[ad_1]

RomoloTavani

After a dismal 2023, Disney (NYSE:DIS) seems to haven’t discovered something from the failures of the previous few years. The media firm has made plenty of noise relating to the Board of Administrators alignment, however the firm seems to haven’t mounted the movie studio. My funding thesis stays Impartial on the inventory, with no obvious adjustments being applied on the media big.

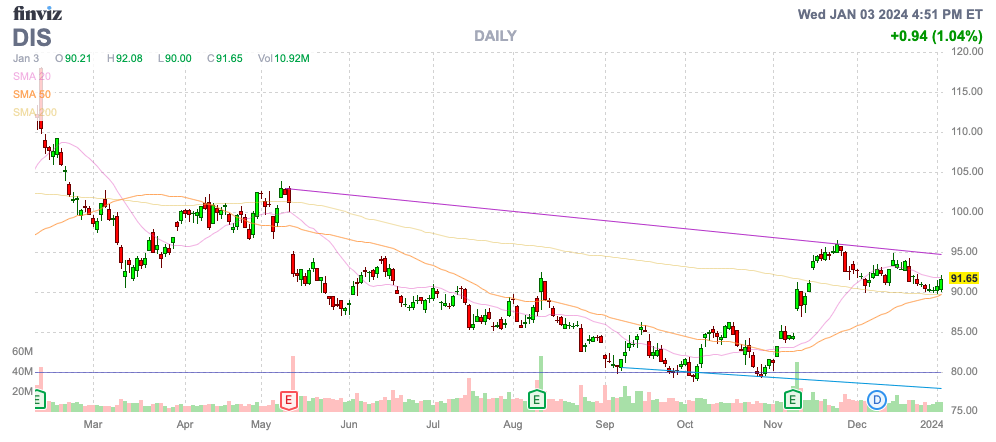

Supply: Finviz

Dismal 2023

Disney had such a foul yr that Common overtook Disney for the highest grossing film studio in 2023. The NBCUniversal (CMCSA) Studio Group edged out Disney with complete world field workplace gross of $4.91 billion, in comparison with an estimate of $4.83 billion for Disney.

Disney has had the highest world grossing field workplace since 2016 and solely misplaced the home field workplace in the course of the 2020 Covid victory by Sony. Common hasn’t ranked No.1 since hauling in $6.9 billion in studio revenues again in 2015.

The information will get even worse with the projections for 2024 not shaping up very properly as a result of Hollywood strikes. The home field workplace topped $9 billion in 2023, however the projections have field workplace gross sales dipping to $8 billion in 2024.

Whereas returning CEO Bob Iger suggests the corporate misplaced focus, new indicators proceed to emerge that Disney is ready to proceed repeating the political points resulting in the field workplace failures of 2023. The brand new Director of the Star Wars franchise acknowledged she needs to perform the next:

We’re in 2024 now, and it’s about time that we had a girl come ahead to form a narrative in a galaxy far, far-off.

The Canadian-Pakistani girl in control of directing the brand new franchise centered on Rey Skywalker seems headed down the trail of operating off film goers solely trying to be entertained. In keeping with information, the Star Wars franchise viewer is shifted in direction of the male viewer. A survey in 2019 confirmed 70% of males are a fan and almost half of ladies aren’t followers.

Disney seems headed down the trail just like the Snow White film just lately delayed till March 2025. Star Rachel Zegler continually promoted the historic idea of the film franchise as flawed and even concerned a “stalker”.

The Marvels just lately scored the weakest opening ever for the Marvel franchise. The film now has barely handed the $205 million mark globally after almost two months in theaters. The Marvel film is ready to be the worst performing film from the franchise since Disney acquired the studio in 2009.

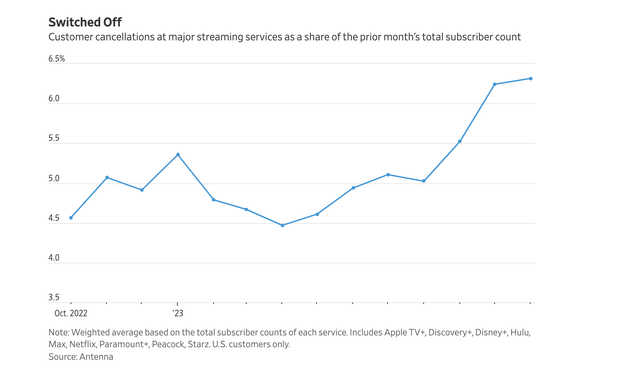

Whereas Disney is having enormous issues on the field workplace, the video streaming market is below main strain. Almost 6.5% of all subscribers now cancel providers on a month-to-month foundation.

Supply: WSJ

The streaming providers satisfied folks to twine reduce with lowball costs and immediately the subscription worth hikes are resulting in a lot increased cancellations. Not surprisingly, video streaming providers have been constructed on courting the cable subscribers in search of higher worth and the big price hikes are pushing extra folks to cancel providers.

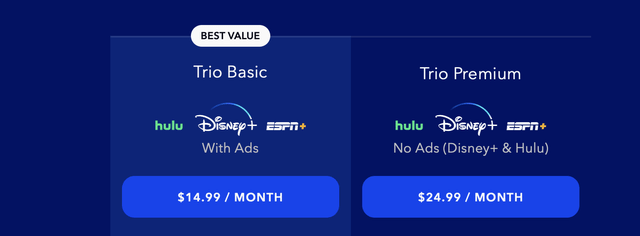

Disney+ now expenses $24.99 for the Hulu/ESPN+ bundle after the service initially began for less than $12.99 in late 2019. The subscription has soared almost 100% in the course of the 4 yr interval and the Disney+ trio is definitely up $2/month with the inclusion of requiring customers to view adverts.

Supply: Disney+

Traders must do not forget that Bathroom Iger was the CEO when Disney+ was launched at $6.99/month worth with no adverts.

Difficult Worth

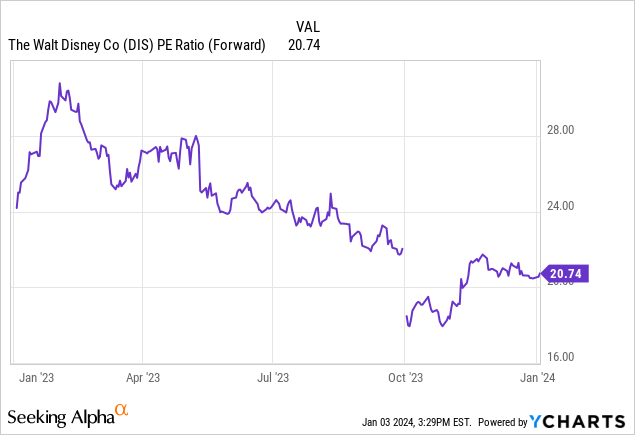

Disney is an advanced funding to personal proper now. The inventory solely trades at 21x ahead EPS targets, however the media firm has to develop earnings by 17% to achieve the analyst goal for FY24.

The corporate has reported 2 consecutive quarters of lacking income targets questioning how Disney is ready to develop earnings so dramatically over the subsequent yr. Nothing in regards to the enterprise course is supportive of the media big turning the quarter exterior of charging aggressively on the Disney+ subscription service to outrun the continuing cancellations.

Disney simply labored out an settlement with activists from ValueAct to help Disney’s slate of board members whereas Blackwells Capital is selling their very own board members, although ones supportive of CEO Bathroom Iger. The Trian Fund, run by Nelson Peltz, remains to be in search of their board members, which stay crucial of Disney.

The corporate would not have so many activists circling the enterprise, if Disney was on the trail to the almost 20% EPS progress charges of the subsequent 3 years. EPS estimates proceed to slip making our view on the inventory Impartial.

Takeaway

The important thing investor takeaway is that Disney nonetheless seems extra centered on the activists circling the enterprise than on fixing the problem impacting studio field workplace gross sales. The corporate requires far an excessive amount of EPS progress throughout 2024 to make the inventory interesting round $90.

[ad_2]

Source link