[ad_1]

Focus is on Disney’s earnings report, with shut consideration to subscriber losses attributable to latest value will increase

Regardless of considerations, forward-looking estimates counsel improved EPS and a ten% income increase this quarter

Disney’s inventory touched pandemic lows not too long ago and the earnings report and feedback from administration within the earnings name shall be key for a turnaround

The highlight is on Walt Disney Firm (NYSE:) because the leisure behemoth prepares to unveil its newest quarterly monetary outcomes after right this moment’s market shut.

Within the earlier final August, the Burbank, California-based firm managed to exceed expectations in earnings per share (EPS) however fell barely quick in quarterly income, showcasing a combined efficiency.

DIS’s lackluster efficiency in its broadcasting enterprise has contributed to analysts’ apprehensive outlook for the This autumn monetary outcomes.

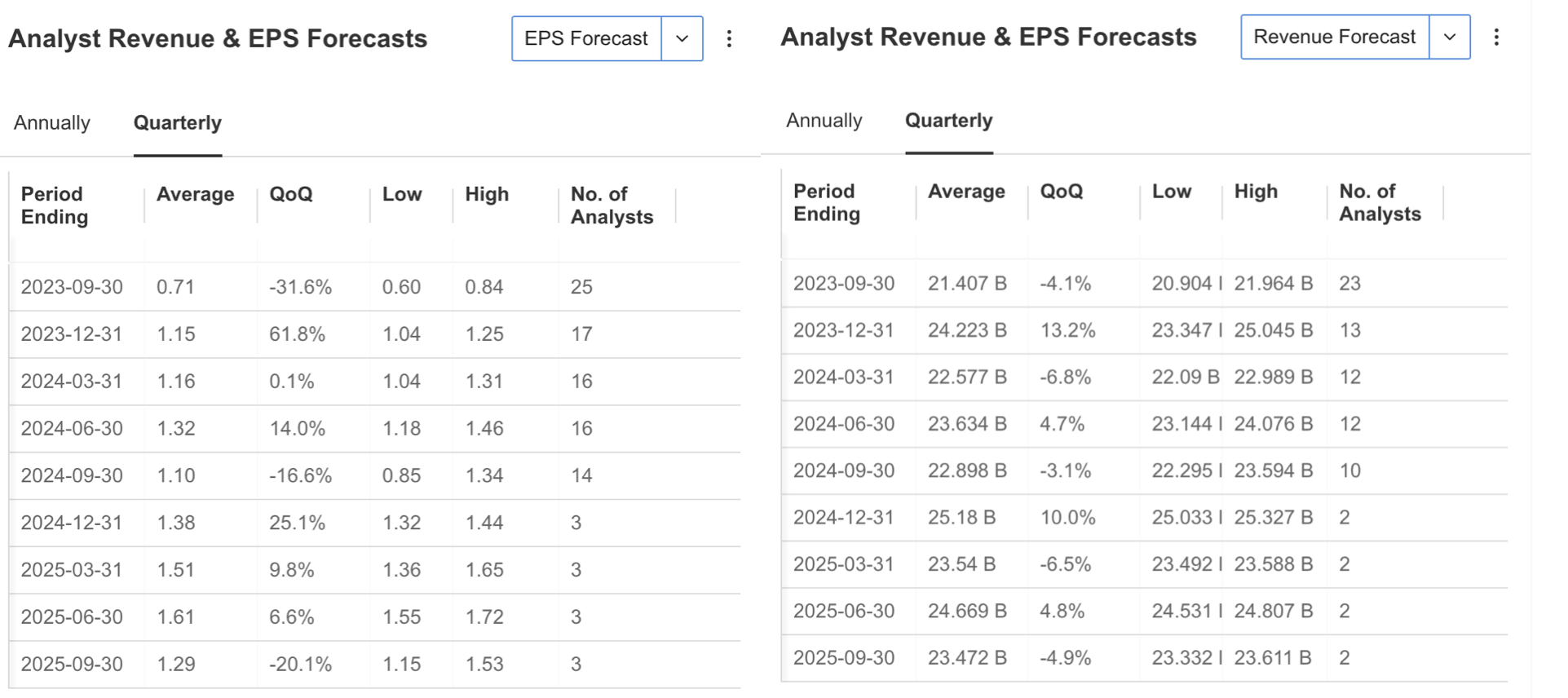

A have a look at the InvestingPro analyst survey reveals that over the previous three months, 14 analysts have downwardly revised their expectations for each EPS and income. In distinction, solely 3 analysts have raised their forecasts.

Supply: InvestingPro

Whereas some analysts current a pessimistic outlook for Disney’s final quarter earnings, it is important to contemplate the present negativity as a probably short-lived section, particularly when specializing in future forecasts. The truth is, there may be an estimate that Disney’s earnings per share (EPS) might improve to round $1 by the top of the 12 months, showcasing an optimistic shift.

Projections additionally point out that income expectations for the present quarter are presently set at $24.2 billion, marking a ten% improve. Notably, the corporate’s sturdy efficiency in worldwide theme parks is cited as a compelling cause for this improved outlook because the 12 months concludes.

Supply: InvestingPro

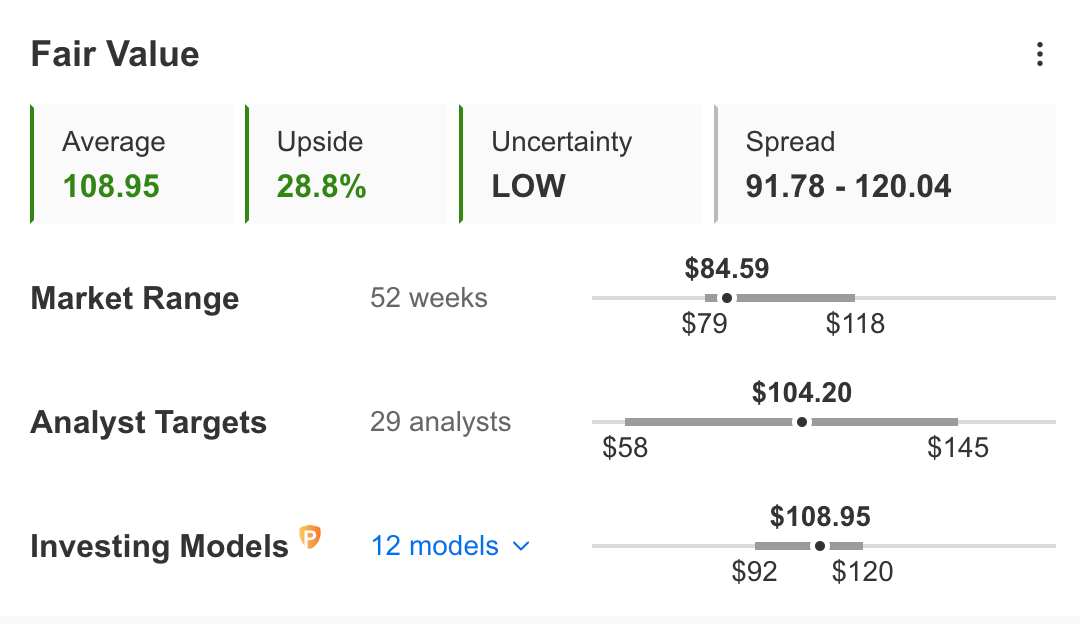

Value forecasts for DIS shares primarily based on a 12-month interval replicate the share’s upside potential of near 30%. Though analysts supply a downward revision for the 4th quarter, they foresee a price improve of near 25% from the present stage over a one-year interval. InvestingPro’s honest worth evaluation additionally calculates that DIS can rise as much as $109 within the quick time period over 12 monetary fashions.

Supply: InvestingPro

Reviewing DIS’s value chart, it is evident that the inventory has been following a downward trajectory since March 2021. Regardless of some transient durations of upward motion early within the 12 months, DIS maintained its total downtrend, reaching a low of $79 in October. Within the lead-up to the earnings report, the inventory has been buying and selling across the $84 vary, reflecting an almost 10% drop for the reason that starting of the 12 months.

Disney’s Potential Subscriber Loss in Focus Following Value Enhance

Within the earnings report back to be introduced right this moment, the variety of subscribers on Disney’s digital platforms will as soon as once more be rigorously monitored. Because the variety of subscribers continued to say no, the corporate determined to extend costs with rival firms to extend income per subscriber. Though that is seen as a revenue-enhancing impact, it additionally creates uncertainty by bringing the danger of accelerating the corporate’s subscriber loss.

Earlier this 12 months, CEO Bob Iger pledged to make Disney’s broadcasting enterprise worthwhile. As well as, whereas the corporate continues to battle in tv networks reminiscent of Disney Channel, ESPN, and ABC, Iger’s efforts to seek out potential strategic traders for ESPN and the choice to purchase the remainder of Hulu’s shares are more likely to be the problems that can stand out within the assertion to be made after the earnings report.

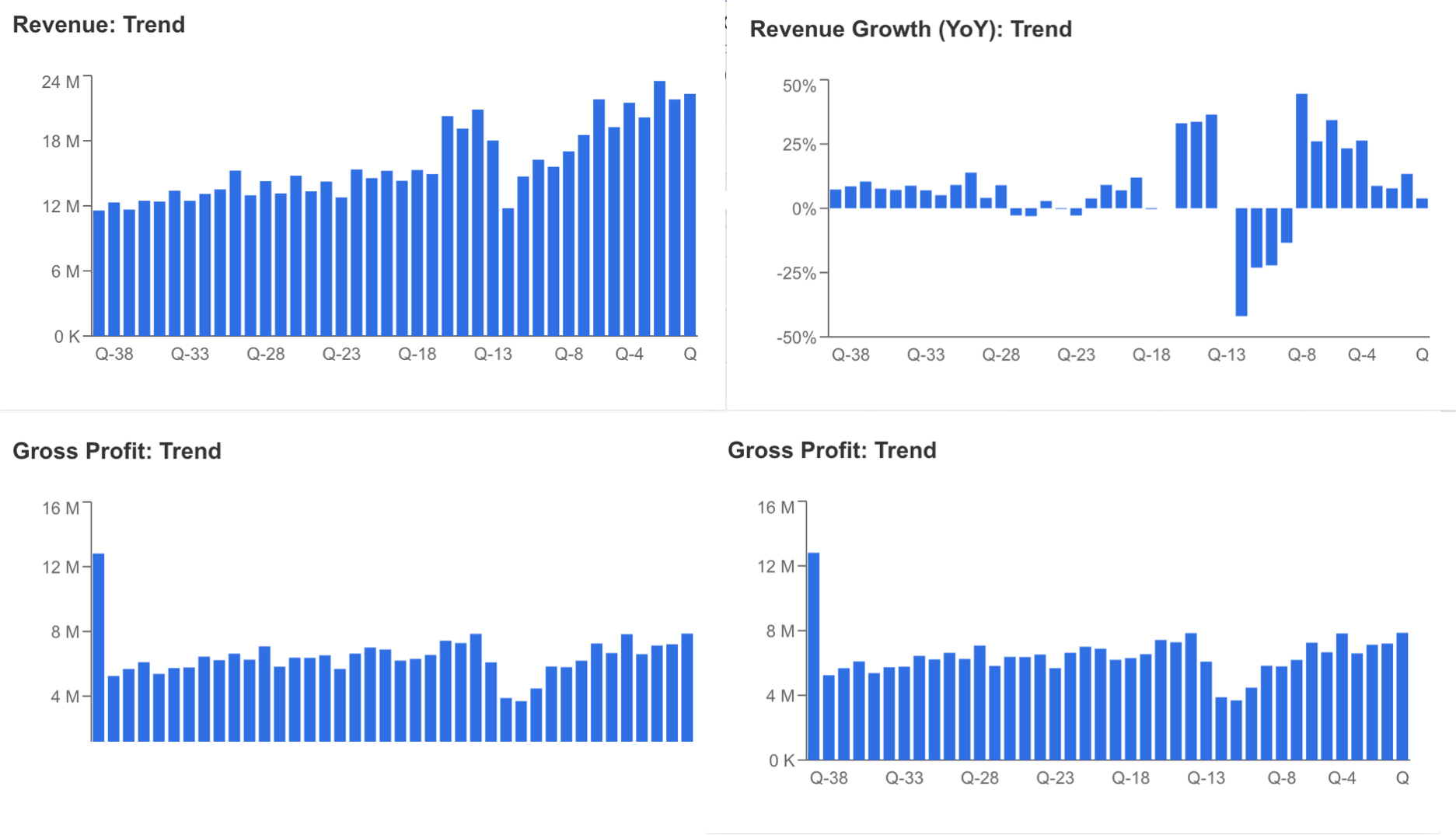

Among the many vital monetary gadgets of Disney earlier than the earnings report, it’s seen that income remained above $20 billion on a quarterly foundation within the final 1-year interval. However, the downward pattern in income development is a warning signal. Whereas the upward pattern in prices continues to suppress gross revenue, the gross revenue margin fluctuates between 30%-35%.

Supply: InvestingPro

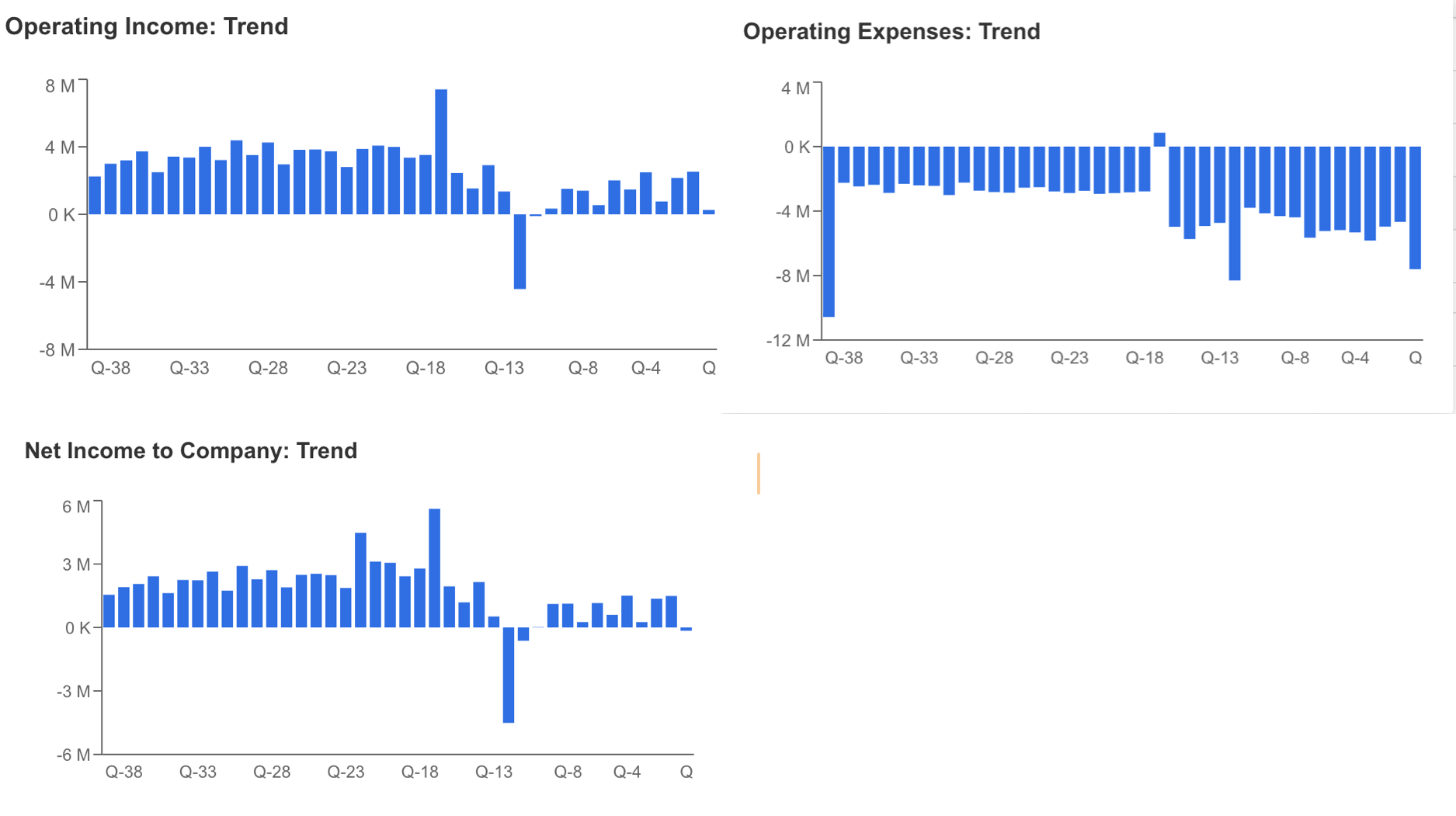

One other unfavorable issue for Disney was the sharp decline in working earnings within the earlier quarter whereas working bills rose. Inside all these negativities, we noticed that internet revenue, which has been low for a very long time, changed into a loss within the final quarter.

Supply: InvestingPro

Summarizing the negatives for the corporate, there are analysts’ unfavorable revision of the earnings report, the latest decline in income development, the persevering with common debt stage, and the excessive value/earnings ratio.

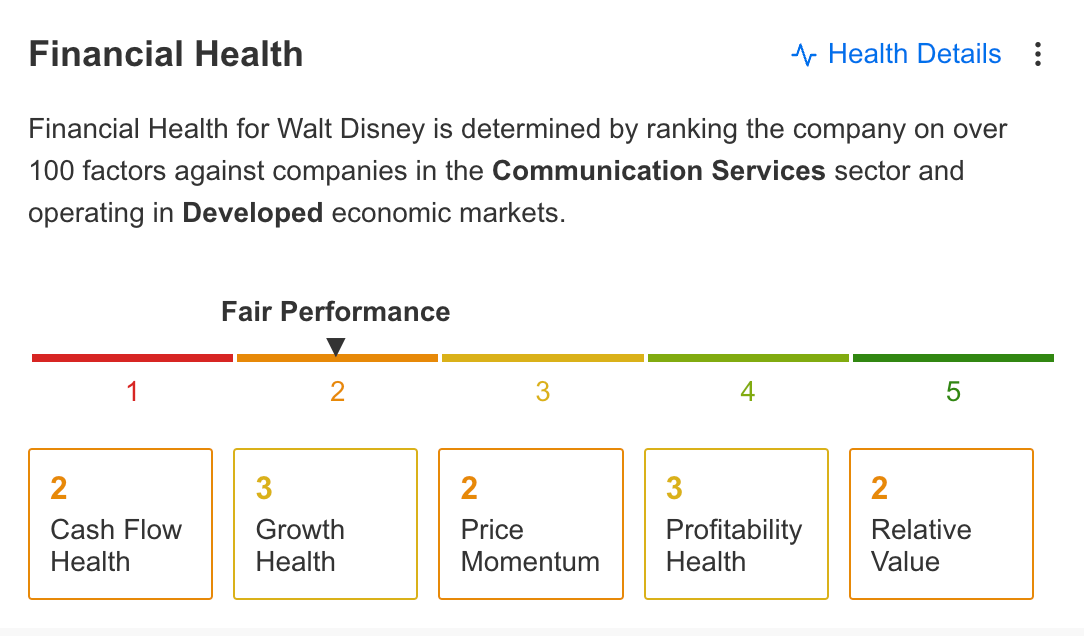

In mild of the newest monetary knowledge, we will see that Disney’s monetary scenario is beneath common.

Supply: InvestingPro

Subsequently, whereas Disney’s shares could presently seem undervalued as they attain historic lows, the corporate’s future stays unsure amid difficult instances. The fierce competitors within the digital realm may not suffice to boost profitability, even with subscription value hikes. Moreover, the best way the corporate’s administration handles asset allocation provides to this uncertainty.

Contemplating these elements, traders may choose to carry off till Disney achieves constant profitability in its broadcasting enterprise and efficiently steers its linear community phase again on observe.

Disney Inventory: Technical Outlook

Final month, the inventory plummeted to $79, marking its lowest stage since March 2020. There have been restricted shopping for makes an attempt from these lower cost ranges, and the inventory’s future stays unsure.

If the statements made after the earnings report handle to persuade traders, reaching a breakthrough to succeed in the $90 vary within the preliminary stage may very well be interpreted as a constructive step in breaking the long-term downtrend.

Subsequently, the importance of weekly closes above the $96 mark turns into essential for a pattern reversal, and it is believable that purchasing exercise could strengthen past this threshold.

Conversely, a surge in promoting strain post-earnings report may exert downward strain round $85, which is the closest resistance stage for DIS shares. In such a state of affairs, the inventory might probably set up new lows beneath the $80 mark.

***

Black Friday Sale – Declare Your Low cost Now!

Disclaimer: The creator doesn’t personal any of those shares. This content material is only for academic functions and can’t be thought of as funding recommendation.

[ad_2]

Source link