[ad_1]

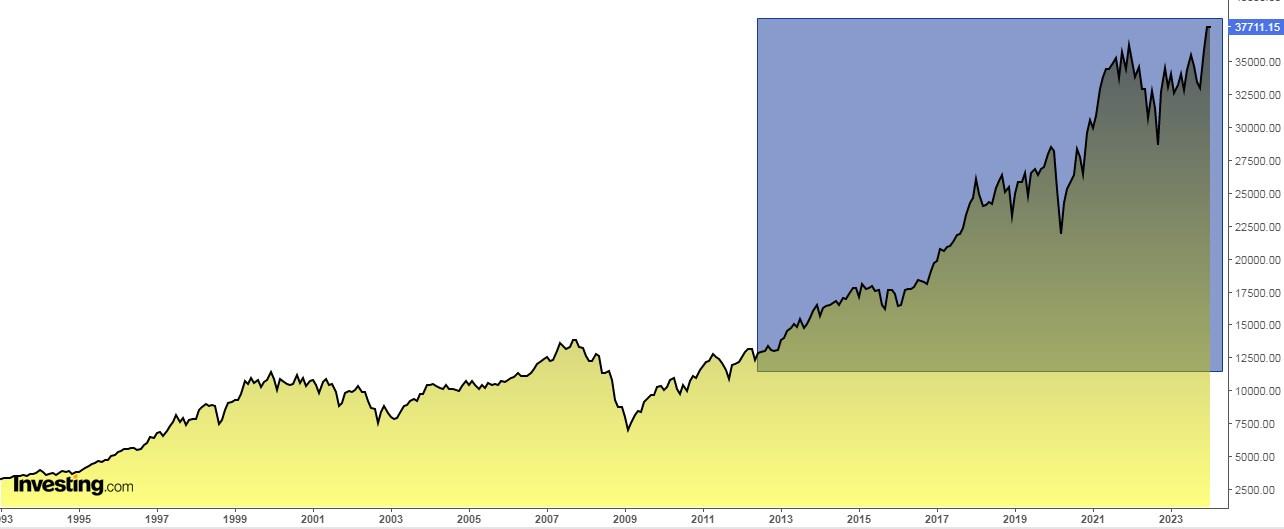

The Dow Jones, setting all-time highs in 2023 and early 2024, has now prolonged its streak to a formidable 12 consecutive years.

Moreover, Wall Avenue is eyeing Cathie Wooden’s ARK Innovation ETF shares, anticipating sturdy progress in 2024.

In the meantime, the Japanese inventory market, significantly the Nikkei 225, has proven outstanding power this yr to date.

Trying to beat the market in 2024? Let our AI-powered ProPicks do the leg give you the results you want, and by no means miss one other bull market once more. Study Extra »

Yesterday marked Martin Luther King Day, a federal vacation since 1983. Traditionally, the market has exhibited a optimistic common response on the Friday earlier than and a weaker efficiency on the next Tuesday. Listed here are the figures:

The , on common, falls by -0.31% the day after MLK.

The skilled a median decline of -0.25% on the day after.

The information a median drop of -0.22%.

The reveals a decline of -0.34%.

As of this writing, futures are deep into pink territory, so it seems as if historical past ought to prevail on this one once more immediately.

Furthermore on the historical past rimes entrance, regardless of the sluggish begin to the yr, alerts nonetheless look optimistic for the Dow.

In 2023, the the commercial index narrowly preserved a formidable streak, managing to set a minimum of one new all-time excessive annually for a number of consecutive years.

In 2023, with the achievement of setting all-time highs and an extra incidence in early 2024, the Dow Jones has now prolonged its streak to a formidable 12 consecutive years, matching the earlier report from 1989 to 2000.

Yr 2013: 52

Yr 2014: 38

Yr 2015: 6

Yr 2016: 26

Yr 2017: 71

Yr 2018: 15

Yr 2019: 23

Yr 2020: 14

Yr 2021: 45

Yr 2022: 2

Yr 2023: 7

Yr 2024: 1

It is noteworthy that contemplating the interval from 1900 to 2024, the Dow Jones skilled years of fluctuation. Over this span, there have been 56 years wherein it reached a minimum of one all-time excessive and 69 years wherein it didn’t.

Probably the most extended stretch with none all-time excessive occurred from 1930 to 1953.

5 Cathie Wooden Shares That Wall Avenue Is in Love With

Regardless of the optimistic winds for the Dow, it is one other sort of inventory that is been main the bunch: high-flying tech.

In truth, after a deep sell-off in 2022, Wall Avenue has been excited a couple of a number of shares held by Cathie Wooden in her ARK Innovation ETF (NYSE:), which ended 2023 with a return of +67%, beating the (+54%) and the (+24.23%).

Predominant shares in her ETF:

Verve Therapeutics Inc (NASDAQ:)

2U Inc (NASDAQ:)

Intellia Therapeutics Inc (NASDAQ:)

InVitae Corp (NYSE:)

Ginkgo Bioworks Holdings (NYSE:)

It is value noting that Cathie Wooden has resumed shopping for shares of Tesla (NASDAQ:) in 2024. This follows a sample the place she bought Tesla shares in a number of phases over three consecutive quarters all through 2023.

Intriguingly, she divested throughout a interval of sturdy inventory ascent and is now reacquiring them at a time when Wall Avenue is displaying growing skepticism in the direction of the corporate for varied causes:

A slowdown in electrical vehicles is anticipated.

Authorities incentives are coming to an finish.

The cheaper fashions of its Chinese language rival BYD (SZ:) pose a menace within the type of competitors and can attempt to snatch the primary place because the chief within the sector.

Particularly, she acquired 216,000 shares between December 20 and January 3.

Crude Oil: Greatest Risk to Inflation

costs surged (reaching above $80) after a U.S.-led coalition launched strikes in opposition to Houthi insurgent targets in Yemen.

Whereas the strikes have been aimed toward lowering the menace to worldwide delivery, they might escalate the battle within the Center East.

The primary upside danger to costs pertains to Iran and whether or not it turns into straight concerned within the battle, which may threaten oil provides in a area that produces a 3rd of the world’s crude.

The instability within the Pink Sea may prohibit for months a key route for exchanges between Asia and Europe, by which the passage of container ships, compelled to make longer and extra pricey journeys, has already been diminished by 90%.

In truth, the typical worth of delivery a container has soared this week by +85% greater than within the second half of December.

This may very well be a serious setback for the world economic system since 5% of worldwide commerce passes by this route, so many merchandise shall be significantly costly and it will not precisely assist inflation to fall.

The Rise of the Japanese Inventory Market

The index crossed the 35,000 mark for the primary time in virtually 34 years and over the previous 52 weeks, it has risen +36.7%, ending the week up over +6% and shocking everybody besides Warren Buffett, who began shopping for in Japan in 2020.

In the meantime, the index , which has a broader vary of corporations, rose for the seventh straight session.

Power in Japan has pushed each indexes to 34-year highs amid inflows from international buyers, a good change fee, and investor optimism {that a} decades-long deflation is nearing an finish.

As well as, Chinese language buyers are flocking to Japanese exchange-traded funds.

Rating of the inventory markets in 2024

Right here is the rating of the principle European and US inventory exchanges to date in 2024:

Japanese Nikkei +6.31%.

Italian +0.39%

+0,29%

Spanish -0.07

Dow Jones -0.26%

-0,26%

-0,28%

-0,92%

-1,03%

UK -1.40%

Investor sentiment (AAII)

Bullish sentiment, i.e. expectations that inventory costs will rise over the following six months, stands at 48.6% and is above its historic common of 37.5%.

Bearish sentiment, i.e. expectations that inventory costs will fall over the following six months, is at 24.2%, under its historic common of 31%.

***

In 2024, let arduous choices grow to be straightforward with our AI-powered stock-picking software.

Have you ever ever discovered your self confronted with the query: which inventory ought to I purchase subsequent?

Fortunately, this sense is lengthy gone for ProPicks customers. Utilizing state-of-the-art AI know-how, ProPicks gives six market-beating stock-picking methods, together with the flagship “Tech Titans,” which outperformed the market by 670% over the past decade.

Be a part of now for as much as 50% off on our Professional and Professional+ subscription plans and by no means miss one other bull market by not understanding which shares to purchase!

Declare Your Low cost Right now!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, or suggestion to take a position as such it’s not supposed to incentivize the acquisition of property in any means. I wish to remind you that any sort of asset, is evaluated from a number of factors of view and is extremely dangerous and due to this fact, any funding determination and the related danger stays with the investor.

[ad_2]

Source link

Add comment