[ad_1]

Fokusiert

Heading into the biopharma Q3 earnings season, Financial institution of America has taken a bullish stance on Eli Lilly (NYSE:LLY) and Gilead (NASDAQ:GILD) whereas elevating considerations on COVID-era favorites resembling Pfizer (NYSE:PFE) and Regeneron (NASDAQ:REGN).

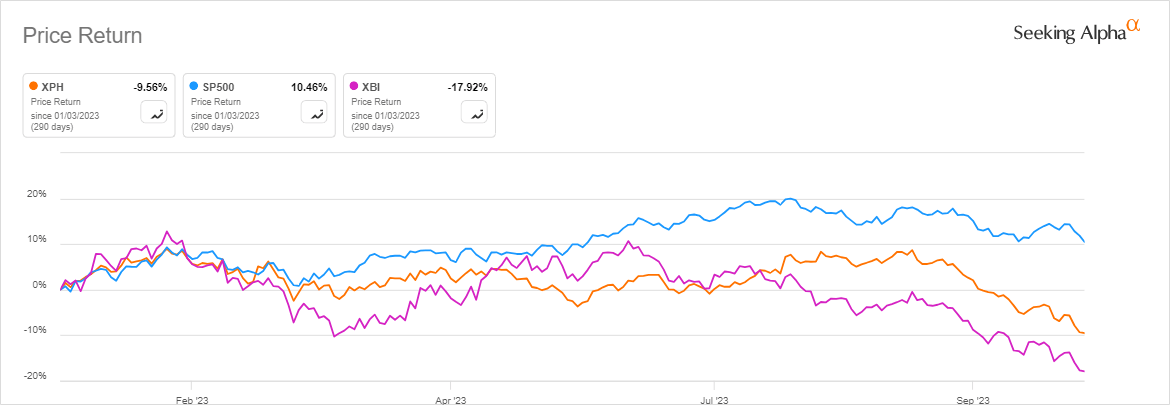

The top of the pandemic emergency has upended the healthcare sector, with biotech and pharma shares underperforming the broader market this 12 months, as indicated on this graph.

Traders have thrown their weight behind weight problems drug builders Novo Nordisk (NVO) and Eli Lilly (LLY) as makers of COVID-19 merchandise resembling Pfizer (PFE) and Regeneron (REGN) grapple with a decline in pandemic-era income growth.

Nevertheless, because the earnings season will get underway, Financial institution of America attributes biopharma’s YTD underperformance to sector rotation, noting that markets count on a “tender touchdown” amid enhancing macroeconomic situations.

“That stated, the main focus is prone to stay on industrial execution, versus macro dangers and the IRA,” BofA analyst Geoff Meacham wrote, indicating the significance of modifications launched by the Biden Administration’s Inflation Discount Act (IRA).

Forward of Q3 earnings, Meacham sees Eli Lilly (LLY) and Gilead Sciences (GILD) benefiting from robust demand for his or her merchandise, focused at diabetes/ weight reduction, and HIV, respectively.

With above-consensus Q3 gross sales estimates for each companies, Financial institution of America reaffirmed Purchase scores for LLY and GILD in a current analysis notice whereas maintaining their worth targets at $700 and $95, respectively.

Nevertheless, BofA shouldn’t be satisfied of the prospects of Pfizer (PFE) and Regeneron (REGN). Citing uncertainty in demand for the corporate’s COVID merchandise, the agency sees below-consensus Q3 gross sales for PFE and points a Impartial score and a $45 per share goal on the inventory.

Days in the past, Pfizer (PFE) lowered its 2023 income outlook by as a lot as $9B because of lower-than-anticipated gross sales for its pandemic-era merchandise, notably its COVID capsule, Paxlovid.

Nevertheless, BofA maintains the Underperform score and $680 per share goal on REGN. With below-consensus Q3 gross sales for REGN, Meacham cites strain on the corporate’s Eylea franchise within the U.S. regardless of current FDA approval of a high-dose model of the blockbuster eye remedy.

Extra on Gilead, Eli Lilly, and so on.

[ad_2]

Source link