[ad_1]

Up to date on March twenty first, 2024 by Bob Ciura

Investing in high-quality dividend development shares can result in excellent long-term returns. Buyers searching for dividend revenue and sustainable development ought to begin with the Dividend Aristocrats, an unique group of firms which have raised their dividends for 25+ consecutive years.

With this in thoughts, we created a full listing of all 68 Dividend Aristocrats and important monetary metrics like dividend yields and price-to-earnings ratios.

You’ll be able to obtain an Excel spreadsheet with the total listing of Dividend Aristocrats through the use of the hyperlink beneath:

Disclaimer: Positive Dividend is just not affiliated with S&P International in any method. S&P International owns and maintains The Dividend Aristocrats Index. The data on this article and downloadable spreadsheet is predicated on Positive Dividend’s personal evaluation, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person traders higher perceive this ETF and the index upon which it’s primarily based. Not one of the info on this article or spreadsheet is official knowledge from S&P International. Seek the advice of S&P International for official info.

There are solely 68 Dividend Aristocrats. This text will evaluation diversified industrial producer Stanley Black & Decker (SWK).

Stanley Black & Decker has an incredible observe report of dividend funds. The corporate has paid dividends for 147 years and has elevated its dividend yearly for 56 consecutive years. Right now, the corporate’s dividend seems secure relative to its underlying fundamentals.

This text will focus on the qualities which have made Stanley Black & Decker a time-tested dividend development inventory.

Enterprise Overview

Stanley Black & Decker is the results of Stanley Works’ $3.5 billion acquisition of Black & Decker in 2009. Stanley Works and Black & Decker had been each named after their respective founders. Stanley Works was shaped in 1843 when Frederick Stanley began a small store in New Britain, Connecticut, the place he manufactured bolts, hinges, and different {hardware}. His merchandise developed a popularity for his or her high quality.

In the meantime, Black & Decker was began by Duncan Black and Alonzo Decker in 1910. Like Stanley, they opened a small {hardware} store. In 1916, they obtained a patent to fabricate the world’s first moveable energy device.

Over the subsequent 175 years, Stanley Black & Decker has steadily grown into one of many world’s largest industrial product producers.

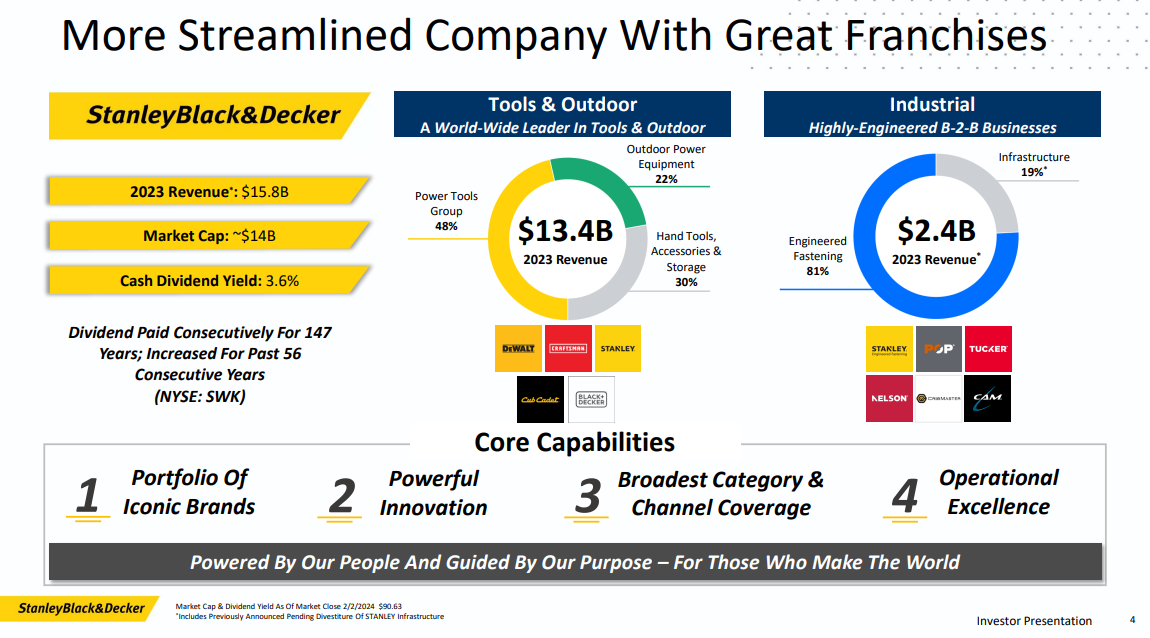

Supply: Investor Presentation

Its principal merchandise embrace hand instruments, energy instruments, and associated equipment. It additionally produces digital safety options, healthcare options, engineered fastening methods, and extra.

The corporate has annual gross sales of greater than $15 billion. It operates three enterprise segments: Instruments & Storage, Safety, and Industrial merchandise.

The corporate has produced glorious development charges lately primarily resulting from an aggressive acquisition technique.

Progress Prospects

On February 1st, 2024, Stanley Black & Decker introduced fourth quarter and full 12 months outcomes for the interval ending December thirty first, 2023. For the quarter, income declined 6.3% to $3.7 billion, which was $104 million beneath estimates. Adjusted earnings-per-share of $0.92 in contrast favorably to -$0.10 within the prior 12 months and was $0.14 higher than anticipated. For 2023, income fell 6.5% to $15.8 billion whereas adjusted earnings-per-share was $1.45.

Firm-wide natural development declined 7%. Natural gross sales for Instruments & Out of doors, the biggest phase throughout the firm, decreased 8% resulting from continued weak spot in client out of doors and DIY classes. North America was decrease by 10% whereas Europe and Rising Markets had been each down by 1%. U.S. level of gross sales stay increased in comparison with 2019 ranges.

The Industrial phase decreased 4%, as features in Engineered Fastening had been greater than offset by weaker Infrastructure outcomes. Adjusted gross margin expanded 220 foundation factors to 29.8% resulting from price controls and decrease stock destocking.

On a sequential foundation, the adjusted working margin improved 180 foundation factors. The corporate’s price discount program stays on observe to ship $2 billion in pre-tax financial savings by 2025. Stanley Black & Decker has achieved $1.1 billion of price financial savings since beginning this system. Stock was decreased by $1.1 billion in This fall in comparison with the prior 12 months.

Acquisitions have helped form Stanley Black & Decker’s product portfolio. For instance, in 2017, Stanley Black & Decker closed on the $1.95 billion acquisition of the Instruments enterprise of Newell Manufacturers (NWL). This acquisition strengthened the corporate’s foothold in instruments and added the high-quality Irwin and Lennox manufacturers to the product portfolio.

Aggressive Benefits & Recession Efficiency

Stanley Black & Decker’s principal aggressive benefits are its model portfolio and international scale. Innovation and scalability are on the core of the corporate’s development technique. It has a management place in its three product classes, and its model power provides the corporate pricing energy, resulting in high-profit margins.

Moreover, it’s comparatively straightforward for the corporate to scale up its manufacturers, because of distribution efficiencies.

To retain these aggressive benefits, Stanley Black & Decker always invests in product innovation. That stated, Stanley Black & Decker is just not immune from recessions. Earnings declined considerably in 2008 and 2009. As an industrial producer, Stanley Black & Decker is reliant on a robust financial system and a financially-healthy client.

Stanley Black & Decker’s earnings-per-share in the course of the Nice Recession are beneath:

2007 earnings-per-share of $4.00

2008 earnings-per-share of $3.41 (15% decline)

2009 earnings-per-share of $2.72 (20% decline)

2010 earnings-per-share of $3.96 (46% enhance)

Regardless of the steep decline in earnings from 2007-2009, Stanley Black & Decker recovered simply as rapidly. Earnings-per-share elevated one other 32% in 2011 and reached a brand new excessive. Earnings have continued to develop within the years since.

Valuation & Anticipated Returns

Utilizing the present share worth of ~$96 and anticipated earnings-per-share for 2024 of ~$4.00, Stanley Black & Decker has a price-to-earnings ratio of 24. That is increased than the long-term common valuation of 12.

Stanley Black & Decker inventory seems to be overvalued, provided that its price-to-earnings ratio is increased than its historic norm, which can also be our truthful worth estimate for the inventory. If the inventory’s valuation had been to compress to satisfy its historic common by 2029, traders would expertise a -12.9% headwind to annualized whole returns over this time.

Going ahead, returns will, subsequently, doubtless be comprised of earnings development, dividends, and valuation a number of compression. As a result of natural development and acquisitions, we really feel that an anticipated EPS development charge of 8% per 12 months is sustainable.

The inventory has a present dividend yield of three.5%. Based mostly on this, whole returns would attain roughly -1.4% per 12 months, consisting of earnings development, dividends, and valuation a number of compression. This can be a damaging anticipated charge of return, which means Stanley Black & Decker inventory has a promote advice.

Closing Ideas

Stanley Black & Decker is just not a high-yield inventory, but it surely has all the qualities of a robust dividend development inventory. It has a prime place in its trade, sturdy money stream, and sturdy aggressive benefits.

The corporate’s constructive development outlook bodes effectively for the dividend. The inventory seems overvalued at present. Moreover, Stanley Black & Decker will very doubtless proceed to hike its dividend every year for the foreseeable future.

For the reason that inventory is predicted to provide damaging annualized whole returns over the subsequent 5 years, Stanley Black & Decker inventory stays a promote for long-term dividend development traders.

Moreover, the next Positive Dividend databases include probably the most dependable dividend growers in our funding universe:

In the event you’re searching for shares with distinctive dividend traits, think about the next Positive Dividend databases:

The key home inventory market indices are one other strong useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.

[ad_2]

Source link