[ad_1]

Printed by Bob Ciura on November 14th, 2023

The Dividend Kings are an illustrious group of firms. These firms stand aside from the overwhelming majority of the market as they’ve raised dividends for at the very least 50 consecutive years.

We consider that traders ought to view the Dividend Kings as essentially the most high-quality dividend development shares to purchase for the long run.

With this in thoughts, we created a full checklist of all of the Dividend Kings. You’ll be able to obtain the complete checklist, together with vital monetary metrics corresponding to dividend yields and price-to-earnings ratios, by clicking the hyperlink under:

This group is so unique that there are simply 53 firms that qualify as a Dividend King. Fortis Inc. (FTS) lately elevated its dividend for the fiftieth consecutive 12 months, becoming a member of the checklist of Dividend Kings.

This text will talk about the corporate’s enterprise overview, development prospects, aggressive benefits, and anticipated returns.

Enterprise Overview

Fortis is Canada’s largest investor-owned utility enterprise with operations in Canada, america, and the Caribbean. It’s cross-listed in Toronto and New York. Fortis trades with a present after-tax yield of three.7% (about 4.3% earlier than the 15% withholding tax utilized by the Canadian authorities). Until in any other case famous, US$ is used on this analysis report.

On the finish of 2022, Fortis had 99% regulated property: 82% regulated electrical and 17% regulated gasoline. As effectively, 64% have been within the U.S., 33% in Canada, and three% within the Caribbean.

Supply: Investor Presentation

Fortis reported Q3 2023 outcomes on 10/27/23. For the quarter, it reported adjusted web earnings of CAD$411 million, up 20.5% versus Q3 2022, whereas adjusted earnings-per-share (EPS) rose 18.3% to CAD$0.84. The corporate famous that the rise mirrored “the brand new price of capital parameters authorized for the FortisBC utilities in September 2023 retroactive to January 1 2023.”

It additionally benefited from larger retail income in Arizona because of hotter climate and new buyer charges at Tucson Electrical Energy, efficient September 1, 2023, in addition to fee base development throughout its utilities. “A better U.S.-to-Canadian greenback international change fee and better earnings at Aitken Creek, reflecting market situations, additionally favorably impacted earnings.” Notably, Fortis raised its quarterly dividend by 4.4% to CAD$0.59 per share in September.

The year-to-date (YTD) outcomes present a much bigger image. On this interval, the adjusted web earnings climbed 17.3% to CAD$1,152 million, whereas adjusted EPS rose 15% to CAD$2.37. The corporate’s YTD capital investments have been CAD$3.0 billion, and it’s on observe to make C$4.3 billion of capital investments this 12 months. We elevate our 2023 EPS estimate to $2.22.

Progress Prospects

Utility firms are usually labeled as sluggish, however regular growers. Certainly, we count on Fortis to develop its earnings-per-share by 5.5% yearly over the subsequent 5 years. This development will likely be pushed by a number of elements.

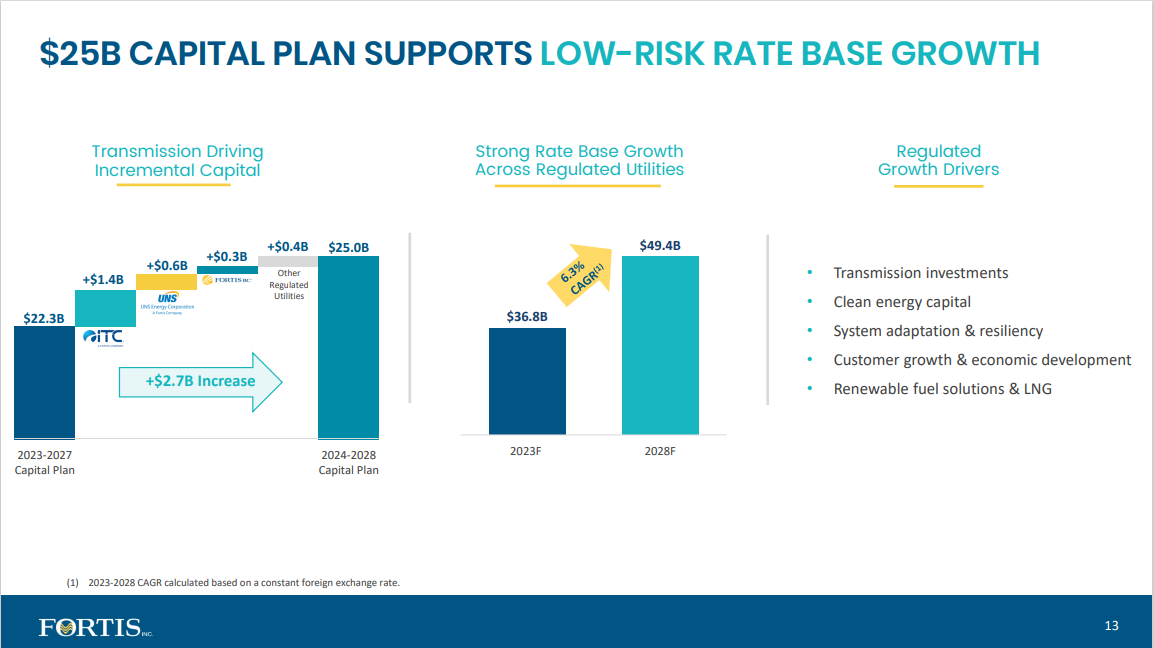

After releasing its five-year capital plan of CAD$25 billion for 2024 to 2028, which suggests a mid-year fee base development at a compound annual development fee of ~6.3% from C$36.8 billion in 2023 to C$49.4 billion in 2027, the corporate additionally maintained its dividend development steerage of 4-6% by way of 2028.

Supply: Investor Presentation

The capital plan consists of investing in areas, corresponding to a greener and improved grid and a shift from fossil gas to photo voltaic and wind era. Importantly, this development fee is earlier than the influence of acquisitions, which have traditionally beenimportant for Fortis.

Aggressive Benefits & Recession Efficiency

Utility firms typically profit from a number of benefits. The primary is that they normally function in a near-monopoly on the areas that they service.

As a result of demand for Fortis’s utility providers doesn’t change a lot in varied financial environments, Fortis’s outcomes have been fairly resilient by way of financial uncertainties, together with the one we’re experiencing during which inflation and rates of interest are larger than latest historical past.

As well as, Fortis is exclusive due to its cross-border publicity. Its well timed U.S. acquisitions of regulated utilities since 2013 have allowed Fortis to now generate greater than half of its income from that nation.

Given these built-in benefits, many utilities typically outperform different sectors of the market throughout recessions. Beneath are the corporate’s earnings-per-share outcomes throughout, and after, the Nice Recession:

2007 earnings-per-share: $1.32

2008 earnings-per-share: $1.52 (15% improve)

2009 earnings-per-share: $1.51 (~1% lower)

2010 earnings-per-share: $1.81 (20% improve)

The corporate grew its diluted earnings-per-share in 2008, adopted by only a minor decline in 2009, which was the worst of the recession. Fortis then shortly rebounded with 20% earnings development in 2010.

Valuation & Anticipated Whole Returns

We count on Fortis to generate earnings-per-share of US$2.22 for 2023. On the present share worth, FTS inventory trades for a price-to-earnings ratio of 18.5.

Given the corporate’s steady enterprise mannequin, we consider truthful worth is nineteen occasions earnings, which is near the common valuation of the inventory for the final 5 years. Reverting to our goal valuation by 2028 would end in a a number of enlargement, boosting annual returns by 0.5%. As well as, we count on annual EPS development of 5.5% which can even contribute to shareholder returns.

Lastly, dividends will increase returns as FTS inventory at present yields 4.1%.

Supply: Investor Presentation

FTS has now elevated its dividend for 50 consecutive years. Fortis’ payout ratio has historically been about 70% of earnings. The dividend is vital to administration, and we consider it’s protected and will proceed to rise for years to return.

Subsequently, FTS is predicted to return 10.1% yearly by way of 2028. An anticipated return above 10% qualifies FTS inventory as a purchase.

Remaining Ideas

There’s a lot to love about Fortis, corresponding to its recession-proof enterprise mannequin, the excessive success of fee improve approvals, and the lengthy historical past of dividend development. Solely essentially the most well-run companies pays dividends for so long as Fortis has.

Shares of Fortis seem fairly valued. The corporate ought to proceed to develop earnings, and consequently its dividends, for a few years. With an anticipated return above 10%, the inventory is a purchase.

The next articles comprise shares with very lengthy dividend or company histories, ripe for choice for dividend development traders:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.

[ad_2]

Source link