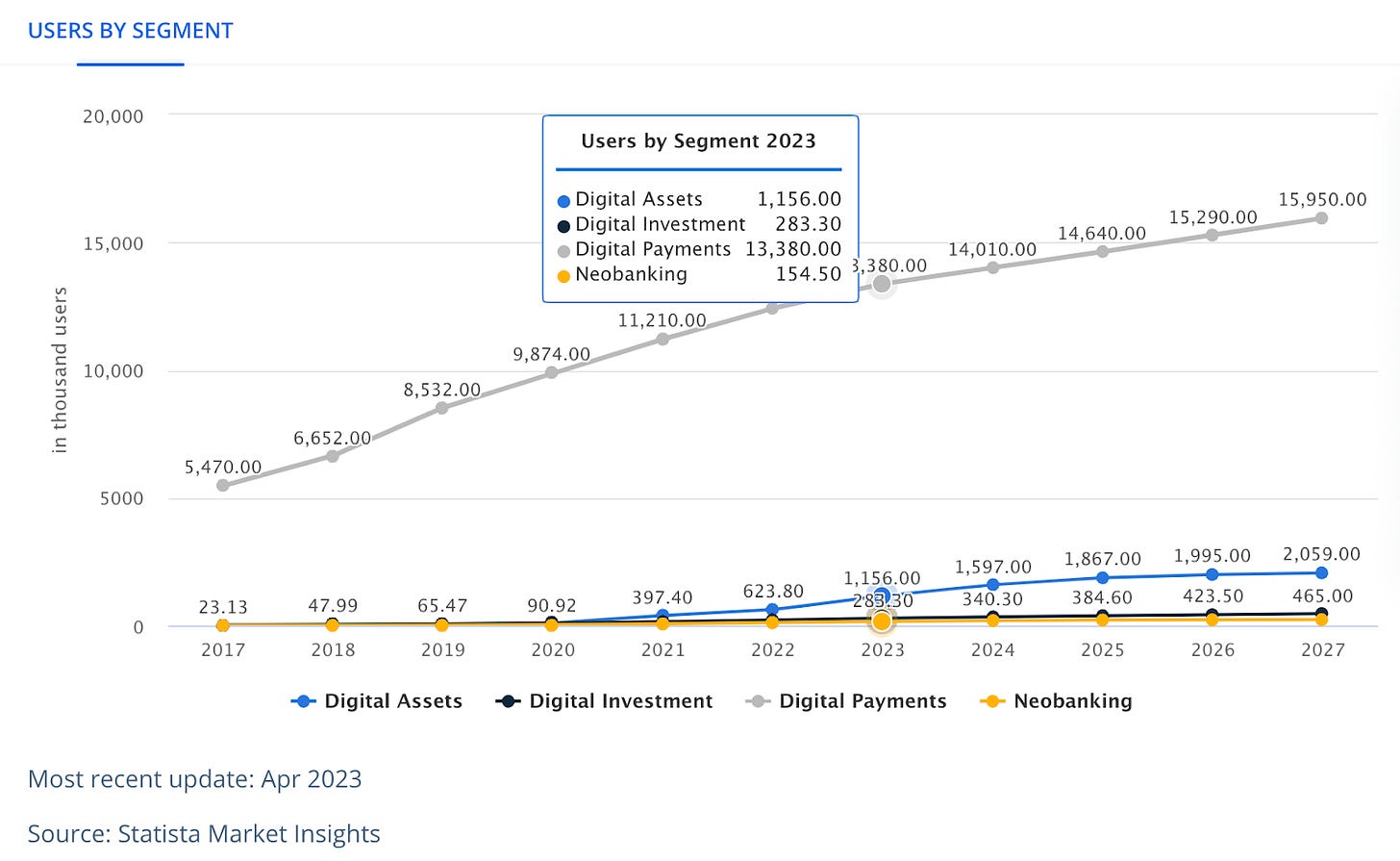

In response to Statista, the variety of customers of digital fee companies grew from 5,4 million customers in 2017 to over 12 million in 2023

Transaction quantity by fee organizations in 2022:

In 2022, fee organizations carried out transactions price 116 trillion. sum, which is 2.1 occasions greater than in 2021.

The amount of transactions in fee companies continues to develop each quarter. If in January-March it amounted to 21.6 trillion soums, then in October-December – 38.2 trillion, or 76.8% extra.

The preferred function of transactions in fee companies was fee for cell communications – over the yr it reached 10.46 trillion soums, 3.17 occasions increased than the earlier yr. The most important enhance was proven by utilities – 3.4 occasions or 8.94

trillion soums.

The amount of on-line funds for presidency companies additionally elevated noticeably, amounting to six.1 trillion soums or 236% greater than the figures for 2021. Mortgage funds throughout the identical time elevated 2.6 occasions – to three.64 trillion soums.

The variety of QR codes put in in companies by the data system elevated by solely 8 thousand and amounted to 99 thousand items. Regardless of this, the amount of transactions made via this method elevated from 14.9 billion soums in 2021 to 191.6

billion soums in 2022, and the quantity elevated 4.2 occasions and reached 63.2 thousand items.

In 2022, the amount of transactions utilizing NFC expertise elevated 2.1 occasions in comparison with 2021 and reached 25.5 trillion. Sum

In-store funds (661 billion soums) and funds for transport companies (767 billion soums) greater than doubled. Alternatively, funds for Web companies via fee companies decreased by virtually a 3rd – to 866 billion soums.

Over the previous yr, 11.6 million transactions (+79.2%) price 273.25 billion soums (+60%) have been carried out via digital cash methods (e-wallets). A very robust enhance was noticed within the final quarter when the amount of funds amounted to

124.17 billion soums – virtually twice as a lot because the earlier quarter.

Transaction worth by fee organizations in 2022:

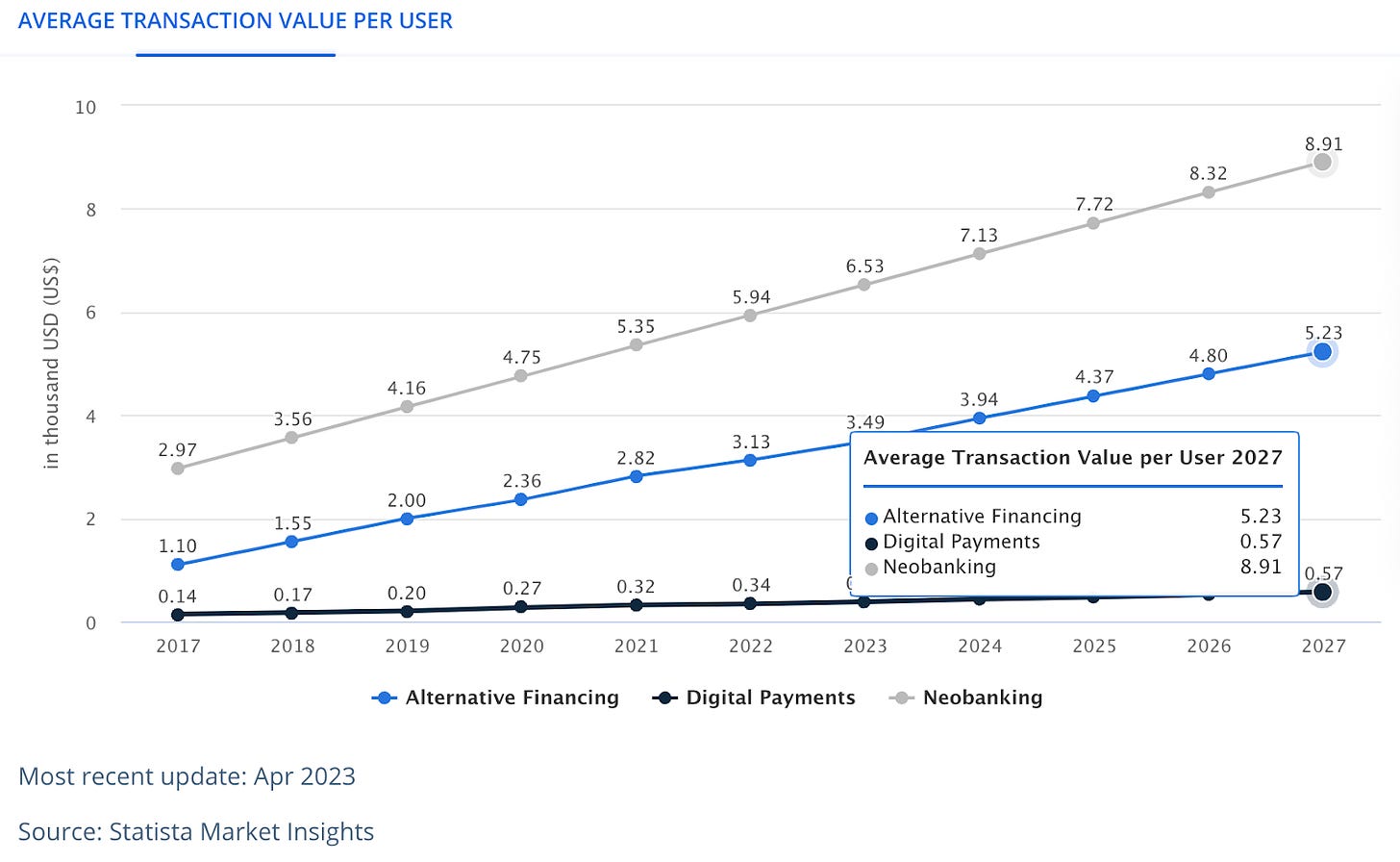

The typical transaction worth per consumer over digital fee companies was 0.34 USD in 2022 and is predicted to develop to 0.57 USD by 2027

Progress components

Fintech, or monetary expertise, is a quickly rising sector in Uzbekistan, with a number of components contributing to its rise.

Digitisation of the financial system and authorities companies:

The digitisation of the financial system and authorities companies of Uzbekistan is a strategic transfer by the federal government and one of many most important components behind the expansion of fintech within the nation. The federal government has applied numerous packages and methods to foster

the event of knowledge and communication applied sciences (ICT) and to construct a floor for customers and companies to get entry to numerous companies digitally.

Customers of fee corporations could make funds to totally different authorities companies resembling training, healthcare, payments for presidency companies and so forth. instantly within the functions. The numbers present that funds for utility companies which have been digitised as half

of the shift towards digitisation and funds for presidency companies have been among the many prime three fee classes in 2022. The amount of on-line funds for utilities elevated 3.4 occasions or 8.94 trillion soums and authorities companies amounted to six.1 trillion

soums or 236% greater than the figures for 2021.

Expertise

Technological developments, such because the rise of smartphones and cell web, have made it simpler for individuals to entry monetary companies, no matter their location or entry to conventional banking companies. In 2019, the Legislation “On Funds and Fee

Programs” was adopted, which decided the authorized standing of the primary classes of fintech enterprise and established ideas resembling digital cash and fee companies. This enabled fee corporations to launch their e-wallets and if earlier than customers needed to have

a banking card to make use of fee companies now they might create their e-wallets with fee companies and begin utilizing monetary companies. Alternatively, on the finish of 2020, banks and fee organisations have been allowed to hold out identification not solely

by the bodily technique but in addition by digital biometric instruments. By the tip of 2022, 26 industrial banks and 13 fee organizations had applied this expertise. This, in flip, has considerably expanded the flexibility of shoppers to remotely use banking and fee

companies (opening a checking account, opening an digital pockets, microloans, receiving funds via worldwide cash transfers) with out instantly visiting financial institution branches or fee organizations. That is notably useful for unbanked populations and

individuals in distant areas.

QR funds have gotten one well-liked fee technique, particularly among the many youthful technology. In the intervening time Payme and Click on are main fee corporations that provide QR funds and no banks besides Uzum Financial institution which operates virtually like a fee firm supply

QR funds. The benefit of QR funds for retailers is in contrast to card-based fee methods, QR code funds don’t require costly point-of-sale terminals or excessive transaction charges. The variety of transactions within the QR On-line system greater than quadrupled

– to 63,287. On the similar time, the variety of fee QR codes elevated solely by 8 thousand. The amount of funds utilizing QR codes in 2022 amounted to 191.6 billion soums. That is 12.8 occasions greater than the earlier yr. The event of infrastructure for

funds through NFC smartphone units additionally continues. At present, the Faucet-to-phone system is utilized by greater than 2,300 enterprises. The amount of NFC transactions over the previous yr elevated 2.1 occasions and reached 25.5 trillion sums.

E-commerce

E-commerce and marketplaces are two sectors of the digital financial system which can be fostering the expansion of fintech and funds. In response to KPMG in 2022, the e-commerce market in Uzbekistan achieved a exceptional milestone, reaching a measurement of 311 million US {dollars}.

Fintech and funds are the applied sciences and companies that facilitate the switch of cash and worth between events in e-commerce transactions. Fintech and funds are the applied sciences and companies that facilitate the switch of cash and worth between

events. Uzum one of many largest ecosystems in Uzbekistan has its market, meals supply, banking, and so forth. and after the merger with Click on one of many largest fee corporations has its fee companies. Uzum permits its prospects to make funds for purchases

instantly within the banking at supply factors and this creates a singular expertise. Resulting from their scale and large buyer base, Payme and Click on have develop into two must-have fee companies on virtually all e-commerce shops and marketplaces. BNPL is one other instrument

that’s popularised via e-commerce gross sales pushing the boundaries of cashless fee via fee and BNPL apps. E-commerce is driving innovation in service provider fee companies too for instance with the assistance of BNPL retailers can appeal to extra prospects

and enhance gross sales. Retailers specializing in integrations with worldwide fee gateways to promote internationally.

Customers

Customers are more and more demanding handy, quick, and user-friendly monetary companies. Fintech options typically supply a extra streamlined and customer-centric expertise than conventional banking methods. To fulfill buyer wants and desires fintech shifting

in the direction of constructing tremendous apps the place monetary, non-financial and e-commerce companies are mixed in place. Click on and Payme are the 2 largest tremendous apps out there, nonetheless, different gamers are following traits for instance People a digital community operator

additionally working actively in that path.

Challenges

Fintech corporations are revolutionizing the monetary sector by providing modern options for funds, lending, investing, and extra. Nevertheless, working in a extremely regulated business poses many challenges for these corporations.

Some of the important challenges is compliance necessities, which differ throughout totally different regulatory organisations in Uzbekistan. Compliance necessities can have an effect on numerous elements of fintech operations, resembling information safety, buyer verification,

anti-money laundering, tax reporting, and client safety. Fintech corporations want to make sure that they adjust to all of the related legal guidelines and laws within the markets they function in, or they might face authorized penalties, reputational harm, or lack of

prospects.

– Anti-money laundering and counter-terrorism financing (AML/CTF): Fintech corporations are uncovered to the danger of getting used for cash laundering or terrorism financing actions, particularly if they provide companies resembling remittances, funds, lending or

crowdfunding. Due to this fact, fintech corporations must adjust to AML/CTF laws within the markets the place they function, which can embody conducting buyer due diligence, monitoring transactions, reporting suspicious actions or freezing property. Nevertheless,

AML/CTF laws usually are not at all times constant or aligned with worldwide requirements, and pose challenges for small fintech corporations by way of implementation, price and scalability.

– Taxation: Fintech corporations could face taxation points in rising markets, resembling double taxation, withholding tax or value-added tax. These points could come up because of the cross-border nature of fintech companies, the dearth of readability on the tax residency or

everlasting institution of fintech corporations or the absence of tax treaties or agreements between international locations. Taxation points could have an effect on the profitability and competitiveness of fintech corporations in rising markets.

To beat this problem, regulators must put money into compliance experience, expertise, and partnerships that may assist them navigate the advanced regulatory panorama and adapt to altering buyer expectations.

Conclusion

In conclusion, the fintech ecosystem in Uzbekistan is experiencing exceptional progress and presents promising alternatives for each native and worldwide gamers. The statistics and numbers exhibit the upward trajectory of this sector, indicating a

robust demand for modern monetary options amongst customers.

The components driving fintech progress in Uzbekistan are numerous. Firstly, the federal government’s dedication to digital transformation and financial reforms has created an enabling setting for fintech corporations to thrive. Moreover, a younger tech-savvy inhabitants

with growing entry to cell units and web connectivity additional fuels the adoption of fintech companies.

Nevertheless, you will need to acknowledge the challenges confronted by fintech corporations working in Uzbekistan. Regulatory frameworks are nonetheless evolving, requiring extra readability and adaptability to accommodate modern enterprise fashions whereas guaranteeing client

safety.

Regardless of these challenges, there’s optimism throughout the business as stakeholders collaborate in the direction of addressing these points collectively. The federal government’s efforts in the direction of regulatory developments coupled with initiatives fostering collaboration between conventional

monetary establishments and fintech corporations point out constructive developments on the horizon.

As we glance forward, it’s evident that continued investments in expertise infrastructure, expertise growth packages, and supportive insurance policies shall be essential parts in shaping a thriving fintech panorama inside Uzbekistan.

General, it is an thrilling time for fintech in Uzbekistan as innovation continues to reshape the monetary companies business. With a sustained give attention to overcoming challenges collaboratively whereas capitalizing on progress drivers current throughout the nation’s

dynamic market situations, we will anticipate additional evolution of this flourishing sector.

[ad_2]

Source link