[ad_1]

Anton Petrus/Second by way of Getty Photographs

Are you conversant in Royalty Trusts? The Power business has a number of of those entities, which lease out land that they personal to vitality producers, in return for receiving royalties on crude oil and pure fuel. These trusts will be a lovely supply of revenue for traders.

Dorchester Minerals, L.P. (NASDAQ:DMLP) is without doubt one of the older vitality trusts, based in 1982.

One of many massive variations between DMLP and plenty of different vitality trusts is that DMLP can purchase new properties with the intention to improve or preserve its reserves.

Holdings:

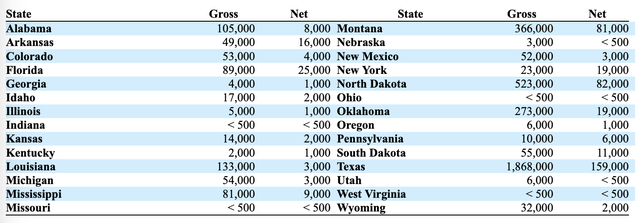

DMLP owns properties in 28 states, consisting of manufacturing and nonproducing mineral, royalty, overriding royalty, web income, and leasehold pursuits.

DMLP website

In July-September 2023, DMLP acquired 2184 web royalty acres situated in three counties in Texas in alternate for ~1.2M widespread items representing restricted partnership pursuits within the Partnership valued at ~$35.5M.

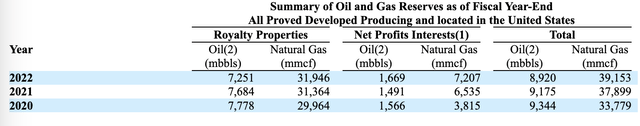

Its Royalty properties’ oil reserves declined from 7,684 to 7,251 mmbls in 2022, whereas its pure fuel reserves elevated from 31,364 to 31,946 mmcf.

NPI – Web Earnings Curiosity elevated by 12% in 2022, to 1,669 mmbls; and its pure fuel NPI’s elevated by 10%.

Complete oil reserves decreased by 2.8% in 2022, whereas whole pure fuel reserves elevated by 3.3%.

DMLP 2022 10K

Earnings:

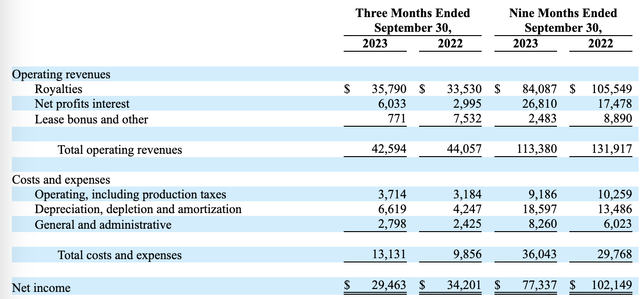

Royalties generated 84% of DMLP’s revenues in Q3 ’23, and 74% in Q1-3 ’23. Like different trusts, DMLP has minimal working and G&A bills, so most of its revenue flows by means of to unitholders. There’s non-cash Depreciation and Amortization.

58% of the Q3 ’23 receipts mirrored oil gross sales throughout June 2023 by means of August 2023 and pure fuel gross sales throughout Could 2023 by means of July 2023; and ~42% from prior gross sales intervals. The typical indicated costs for oil and pure fuel gross sales money receipts attributable to the Royalty Properties throughout the third quarter of 2023 had been $64.74/bbl and $1.97/mcf, respectively, vs. $91.49/bbl and $6.55/mcf in Q3 ’22.

The typical indicated costs for oil and pure fuel gross sales money receipts attributable to the NPI properties throughout the third quarter of 2023 had been $61.63/bbl and $1.70/mcf, respectively, vs. $87.87/bbl and $6.40/mcf in Q3 ’22.

DMLP website

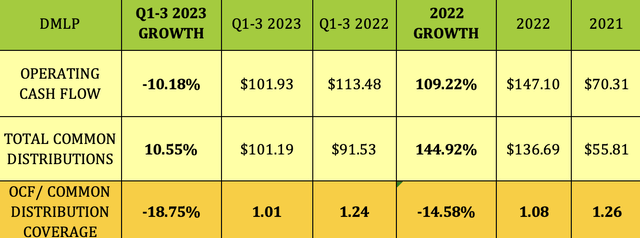

As detailed above, a lot decrease oil and pure fuel costs decreased DMLP’s revenues, Web Revenue, EBITDA and Money Circulation in Q1-3 ’23, which was a reversal of the large positive aspects made in 2022.

Hidden Dividend Shares Plus

Whereas DMLP hasn’t but launched its This fall ’23 report, it did expose this data on its This fall ’23 distribution announcement:

“Money receipts attributable to the Partnership’s Royalty Properties throughout the fourth quarter totaled ~$28.3. Roughly 72% of those receipts mirror oil gross sales throughout September 2023 by means of November 2023 and fuel gross sales throughout August 2023 by means of October 2023, and roughly 28% from prior gross sales intervals. Money Receipts attributable to the Partnership’s Web Earnings Pursuits throughout the fourth quarter totaled roughly $4.6 million. Roughly 77% of those receipts mirror oil gross sales and fuel gross sales throughout August 2023 by means of October 2023, and roughly 23% from prior gross sales intervals.”

That ~$33M whole signifies a quarterly decline vs. the ~$42M DMLP had in Q3 ’23.

Dividends:

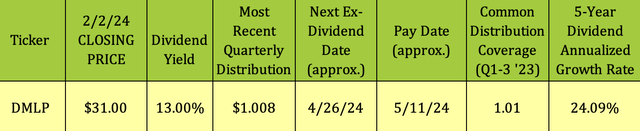

The distribution of $1.007874 per widespread unit represented exercise for the three-month interval ended December 31, 2023 and is payable on February 8, 2024 to widespread unitholders of file as of January 29, 2024.

At its 2/2/24 $31.00 closing worth, DMLP’s ahead yield is 13%. It has a really excessive 5-year dividend development common of over 24%, attributable to a 128% soar in distributions in 2022 vs. 2021.

Hidden Dividend Shares Plus

DMLP’s partnership settlement requires “that we distribute quarterly an quantity equal to all funds that we obtain from the Royalty Properties and the NPI (aside from money proceeds obtained by the Partnership from a public or non-public providing of securities of the Partnership) much less sure bills and cheap reserves.” (2022 10K)

Distribution protection was 1.01X in Q1-3 ’23, a lot decrease than the 1.24X seen in Q1-3 ’22. Full yr 2022 protection was 1.08X.

Hidden Dividend Shares Plus

Taxes:

DMLP points a Okay-1 to unitholders at tax time. LP distributions might embody Return of Capital, ROC, which gives you a tax deferral profit, but additionally decreases your tax foundation. There additionally might UBTI concerned. Please seek the advice of your tax advisor for extra particulars.

Insiders:

CFO Moriyama purchased ~8K items at $28.12, and CEO Ehrmann purchased 4450 items at $28.02 in early November. DMLP’s 52-week vary is $26.50 – $33.60.

Debt & Liquidity:

DMLP has no debt.

As of September 30, 2023, its NPI was in a surplus place and had excellent capital commitments, primarily within the Bakken area, equaling money readily available of $4.9M.

Efficiency:

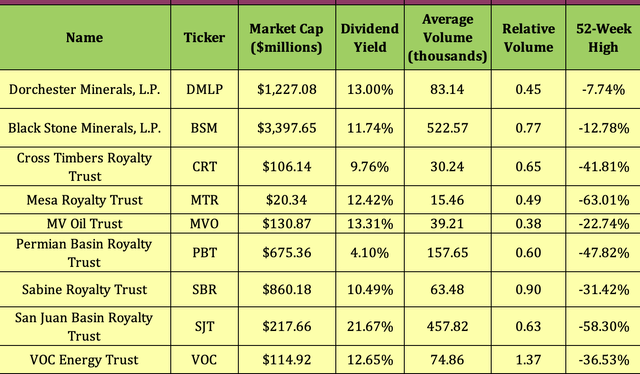

We checked out a number of different energy-related trusts’ dividend yields, buying and selling quantity and efficiency over the previous month, quarter, yr and yr up to now.

DMLP is the 2nd largest of the group, with a $1.23B market cap, behind Black Stone Minerals (BSM), $3.4B.

San Juan Basin Royalty (SJT) has the very best dividend yield, at 21.67%. MV Oil Belief (MVO) has the 2nd highest dividend yield, at 13.31%, with DMLP proper behind, at 13%. You possibly can see why some revenue traders favor vitality trusts, with many of the dividend yields in extra of 10%.

BSM and SJT have the very best common each day quantity by far, at 523K and 458K, respectively, whereas DMLP averages 83K. VOC Power Belief (VOC) is the one one on this group with over 1X relative quantity, whereas DMLP is barely at 45% of its common quantity.

Buyers are taking a pause – DMLP is simply 7.7% beneath its 52-week excessive, the closest to that determine on this group.

Hidden Dividend Shares Plus

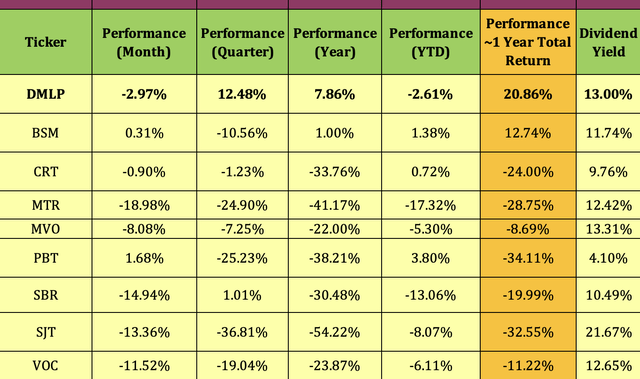

To date in 2024, DMLP has lagged PBT, BSM, and CRT, which all have constructive worth performances, vs. DMLP’s -2.6% mark.

Trying again over the previous yr, DMLP outperformed this group, with a 7.86% worth acquire, and a ~20.86% whole return. BSM was the one belief on this group with a 1-year worth acquire, and a constructive whole return.

Hidden Dividend Shares Plus

Parting Ideas:

Should you’re on the lookout for energy-related revenue, add DMLP to your watch record, and await a big market pullback earlier than shopping for items. It is at present ~15% beneath its all-time excessive.

Should you’re keen on different excessive yield automobiles, we cowl them each Friday and Sunday in our articles.

All tables furnished by Hidden Dividend Shares Plus, until in any other case famous.

[ad_2]

Source link