[ad_1]

Viktoriya Telminova/iStock through Getty Pictures

Given the variety of wonderful dividend-focused buyers who collect and alternate concepts on Looking for Alpha, I’ll not have to elucidate the Canine of the Dow idea. However for individuals who should not acquainted, here is a abstract:

The Canine of the Dow refers to a stock-picking technique that makes use of the ten highest dividend-yielding shares from the Dow Jones Industrial Common (DJIA) every year. The Canine of the Dow technique, a long-term funding technique, was popularized by American cash supervisor and writer Michael B. O’Higgins in 1991.

Identical to any index or assortment of shares grouped right into a “basket,” the Canine of the Dow are adopted as a strict rules-based portfolio by some. However I feel the worth in it’s by means of utilizing it as an enter to a broader dividend portfolio of shares, ETFs or each. In a “previous life” as they are saying, I used to be the lead supervisor of a mutual fund that aimed to personal dividend shares and rotate them, primarily based on a way I created, to generate as excessive a yield as market situations would enable, with capital preservation as a key twin mandate. Lengthy earlier than that point, I used to be a dividend inventory and ETF aficionado, sufficient to have created an indicator that evaluates shares primarily based on their dividend historical past.

Pavlov’s Canine of the Dow?

That is why, when this final week of the yr rolls round, market watchers like me have a bell ring of their heads, akin to Pavlov’s canine. Besides on this case, the canine are these Canine of the Dow! So since it’s that point of yr, and the 2024 Canine of the Dow are established, I will do two issues right here:

1. Analyze the brand new Canine of the Dow, the ten shares within the Dow 30 with the very best yields at year-end

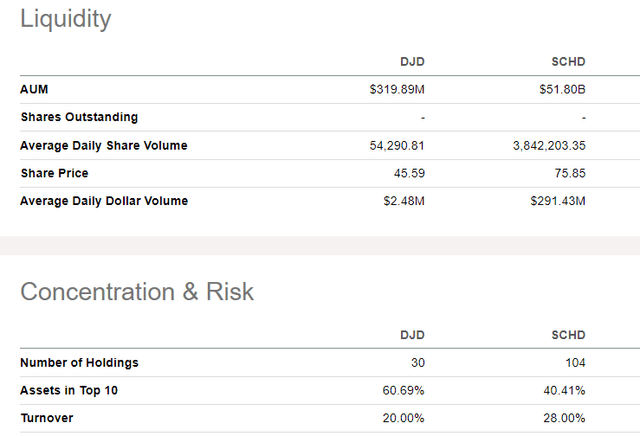

2. Make the case for an underfollowed ETF, the Invesco Dow Jones Industrial Common Dividend ETF (NYSEARCA:DJD), a relative Chihuahua at $320 million in belongings in comparison with the wildly standard Schwab U.S. Dividend Fairness ETF (SCHD), with its $50 billion in investor belongings.

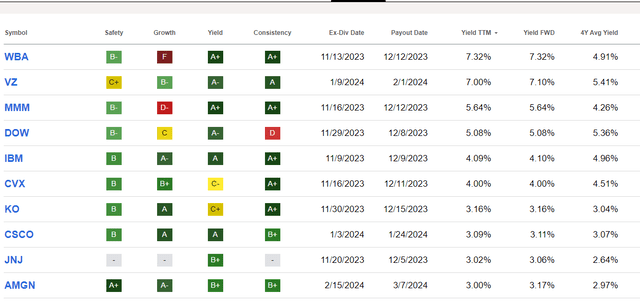

Listed below are 2024’s Canine of the Dow. Notice that the majority of them are the identical as final yr’s record. Intel (INTC) and JPMorgan (JPM) are gone, and Cisco (CSCO) and Coca-Cola (KO) are in. The opposite eight shares are the identical. Given the sturdy efficiency in 2023 of the 2 shares exiting and the lagging returns of the 2 that entered, it is sensible.

Looking for Alpha

As for the remaining, they replicate what we noticed in 2023 very effectively: a really slim marketplace for a lot of the yr, with tech main the way in which and the Magnificent 7 members of the Dow, Apple (AAPL) and Microsoft (MSFT) being serially low yielders who haven’t certified for this record shortly. What this does replicate is that there are a lot of high-quality companies which are secure however not spectacular, they usually yield far more than the 1.4% yield of the S&P 500 Index.

To me, the extra seemingly course for the US inventory market in 2024 is that we’ll see one thing we didn’t see in 2022 or 2023: stable relative efficiency by the shares of money flow-rich companies over the so-called “lengthy period” shares that require one to purchase into the narrative of excessive future earnings development, then maintain their breath and hope the inventory grows into the lofty valuation.

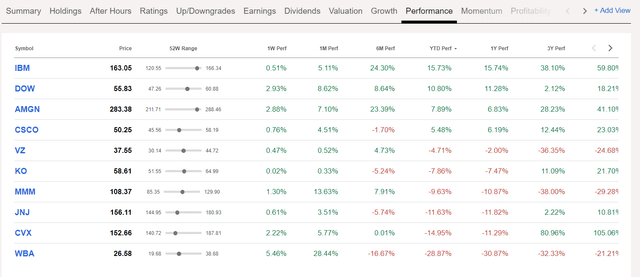

Subsequent, let’s check out the up to date Canine of the Dow utilizing previous efficiency. With a median 2023 return of round -3.7%, and a median 3-year complete return of underneath 7% (complete over the three years), plus the yield-stock nature of many of those names to start with, it’s no shock they’re again for one more yr on this record.

Looking for Alpha

Some buyers would cease studying proper right here and say, “the Dow is an old school option to monitor the inventory market. The S&P 500 is the US market benchmark now.” I am not sufficiently old to recollect when the S&P 500 debuted (1957), however I’ve been round lengthy sufficient to recollect when the Dow, not the S&P 500, was “the market.” Within the 1987 crash, it was the 500-point Dow collapse that made the headlines.

Quick-forward to right this moment and the S&P 500 is clearly the most well-liked US inventory market benchmark. But 45% of the S&P 500 can be within the Nasdaq 100, the very best diploma of overlap on report. Moreover, the S&P 500 has grow to be, just like the Nasdaq, an index pushed by a small variety of shares. To be clear, I’m as large a fan of “concentrated investing” as you’ll discover anyplace. However with the S&P 500’s greatest holdings, they’re too associated by the “Magnificent 7” aura to make me suppose that index is an efficient illustration of the entire US economic system and enterprise panorama because the Dow continues to be.

Even with the Dow’s quirky price-weighting allocation system, these 30 shares give me a greater image of what the “inventory market” is doing and the place it may go as trying on the high 30 shares by weight within the S&P 500 index. That is simply my take, and I do know it’s a extremely unpopular one in an period the place ETFs linked to that index and the Nasdaq 100 dominate the inflows and DIA is an afterthought.

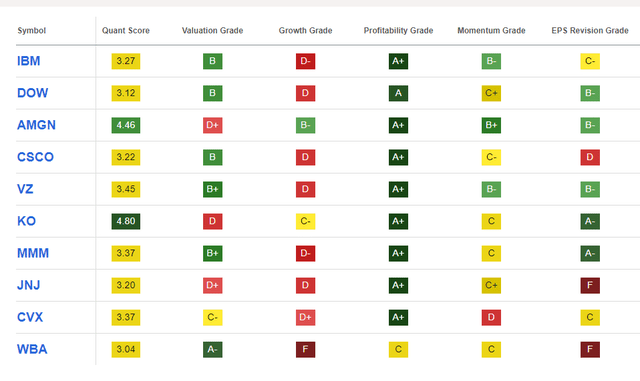

That brings me to the Looking for Alpha quant grades for the up to date Canine of the Dow. The general scores are middling, as are their collective valuation, development and momentum grades. Buyers are hard-pressed to seek out mega cap corporations promoting at low teenagers P/E multiples as small cap and non-US shares sometimes do right this moment. So my views listed here are relative: in different phrases, I just like the Dow-type shares far more in 2024 than the Nasdaq/S&P 500 greatest weightings.

However what actually stands out right here is the Profitability Grades for these 10 shares. Eight A+ scores, an A and a single C score. THAT is the place I am taking a look at this and considering that after a messy 2022 for all shares, a robust 2023 for some, 2024 would possibly simply be the yr the place the 2-year laggards revert to the imply.

And whereas Microsoft and Apple are frequent to all of these indexes, and Microsoft is a robust 6.6% of the Dow at present, Apple is just a 3.4% weighting. This text is not going to dive into the implications of that, however one other one quickly most likely will.

Looking for Alpha

DJD: an ETF that runs with the large canine (of the Dow, that’s)

So, in case you just like the Canine of the Dow idea, and you want their relative place heading into 2023, you may have a number of choices. One is to purchase the ten shares in no matter weighting you would like. That is your name, not mine.

The opposite is to get extra accustomed to DJD. And in an effort to additionally educate buyers in regards to the danger of “hero-worship” in ETF investing, I made a decision to stack DJD up in opposition to the $50 billion, low price, sturdy past-performance behemoth I am usually ridiculed for referring to as “overrated.” To be clear, SCHD is a high quality ETF. And by that I imply it’s OK. However I simply do not see the rationale for it to be so highly-favored over a set of different dividend ETFs, particularly when totally different elements of the dividend inventory house are inclined to go out and in of favor.

In development inventory markets, dividend development will seemingly win out. In bear markets, top quality wins. In falling rate of interest environments, excessive yield shares win, so long as they aren’t ticking time bombs, with yields that look good and excessive, however are weak. Frankly, that case might be made for one or two of the Canine of the Dow, however once more, that is past the scope of this text.

I’ve conversed politely with sufficient people within the Looking for Alpha feedback part to understand that SCHD is 2 issues:

1. An ETF whose holders are very devoted to it

2. An ETF whose holders might not be as conscious of the dangers to its strategy going ahead

My objective is to not speak anybody out of SCHD, as a result of my opinion is simply that, an opinion. However I’ve seen a large sufficient number of markets and spent 37 years understanding what makes them tick at totally different occasions. And so after I see that there are a lot of high quality dividend ETFs like DJD and others I’ll quickly write about, however comparatively nobody considers them, I determine it’s time to converse out.

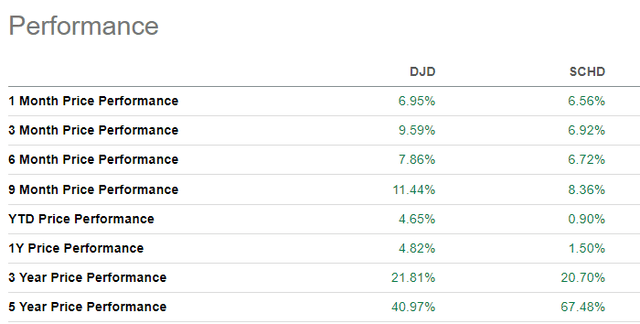

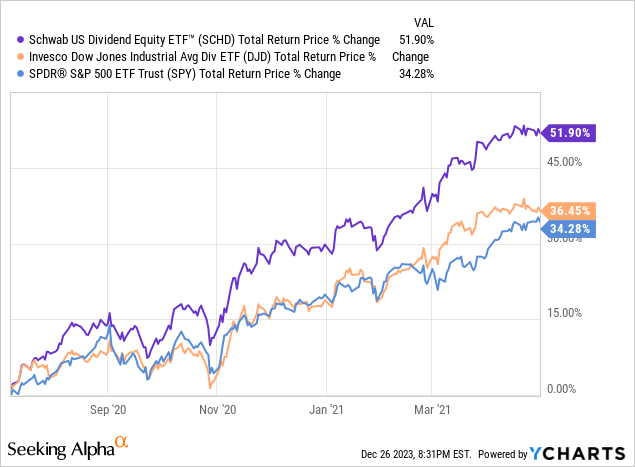

The desk under exhibits that DJD and SCHD have been forwards and backwards relying on what trailing time interval you have a look at. The previous three years might be essentially the most telling interval on this fast desk, because it contains some large ups, large downs and in betweens. However SCHD romped over DJD throughout 2019 and 2020, the 2 years which are within the 3-year and 5-year intervals under.

Looking for Alpha

However as I’ve famous many occasions in my articles and the feedback part, trailing return or annual (calendar yr) previous efficiency might be the least helpful knowledge level one can use in such a evaluation, and simply essentially the most deceptive. For practically 4 a long time, I’ve seen buyers get suckered into shopping for what simply went up essentially the most, or sticking with funds as a result of they satisfied themselves they have been higher than they have been. Kind of like seeing a brand new quarterback on your soccer workforce, and when he has a couple of good video games, assume that it’s going to proceed for years.

It’s laborious for buyers to separate what “feels good” (owned one thing and it has accomplished effectively) versus what the market local weather was and is, and the way they’re totally different. I’m fairly satisfied that 2023 and 2021, the final two superb up years for big cap US development shares, are much less more likely to be repeated too usually throughout the subsequent 5-10 years. So I attempt to impart some expertise in seeing a dozen or extra such shifts because the Nineteen Eighties.

I do this realizing that many will not care or will even mock the hassle. However that will not cease the open-minded people from studying from the perception. None of us can predict the longer term, however we might be prepared for main modifications in what markets reward, and that is the intention right here.

DJD’s decrease asset base is unfold throughout 30 shares (the Dow 30) and they’re weighted in descending order of dividend yield, which is within the spirit of Canine of the Dow, however with two key variations:

* It owns 30 shares not 10

* It weights them in response to yield, whereas the Canine of the Dow are sometimes weighted equally (10% every if one have been making a portfolio with that technique).

Looking for Alpha

As you may see above, DJD is concentrated the way in which I like my ETFs. I favor to know what I personal and monitor it as if I owned the shares immediately. So having 10 of them account for extra the three/5 this a part of my portfolio allocation is simply high quality. SCHD is sort of concentrated for an ETF with 100+ holdings, however solely 2/3 as targeted as DJD.

Beneath we see that on a 1-year rolling return foundation, the 2 ETFs are comparable. SCHD went flying out of the pandemic low in mid-2020, and as proven right here, flew previous even SPY for a time frame. That is apparently one of many historic intervals the place the legend of SCHD was born.

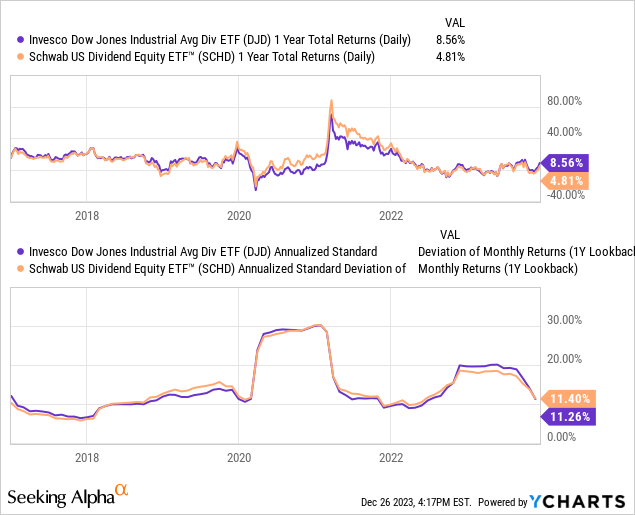

Beneath, we see that DJD has had a bonus over the previous 12 months, outperforming SCHD by about 3.75%. To that I say, “so what?” That is not the purpose right here. I am not cheerleading for DJD right here as a lot as saying that if one likes the Dow Canine concept, DJD goes to focus on it higher than some other ETF I do know of.

We additionally see within the decrease a part of the chart that DJD and SCHD have been true friends relating to volatility and consistency of returns, primarily based on their practically similar customary deviations over a lot of the previous half-decade.

Abstract factors

The Canine of the Dow have been refreshed for 2024, and the message I get from it’s that there are nonetheless some US blue chip shares which have the potential to make up a few of the floor they’ve misplaced within the post-pandemic funding fever that has made fashionable markets what they’re: completely nuts in comparison with the previous! However I feel the drumbeat for these conventional blue chips which are present in and across the Dow Jones Industrial Common is getting louder. Perhaps the FAANG tree can go to the sky, however I feel that is a much bigger danger than trying extra towards worthwhile corporations buying and selling at extra affordable multiples. DJD sells at about 16x earnings.

As for SCHD, I get it. It’s a stable dividend ETF. I simply suppose it’s overrated, after we think about what number of different dividend ETFs are on the market, together with one with the see-through means of DJD’s extremely concentrated portfolio. I fee DJD a Purchase on a relative foundation to the S&P 500, which I feel is the one option to consider giant cap fairness ETFs when a lot of the market tends to rise and fall collectively (thanks algorithms and indexation!). As for SCHD, on that very same foundation, it is a Maintain to me. I do not think about it for my portfolios as I do DJD, however it’s of the character that it must also be aggressive with the S&P 500 if and when the obsession with a small variety of large shares lastly reverses meaningfully.

The Canine of the Dow is someplace between quirky, fascinating and legendary, relying on one’s private investing historical past. To me, it’s nonetheless top-of-the-line annual rituals to trace, to maintain me centered and make me take into consideration the place the US inventory market stands because the annual calendar turns.

[ad_2]

Source link