[ad_1]

JHVEPhoto

Thesis

Due to my background in vitality manufacturing, I recurrently test in on a number of utilities. After I final wrote an article about Dominion Power, Inc. (NYSE:D), I got here to the conclusion that this firm had positioned itself into a particularly unattractive debt state of affairs.

Nonetheless, the actions taken by the corporate throughout this most up-to-date quarter signify a big course correction. They nonetheless have fairly a methods to go, however now look like headed towards a monetary state of affairs the place I might think about shopping for. After reviewing their present financials and valuation, I presently price Dominion as a Maintain.

Firm Background

Dominion Power, Inc. is a utility supplier headquartered in Richmond, Virginia. They supply pure gasoline and electrical energy for roughly 7 million clients. Like many utility suppliers in the USA, they’ve set a aim of reaching net-zero emissions by 2050.

States Served (Dominionenergy.com)

Lengthy-Time period Tendencies

The USA pure gasoline market is anticipated to expertise a CAGR of 5% till 2028. The USA energy market is anticipated to expertise a CAGR of over 5.6% by means of 2027. The Inflation Discount Act is at the moment offering robust tailwinds for utility suppliers throughout the nation.

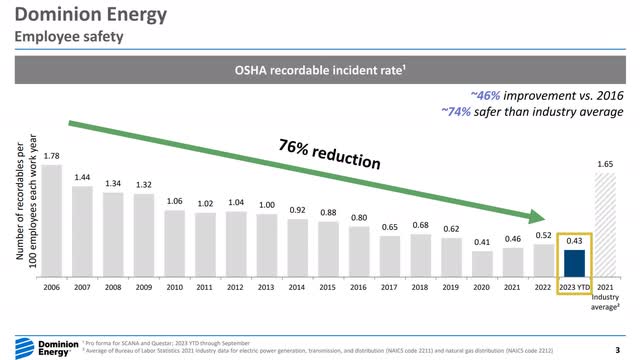

Dominion has been actively working to enhance its security document through the years. These efforts have had a optimistic influence.

Security Document (Q3 2023 Investor Presentation Web page 3)

Steering

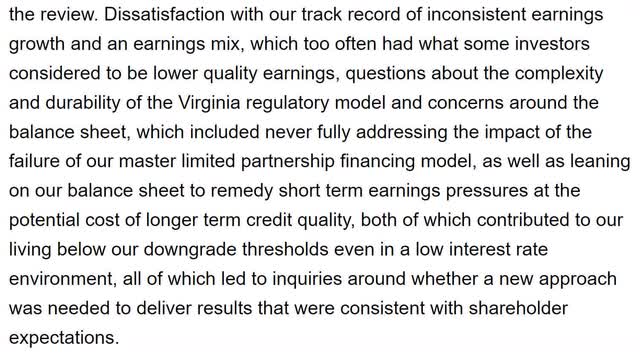

Their most up-to-date earnings name transcript revealed many particulars I’m not overlaying right here. I’m solely highlighting what I think about to be an important factors. They’re within the strategy of a evaluate to find out the perfect plan of action to carry out some form of operational pivot to enhance investor returns.

Steering 1 (Q3 Earnings Name Transcript)

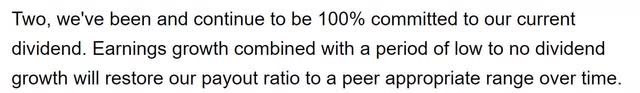

They’ve acknowledged that they continue to be dedicated to sustaining their present dividend.

Steering 2 (Q3 2023 Earnings Name Transcript)

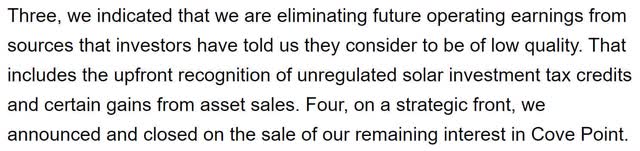

They’ve shifted their stance on buying and sustaining low-quality income sources.

Steering 3 (Q3 2023 Earnings Name Transcript)

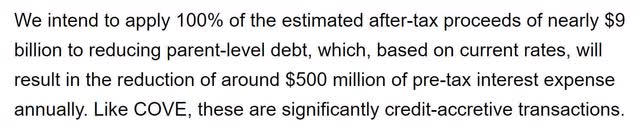

Most significantly, they paid off $3.3B in debt and have declared their intent to spend all obtainable after-tax earnings to pay it down additional.

Steering 4 (Q3 2023 Earnings Name Transcript)

The board has stepped in and tied a good portion of the CEO’s compensation to investor returns.

Steering 5 (Q3 2023 Earnings Name Transcript)

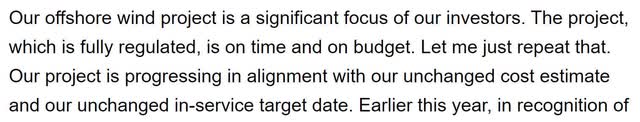

Their offshore wind challenge continues to be on observe to fulfill their beforehand established objectives.

Steering 6 (Q3 2023 Earnings Name Transcript)

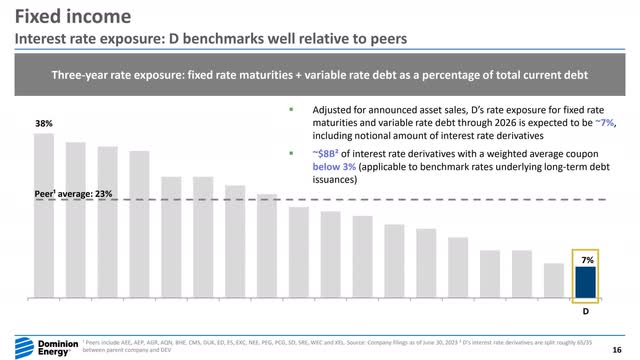

Though their debt load is kind of giant, the standard of that debt is healthier than a lot of their friends.

Steering 7 (Q3 2023 Investor Presentation)

This may be seen visually on web page 16 of their Q3 2023 investor presentation, which will be discovered right here.

Debt High quality (Q3 2023 Investor Presentation)

Annual Financials

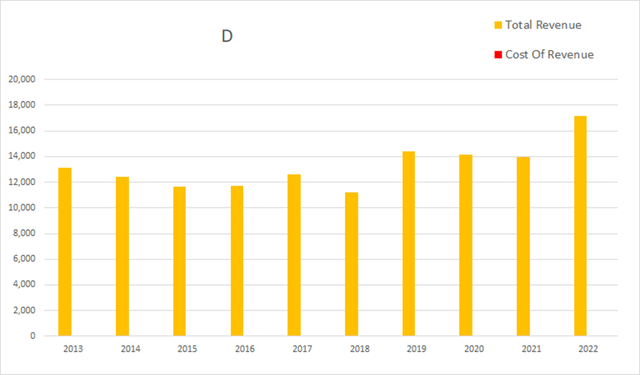

The corporate has been growing its income at a quite gradual price over the past decade. In 2013 that they had an annual income of $13,120M. By 2022 that had grown to $17,174M. This represents a complete improve of 30.9% at a mean annual price of three.43%.

D Annual Income (By Creator)

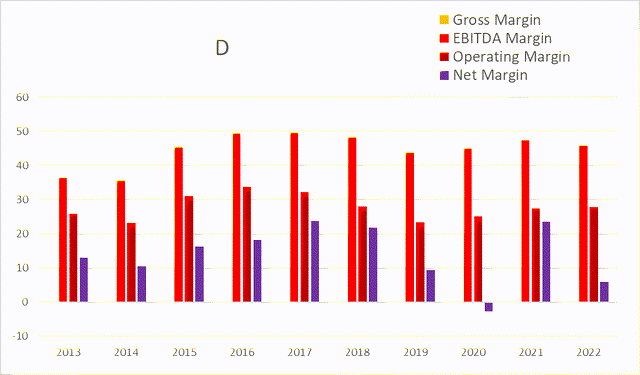

As a result of they’re in the midst of a multi-decade portfolio shuffle, I count on their margins to proceed fluctuating as time goes on. As of the latest annual report, EBITDA margins had been 45.92%, working margins had been 27.79%, and internet margins had been 5.79%.

D Annual Margins (By Creator)

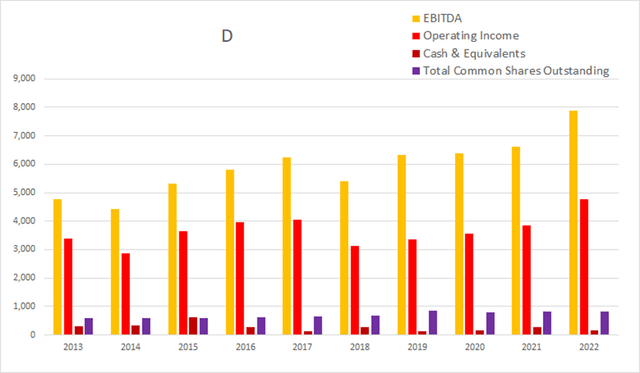

Whole widespread shares excellent was at 581M in 2013; by the top of 2022 that had risen to 835M. This represents a 43.72% rise in share depend, which comes out to a mean annual price of 4.86%. Over that very same time interval working revenue rose from $3,387M to $4,773M, a 40.92% whole improve, at a mean price of 4.55%. The final decade of dilution has been barely accretive.

D Annual Share Depend vs. Money vs. Earnings (By Creator)

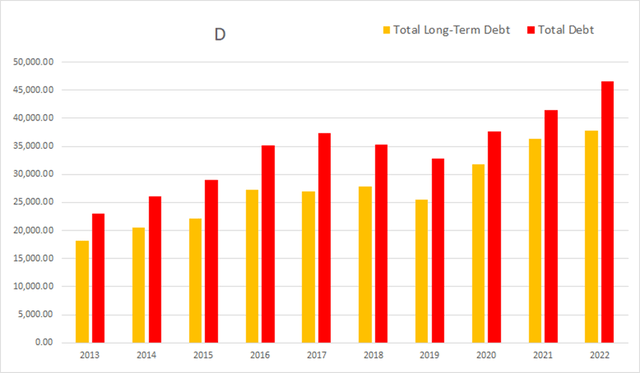

Their debt has risen considerably over the past decade. As of the 2022 annual report, that they had -$1,001M in internet curiosity expense, whole debt was $46,608M, and long-term debt was $37,730M.

D Annual Debt (By Creator)

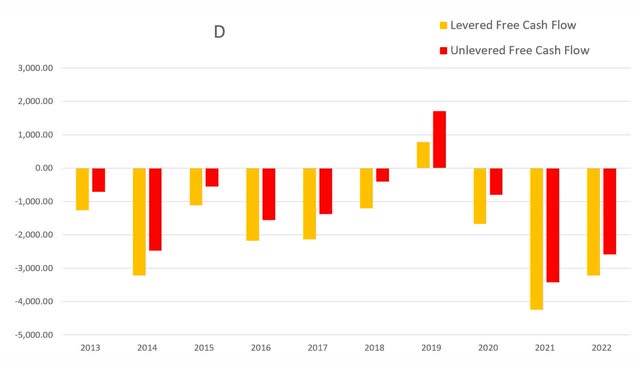

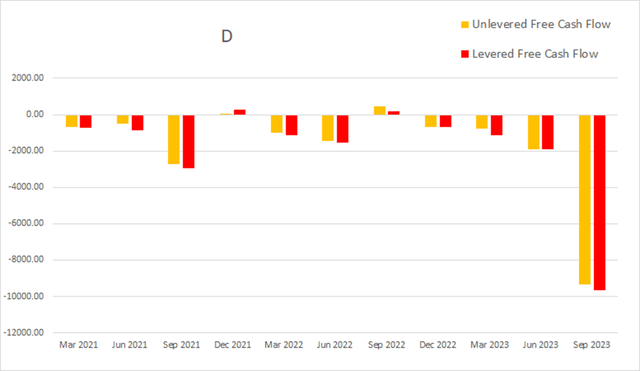

Annual money flows have been detrimental for many of the final decade. As of this most up-to-date annual report, money and equivalents had been $153M, working revenue was $4,773M, EBITDA was $7,886M, internet revenue was $994M, unlevered free money move was -$2,591.9M, and levered free money move was -$3,217.50M.

D Annual Money Stream (By Creator)

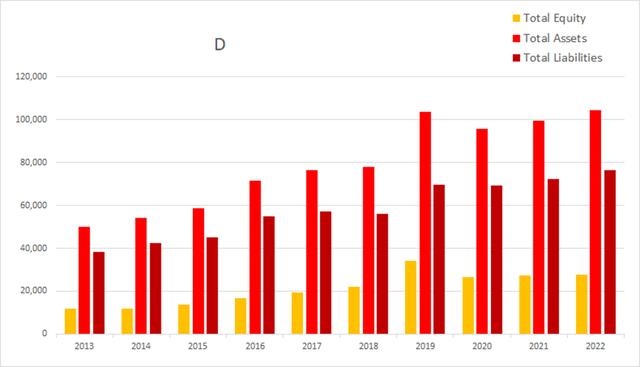

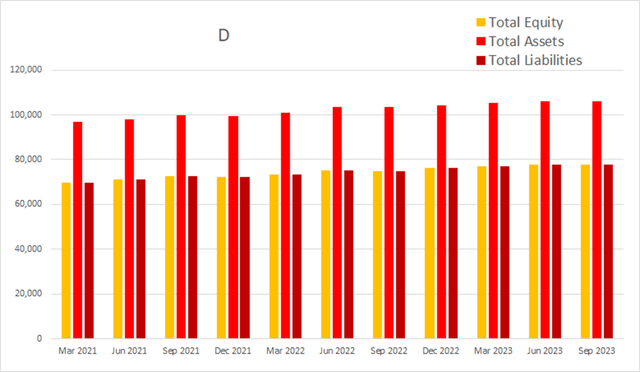

Their whole fairness was rising till it reached a peak in 2019. It has been comparatively flat since then.

D Annual Fairness (By Creator)

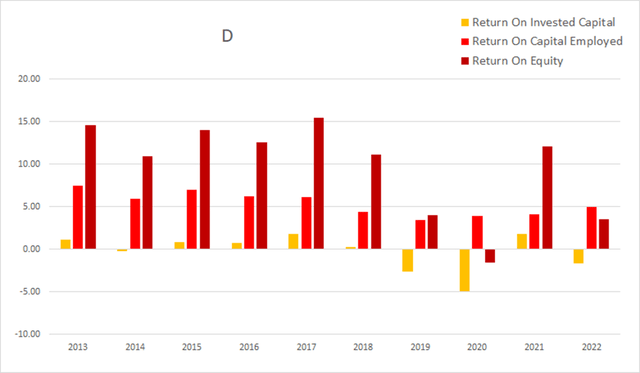

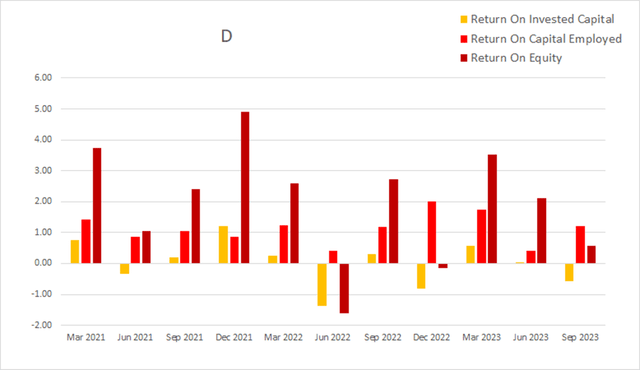

Their returns turned unattractive in 2019 and have but to get well to their earlier vary. As of the latest annual report, ROIC was -1.66%, ROCE was 5.00%, and ROE was at 3.57%.

D Annual Returns (By Creator)

Quarterly Financials

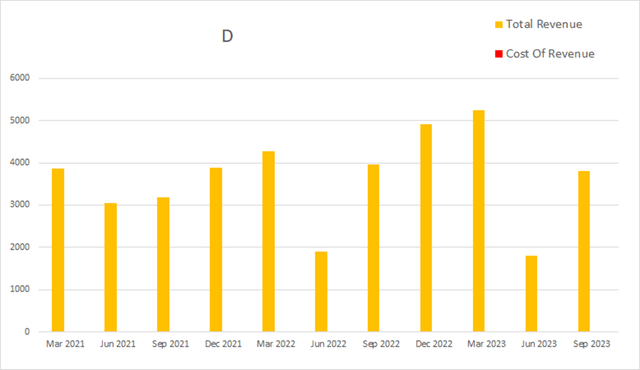

Their quarterly financials present clear seasonality. They expertise lower-than-average income throughout hotter months, and higher-than-average income throughout colder months. Eight quarters in the past Dominion had a quarterly income of $3,176M. 4 quarters in the past it reached $3,963M. By this most up-to-date quarter that had dropped to $3,810M. This represents a complete two-year rise of 19.96% at a mean quarterly price of two.50%.

D Quarterly Income (By Creator)

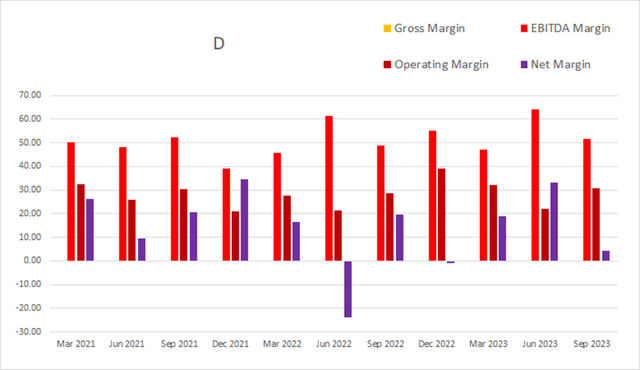

Their quarterly margins don’t look like considerably affected by the seasonal adjustments in income. As of the latest quarter EBITDA margins had been 51.76%, working margins had been 30.63%, and internet margins had been at 4.28%.

D Quarterly Margins (By Creator)

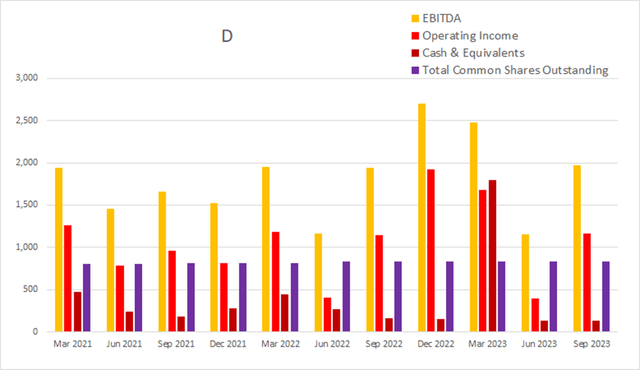

Their dilution price seems to have been decrease over the past couple of years than the typical they’ve been experiencing over the past decade. The sum of their final eight quarters of dilution comes to three.31%; over the past 4 quarters, this has dropped to 0.48%.

D Quarterly Share Depend vs. Money vs. Earnings (By Creator)

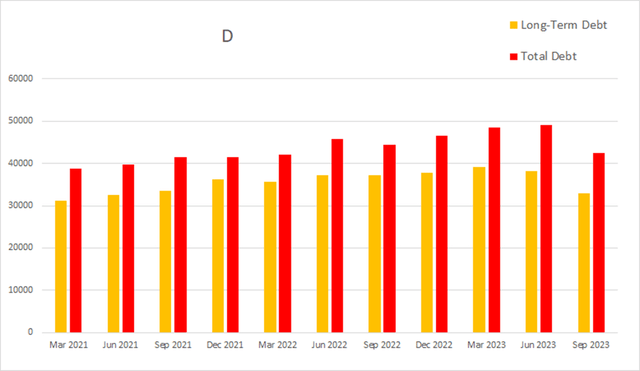

On this most up-to-date quarter, Dominion had -$500M in internet curiosity expense, whole debt was at $42,435M, and long-term debt was at $32,915M.

D Quarterly Debt (By Creator)

As of the latest earnings report, money and equivalents had been $137M, quarterly working revenue was $1,167M, EBITDA was $1,972M, internet revenue was $163M, unlevered free money move was -$9,344.6M and levered free money move was -$9,657.1M.

D Quarterly Money Stream (By Creator)

When viewing their quarterly financials, their whole fairness has been steadily rising.

D Quarterly Whole Fairness (By Creator)

Their quarterly margins are displaying important variation. As of the latest earnings report ROIC was -0.56%, ROCE was 1.21%, and ROE was 0.58%.

D Quarterly Returns (By Creator)

Valuation

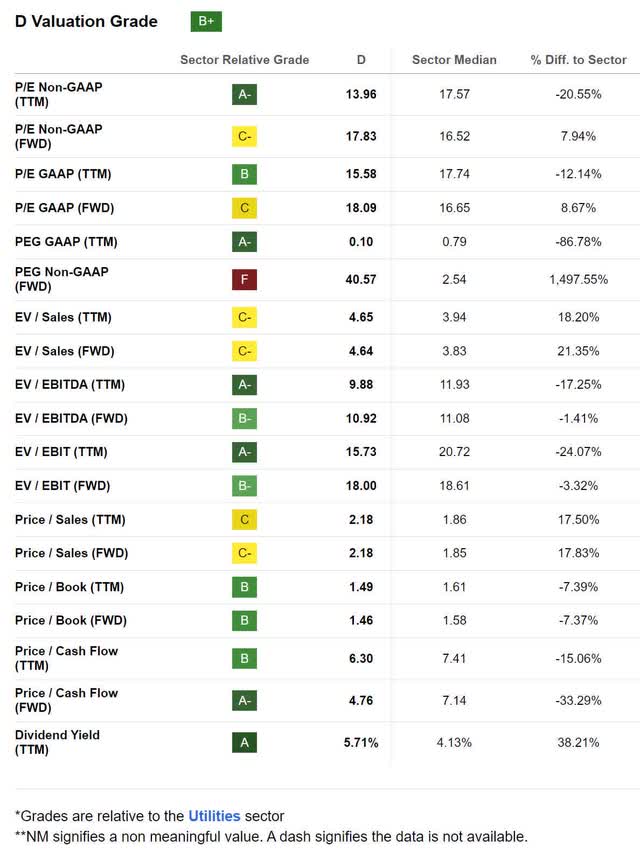

As of November 18th, 2023, Dominion had a market capitalization of $39.22B and traded for $46.74 per share. Utilizing their ahead P/E of 18.09x, their EPS Lengthy-Time period CAGR of 0.44%, and their ahead Yield of 5.71%, I calculated a PEGY of two.941x and an Inverted PEGY of 0.340x. This PEGY estimate implies the intrinsic worth of the corporate is presently round $15.89 per share from a progress perspective.

D Valuation (In search of Alpha)

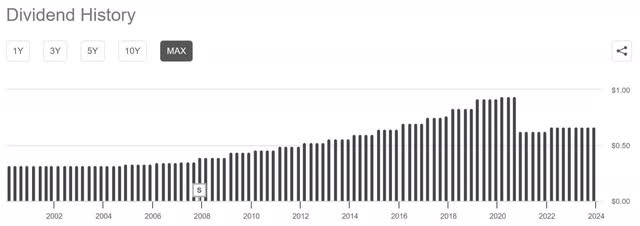

If I as an alternative select to make use of a Dividend Low cost Mannequin, I get a considerably totally different consequence. The corporate acknowledged of their earnings name that they had been dedicated to sustaining the current dividend whereas they pay down debt. In search of Alpha lists a projected dividend CAGR of 1.89%. Utilizing the present annual dividend of $2.67 per share, a dividend progress price of 1.89%, a reduction price of 9%, and assuming they’ll keep this dividend progress for 20 years, a reduced money move calculator produces a good worth estimate of $36.03 per share.

D Dividend Historical past (In search of Alpha)

Dangers

Together with many of the different utilities in the USA, Dominion is in the midst of a multidecade portfolio adjustment. Not solely are they more likely to face momentary durations of diminished earnings in the course of the change, however the closing portfolio of vitality sources they find yourself with is probably not as worthwhile as present-day projections.

Catalysts

As they proceed paying down their long-term debt, the burden it locations on their returns will diminish. In the event that they pay it down far sufficient, the corporate might discover itself in a state of affairs the place they don’t seem to be solely in a position to start elevating the dividend, they are able to start shopping for again shares. Whereas most utilities don’t view buybacks as a precedence, having the ability to use buybacks to outpace any and all stock-based compensation can be a big step towards making Dominion a extra engaging funding.

Conclusions

This will likely sound like heresy to present shareholders, however I consider corporations ought to all the time prioritize their long-term well being over paying a dividend. In my final article, I acknowledged that I believed they need to minimize the dividend even additional and attempt to pay down their debt as quick as doable. Sustaining their dividend whereas they dedicate all obtainable funds to paying it down is a much less dramatic place for them to undertake; one which can be much less more likely to go away current shareholders upset.

General, they’ve put themselves on a significantly better path. Due to their shift in perspective, I not consider the corporate is in any hazard of slipping right into a debt spiral. Nonetheless, the street out of the outlet they’ve discovered themselves on just isn’t a brief one. They acknowledged they had been planning on spending about $9B per yr paying down debt. With their current long-term debt at $32.925B, it ought to take them about 3.65 years to pay it right down to zero. Utilities are used to working with important debt, so I consider it’s seemingly they may merely pay it right down to ranges they think about wholesome. I do not count on them to try to pay all of it the best way off.

In some unspecified time in the future over the following 3.65 years, I count on administration to really feel they’ve improved their state of affairs sufficient that they start elevating the dividend. Whereas that is more likely to trigger a valuation enchancment, I’ll view it as an indicator that I ought to critically think about opening a place in Dominion.

[ad_2]

Source link