[ad_1]

by Fintechnews Switzerland

February 9, 2024

Regardless of plunging investments, the digital banking sector witnessed elevated innovation and dynamism in 2023.

New neobanks have been launched to handle particular wants, banking incumbents launched digital banking arms to maintain up with the altering aggressive panorama, and market leaders expanded their world foothold in rising markets, a brand new evaluation by French fintech-focused analysis C-Innovation reveals.

The report, launched in January 19, 2024, explores the worldwide neobanking scene, delving into the sector’s key gamers and their progress methods, investigating the primary developments noticed in 2023 and sharing predictions about what lies forward for the business.

In line with the report, 2023 noticed funding to digital banking firms lower considerably, plummeting by 65% from US$10.9 billion in 2022 to US$3.8 billion in 2023 amid lingering inflation, hawkish financial insurance policies, and provide chain disruptions. The dip is reflective of the broader pullback noticed within the world fintech business, which noticed fintech investments lower by 52% year-over-year (YoY) to US$44.9 billion.

Yearly digital banking enterprise capital funding (2019-2023), Supply: C-Innovation, Jan 2024

regional funding developments, the evaluation discovered that Oceania was the toughest hit, recording no digital banking funding in any respect, adopted by North America which skilled a major lower of 74% in enterprise capital (VC) funding.

Europe and Asia confirmed some resilience by securing substantial funding of US$1.2 billion and US$1.1 billion, respectively. This development was pushed by robust VC funding exercise in eight international locations, particularly Finland, Israel, Italy, Japan, Netherlands, Singapore, South Africa, and South Korea, the place VC funding defied the chances and recorded a rise in funding to the digital banking section.

International digital banking funding in 2023, Supply: C-Innovation, Jan 2024

A brand new wave of neobanking gamers

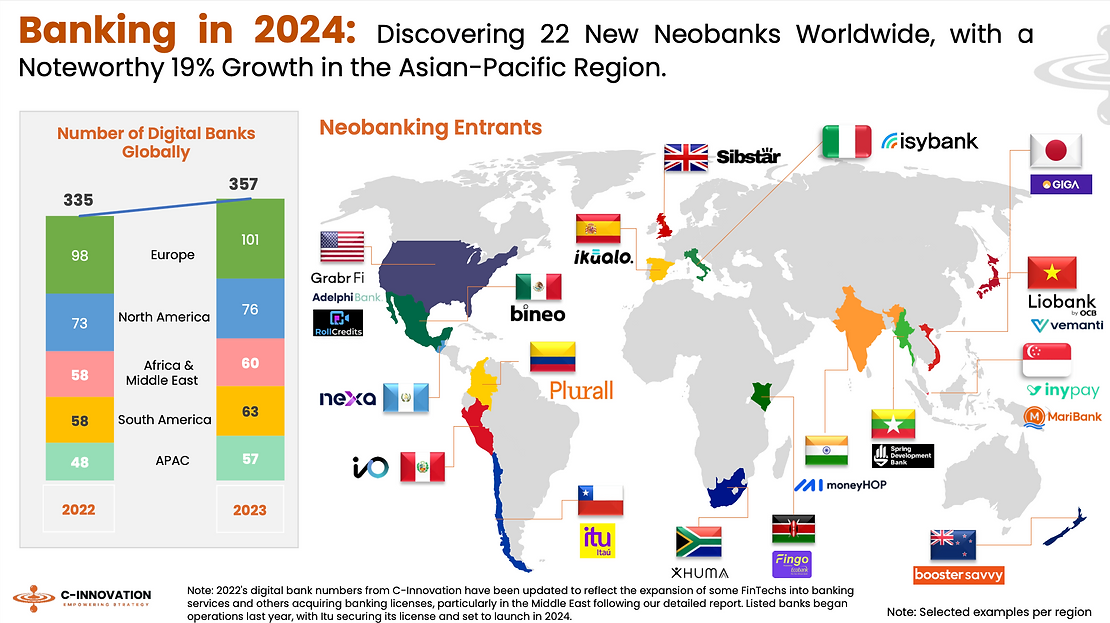

Regardless of the funding downturn, the C-Innovation evaluation reveals that the worldwide digital banking section expanded in 2023 by including greater than 20 market entrants, bringing the whole variety of neobanks accessible around the globe to 354.

These new gamers are catering to varied market niches throughout totally different areas and spearheading a shift in the direction of extra accessible, inclusive and user-focused monetary providers.

Variety of digital banks globally, Supply: C-Innovation, Jan 2024

In Asia-Pacific (APAC), new market entrants are addressing particular wants by offering aggressive rates of interest and multi-currency accounts, and by concentrating on migrant populations. In Singapore, Maribank affords a extremely aggressive fee of two.88% each year for private financial savings accounts, and an interesting 2.5% rate of interest on enterprise accounts. In Myanmar, Spring Improvement Financial institution lets clients benefit from the flexibility of a multi-currency account, supporting transactions in as much as 10 totally different currencies.

In South America, innovation within the neobanking area is being largely pushed by banking incumbents and conventional monetary establishments, with notable examples of options which have hit the market over the previous 12 months or so together with Bineo from Grupo Financiero Banorte in Mexico, Io from Banco de Credito (BCP) in Peru, and Itu from Itau in Chile.

Bineo goals to supply financial savings accounts and private loans with seeks so as to add 2.8 million new shoppers within the subsequent 5 years; Io is a digital banking providing that comes with digital and bodily Visa-backed client bank cards with no onboarding charges; and Itu is a digital banking enterprise initially providing a digital account and a Mastercard debit card.

Different neobanks are anticipated to hit the South American market quickly, together with the Openbank digital banking service by Santander Mexico, and Hey Banco, which is backed by Banregio Grupo Financiero.

In Europe, UK-based firm Sibstar launched in March 2022 a neobanking providing comprising a debit card and an app designed to assist individuals residing with dementia and their households to soundly handle on a regular basis spending. The Mastercard debit card is pre-loaded with funds, then how and the place the cash is spent might be managed by the Sibstar app. The app’s cash administration controls embody spend limits, ATM, on-line, cellphone change on/off, prompt freeze, auto high up, and actual time notifications which might be modified immediately and remotely.

Within the realm of rising markets, UK-based agency Fintech Farm continued to pursue its world growth plans, launching in 2021 Leobank in Azerbaijan and opening Liobank in Vietnam in 2023. Concentrating on underdeveloped banking sectors and markets with giant underbanked populations, Fintech Farm goals to launch neobanks in India and Nigeria this 12 months.

Fintech Farm secured a US$22 million Sequence B funding spherical in April 2023 to gas its progress and create user-friendly cell apps and credit score merchandise for the underserved. The spherical, which comprised a mixture of fairness and convertible mortgage, valued Fintech Farm over US$100 million, in line with on-line publication AIN.Capital.

Predictions for 2024

Waiting for 2024, C-Innovation expects the worldwide digital banking panorama to proceed to evolve, formed by the interaction of conventional monetary establishments, established neobanks, and new market entrants.

Conventional banks are set to proceed their digital journey, specializing in refining digital transformation methods. This may occasionally entail enhancing digital interfaces, integrating applied sciences like synthetic intelligence (AI) and blockchain, and providing personalised monetary providers to retain and appeal to tech-savvy shoppers.

Established neobanks are more likely to keep or improve their market share by agility, revolutionary merchandise, and customer-centric approaches. To maintain profitability, they might broaden into lending providers, tapping into private and enterprise mortgage markets to diversify income streams.

Lastly, new neobanking firms coming into the market in 2024 are anticipated to focus on particular market gaps, reminiscent of underserved demographics and area of interest monetary merchandise. Their success will depend upon their potential to distinguish themselves in an more and more crowded market and their capability to swiftly adapt to regulatory and financial shifts, the report says.

With VC funding drying up for tech startups, firms within the neobanking business are shifting their priorities from speedy growth to profitability. Knowledge launched in November 2023 by technique consulting agency Simon-Kucher point out that this technique has thus far paid off, with an rising variety of neobanks reaching profitability and business revenues rising by about 43% over the previous two years or so. As of October 2023, the worldwide neobanking sector served roughly 1.1 billion shoppers, a determine which represents a formidable enhance of greater than 30% between mid-2022 and This fall 2024.

Featured picture credit score: edited from freepik

[ad_2]

Source link