[ad_1]

Up to date on November ninth, 2023

The Dividend Kings are a selective group of shares which have elevated their dividends for not less than 50 years in a row. We imagine the Dividend Kings are among the many highest-quality dividend progress shares to purchase and maintain for the long run.

With this in thoughts, we created a full checklist of all of the Dividend Kings. You’ll be able to obtain the complete checklist, together with vital monetary metrics equivalent to dividend yields and price-to-earnings ratios, by clicking the hyperlink beneath:

One of many latest members to affix this checklist is S&P International (SPGI). S&P International, like all Dividend Kings, has a really spectacular dividend monitor file. It has paid a dividend yearly since 1937 and has raised its dividend for 50 years in a row.

This text will talk about the corporate’s enterprise overview, progress prospects, aggressive benefits, and anticipated returns.

Enterprise Overview

S&P International is a worldwide supplier of monetary companies and enterprise data. The corporate traces its roots again to 1917 when McGraw Publishing Firm and the Hill Publishing Firm got here collectively. The corporate was first named McGraw Hill Monetary. In 1957, McGraw Hill launched the S&P 500, essentially the most widely-recognized index of all large-cap U.S. shares.

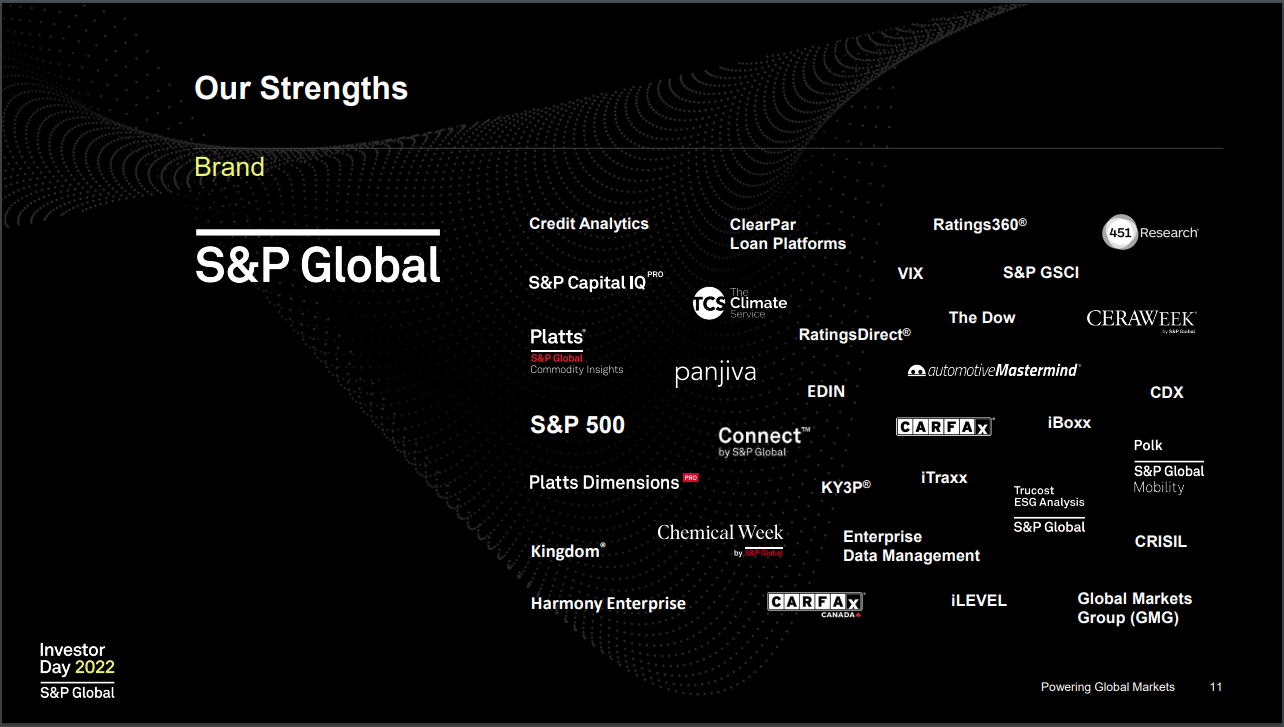

S&P International gives monetary companies to the worldwide capital and commodity markets, together with credit score rankings, benchmarks, analytics, and different knowledge to commodity market individuals, capital markets, and automotive markets. The corporate’s 5 divisions are: Scores, Market Intelligence, Commodity Insights, Mobility, and S&P Dow Jones Indices.

S&P International has a extremely worthwhile enterprise mannequin. It’s the business chief in credit score rankings and inventory market indexes, which allows it to generate high-profit margins and progress alternatives.

Supply: Investor Presentation

Notably, on February twenty eighth, 2022, S&P International merged with HIS Markit. The merger permits the corporate to supply a stronger, extra numerous product portfolio on a good bigger scale. The corporate as we speak has a market capitalization of practically $120 billion and generates $12 billion of annual income.

S&P International posted third quarter earnings on November 2nd, 2023, and outcomes have been higher than anticipated on each the highest and backside traces. Adjusted earnings-per-share got here to $3.21, which was 17 cents forward of expectations. Income was up virtually 8% year-over-year to $3.08 billion, which was $50 million forward of estimates.

Bills have been $2.02 billion, down from $2.08 billion, and roughly flat year-over-year. Adjusted working revenue was $1.47 billion, up from $1.44 billion in Q2, and up from $1.32 billion a 12 months in the past.

Progress Prospects

S&P International has a powerful monitor file. It has grown its earnings-per-share at a 19% compound annual progress price during the last eight years.

The corporate’s previous progress has been the results of a sequence of secular traits, that are, in actual fact, nonetheless current as we speak. On condition that company debt has been very talked-about within the final decade, buoyed by low world rates of interest, enterprise rankings have been vital. With the current improve in rates of interest, traders are prone to preserve a detailed eye on these rankings. Nevertheless, on account of elevated charges, fewer debt issuances come up, negatively impacting S&P International’s outcomes.

Moreover, the growing demand for monetary evaluation and ETFs ought to support in rising the corporate’s merchandise and earnings.

Share buybacks may also support in progress on a per-share foundation. The corporate additionally famous it was beginning a brand new $1.3 billion accelerated share repurchase program, price about 1% of the present float.

The corporate has additionally been very lively in acquisitions and divestments to reinforce its enterprise. First, the corporate accomplished a major merger with HIS Market in February 2022. In December 2022, the corporate acquired the Shades of Inexperienced enterprise from the Heart for Worldwide Local weather Analysis. This acquisition expanded S&P International Scores’ second-party opinions (SPOs) providing.

And on January seventeenth, 2023, S&P International agreed to promote its Engineering Options Enterprise to KKR for $975 million in money, which might equal roughly $750 million after tax and be utilized to repurchase its personal shares.

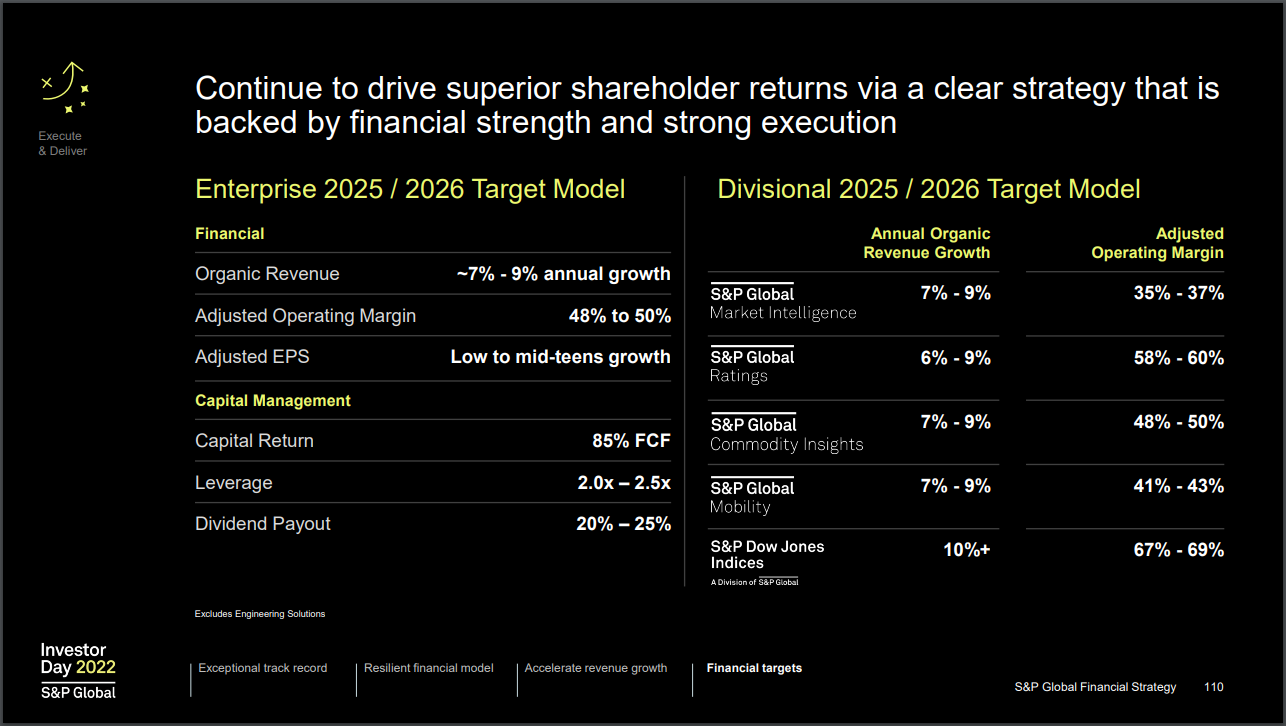

Supply: Investor Presentation

Management not too long ago said that they count on to attain 7% to 9% natural annual income progress by 2025 – 2026. The corporate additionally expects to attain an adjusted working margin between 48% to 50% and low to mid-teens progress in annual adjusted diluted EPS.

We forecast that S&P International can develop its earnings-per-share by 10% over the following 5 years.

Aggressive Benefits & Recession Efficiency

S&P International advantages from a number of aggressive benefits. The corporate operates within the extremely concentrated monetary rankings business. It’s one in every of solely three main credit standing businesses within the U.S. that management over 90% of world monetary debt rankings. The opposite two are Moody’s (MCO) and Fitch Scores.

The corporate possesses a robust moat as there are great boundaries to entry in its business. New entrants would discover it tough, if not unimaginable, to garner the required belief from the monetary business and authorities to turn into an accepted ranking company.

S&P International’s aggressive benefit and moat enabled it to stay worthwhile even through the Nice Recession when earnings decreased by -21% to $2.33. Whereas many firms have been getting ready to collapse, S&P International was removed from reporting losses.

Through the COVID-19 pandemic disaster, S&P International’s outcomes held up tremendously, and the corporate achieved new file outcomes 12 months after 12 months.

Valuation & Anticipated Returns

Primarily based on our estimate for 2023 earnings-per-share of $12.55 and a present share worth of $388, shares of S&P International are buying and selling at a P/E ratio of 30.9.

This valuation is wealthy for S&P International, which has traded for a mean P/E ratio of about 23 during the last 5 years. Our honest worth estimate for the corporate is 26 occasions earnings, contemplating the corporate has produced robust outcomes in recent times.

Shares seem like overvalued, buying and selling properly forward of our estimates. If shares have been to retreat to a price-to-earnings ratio of 26.0 over the following 5 years, traders would see a discount in annual returns of three.4%.

The inventory additionally has a present dividend yield of 0.9%. The dividend is extremely safe, with a payout ratio of solely 29%. Nevertheless, the yield just isn’t notably attractive for revenue traders.

Mixed with the estimated 10% earnings-per-share progress price, S&P International is forecasted to generate complete returns of seven.5% per 12 months by 2028. Given this price of return, S&P International shares are rated a maintain.

Remaining Ideas

S&P International has skilled great progress within the final decade. Its aggressive benefits and powerful place in its ranking business oligopoly will proceed to guard the corporate’s draw back. Mixed with its robust share buyback program and strategic mergers & acquisitions exercise, the corporate has a vivid future nonetheless.

The corporate has now achieved Dividend King standing following its fiftieth consecutive annual dividend improve. Nonetheless, the low dividend yield just isn’t so interesting.

For the time being, although, shares are buying and selling for a wealthy valuation, which gravely reduces the attractiveness of the inventory.

Moreover, the next Certain Dividend databases include essentially the most dependable dividend growers in our funding universe:

When you’re in search of shares with distinctive dividend traits, contemplate the next Certain Dividend databases:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.

[ad_2]

Source link