[ad_1]

Up to date on February twenty ninth, 2024

Every year, we publish an in-depth have a look at every of the Dividend Aristocrats, an unique record of shares within the S&P 500 Index with 25+ years of consecutive dividend will increase. There are simply 68 Dividend Aristocrats in your entire S&P 500 Index, indicating issue in reaching 25 consecutive annual dividend will increase.

To hitch the Dividend Aristocrats record, an organization should have aggressive benefits and the power to extend its dividend annually, even throughout recessions. Consequently, Dividend Aristocrats are a wonderful supply of dividend progress shares.

With this in thoughts, we created a listing of all 68 Dividend Aristocrats, with vital metrics corresponding to dividend yields and price-to-earnings ratios. You may see the complete record of all 68 Dividend Aristocrats by clicking on the hyperlink beneath:

Disclaimer: Positive Dividend shouldn’t be affiliated with S&P World in any manner. S&P World owns and maintains The Dividend Aristocrats Index. The knowledge on this article and downloadable spreadsheet is predicated on Positive Dividend’s personal evaluation, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person traders higher perceive this ETF and the index upon which it’s primarily based. Not one of the info on this article or spreadsheet is official knowledge from S&P World. Seek the advice of S&P World for official info.

Up subsequent in our annual Dividend Aristocrats In Focus collection is S&P World Inc. (SPGI).

S&P World has a really spectacular dividend observe document. It has paid a dividend yearly since 1937 and has raised its dividend for 51 years in a row.

This text will look carefully at S&P World and what makes it such a high-quality dividend progress inventory.

Enterprise Overview

S&P World traces its roots again to 1917 when McGraw Publishing Firm and the Hill Publishing Firm got here collectively. The corporate was first named McGraw Hill Monetary. In 1957, McGraw Hill launched the S&P 500, probably the most widely-recognized index of all large-cap U.S. shares.

S&P World affords monetary companies to the worldwide capital and commodity markets, together with credit score scores, benchmarks, analytics, and knowledge. It derives income from 4 working segments: Rankings, Market Intelligence, Platt’s, and S&P Dow Jones Indices. S&P World has a extremely worthwhile enterprise mannequin. It’s the trade chief in credit score scores and inventory market indexes, offering high-profit margins and progress alternatives.

S&P World has a really robust enterprise mannequin. At the moment, the S&P 500 is arguably the world’s most widely-known inventory market index.

S&P World advantages from a powerful secular pattern, particularly the steadily rising quantity of world debt. This pattern has markedly accelerated within the final three years, as practically all of the international locations have issued unprecedented quantities of debt in response to the pandemic.

As well as, quite a few corporations have come beneath strain, and thus they’ve issued considerable quantities of debt. This can be a robust tailwind for the enterprise of S&P World, which has loved a steep improve in its variety of debt scores.

The energy of the enterprise mannequin of S&P World has been on full show in recent times.

Progress Prospects

S&P World has exhibited a formidable efficiency document. It had grown its earnings per share yearly for greater than a decade, apart from 2022, when the corporate took a breather resulting from blowout earnings in earlier years.

The distinctive progress price mixed with the constant efficiency are testaments to the energy of the enterprise mannequin of S&P World and its dependable progress trajectory.

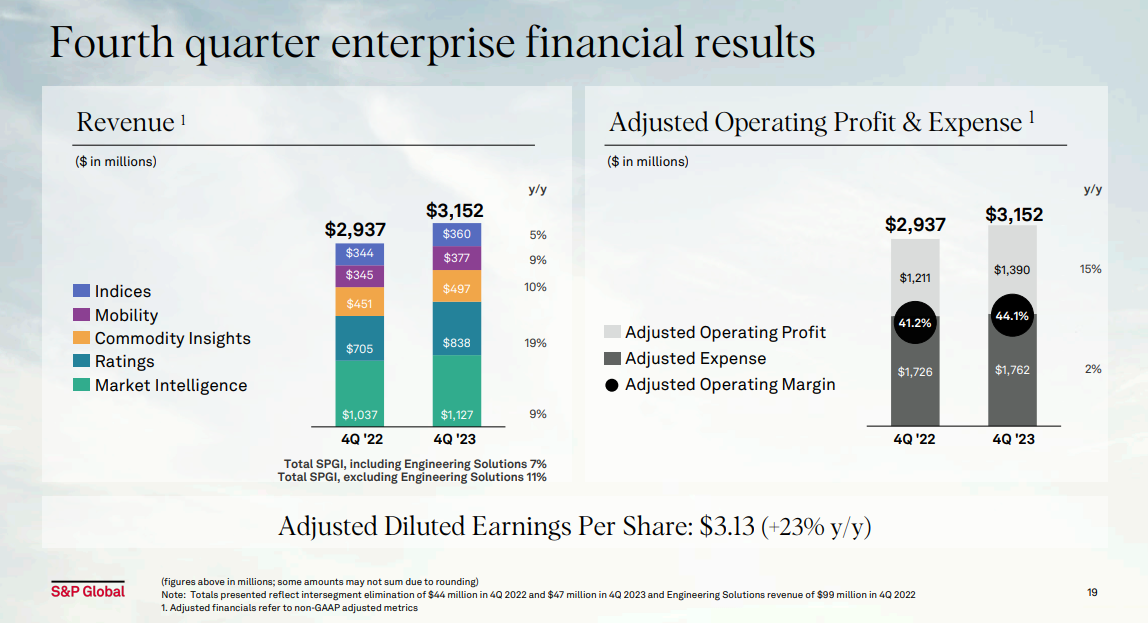

S&P posted fourth quarter and full-year earnings on February eighth, 2024. Adjusted earnings-per-share for the fourth quarter got here to $3.13, which missed by a penny. Earnings rose from $2.54 per share within the year-ago interval.

Supply: Investor Presentation

Income was up 7% year-over-year to $3.15 billion, beating estimates by $20 million. Market Intelligence income was $1.13 billion, up from $1.04 billion a yr in the past. Rankings income rose from $705 million to $838 million. Commodity Insights income was $497 million, up from $451 million.

Mobility income rose from $345 million to $377 million. Indices income was $360 million, up from $344 million a yr in the past. Adjusted working revenue was $1.39 billion, down from $1.47 billion in Q3, however up sharply year-over-year from $1.21 billion.

Steering was barely weaker than analysts had anticipated, sending the inventory decrease after the report. Nonetheless, we begin 2024 with an estimate of $14.00 in earnings-per-share, which might be a document if achieved.

Aggressive Benefits & Recession Efficiency

S&P World enjoys a number of aggressive benefits. First, it operates in a extremely concentrated trade. It’s certainly one of solely three main credit standing businesses within the U.S., together with Moody’s (MCO) and Fitch Rankings.

Put collectively, these three corporations management over 90% of the worldwide monetary debt score trade, with S&P World on prime. Furthermore, there are excessive boundaries to entry on this trade. Particularly, changing into an accepted score company would require an excessive amount of belief from the monetary trade and authorities that’s arduous to construct rapidly, if in any respect.

Purchasers pay S&P World hefty sums for funding analysis, as S&P World has constructed a powerful repute over its many many years of enterprise. These aggressive benefits helped the corporate stay constantly worthwhile all through the Nice Recession:

2007 earnings-per-share of $2.94

2008 earnings-per-share of $2.51 (15% decline)

2009 earnings-per-share of $2.33 (7% decline)

2010 earnings-per-share of $2.65 (14% improve)

S&P World’s earnings declined in 2008 and 2009, as traders ought to anticipate throughout recessions. A world recession will naturally end in decrease demand for monetary companies as traders exit the markets. With that stated, S&P World rapidly bounced again after the recession ended. By 2011, earnings-per-share had hit a brand new post-recession excessive.

Valuation & Anticipated Returns

Based mostly on the anticipated earnings per share of $14 for 2024, the inventory has a price-to-earnings ratio of 30.8. S&P World’s 5-year common price-to-earnings ratio is 29.1, so we’re assuming a good price-to-earnings ratio of 29 instances given the sustained, excellent efficiency the corporate has produced.

If shares have been to retreat to a price-to-earnings ratio of 29 over the following 5 years, traders would see a discount in annual returns of 1.2%. The inventory additionally has a present dividend yield of 0.8%. The dividend is very safe, with a payout ratio of solely 26%.

A possible bull-case breakdown of future returns is as follows:

11% earnings-per-share progress

0.8% dividend yield

-1.2% valuation headwind

On this situation, S&P World will generate a complete return of 10.6% per yr by way of 2029. This qualifies the inventory as a purchase in our view.

Because of its distinctive efficiency document and its constant efficiency, S&P World has virtually all the time traded with a premium valuation.

Remaining Ideas

S&P World is a powerful enterprise with an extended progress runway forward. There’ll all the time be a necessity for monetary score companies whereas future progress potential is robust in new areas as nicely, corresponding to knowledge and monetary know-how. S&P World will speed up its progress in these segments through acquisitions.

The dividend yield of 0.8% won’t be enticing to revenue traders, because it trails the S&P 500 present yield of 1.6%, however dividend progress traders ought to view the inventory extra favorably.

S&P World receives a purchase suggestion on the present worth.

Moreover, the next Positive Dividend databases comprise probably the most dependable dividend growers in our funding universe:

In the event you’re in search of shares with distinctive dividend traits, contemplate the next Positive Dividend databases:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.

[ad_2]

Source link