[ad_1]

Merchants await some key knowledge releases, RBNZ determination amid quiet begin to the weekYen broadly firmer after CPI beat, provides to greenback weak spot as euro extends gainsEquity rally loses some steam however surges

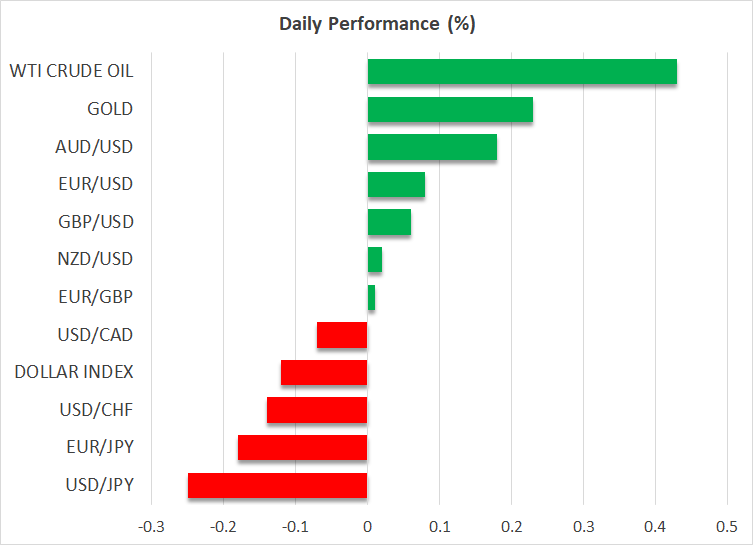

Markets calm forward of information flurry as greenback strugglesThe US greenback was headed for its seventh straight session of losses in opposition to a basket of currencies on Tuesday at the same time as buyers continued to reduce their price lower expectations for the Fed. There’s been no change to the tender touchdown narrative for the US economic system however within the absence of recent drivers for the reason that CPI and PPI stories, the greenback has taken a little bit of a backseat, permitting its friends to shine.

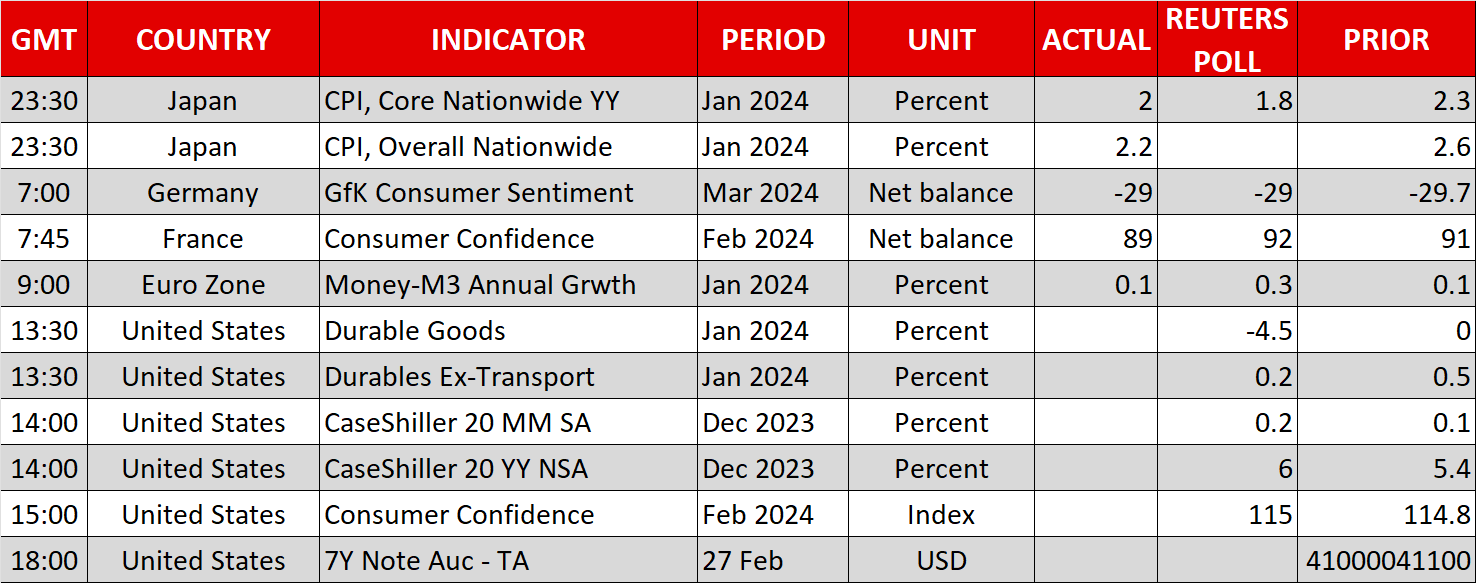

That might all change this week, nonetheless, as markets brace for a knowledge dump out of the US in addition to for a slew of inflation stories globally. Sturdy items orders and the Convention Board’s client confidence gauge will kick issues off immediately. The primary focus, although, might be Thursday’s core PCE worth index.

Are dovish Fed bets in a shedding battle?With Fed officers seemingly not in a rush to chop charges, any upside surprises within the Fed’s most well-liked inflation metric may see easing bets being decreased to 3 cuts – consistent with the FOMC dot plot – and even much less. Just lately appointed Kansas Metropolis Fed President, Jeffrey Schmid, was the newest to warn in opposition to reducing charges pre-emptively in his debut speech on Monday.

Except there’s a big deterioration within the inflation or employment outlook over the approaching weeks, there’s an actual hazard that even June could be deemed too early for the Fed to start slashing charges. While there’s no sense of panic simply but, no less than not in fairness markets, Treasury yields have been creeping increased currently, suggesting elevated warning over the rate of interest outlook.

The 2-year yield, specifically, is again close to December ranges, boosted partly by yesterday’s public sale, which additionally included five-year notes. The Treasury public sale continues on Tuesday with the sale of seven-year notes.

A much-needed increase for the yenJapan’s two-year authorities bond yield can also be within the highlight immediately because it hit the very best since 2011 following some sturdy inflation figures. The core CPI price fell lower than anticipated in January to 2.0% from 2.3% y/y, versus forecasts of 1.8%. Japan appears to be displaying some indicators of persistent inflationary pressures and this has introduced a March price hike again on the desk for the Financial institution of Japan.

The yen gained throughout the board on the again of the CPI beat, firming to round 150.20 to the greenback.

Euro stays bullish, eyes CPI knowledge, awaits RBNZ decisionThe euro, in the meantime, remained buoyant round $1.0850, as buyers re-assessed price lower bets for the European Central Financial institution following final week’s stronger-than-expected providers PMIs out of the Eurozone. Though the German economic system is unlikely to come back out of the doldrums anytime quickly, sooner progress in different member states would give the ECB much less purpose to behave swiftly relating to price cuts. Nonetheless, a lot will depend upon Friday’s flash CPI estimates, which may present inflation easing additional in February and probably weighing on the euro.

The Australian greenback was one among immediately’s higher performers forward of month-to-month CPI readings due early on Wednesday, however the New Zealand greenback prolonged its slide amid doubts about the potential for price hikes by the RBNZ. New Zealand’s central financial institution is predicted to carry charges when it declares its determination at 01:00 GMT tomorrow however is more likely to keep a tightening bias.

Wall Avenue rally stalls however Bitcoin powers aheadIn fairness markets, US futures had been barely optimistic following the primary loss for the S&P 500 on Monday after three days of features. That didn’t deter Japan’s , nonetheless, to shut at yet one more report excessive immediately.

Cryptocurrencies additionally rallied, led by Bitcoin, which briefly topped $57,000 earlier immediately for the primary time since December 2021. Demand for Bitcoin has soared following the approval of spot ETFs, with the pre-halving impact additionally contributing to its current features. Nonetheless, yesterday’s bounce seems to have been triggered by stories that MicroStrategy, a enterprise intelligence agency, has purchased as much as $155 million price of Bitcoin, with buyers decoding that as one other vote of confidence within the well-liked crypto.

[ad_2]

Source link