[ad_1]

Greenback caught within the center

A combined batch of financial knowledge releases left the US greenback and fairness markets and not using a clear route on Friday. On the intense facet, the US employment report for December exceeded expectations, with nonfarm payrolls beating forecasts and wage development coming in hotter than anticipated.

Nonetheless, a pointy drop in labor drive participation served as a warning that employment situations should not fairly as robust as they appear at first look. That was shortly adopted by a disappointing ISM non-manufacturing survey, which signaled weaker hiring intentions amongst companies and a slowdown in new orders.

The greenback traded greater immediately after the employment report however its good points quickly began to evaporate and it in the end closed the session unchanged. It was the same story within the fairness house, with shares on Wall Road closing a unstable session close to their opening ranges.

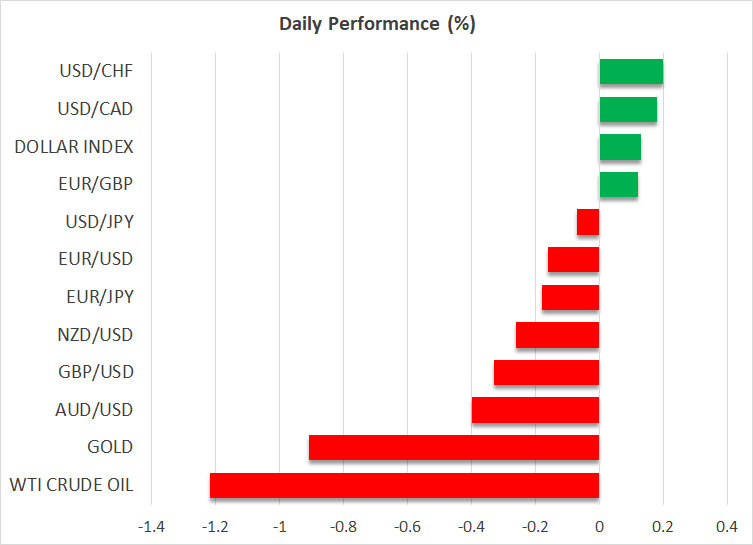

Total, this dataset didn’t have a lot of an impression on the anticipated trajectory of Fed rates of interest. Buyers weighed an honest employment report towards a depressing ISM survey and determined that the 2 cancel one another out. This elevates the significance of the upcoming CPI knowledge on Thursday, which might break the impasse within the debate over how quickly the Fed will slash charges.Gold struggles for altitude, oil hits tough patch

Within the commodity sphere, gold costs traded in comparable trend to the US greenback and equities on Friday, closing close to their beginning ranges after whipsawing round. That stated, bullion resumed its decline early on Monday, feeling the warmth of a barely stronger greenback and a few opposed bond market strikes.Gold’s efficiency within the close to time period will depend upon this week’s inflation stats, however within the larger image, the elemental outlook seems favorable as it’s merely a matter of time till rates of interest come down. The development of central banks buying gold immediately is one other bullish improvement that would persist for years if the geopolitical local weather stays unstable.

Talking of geopolitics, worries a few conflagration within the Center East intensified final week after Israel struck the capital of Lebanon to kill a senior Hamas chief. These escalation fears translated into a lift for oil costs, however the transfer has already began to expire of juice, following information that Saudi Arabia will lower the value at which it sells crude.

When a serious oil producer like Saudi Arabia affords worth reductions, it’s both an indication of concern about weakening demand situations or an try and cease international producers such because the USA from stealing market share away. Both means, it’s a bearish sign for power costs.Chinese language shares fall as shadow financial institution goes bankrupt

One of many greatest gamers on the coronary heart of the Chinese language shadow banking system filed for chapter on Friday, offering the clearest indication up to now that the property market disaster has began to contaminate the opaque lending trade. Although buyers had been conscious Zhongzhi Enterprise Group was dealing with extreme liquidity points, the information of its chapter nonetheless dragged native fairness markets down right now.

Zhongzhi’s downfall underscores the difficulties Beijing faces in its try and stabilize the actual property market and rein in personal debt ranges, in a monetary system that features many darkish corners and due to this fact hidden dangers.

Lastly within the US, Congressional leaders reached a spending deal that makes a partial authorities shutdown later this month much less probably. That stated, the deal nonetheless must cross each chambers of Congress and be signed by the President.

[ad_2]

Source link