[ad_1]

Protection shares have lagged the S&P 500 regardless of rising geopolitical dangers

However these shares may lastly be gearing as much as overtake the index

As orders begin to circulate in for these three corporations, their shares may very well be poised for a rally

Safe your Black Friday positive factors with InvestingPro’s as much as 55% low cost!

Amid escalating geopolitical dangers prior to now few months, consideration has turned to protection shares. Whereas challenges within the protection trade have affected their efficiency relative to the index since final yr, the continued inflow of orders these corporations are receiving suggests issues may very well be about to vary for this sector.

There was a surge in world army spending following Russia’s invasion of Ukraine final yr. Whole world spending surged by 3.7% YoY to succeed in simply above $2 trillion. Current occasions, such because the battle between Israel and Hamas, spotlight the enduring development of elevated protection spending globally.

This ongoing geopolitical uncertainty has prompted international locations to bolster their defenses, indicating that protection shares might develop into outstanding in long-term funding portfolios. So on this piece, we are going to check out three outstanding protection corporations you possibly can think about including to your portfolio as international locations hold rising their protection budgets.

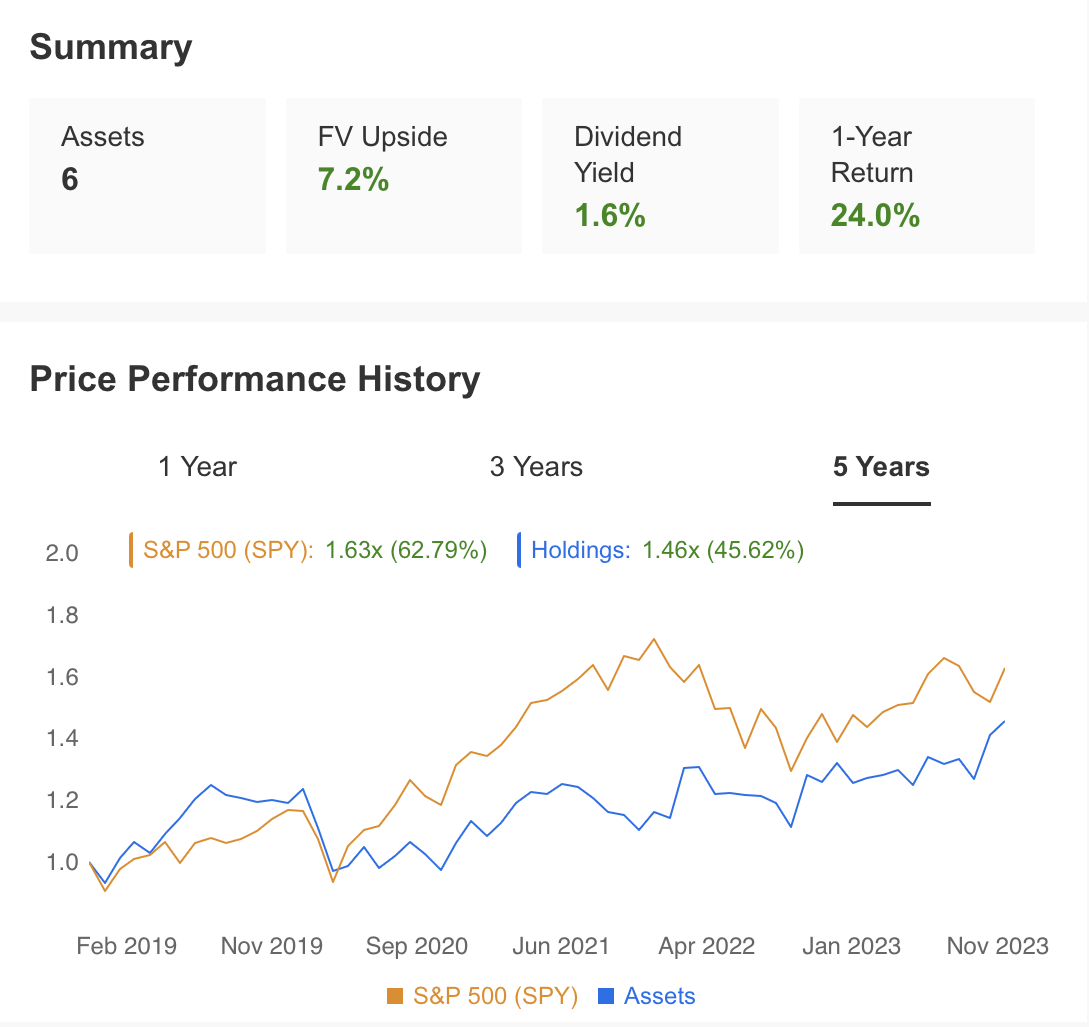

Protection Shares Have Lagged the Broader Market

Inspecting the long-term efficiency, a portfolio comprising 6 protection shares has lagged behind the since 2020. Regardless of a average upward trajectory for each the S&P 500 and protection shares after 2020, the latter has lagged behind as the previous continues to surge.

Supply: InvestingPro

The U.S. protection trade has grappled with challenges that had been mirrored within the earnings studies of corporations inside this sector. Points in the course of the manufacturing section, impeding supply targets, alongside provide chain and employment challenges, have been notable hurdles.

Nonetheless, the substantial backlogs and orders stand out as key elements with vital upside potential for these corporations within the upcoming durations. This resilience signifies that market demand stays sturdy regardless of geopolitical dangers. Overcoming elementary challenges pressuring the margins of protection trade companies holds the potential for a considerable surge in each margins and earnings inside the protection market.

So with out additional ado, listed below are the three shares:

1. Rtx

Rtx (NYSE:) is at the moment the biggest protection firm among the many corporations we consider, with a market cap of $118.3 billion. Though its P/E ratio stays greater than different corporations at 36.2X, the corporate is well-positioned for long-term funding with a dividend yield of two.9% amongst dividend payers.

This inference may be supported by the corporate’s $190 billion backlog of orders as of Q3. Roughly $75 billion of those orders come from the protection sector. Accordingly, if the corporate overcomes the provision course of and manufacturing issues, that are seen because the structural issues of the sector, will probably be inevitable for the corporate to attain a wholesome money circulate.

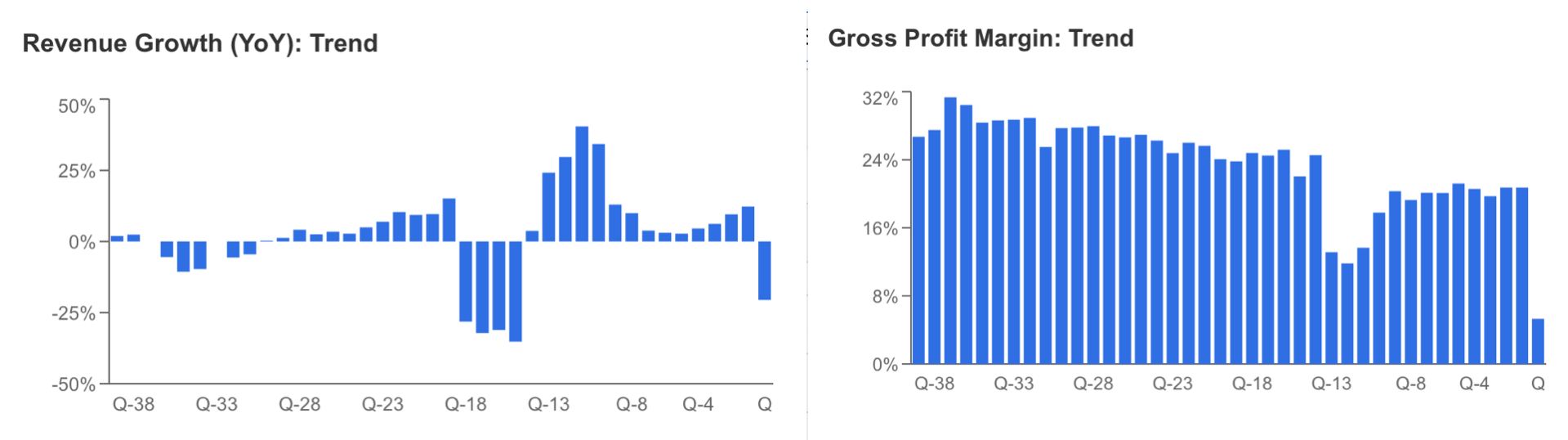

Then again, whereas the corporate introduced a pointy decline in income in its final quarter report, it appears probably that income progress will return to optimistic territory within the coming durations with the supply of backlog orders. As well as, the advance within the gross revenue merchandise affected by the income decline can be intently monitored.

Supply: InvestingPro

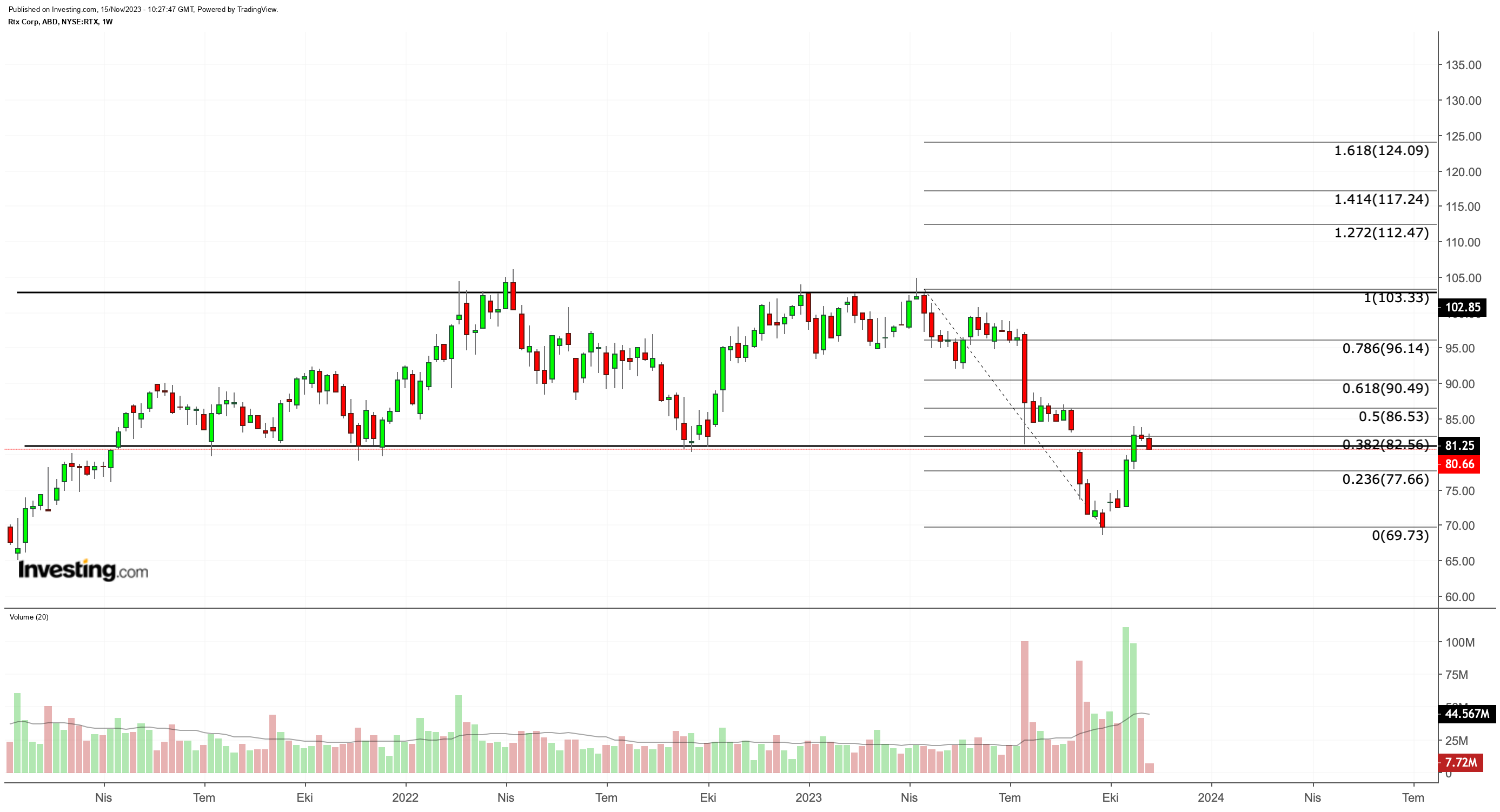

Trying on the worth efficiency of the inventory, it’s seen that the downward momentum was reversed within the rising stress setting in October, whereas the share interrupted the restoration motion within the $80 band after displaying a partial worth improve of 15%.

RTX, which is at the moment testing the worth stage that has been used as long-term assist since 2021, has the potential to technically transfer its rise towards the $100 band if it could actually set up floor above this stage.

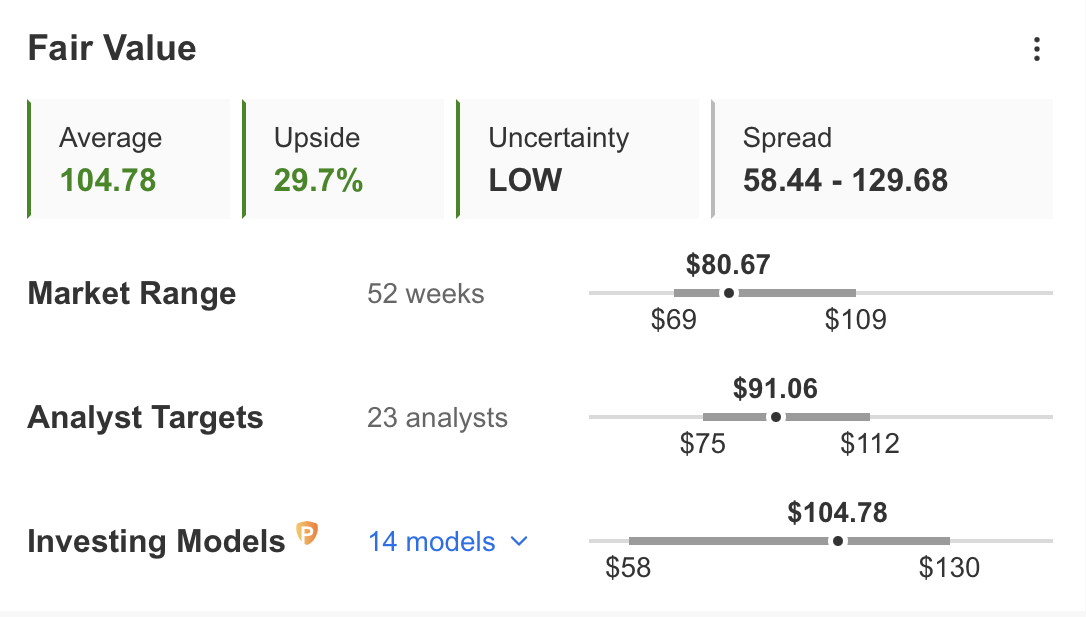

When the honest worth evaluation is checked on InvestingPro, it may be seen that RTX has the potential to rise as much as $104 in response to 14 fashions.

Supply: InvestingPro

2. Lockheed Martin

Lockheed Martin (NYSE:), one other outstanding protection firm on this interval, comes behind RTX with a market capitalization of near $110 billion. Whereas LMT provides a valuation under the sector with 15.8X P/E, it’s among the many protection shares that may be most popular for long-term buyers with a dividend yield of two.8%.

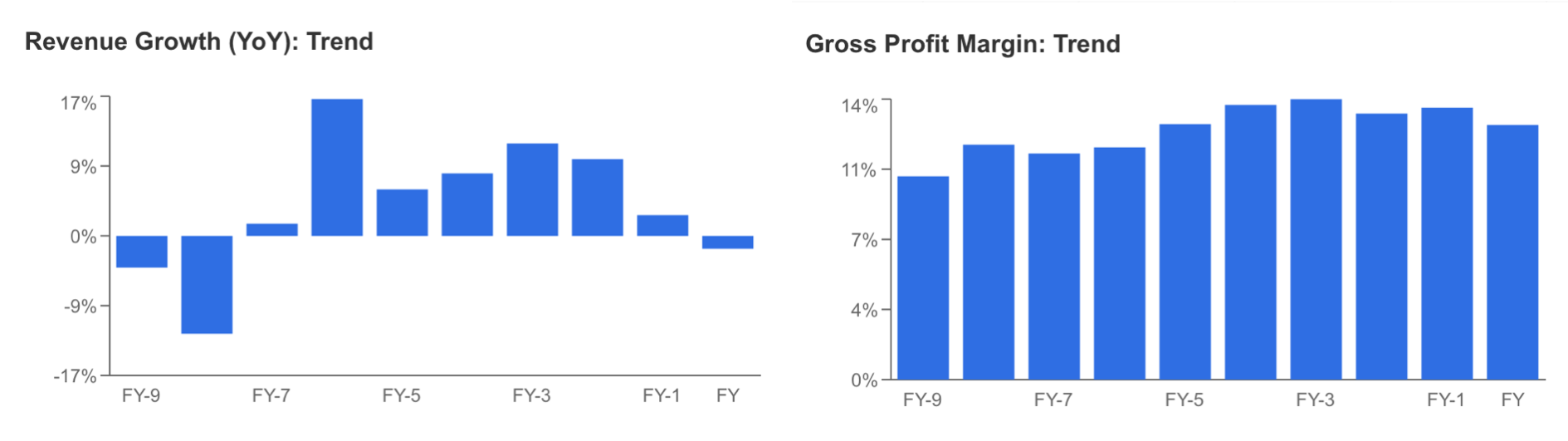

Lockheed Martin, which reported an order backlog of $159 billion within the first half of the yr, is among the many protection corporations with progress potential and income progress may speed up. Thus, income progress, which has continued to say no within the final 3 years, might reverse and revenue margins might enhance.

Supply: InvestingPro

In Lockheed, the funding in next-generation protection expertise with R&D research approaching 3 billion {dollars} this yr may be thought of as an element supporting progress.

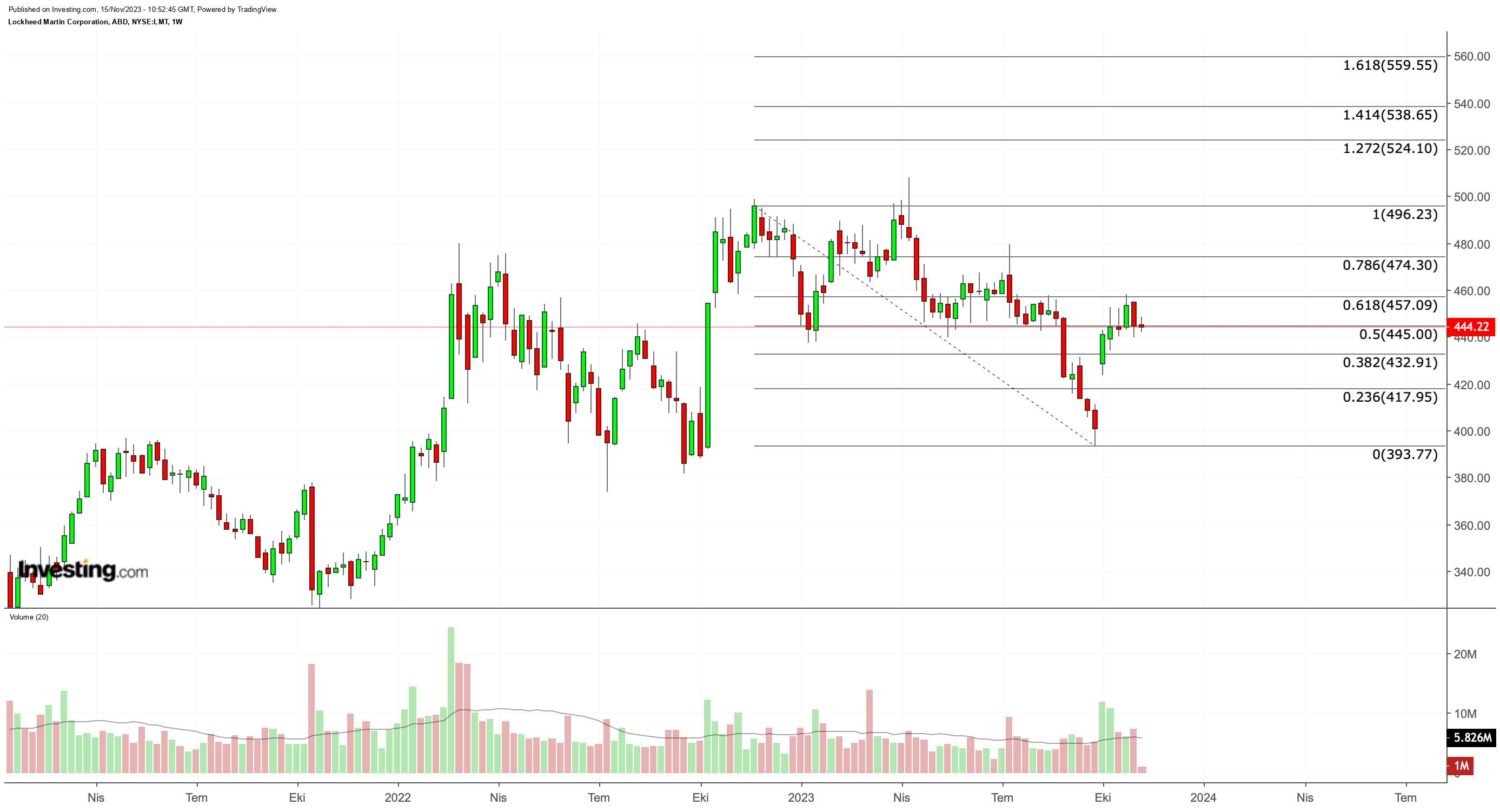

Trying on the LMT inventory technically, it’s seen that with the October bounce, the worth reached the Fib 0.618 correction stage at $457 in response to the short-term downward momentum. In case of a weekly shut above this resistance, the restoration development might proceed and the share worth might proceed its development as much as the vary of $525 – 560.

Supply: InvestingPro

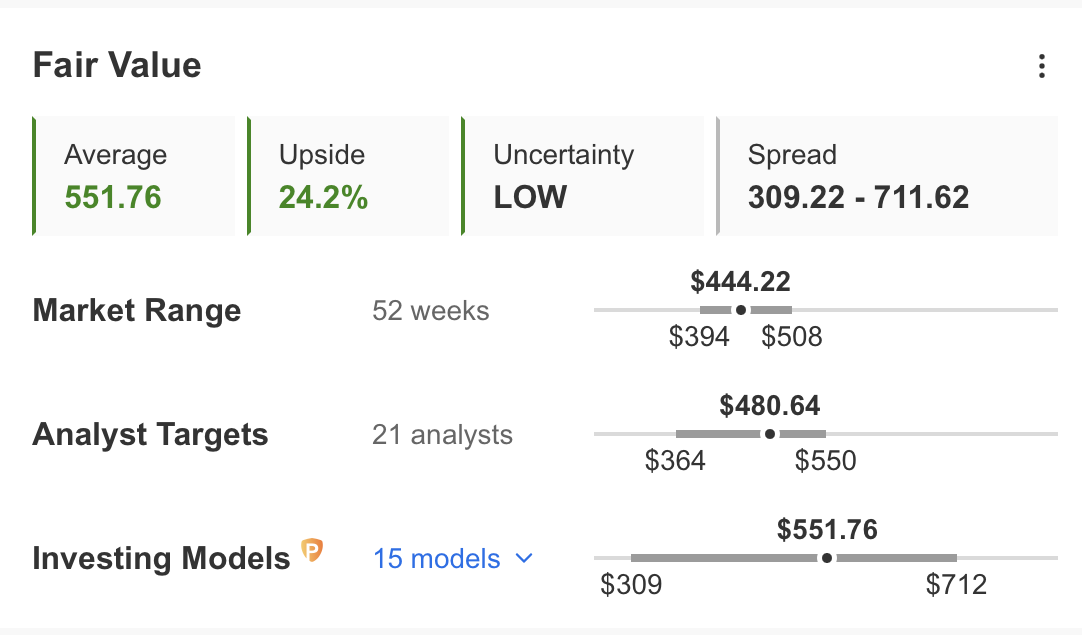

InvestingPro honest worth calculation additionally reveals that LMT has the potential to rise as much as $550 in keeping with the technical outlook with a 25% improve in worth inside a yr.

3. Leonardo

With a market capitalization of $5.1 billion, Leonardo DRS (NASDAQ:) is comparatively small in comparison with different protection trade corporations, however with a excessive progress potential.

Leonardo stands out as a supplier of protection merchandise and expertise and continues to broaden its product vary yearly. In response to its newest monetary outcomes, the corporate has a excessive P/E ratio of 34.4X. The inventory is overvalued within the quick time period with an upward development since June 2022.

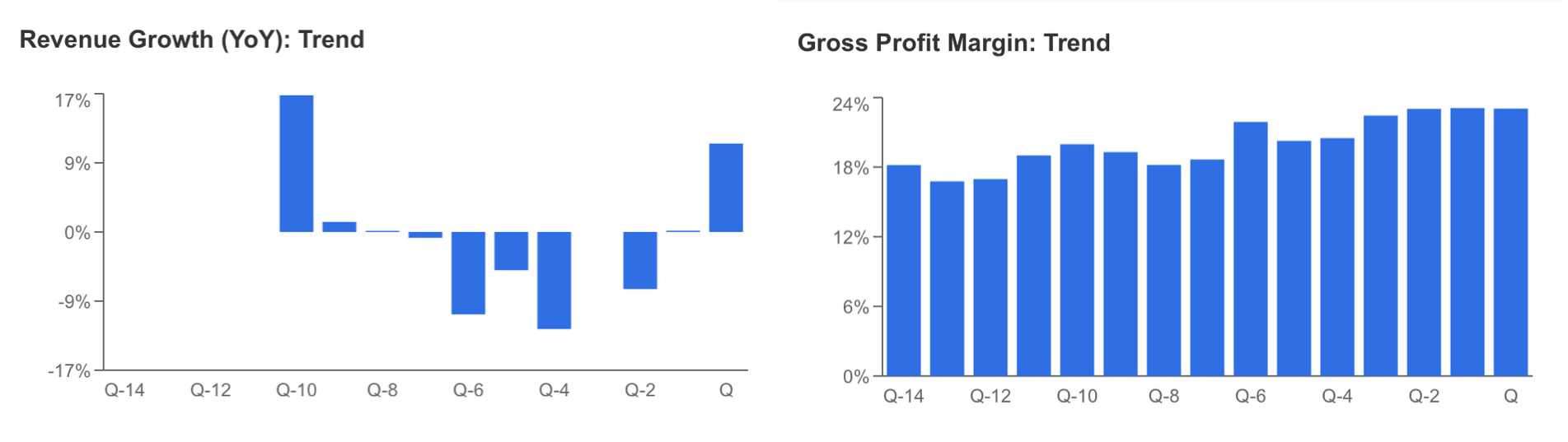

As well as, the corporate, which introduced a robust stability sheet within the final quarter, was welcomed positively as income progress shifted to optimistic momentum and revenue margin continued to be maintained within the 20% band. As well as, the corporate is pursuing an aggressive progress technique by numerous mergers and acquisitions.

Supply: InvestingPro

LRS, which has maintained its long-term uptrend with a 25% improve in worth since October, reached the $ 20 stage this week and technically seems prefer it has reached a crucial resistance stage for a correction section.

Accordingly, if LRS performs a weekly shut under $ 20, the potential of a retracement in direction of the $ 16 – $ 18 vary might improve. Then again, if the rally continues with a ground above $ 20, we will see that the momentum might proceed towards the $ 28 – $ 30 vary.

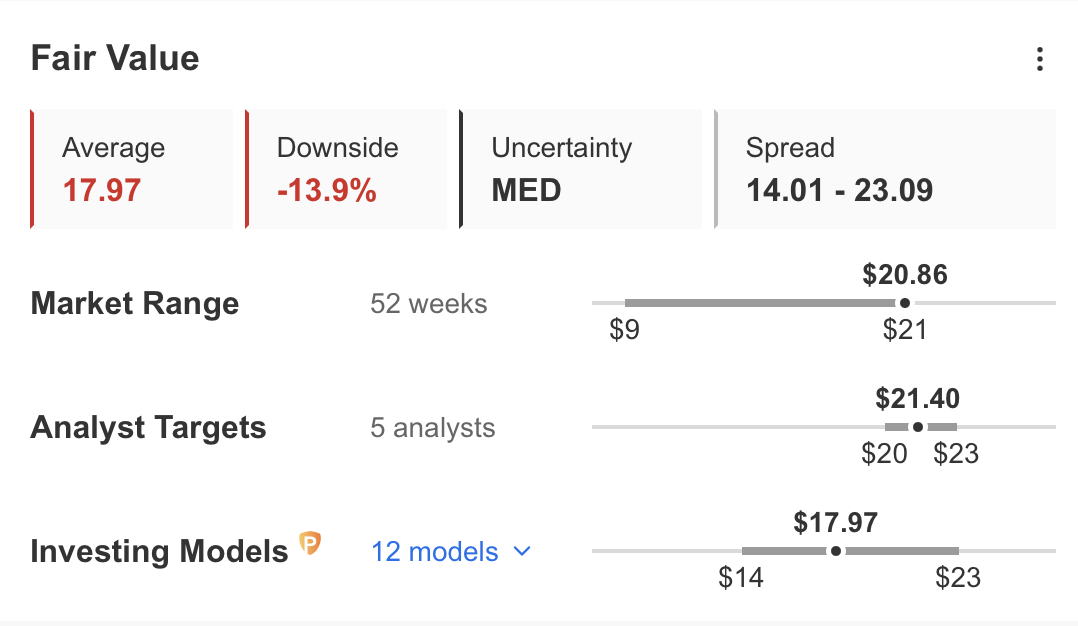

Overbought circumstances stand out within the honest worth evaluation, whereas it’s estimated that the inventory might decline to $18 within the coming durations.

Supply: InvestingPro

Conclusion

In abstract, whereas protection shares have usually underperformed in recent times because of provide issues, they’ve began to draw the eye of buyers with the rise in geopolitical issues around the globe.

In consequence, on this interval when world peace is underneath menace, the rising orders of corporations might trigger a long-term rally by guaranteeing fast progress as the present issues start to be solved.

***

Purchase or Promote? Get the reply with InvestingPro for Half of the Worth This Black Friday!

Well timed insights and knowledgeable selections are the keys to maximizing revenue potential. This Black Friday, make the neatest funding resolution out there and save as much as 55% on InvestingPro subscription plans.

Whether or not you are a seasoned dealer or simply beginning your funding journey, this provide is designed to equip you with the knowledge wanted for extra clever and worthwhile buying and selling.

Black Friday Sale – Declare Your Low cost Now!

Disclaimer: The writer doesn’t personal any of those shares. This content material, which is ready for purely academic functions, can’t be thought of as funding recommendation.

[ad_2]

Source link