[ad_1]

Justin Paget/DigitalVision through Getty Pictures

Introduction

Final 12 months, I began protecting Zoetis Inc. (NYSE:ZTS), the animal health-focused healthcare large.

My most up-to-date article on this inventory was written on January 10, once I went with the title “Animal Kingdom’s Ally: Zoetis And Its Path To 10%+ Returns.”

This is part of my takeaway again then:

Regardless of financial uncertainties, the corporate anticipates continued success in key franchises, projecting double-digit operational progress for the companion animal portfolio.

Quick ahead, the corporate now trades under $200, because it has dropped greater than 24% since my January article.

18% of this decline is market weak point and the continued progress to worth rotation. The remaining 6% are brought on by headlines of probably large opposed results of one in all its key blockbuster medication. That is additionally the principle cause why I am scripting this replace, as numerous readers have requested me if it is a severe threat or a shopping for alternative.

Therefore, on this article, I am going to provide the particulars of the latest decline and clarify what to make of the danger/reward after one of many market’s greatest compounders lately has began to point out vital weak point.

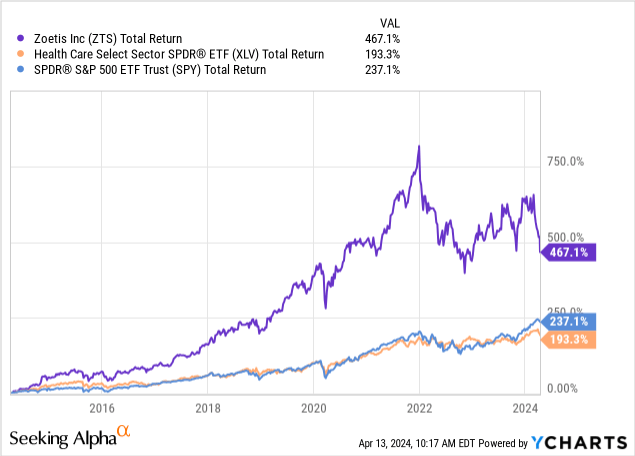

In any case, regardless of the sell-off, ZTS continues to be up near 470% over the previous ten years! That is virtually twice as excessive because the S&P 500’s return.

So, let’s dive into the small print!

Inventory-Breaking Headlines

Earlier than we proceed, I all the time like to say one necessary factor earlier than I talk about potential lawsuits. At no level will I accuse Zoetis of something on this article. I am solely reporting on the details. I present analysis. I am not an activist.

One of many greatest dangers in healthcare is lawsuits.

Since 2019, litigation involving pharmaceutical corporations has accounted for a major share of all lawsuits. The plurality of those circumstances are wide-reaching healthcare product-liability fits involving lots of of plaintiffs. – Legislation Road

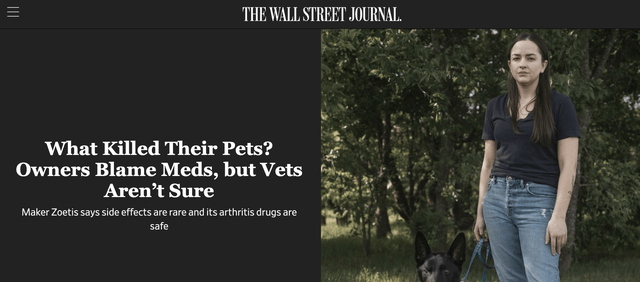

This appears to hit Zoetis as nicely, because the inventory dropped 8% on Friday after The Wall Road Journal printed the headline under:

Wall Road Journal

The article began by sharing the story of Daisy, a 12-year-old rescue canine who struggled with a stiff proper rear hip.

After attempting Zoetis’ new arthritis drug, Librela, the signs turned worse. Ultimately, she needed to be put down attributable to kidney failure.

Based on the article, Librela and related therapies for cats have been the primary antibody medication for pets authorized by the Meals and Drug Administration (“FDA”).

Basically, they promised to alleviate painful arthritis in animals, with Librela being a hopeful drug to probably flip into a brand new franchise drug for Zoetis.

That is what Zoetis mentioned about Librela in its February 14 earnings name:

The launch of Librela and Solensia, the primary two injectable monoclonal antibodies for the alleviation of osteoarthritis, is basically bettering the standard of life for canines and cats, and strengthening the human-animal bond. That is why at the moment Librela stays the primary promoting OA ache product in Europe. – ZTS 4Q23 Earnings Name

Furthermore:

World progress got here primarily from the influence of latest launch markets, bolstered by the This autumn full launch of Librela within the US.

And yet another:

We moved to a full launch of Librela within the US early within the fourth quarter, and we’ve been happy with the outcomes our subject drive has been in a position to drive to this point. Librela posted $44 million in US gross sales within the quarter, which is on the larger finish of our preliminary expectations.

Going again to The Wall Road Journal article, Zoetis reportedly noticed unintended effects in fewer than 1% of the greater than 18 million pictures of each medication that have been administered to date, with each veterinarians and pet house owners having reported success with these medication.

Based on the article:

The FDA obtained greater than 3,800 experiences of unintended effects in regards to the medication by means of the tip of final 12 months. The European Medicines Company has obtained greater than 12,300 experiences of unintended effects involving Librela and greater than 7,700 for Solensia since 2021, when the medication went on sale in Europe. The figures embody experiences from the U.S. and different nations outdoors of the European Union.

In consequence, folks at the moment are beginning petitions to recall Librela for additional testing. No less than one petition has greater than 3,800 signatures.

With all of this in thoughts, I’m not satisfied Zoetis is staring into the abyss right here. It could be the case, however for now, I consider we’d like far more proof to make the case that Zoetis launched a drug that wasn’t prepared.

Librela and Solensia goal a protein referred to as “nerve progress issue,” which permits animals to really feel much less ache.

One cause for these points could possibly be that some veterinarians don’t carry out a whole work-up and examination earlier than administering these medication – in keeping with the WSJ.

In different phrases, the drug will not be proper for all canines and cats. I am not a medical skilled (removed from it, really), however I believe this is smart after having listened to hours of lectures from professionals who wish to individualize healthcare normally.

Dr. Duncan Lascelles, a professor of translational ache analysis and administration at North Carolina State College’s School of Veterinary Drugs who helped Zoetis design Solensia research, recommends prescribing the drug to canines matching the standards used within the trial. The trials didn’t embody canines with neurological situations or lameness unrelated to osteoarthritis. – The Wall Road Journal

Primarily based on all the things I’ve learn to date, I’m not afraid that Librela and Solensia can be banned. Whereas the present development could possibly be very dangerous for short-term enterprise, as some pet house owners could avoid these medication, I consider we may see a extra focused software.

On a facet notice, this jogs my memory of IDEXX Laboratories (IDXX), a inventory I’ve a bullish ranking on. This firm presents diagnostic instruments and providers. It helps veterinarians to get a greater image of an animal’s well being, together with laboratory testing and in-clinic evaluation.

These Zoetis points appear to be very bullish for these options, as they may probably make it a lot simpler to get a greater understanding of which medication must be administered.

I am going to probably cowl IDXX quickly.

Going again to Zoetis, I’d not be stunned if the precise influence on gross sales have been to be much less extreme than some could anticipate proper now.

It additionally helps that its general enterprise stays very strong.

The Core Enterprise Stays Sturdy

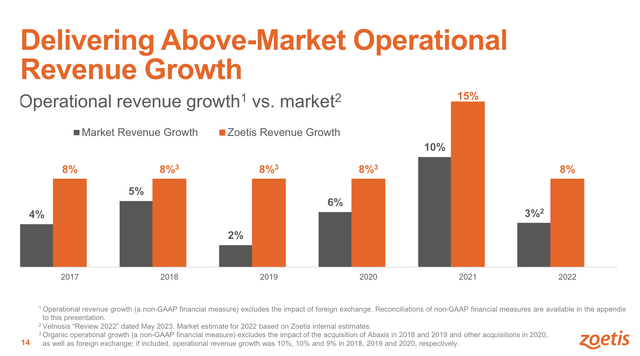

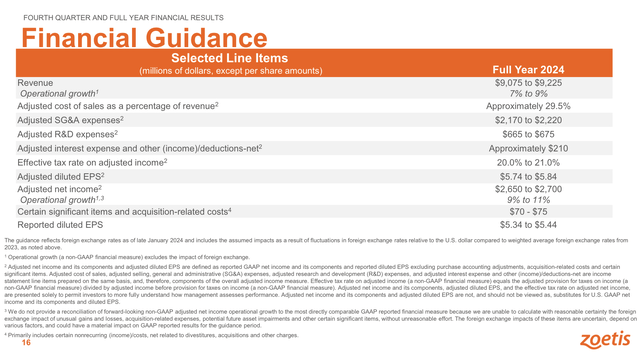

Throughout the Annual World Healthcare Convention from Barclays on March 14, the corporate famous that its steerage expectations of top-line progress are between 7% and 9% on an operational foundation.

These numbers are spectacular, as the corporate has constantly outpaced the market by about 3 factors per 12 months over the previous decade.

The chart under reveals the historic above-market efficiency as offered in its July 2023 investor overview.

Zoetis Inc.

Along with strong top-line progress expectations, Zoetis expects bottom-line progress above top-line progress, with adjusted web revenue steerage of 9% to 11% for 2024.

This implies the corporate expects to additional enhance margins, which permits earnings progress to outperform income progress.

Basically, regardless of making vital investments throughout varied points of the enterprise, together with analysis and improvement, manufacturing, and provide chain, Zoetis stays centered on driving bottom-line progress, which explains why it expects a minimum of 9% adjusted web revenue progress in 2024.

Zoetis Inc.

Sadly, these numbers will probably have to return down. Even when the present arthritis drug difficulty may be contained, I anticipate it to end in considerably lower-than-expected gross sales – a minimum of till the corporate can restore confidence from pet house owners.

Furthermore, whereas the corporate is seeing some headwinds in China, it believes its combine between companion animal and livestock segments supplies resilience in opposition to market fluctuations and allows the corporate to capitalize on varied progress alternatives.

Moreover, ongoing investments in therapeutic areas like renal, cardiology, and oncology could possibly be promising drivers of future progress.

We have now significant life cycle innovation, which tends to be about 50% of our spend in R&D. After we’ve seen an uptick like we have seen lately, it is a bit of bit extra new versus life cycle innovation, I’d say.

[…] we’re more than happy and we’ve a monitor report of efficiency throughout not solely R&D, however how our business groups then take the innovation to develop and develop markets. – Barclays Annual Healthcare Convention

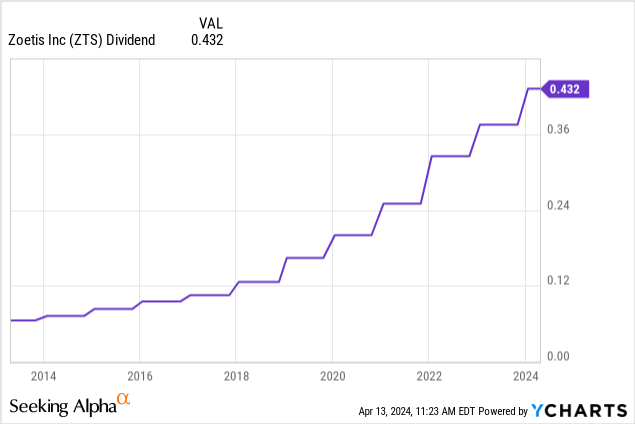

The corporate additionally has a extremely favorable dividend.

Whereas its yield is simply 1.2%, the dividend is protected by a sub-30% payout ratio and comes with a five-year CAGR of 23.5%.

So, what does all of this imply for its valuation?

Valuation

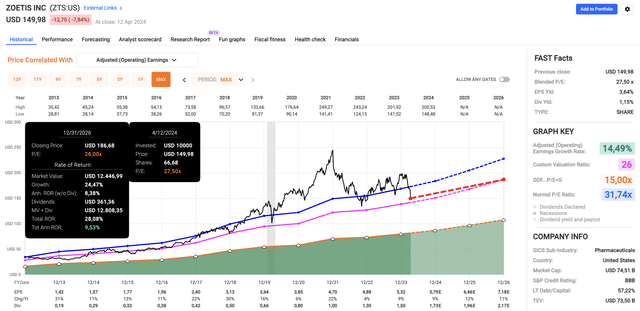

After its crash, ZTS trades at a blended P/E ratio of 27.5x. That is under its normalized P/E ratio of 31.7x. Technically talking, I’d give the corporate a $228 value goal if it have been to develop EPS as anticipated.

Proper now, utilizing the FactSet knowledge within the chart under, the corporate is predicted to develop EPS by 7% this 12 months, probably adopted by 12% and 11% progress in 2025 and 2026, respectively.

FAST Graphs

Nevertheless, I consider we’ve to imagine that the corporate will see slower progress. As I mentioned earlier than, even when the Librera downside seems to be non permanent, I anticipate to see a headwind for gross sales.

Nonetheless, I consider the corporate is buying and selling at a really enticing value, given its long-term progress prospects.

Within the first 5 years after its spin-off from Pfizer (PFE), the corporate traded near 26x earnings. Even when it have been to take care of that valuation, it may return practically 10% per 12 months – theoretically talking.

Therefore, I’ll persist with a Purchase ranking.

That mentioned, traders must be conscious that the inventory may see extra short-term turmoil *if* the Librera difficulty seems to be greater than anticipated.

Though I don’t anticipate that to be the case, we all the time have to deal with these potential lawsuit conditions with excessive care, which implies I’d by no means suggest traders taken with ZTS begin a full place instantly.

Takeaway

Regardless of latest setbacks, Zoetis presents a compelling long-term funding alternative.

Whereas dealing with challenges associated to opposed drug results and market volatility, the corporate’s strong core enterprise and diversified progress methods stay intact.

Traders ought to monitor developments carefully however contemplate the potential for a rebound in gross sales and sustained progress.

With a strong dividend and enticing valuation, Zoetis warrants a cautious however optimistic Purchase ranking.

Professionals & Cons

Professionals:

Sturdy Core Enterprise: Zoetis has a resilient core enterprise with a constant industry-beating efficiency, supported by its give attention to companion animal and livestock segments. Numerous Progress Alternatives: The corporate’s ongoing investments in therapeutic areas like renal, cardiology, and oncology place it for future progress amidst market fluctuations. Enticing Valuation: Regardless of latest challenges, ZTS trades at a compelling value, providing the potential for elevated long-term returns, particularly contemplating its historic valuation and progress trajectory. Dividend Stability: With a sub-30% payout ratio and a five-year CAGR of 23.5%, Zoetis presents a steady dividend, offering extra worth to traders searching for revenue.

Cons:

Quick-Time period Volatility: The inventory could expertise short-term turbulence, notably if considerations relating to opposed drug results persist, probably impacting gross sales and investor sentiment. Regulatory Dangers: Ongoing litigation and regulatory scrutiny, notably surrounding the protection and efficacy of latest medication like Librela, pose regulatory dangers that might negatively influence the corporate’s monetary efficiency.

[ad_2]

Source link