[ad_1]

Up to date on November eighth, 2023

The Dividend Kings are a selective group of shares which have elevated their dividends for no less than 50 years in a row. We imagine the Dividend Kings are among the many highest-quality dividend development shares to purchase and maintain for the long run.

With this in thoughts, we created a full checklist of all of the Dividend Kings.

You may obtain the total checklist, together with vital monetary metrics comparable to dividend yields and price-to-earnings ratios, by clicking the hyperlink under:

A comparatively new member to affix this checklist is Nucor Company (NUE), an American metal large that has efficiently navigated the numerous cyclicality and international competitors going through the trade over time with a view to constantly develop its dividend and create worth for shareholders.

This text will focus on the corporate’s enterprise overview, development prospects, aggressive benefits, and anticipated returns.

Enterprise Overview

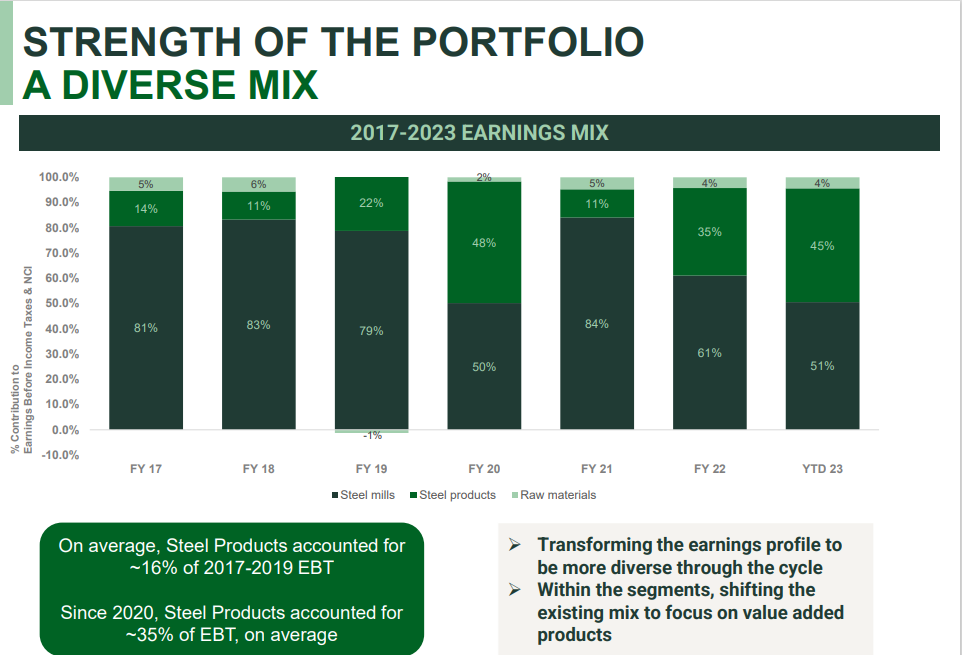

Nucor is headquartered in Charlotte, North Carolina and is a big within the metal trade as the most important publicly traded US-based metal company based mostly on its market capitalization. The corporate presently operates in three segments: Metal Mills (the most important section by income), Metal Merchandise, and Uncooked Supplies.

The metal trade is notoriously cyclical, which makes Nucor’s streak of fifty consecutive years of dividend will increase much more outstanding. The corporate faces challenges from worldwide opponents. Some nations (together with China), subsidize their metal trade, making metal exported to the US artificially low-cost.

Nucor manufactures all kinds of fabric sorts, together with sheet metal, metal bars, structural formations, metal plates, downstream merchandise, and uncooked supplies. Nearly all of the corporate’s manufacturing comes from a mixture of sheet and bar metal, as has been the case for a few years.

Supply: Investor Presentation

Nucor has been profitable over the long-term attributable to its concentrate on low-cost manufacturing. This enables it to take care of profitability throughout downturns and produce vital working leverage throughout higher instances. As well as, it has labored to develop its product choices to new markets whereas sustaining and rising its market management in current channels.

On October 23, 2023, Nucor Company launched its third-quarter earnings report for 2023. The report revealed consolidated web earnings attributable to Nucor stockholders of $1.14 billion, or $4.57 per diluted share. This marked a lower from earnings of $1.46 billion in Q2 2023 and $1.69 billion or $6.50 per diluted share in Q3 2022.

The consolidated web gross sales decreased by 8% to $8.78 billion in Q3 2023 in comparison with $9.52 billion in Q2 2023. The corporate additionally repurchased roughly 3.0 million shares of its widespread inventory at a median value of $168.99 per share throughout Q3 2023.

Progress Prospects

We imagine that Nucor’s earnings-per-share are prone to decline by 6.5% per 12 months over the subsequent 5 years. Nucor’s earnings-per-share fluctuate with metal costs. The corporate’s earlier all-time earnings-per-share excessive got here in2008, which coincided with the all-time excessive value of metal within the US. The components driving the big earnings of 2021 and 2022 are merely unsustainable.

For the long-term, Nucor’s markets have a largely favorable development outlook. Nucor’s diversification by way of finish markets additionally presents some relative stability when downturns strike. This helps the corporate carry out properly in comparison with different metal makers throughout recessions.

Nucor can also be investing in development initiatives that embrace harvesting new income synergies, enhancing operational and provide chain efficiencies, and increasing the companies’ product choices and geographic footprint.

Aggressive Benefits & Recession Efficiency

Nucor is a producer and distributor of metal, which – just like the overwhelming majority of uncooked supplies companies – is essentially a commodity product and due to this fact topic nearly fully to cost as its sole differentiator.

Warren Buffett has the next to say about commodity companies:

“Shares of corporations promoting commodity-like merchandise ought to include a warning label: ‘Competitors could show hazardous to human wealth.’” – Warren Buffett

Definitely, commodity companies usually are not probably the most defensive companies due to their cyclicality. This may be seen by taking a look at Nucor’s efficiency throughout the 2007-2009 monetary disaster:

2007 adjusted earnings-per-share: $4.98

2008 adjusted earnings-per-share: $6.01

2009 adjusted earnings-per-share: web lack of ($0.94)

2010 adjusted earnings-per-share: $0.42

2011 adjusted earnings-per-share: $2.45

As a commodity producer, Nucor is weak to fluctuations within the value of metal. Metal demand is tied to development and the general financial system. In the course of the Nice Recession, the corporate noticed earnings-per-share decline from $6.01 in 2008 to a lack of $0.94 in 2009, and the inventory misplaced two-thirds of its market capitalization in simply six months. Buyers ought to pay attention to the numerous draw back threat of Nucor as it’s prone to carry out poorly in a protracted recession.

Valuation & Anticipated Whole Returns

We assume a normalized earnings power-per-share of $13.26 for 2023, to easy out the cyclicality of outcomes. That places the price-to-earnings energy ratio at 11.6, which is barely under our honest worth estimate of 12.0. For metal producers we stay extra cautious than the final market, in no small half as a result of volatility of commodity costs.

Because of our modeling assumptions, Nucor is barely undervalued at this time. An increasing valuation a number of may increase annual returns by 0.7% over the subsequent 5 years.

As well as, NUE inventory has a present dividend yield of 1.3%. Lastly, we count on NUE’s earnings-per-share to say no by 6.5% per yer. Because of this, whole returns are anticipated to be detrimental. This implies NUE inventory is presently rated a promote.

Last Ideas

Nucor’s standing as a Dividend King helps it to face out among the many extremely unstable supplies sector. There are only a few uncooked supplies companies which have multi-decade monitor information of compounding their dividends and adjusted earnings-per-share.

Nucor has a low dividend yield when in comparison with the broader inventory market, however the firm has an extended historical past of annual dividend will increase. Nucor additionally has a powerful trade place and a wholesome steadiness sheet.

Nonetheless, the inventory doesn’t benefit a purchase suggestion on the present value given its detrimental anticipated returns. For traders which can be searching for uncooked supplies publicity, we advocate ready for a greater alternative to accumulate shares of Nucor.

The next articles comprise shares with very lengthy dividend or company histories, ripe for choice for dividend development traders:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.

[ad_2]

Source link