[ad_1]

PM Pictures

It was 4 years in the past when markets had been in absolute freefall. The truth of the pandemic’s influence on humanity was being felt in markets, with world equities falling a number of proportion factors every session. As markets do, a discounting impact came about by late March 2020, nevertheless.

Shares bottomed out regardless of the worst of COVID-19’s human toll being months down the road. In that perspective, it feels trite to research ETF efficiency charts, however individuals’s monetary lives had been additionally at stake again then. Immediately, amid document highs throughout the US inventory market and with international shares notching their finest ranges since April 2022, instances really feel a lot completely different for buyers.

Immediately, I’m revisiting the WisdomTree U.S. Excessive Dividend Fund ETF (NYSEARCA:DHS). I’ve had a purchase score on this issue ETF for a number of quarters, and I assert that sticking with it stays a strong transfer. Regardless of underperformance to the entire US inventory market for the reason that begin of final yr, its valuation and high quality yield are compelling components. I’ll spotlight a bother spot on the chart, although.

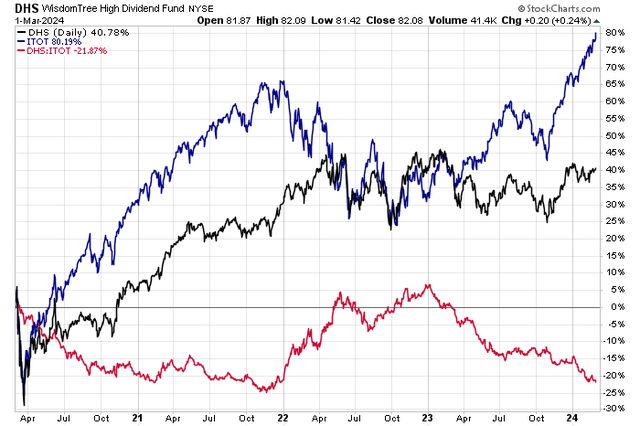

DHS: Weak Relative Returns Since Early 2023 As Mega-Caps Have Shined, Close to Relative Help

Stockcharts.com

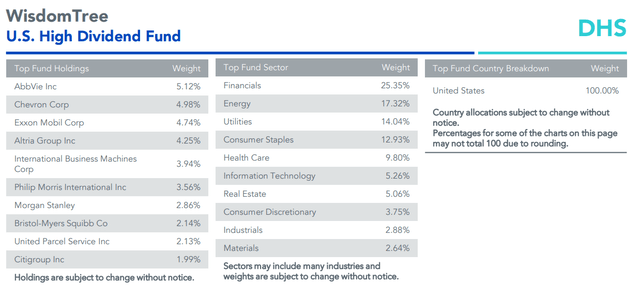

For background and in line with WisdomTree, DHS seeks to trace the funding outcomes of high-dividend-yielding firms within the US fairness market. Buyers can use the ETF to get focused publicity to home shares throughout market cap sizes of high-yield firms. The fund may also be used to switch a price technique to attain demand for each development potential and earnings returns.

DHS is a small fund with simply $1.1 billion in belongings underneath administration as of March 1, 2024. It pays a excessive 4.3% trailing 12-month dividend yield, and the ETF’s annual expense ratio is low to average at 0.38%. Share-price momentum has been lackluster currently, however I make the case that as market sentiment shifts away from strictly favoring mega-caps and towards different measurement profiles, DHS may very well be the high-dividend winner in its class. The danger score is considerably smooth at a C+ by In search of Alpha, however liquidity metrics are wholesome given the ETF’s historic quantity profile and low median 30-day bid/ask unfold of 4 foundation factors.

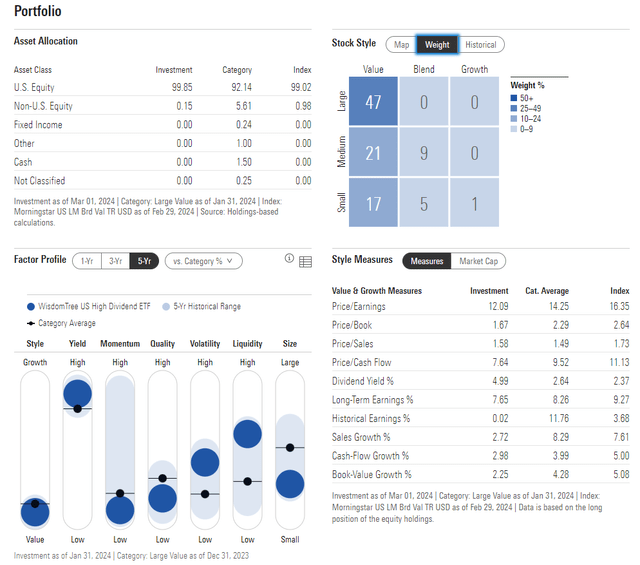

What units DHS other than different home high-dividend ETFs is that the fund has ample SMID-cap publicity. The three-star, bronze-rated portfolio by Morningstar options only a 47% allocation to massive caps, with 30% in US mid-caps and a cloth 23% in small caps.

DHS: Portfolio & Issue Profiles

Morningstar

Given power among the many largest US shares over current months, it has underperformed a few of its high-dividend ETF friends, such because the Vanguard Excessive Dividend Yield ETF (VYM) and the Schwab U.S. Dividend Fairness ETF (SCHD). All three funds, nevertheless, are oriented to the worth type reasonably than development. Ought to a continued broadening out of market efficiency happen as 2024 presses on, then DHS and its friends may very well be engaging locations to allocate capital.

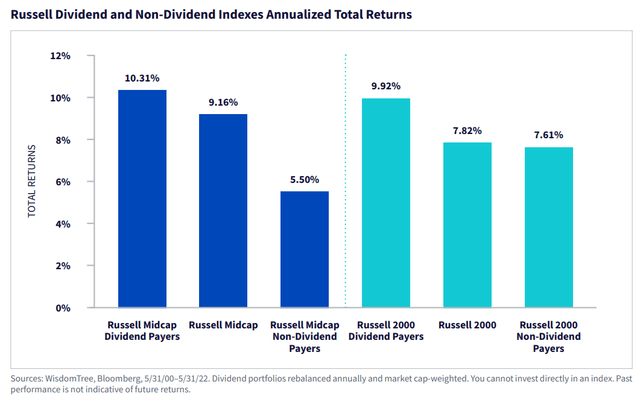

I assert that as participation within the bull market expands, then the once-underperforming SMID-cap area of interest might cleared the path. That will be a boon for DHS, contemplating that its weighted common market cap plots within the mid-cap part of the type field. Mid-cap dividend shares, as illustrated under, have posted robust returns since 2000, outperforming Russell Midcap Non-Dividend payers, per WisdomTree.

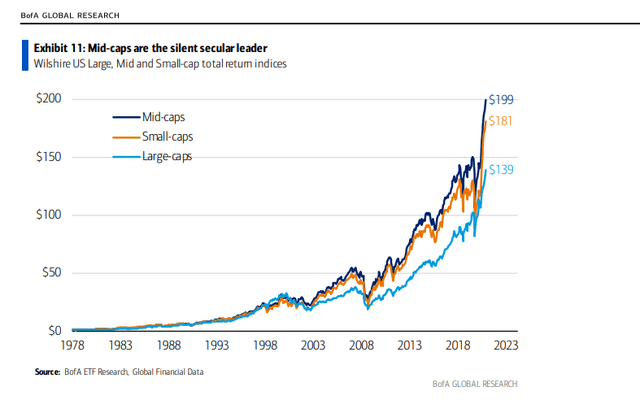

Greater image, mid-caps have produced alpha in comparison with the Russell 2000 Small Cap Index. As I wish to say, buyers ought to cease leaving out the mid-caps – it’s all the time a big vs. small debate on monetary TV when, in line with historical past, mid-caps have outperformed.

Russell Midcap Dividend Payers Shine Since 2000

WisdomTree

Mid-Caps Have Produced the Finest Lengthy-Run Returns

BofA World Analysis

Digging into the portfolio, DHS has a excessive 25% weight within the cyclical Financials sector. With that space of the market breaking out to contemporary highs since early 2022, there’s a case to be made that momentum might persist for worth areas. Furthermore, oil’s transfer towards $80 final week – a four-month excessive – may gain advantage DHS’s excessive 17% Power sector place.

What’s not encouraging is that Utilities has been the worst sector to this point this yr, and DHS has undoubtedly been harm by a virtually 10 proportion level obese to that rate-sensitive space. Tech is simply 5% of DHS, so it is going to transfer materially in another way than the S&P 500 and even different high-dividend funds. In all, DHS trades simply 12.3x ahead earnings as we speak. Distinction that to the S&P 500’s lofty 20+ estimated P/E.

DHS: Financials, Power, Utilities Chubby

WisdomTree

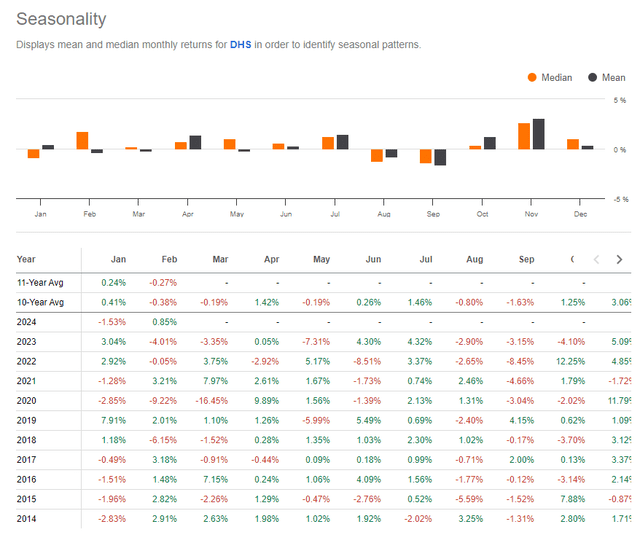

Seasonally, DHS tends to put up combined returns over the approaching months. The March by Could interval has produced about flat returns over the previous 10 years, with the majority of the fund’s whole return not coming till This fall.

DHS: Blended Seasonal Developments by Q2

In search of Alpha

The Technical Take

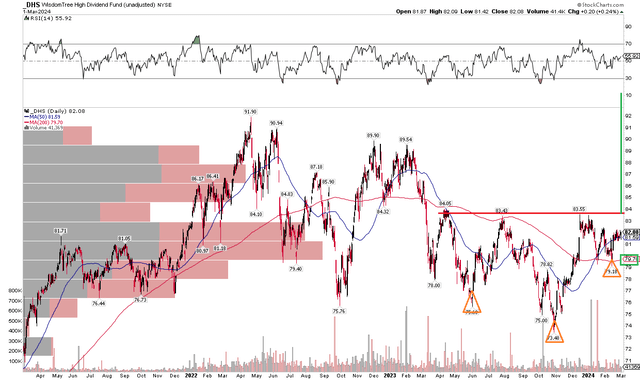

With a low valuation, excessive yield, and as market traits could also be shifting in favor of cyclicals, DHS’s technical chart has its challenges. Discover within the graph under that there is key resistance within the $83 to $84 vary. I want to see the fund breakout above that time of polarity. Ought to it achieve this, then a bullish inverse head and shoulders reversal sample could be triggered. An upside measured transfer value goal to about $94 – an all-time excessive – could be in play primarily based on the peak from the top ($73.48) to the neckline (close to $84), with that vary being added on prime of the neckline.

For now, with a flat 200-day shifting common, the pattern on DHS stays a battle between the bulls and bears. Furthermore, the RSI momentum gauge on the prime of the graph exhibits merely average value power currently. Lastly, with a excessive quantity of quantity by value as much as the $90 spot, a sustained rally is doable, however the onus might be on the bulls to work by vital overhead provide.

General, with vital unfavourable alpha versus the broad market and a few of its high-dividend ETF friends, DHS has its technical troubles.

DHS: Key Resistance Close to $84, Bullish Inverse Head & Shoulders In Play

Stockcharts.com

The Backside Line

I reiterate my purchase score on DHS. Now buying and selling at simply 12 instances ahead earnings estimates and with a portfolio that holds a major quantity of worth and cyclical shares, this fund may very well be place to be allotted as a shift from mega-caps continues.

[ad_2]

Source link