[ad_1]

Eric Francis

I believe {that a} life correctly lived is simply study, study, study on a regular basis.

–Charlie Munger, 2017 Berkshire Hathaway Annual Assembly

To stay is to study, and investing is solely an act of utilized studying.

That’s maybe the first precept I’ve gained from brushing up on the wit and knowledge of Charlie Munger these previous few days.

However there’s a extra elementary lesson I’ve garnered from finding out Munger’s life, and that’s this:

Discover what you like to do and by no means cease doing it.

Munger cherished studying. To him, the world was an countless provide of truths ready to be found.

It’s a must to continue learning if you wish to turn into an amazing investor. When the world adjustments, it’s essential to change.

Probably the most fascinating a part of it’s the approach all these truths work together and overlap to type an infinitely advanced system. Understanding the interactions and relationships inside this method gave Munger an edge in investing.

Whenever you perceive solely a set of info, it is like solely understanding fundamental arithmetic.

However if you perceive how all these info coalesce and reply to one another into an unceasing movement of reactions and cycles, it is like going from linear arithmetic to exponential algebra.

1 + 1 + 1 = 10, or 100, or 1,000

And but, regardless of Munger’s capability to grasp the countless complexity of the world, his fundamental ideas for achievement in investing and life had been fairly easy. He had a novel approach of distilling all of life’s problems into easy, pithy aphorisms that might make even probably the most curmudgeonly amongst us crack a smile.

Munger by no means stopped deliberately studying, which stored his thoughts sharp even nicely into his 90s. His final tv interview was filmed simply weeks earlier than his passing.

I believe there’s an extremely precious lesson we will all study from this, regardless of our age. We have in all probability all heard the well-known quote from Mark Twain: “Discover a job you like to do, and you’ll by no means should work a day once more in your life.”

So many individuals financially and psychologically construction their lives to make retirement the head, the golden years of happiness and leisure. And but, for thus many, once they arrive at this vacation spot, they discover that after a short interval of elation, the sensation of freedom and happiness proves elusive. The job, the child-rearing, the fabric accumulation that had beforehand supplied a driving sense of objective and which means in life have disappeared, changed with nothing.

After which the “golden years” of retirement give approach to a creeping boredom, listlessness, and lethargy.

Munger supplies an instance of the preventive treatment for this unlucky sample. In reality, I believe he exhibits us two parts of a life nicely lived:

Lifelong companionship Lifelong studying

Munger did take pleasure in companionship from marriage. He was married twice. After his first spouse handed away, he remarried, however his second spouse handed away ultimately as nicely. Slightly than a romantic accomplice, his longest operating companion in life was his enterprise accomplice, Warren Buffett.

Munger demonstrates the large, exponential worth of discovering and investing in a companion for all times, letting nothing erode that companionship, not even politics. Munger was a Republican, whereas Buffett is a Democrat, and but they had been the perfect of pals. Buffett as soon as stated that they by no means had an argument, regardless of many disagreements.

The second factor of a life nicely lived is, as mentioned above, lifelong studying.

Munger discovered what he cherished to do and he by no means stopped doing it. He by no means stopped being fascinated with the world and making an attempt to grasp it higher.

In my entire life, I’ve identified no clever folks (over a broad material space) who didn’t learn on a regular basis — none, zero. You’d be amazed at how a lot Warren reads — and at how a lot I learn. My youngsters snigger at me. They suppose I’m a e-book with a few legs protruding.

–Poor Charlie’s Almanack

If Munger had merely determined to cease deliberately studying in some unspecified time in the future, maybe when his wealth reached the psychologically essential benchmark of $1 billion, would he have lived to the age of 99 and been capable of give an interview simply weeks earlier than his dying?

Most likely not.

This is not mere conjecture. There was analysis finished on this. In line with a latest research titled “The Longevity Dividend,” a everlasting behavior of studying is a vital a part of wholesome growing old and a profit to society extra broadly.

Lifelong studying stimulates wholesome growing old, rising the energetic years in longer lives thus rising the variety of years throughout which individuals could make productive contributions leading to extra life satisfaction for people and better prosperity for society.

Think about the unimaginable quantity of wit and knowledge the world would lack if Munger determined to cease studying and easily “take pleasure in retirement” after he turned 65!

This, for my part, is the foremost lesson that traders can study from Munger.

By no means cease studying. By no means cease in search of knowledge. By no means enable your self to really feel that you’ve “finished sufficient” and might cease all significant work, as a result of you’ll find yourself robbing the world and your self of the worth you can contribute.

Lifelong studying and lifelong companionship, to the diploma we will attain them, pay dividends — tangibly and intangibly.

That, above all, is the best takeaway of Munger’s life for dividend traders.

However there’s a lot extra to be stated, after all, about easy methods to apply Munger’s wit and knowledge to dividend investing.

Listed here are a couple of factors.

1. Discover Your Costco

Munger first invested within the warehouse membership retailer Costco (COST) within the Nineteen Nineties and joined its board of administrators in 1997. He known as himself a “whole addict” of Costco and swore he would by no means promote a share (which he did not).

I want every thing else in America was working in addition to Costco does. Assume what a blessing that may be for us all.

–2022 Day by day Journal Annual Assembly

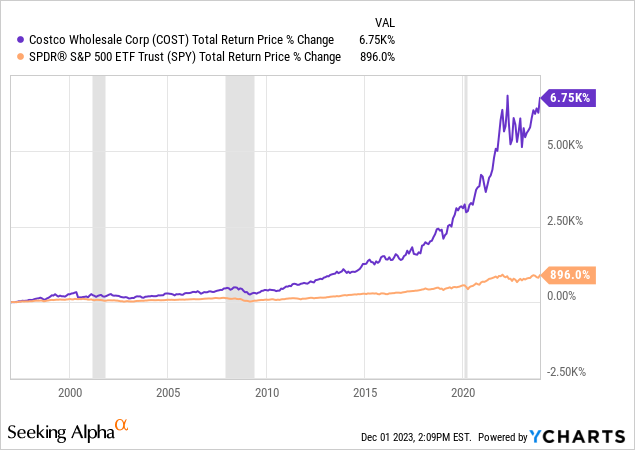

Since becoming a member of the board in 1997, Costco has massively outperformed the market on each a worth and whole return foundation.

The corporate did so whereas additionally rising its dividend for the final 19 consecutive years at a double-digit common annual tempo.

Munger owned about $110 million in Costco shares on the time of his dying, representing rather less than 5% of his $2.6 billion web price. He was the second largest particular person shareholder, behind solely the outgoing CEO Craig Jelinek.

Munger had large conviction and confidence in Costco, largely as a result of the corporate’s enterprise mannequin and worth proposition for purchasers is so dependable and repeatable. Munger really was a “buy-and-hold endlessly” investor in Costco.

Dividend traders can study from this.

Hunt down corporations that present irresistible worth propositions for his or her clients (the less complicated the higher), study every thing you possibly can about them, develop a deep conviction, and by no means promote your shares.

Slightly than “trim your flowers” (to borrow the phrase of one other well-known investing quipster, Peter Lynch) by promoting your winners, harvest the fruit by gathering the dividends. Assume much less about whole returns than the diploma to which your dividend earnings from these investments has grown.

Discover your Costco, and keep it up endlessly.

2. Do not Make investments In Particular person Shares For Diversification

Billionaires have a tendency to not like the concept of diversification. Mark Cuban as soon as stated, “Diversification is for idiots.” And Buffett as soon as stated that diversification is “safety in opposition to ignorance.”

Munger’s pondering intently echoes this sentiment:

One of many inane issues taught in trendy college training is {that a} huge diversification is totally necessary in investing in widespread shares. That’s an insane concept. It isn’t that straightforward to have an unlimited plethora of excellent alternatives which can be simply recognized. And for those who’ve solely acquired three, I would moderately or not it’s my greatest concepts as an alternative of my worst. And now, some folks cannot inform their greatest concepts from their worst, and within the act of deciding an funding already is nice, they get to suppose it is higher than it’s. I believe we make fewer errors like that than different folks. And that may be a blessing to us.

–2023 Berkshire Hathaway Annual Assembly

Munger additionally stated as soon as that it’s a lot simpler to seek out 5 above-average investments than it’s to seek out 100. Even for diligent, lifelong learners, just about nobody can develop deep comprehension and conviction about 100 corporations!

However, after all, Buffett additionally advocated most traders merely purchase the S&P 500 (SPY) and keep away from particular person inventory possession. Why? As a result of most individuals haven’t got the time, curiosity, or endurance to seek out even 5 above-average corporations to purchase and maintain for the long term. And most of the people undoubtedly haven’t got the power to profitably commerce out and in of shares!

If I is perhaps so daring as to change Munger’s knowledge right here, I might say that for many traders, there’s worth in diversification.

However traders completely shouldn’t search diversification by shopping for particular person shares, as a result of we aren’t and cannot be consultants in each sector and trade and enterprise. Particular person shares needs to be purchased based mostly on bottom-up evaluation and particular conviction, not due to what trade or sector they belong to.

For instance, it is a unhealthy concept to suppose, “My portfolio has no industrial corporations. I ought to discover a couple of industrials to purchase,” then spend quarter-hour choosing out some industrials shares and clicking the “purchase” button.

(No judgement. I’m responsible of this myself.)

Put money into particular person shares if and solely if you’re assured that it is an above-average enterprise that ought to flip in above-average efficiency sooner or later.

For diversification, flip to low-cost, well-constructed, passive ETFs. That’s as true for dividend traders as for anyone else.

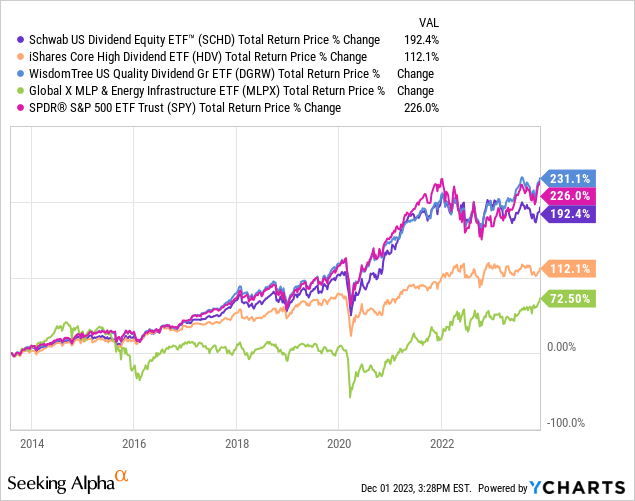

My very own portfolio is closely concentrated in actual property funding trusts (“REITs”), as a result of my background is in actual property and that’s the trade/enterprise mannequin I perceive greatest. So, to diversify away from my tilt towards business actual property, I personal a number of high-quality dividend ETFs:

The Schwab U.S. Dividend Fairness ETF (SCHD) iShares Core Excessive Dividend ETF (HDV) WisdomTree High quality U.S. Dividend Development ETF (DGRW) World X MLP & Midstream Infrastructure ETF (MLPX)

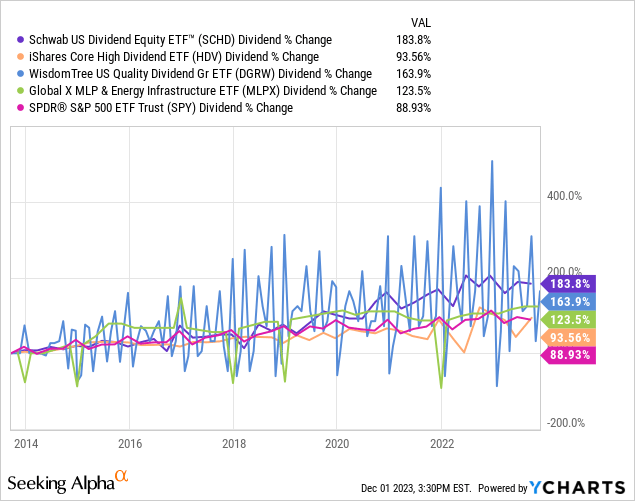

All 4 of those ETFs pay rising dividends and have little or no overlap with my REIT-heavy particular person inventory portfolio. Their collective actual property publicity is just about nil.

Just one — DGRW — has crushed the market during the last decade in whole returns…

…however all of them have crushed the market in dividend development.

And so they have finished so whereas every providing greater dividend yields than the SPY!

For a dividend development investor like me, these 4 ETFs are offering precisely what I would like them to: swiftly rising dividend earnings and diversification.

Go deep with particular person shares. Go extensive with ETFs or funds.

Backside Line

Munger gave traders many extra quips and items of knowledge to chew on. There isn’t any approach I might probably cowl all of them, no less than not in addition to they might be lined. However from the previous survey, traders can garner a handful of precious insights:

Decide to being a lifelong learner, each for your self and for the world. Put money into your relationships and search to domesticate no less than one lifelong companionship. Discover that small variety of corporations about which you may have deep conviction, purchase their shares, and by no means promote. Do not look to particular person shares for diversification.

I am certain there are lots of extra Munger ideas which can be relevant to traders broadly and dividend traders particularly. This temporary record should suffice for now, however for those who consider extra, please go away a remark!

For extra articles on this “Dividend Investing Like…” sequence, take a look at:

[ad_2]

Source link