[ad_1]

Euro (EUR/USD, EUR/GBP, EUR/JPY) Evaluation

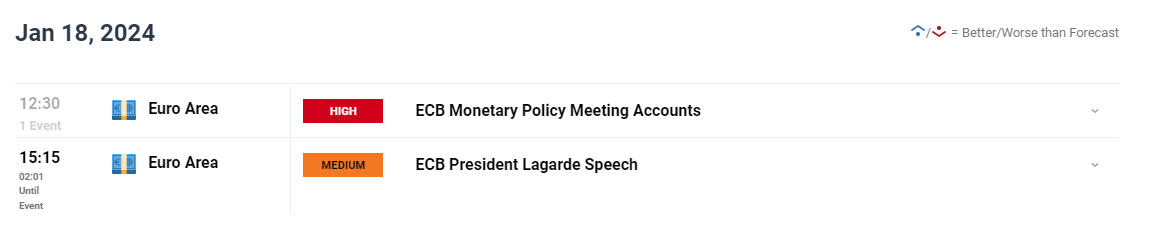

ECB Minutes Stress Progress on Wages a Prerequisite for two% Goal

The ECB minutes referring to the mid-December ECB assembly continued to warn in opposition to complacency as sticky worth pressures can jeopardise reaching the two% goal earlier than 2026. One of many chief considerations for the ECB has emerged by way of wages and the prospect of labour unions lobbying for increased wages in 2024 after seeing declines in actual wages in 2022 and 2023. Larger labour prices run the danger that corporations cross on the elevated expense to the tip client, probably stoking worth pressures additional.

Customise and filter reside financial knowledge by way of our DailyFX financial calendar

Advisable by Richard Snow

Buying and selling Foreign exchange Information: The Technique

The chart under portrays how inflation has been outpacing wage development in Europe however the hole is changing into smaller as disinflation takes maintain and nominal wages have been on the rise.

The ECB minutes additionally revealed that some Governing Council members most well-liked to finish full reinvestments of PEPP (the central financial institution’s model of QE) sooner than agreed however in any other case consensus was achieved among the many group.

EU Wage Development vs Inflation

Supply: Refinitiv, LSEG, ready by Richard Snow

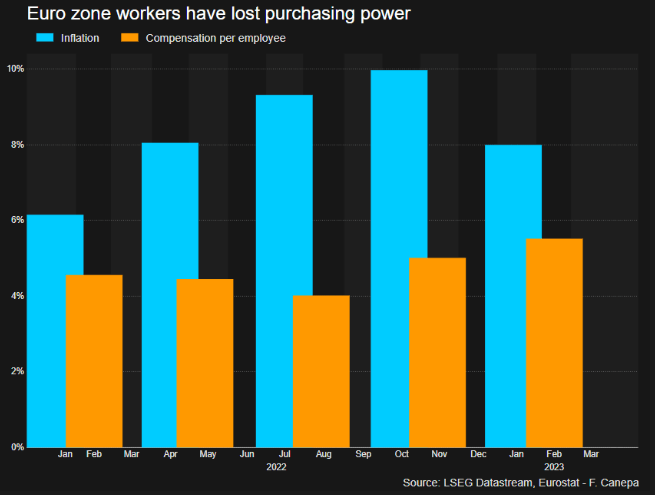

EUR/USD Bearish Continuation Underway because the Greenback Hits its Stride

Higher-than-expected US retail gross sales and the worldwide uptick in inflation has necessitated changes to the timing and magnitude of anticipated rate of interest cuts this 12 months. With markets having tapered aggressive price reduce expectations, the greenback emerged as one of many standout beneficiaries, weighing on EUR/USD.

On Tuesday, the pair broke out of what was a irritating interval of consolidation, buying and selling under the 50-day SMA. Right this moment, the pair now exams the 200-day easy shifting common (SMA), adopted carefully by 1.0831. Momentum seems to favour the draw back when observing the MACD indicator. Stagnant development in Europe continues to weigh on the Euro whereas the US financial system stays comparatively nicely positioned on this regard however development is predicted to ease additional.

EUR/USD Each day Chart

Supply: TradingView, ready by Richard Snow

Advisable by Richard Snow

Learn how to Commerce EUR/USD

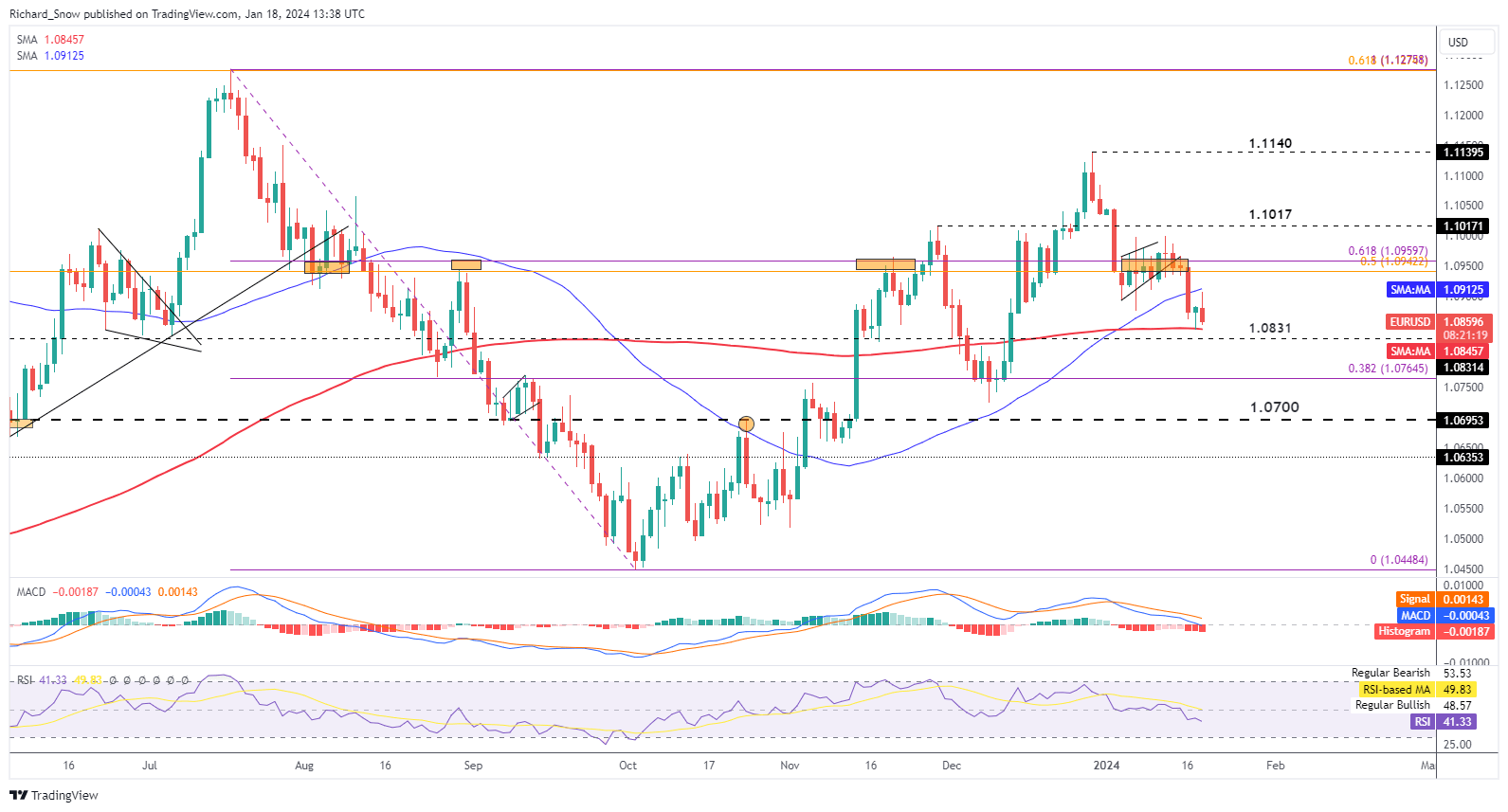

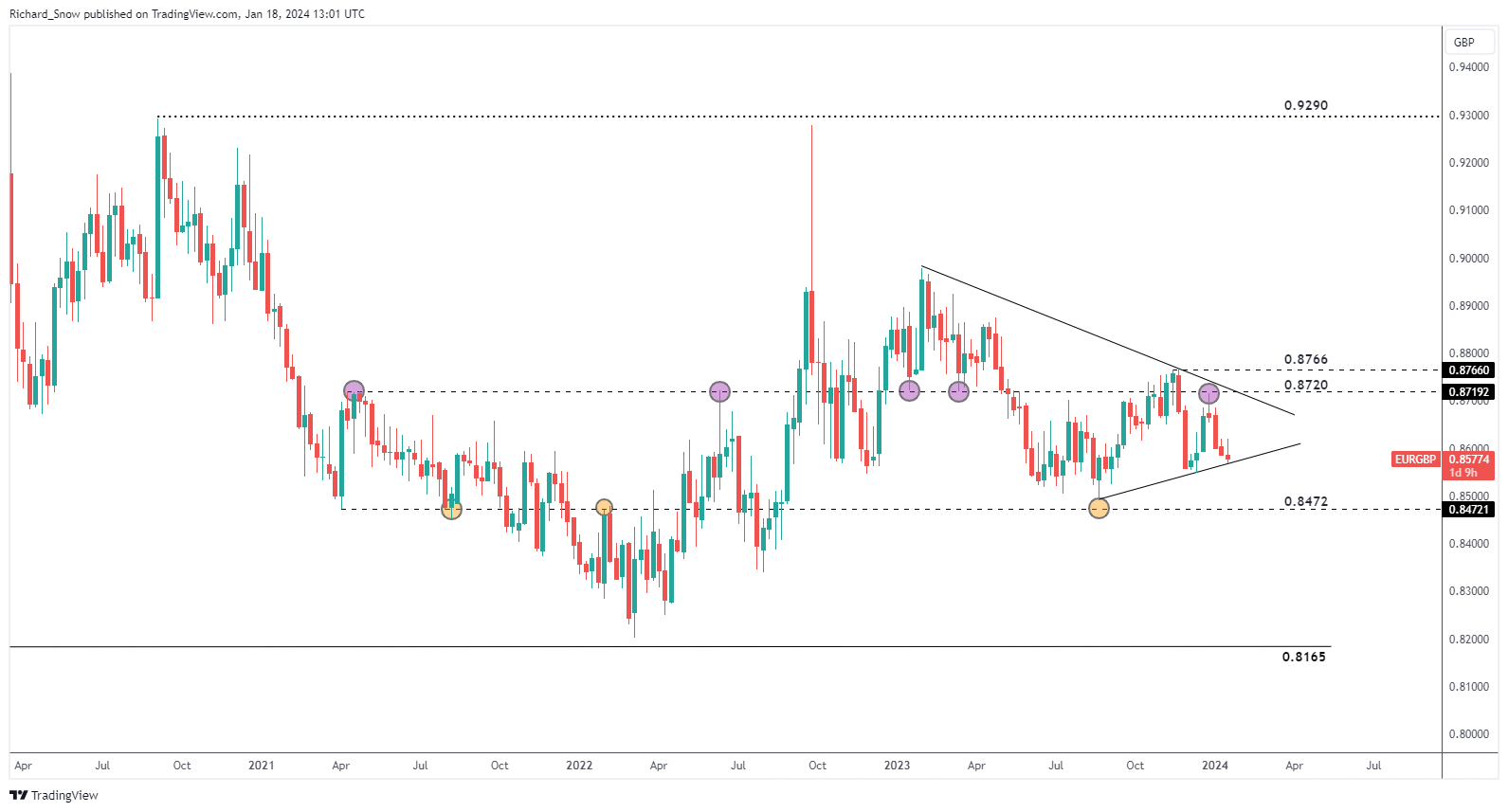

EUR/GBP Exhibits Early Indicators of Longer-Time period Bearish Continuation

EUR/GBP on the day by day chart reveals a need to commerce decrease after breaking out of the narrowing triangle sample, at the moment testing 0.8565, with 0.8515 the subsequent important stage of help. Earlier steerage seemed to the extra outstanding dotted line at 0.8635 for indicators of bullish intent – one thing that has not been confirmed and actually, costs are notably decrease since.

Current, elevated UK inflation knowledge has helped prop up the worth of sterling which offered the primary catalyst for the transfer to the draw back in EUR/GBP. Costs proceed to commerce under the 50 and 200-day SMA, one thing that’s sometimes noticed in down trending markets.

EUR/GBP Each day Chart

Supply: TradingView, ready by Richard Snow

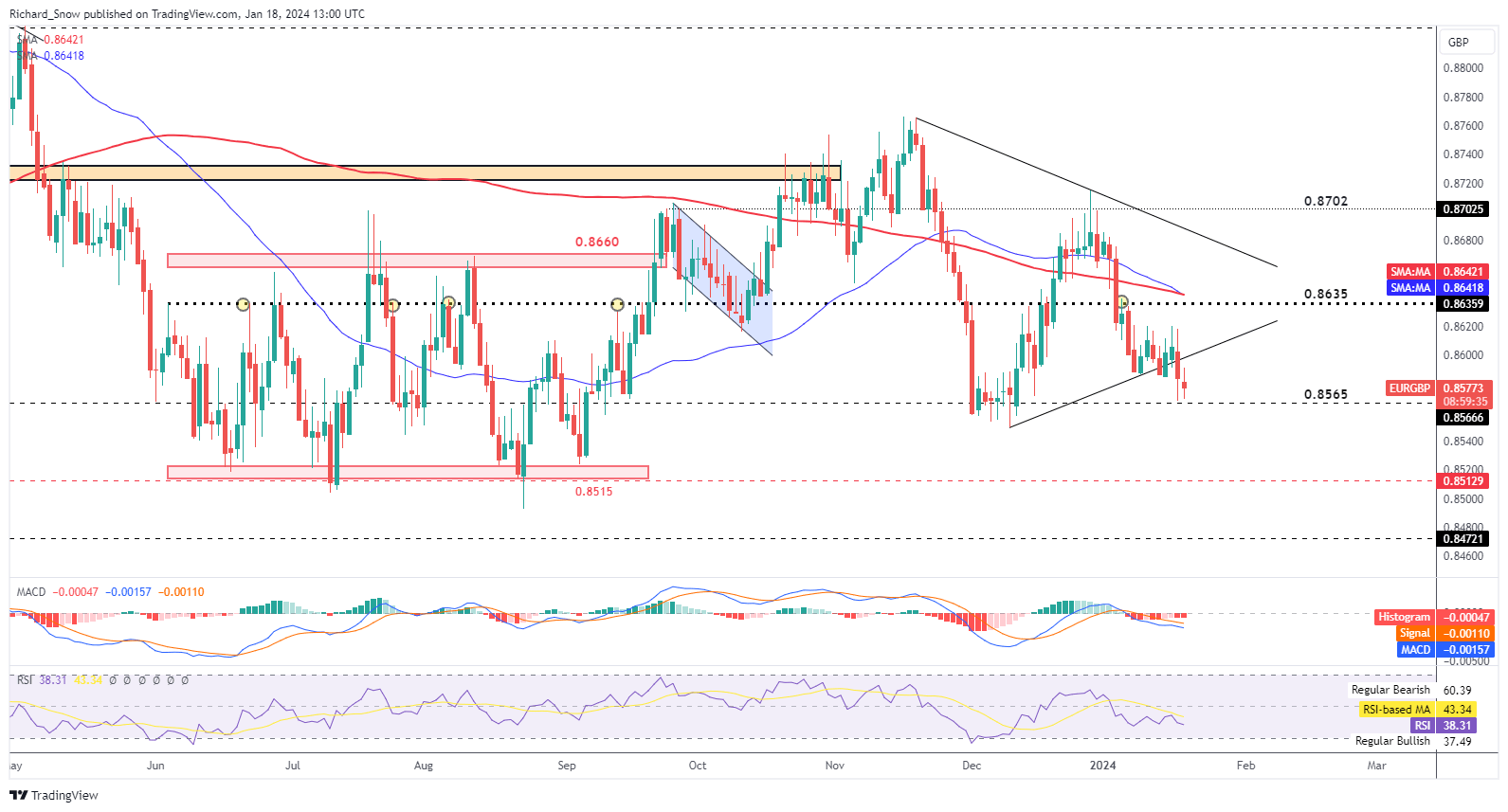

The weekly EUR/GBP chart at the moment holds its triangle sample however trendline help has come underneath strain this week. Taking a zoomed out take a look at the pair, the 0.8472 marker offers a potential stage of curiosity if a bearish transfer have been to increase over the medium-term.

EUR/GBP Weekly Chart

Supply: TradingView, ready by Richard Snow

Elevate your buying and selling expertise and achieve a aggressive edge. Get your palms on the Euro Q1 forecast right this moment for unique insights into key market catalysts that ought to be on each dealer’s radar:

Advisable by Richard Snow

Get Your Free EUR Forecast

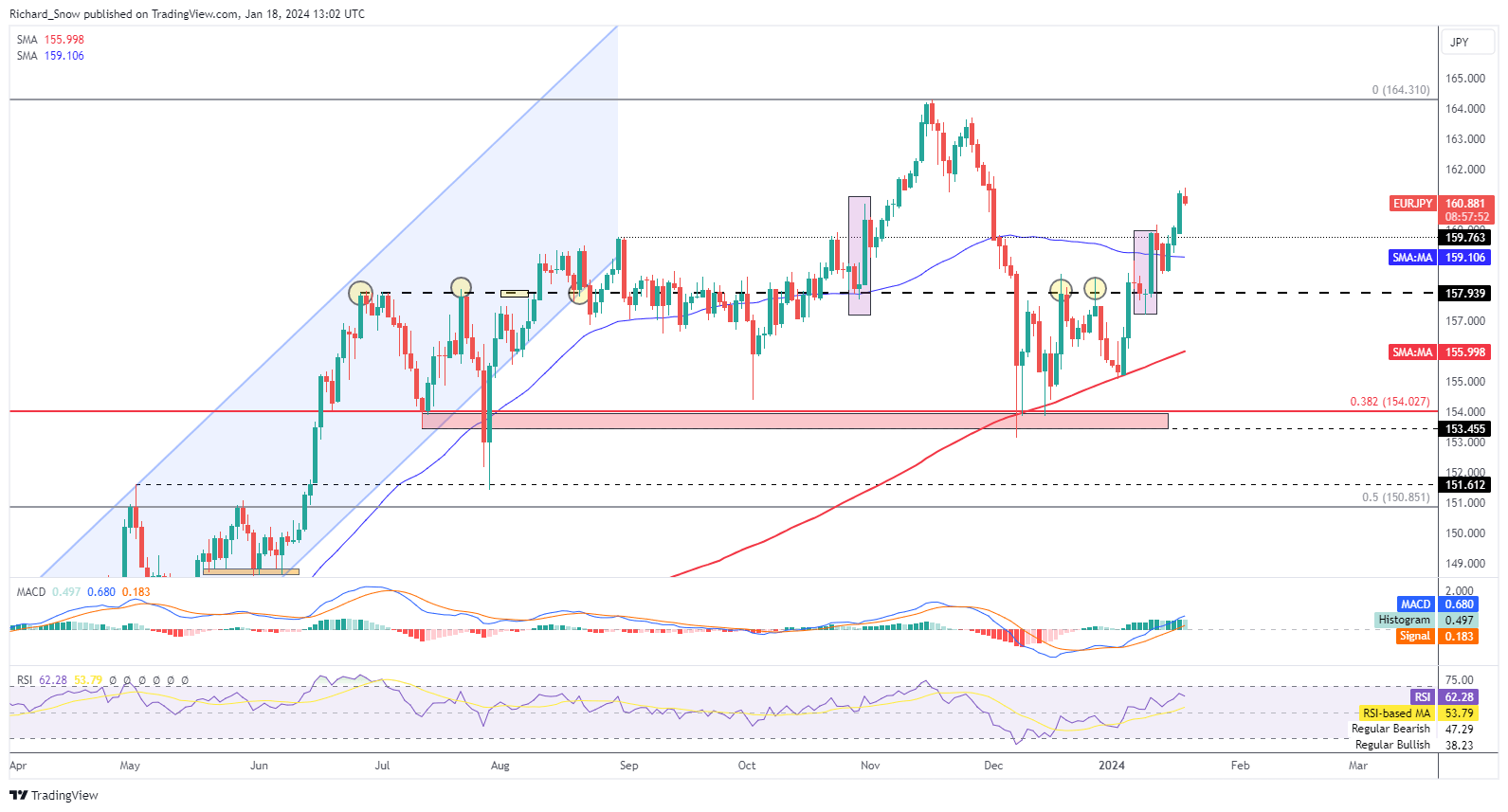

EUR/JPY Takes Benefit of a Depreciating Yen

EUR/JPY in contrast to the prior two chart setups, reveals bullish momentum. The pair trades barely decrease right this moment however worth motion within the first month of the 12 months has revealed nice bullish potential.

Whereas costs are decrease right this moment up to now, prior pullbacks in 2024 had confirmed to be short-lived, establishing the potential for a transfer in the direction of 164.31 – the prior swing excessive in November of final 12 months. The RSI is getting near breaching overbought territory that means it might be prudent to attend for a pullback adopted by extra upward momentum earlier than contemplating bullish EUR/JPY performs

GBP/JPY Weekly Chart

Supply: TradingView, ready by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and observe Richard on Twitter: @RichardSnowFX

factor contained in the factor. That is most likely not what you meant to do!

Load your software’s JavaScript bundle contained in the factor as an alternative.

[ad_2]

Source link