[ad_1]

kupicoo/E+ through Getty Photos

Distribution Options Group (NASDAQ:DSGR) is a specialty distribution firm. DSGR lately introduced the Q3 FY23 outcomes, and I’ll analyze them on this report. It managed to develop its income when there was a softness in its TestEquity enterprise. To deal with the scenario, it has acquired HISCO, a number one distributor serving the commercial know-how market. Nonetheless, regardless of the strong progress in revenues, I assign a maintain score on DSGR, and I’ll focus on the explanations for my maintain score.

Monetary Evaluation

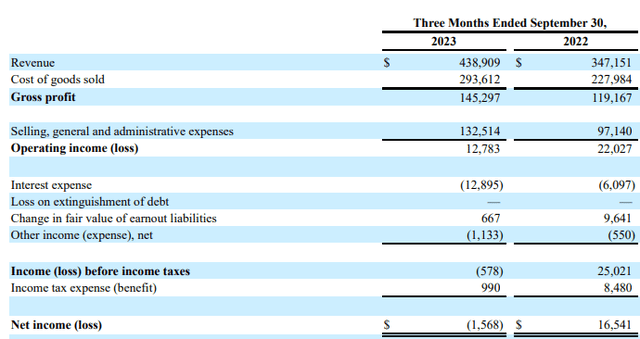

DSGR lately introduced Q3 FY23 outcomes. The income for Q3 FY23 was $438.9 million, an increase of 26.4% in comparison with Q3 FY22. The foremost cause for the rise was revenues from the acquisitions and elevated revenues in its Lawson phase. The acquisitions contributed $106.3 million in income, and the income from the Lawson phase grew by 4.6% in Q3 FY23 in comparison with Q3 FY22. The foremost cause for the Lawson phase’s income improve was a strong efficiency in its authorities navy and Kent automotive enterprise. Its adjusted EBITDA margin was unchanged in Q3 FY23 in comparison with Q3 FY22. The EBITDA margin in Q3 FY23 was 10%.

Searching for Alpha

The web loss for Q3 FY23 was $1.5 million in comparison with a web earnings of $16.5 million. The acquisition and merger-related prices, that are non-recurring, affected its profitability. The natural income in Q3 FY23 was down by 4.2% in comparison with Q3 FY22. Nonetheless, the corporate managed to develop its revenues by making aggressive acquisitions. Nonetheless, at present, there’s a softness within the know-how finish market, particularly within the capital gear and check and measurement gear market. This softness can hamper its income progress within the coming quarters, however to deal with this example, it has lately acquired HISCO, which is likely one of the main distributors that serves the commercial know-how market. Though the HISCO acquisition is sort of new, will probably be fascinating to see how the mixing goes.

Technical Evaluation

TradingView

DSGR is buying and selling at $26.8. In October, it gave a breakout above the $30.5 degree, which was additionally its all-time excessive again then. However quickly after giving the breakout, the inventory reversed, proving to be the basic case of a breakout lure. After the breakout, the inventory began to reverse, and it shortly went beneath $25. I imagine investing in DSGR proper now won’t be a good suggestion as a result of there are at present too many resistance ranges like $28, $30, and $32, which the inventory worth may face. So, investing on the present degree may get your cash caught for a very long time with none returns. So, I feel creating any contemporary shopping for place on this inventory won’t be rewarding. Therefore, I assign a maintain score on DSGR.

Ought to One Make investments In DSGR?

One of many main methods to spice up their income progress is acquisitions, and they’re proving useful for them in occasions of softness available in the market. It will likely be fascinating to see how its HISCO acquisition seems as a result of there’s a softness within the industrial know-how market, which could hamper its progress within the coming quarters, and if the mixing is profitable, then the corporate may be capable to negate the softness concern within the industrial know-how market to some extent. Now, its valuation. DSGR is buying and selling at a non-GAAP P/E [FWD] ratio of 33x, which is above its five-year common of 21.73x. So, the market has rewarded DSGR with a excessive valuation, and I imagine the excessive progress that it has proven lately throughout not the very best market situations was spectacular. When an organization exhibits excessive progress, the market typically rewards it with excessive valuation. However regardless of the excessive progress that it has proven, I feel now shouldn’t be the suitable time to spend money on it, and there are some causes behind it. First, the softness within the industrial know-how market may hamper its progress within the coming quarters, and the acquisition of HISCO is new, so it’d take a while to execute the operations that the corporate has deliberate efficiently. The second cause is the technical chart of DSGR. Its technical chart doesn’t present any alternative. As a substitute, the chart means that it’s higher to keep away from it. Therefore, I imagine one ought to watch for a while and let the market situations enhance. Therefore, I assign a maintain score on DSGR.

Threat

1) The Firm’s web working loss carryforwards as of December 31, 2022, had been $24.2 million from the federal authorities of the US, which can expire in 2026, and $28.7 million from numerous states, which can expire at completely different occasions between 2023 and 2034. As a result of Mergers, DSG might have fewer choices for utilizing its web working losses and different tax attributes created earlier than the Mergers. This may need a unfavourable impact on their money movement and future tax burden.

2) For a large portion of its product stock, together with digital check and measurement gear, TestEquity relies on a single supply. The full quantity of product stock that TestEquity bought from that provider in 2022 and 2021 was roughly 25% and 41% of the full quantity of product stock that TestEquity bought from all of its suppliers throughout these years. Any alterations to the provider’s operations, monetary standing, or enterprise might considerably negatively impression TestEquity’s operations, monetary standing, and operational outcomes.

Backside Line

Their acquisition technique is paying off throughout occasions when there may be softness available in the market. DSGR has been buying and selling over the historic averages, which I imagine is as a result of excessive progress they’ve proven. Nonetheless, I assign a maintain score on DSGR as there’s a softness within the industrial know-how market, and its technical chart exhibits that the inventory worth is perhaps caught in a spread.

[ad_2]

Source link