[ad_1]

Rows of Photo voltaic Panels in Florida csfotoimages

Emera Included (OTCPK:EMRAF) (EMA.TO) (TSX:EMA:CA) is a Canadian-based electrical utility usually neglected and misunderstood by utility sector buyers. I’ve been a shareholder for nearly 10 years and have adopted the firm because it began enjoying fairness banker for sister Canadian utility Algonquin Energy (AQN) in 2010. I’m wanting so as to add to my place with additional inventory weak spot primarily based on Emera’s engaging yield, market valuation, and most significantly, its regulatory atmosphere.

Emera is a holding firm for six regulated utilities, which compares 90% of earnings. A fast synopsis is under, from their newest Traders Presentation:

Tampa Electrical

Utility Sort: Vertically built-in electrical utility

Regulator: Florida Public Service Fee

Regulatory Assemble: 9.25% – 11.25% authorised ROE (10.25% midpoint); 54% authorised fairness; $9.5 billion charge base; in yr 2 of a 3-year charge settlement

Prospects: ~827,000Generating Gas Combine: 78% Pure Fuel, 15% Photo voltaic, 7% Coal

Nova Scotia Energy

Utility Sort: Vertically built-in electrical utility

Regulator: Nova Scotia Utility & Assessment Board

Regulatory Assemble: 8.75% – 9.25% authorised ROE (9.0% midpoint); 40% authorised fairness; $4.6 billion charge base; in yr 1 of a 2-year charge settlement

Prospects: ~541,000

Producing Gas Combine: 44% Coal, 28% Pure Fuel and Oil, 21% Renewable, 7% Petcoke

Emera Newfoundland & Labrador Holdings

Maritime Hyperlink, Utility Sort: Electrical Excessive Voltage Transmission, ~310 miles

Regulator: Nova Scotia Utility & Assessment Board

Regulatory Assemble: 8.75% – 9.25% authorised ROE; 30% authorised fairness; $1.7 billion charge base

Labrador Island Hyperlink, Utility Sort: Electrical Excessive Voltage Transmission, ~685 miles

Regulator: Newfoundland and Labrador Board of Commissioners of Public Utilities

Regulatory Assemble: 8.50% authorised ROE; $740 million fairness funding

Peoples Fuel

Utility Sort: Pure gasoline distribution system

Regulator: Florida Public Service Fee

Regulatory Assemble: 8.9% – 11.0% authorised ROE (10.15% midpoint); 54.7% authorised fairness; $1.9 billion charge base

Prospects: ~468,000

New Mexico Fuel

Utility Sort: Pure gasoline transmission & distribution system

Regulator: New Mexico Public Regulation Fee

Regulatory Assemble: 9.375% authorised ROE; 52% authorised fairness; $0.8 billion charge base

Prospects: ~545,000

Emera Caribbean Utility Corporations: Barbados Mild & Energy and Grand Bahama Energy

Utility Varieties: Vertically built-in electrical utilities

Regulators: BLPC: Honest Commerce Fee, GBPC: The Grand Bahama Port Authority

Regulatory Assemble: BLPC: 10.0% ROE on $420 million fairness charge base; GBPC: 8.37% ROE on $275 million fairness charge base

Prospects: ~152,000Generating Gas Combine: 97% Oil-fired, 3% Renewables

As well as, Emera operates pure gasoline transmission pipelines in Japanese Canada and Florida together with a hydro-electric with pumped storage energy producing facility in Massachusetts. General, Emera has over $15 billion in regulated charge base belongings, companies 2.5 million prospects, and gives a various utility footprint.

In accordance with Regulatory Analysis Associates, a service of S&P International (SPGI), Emera operates in very engaging regulatory environments. As the last word gatekeeper of utility earnings, particular person regulatory businesses possess immense energy over the flexibility of utilities to reward shareholders. As readers know, RRA regulatory atmosphere scores are an essential due diligence issue when evaluating utilities and their funding desirability. In a current SA article

American Electrical Energy (AEP): Engaging Transmission Property, I provided the newest itemizing of states by RRA regulatory scores. S&P International just lately revealed its annual North American Regulated Utilities 2023 report and on pg. 28-29 lists their Canada Regulatory Jurisdiction Evaluation, as of Nov 2023, highlighting a Nova Scotia downgrade. The checklist under outlines every state’s scores together with the proportion of EMRAF regulated asset base inside that state:

Florida: 58% of complete regulated charge base; RRA score – Above Common

Nova Scotia: 22% of complete regulated charge base; RRA score – Sufficient (lowest of 5 teams, similar to Beneath Common within the US)

Newfoundland, Labrador: 12% of complete regulated charge base; RRA score – Extremely Credit score Supportive (similar to Above Common)

New Mexico: 4% of complete regulated charge base; RRA score – Beneath Common

Caribbean: 4% of complete regulated charge base; RRA rating- Common

Combining these profiles, 70% of Emera’s regulated asset base is overseen by regulators grouped as Above Common, 4% as Common, and 26% as Beneath Common. The Nova Scotia regulatory atmosphere is enhancing after a knee-jerk response in 2022 to the widespread utility theme of escalating ratepayer prices. The reactionary 40% fairness ratio is kind of punitive and one other charge evaluate due this yr with the expectation of this ratio being raised.

For buyers who do not recognize the impression of investing in the perfect regulatory atmosphere, Emera earns 63% extra on each greenback of regulated charge base asset in Florida than the similar greenback charge base asset in Nova Scotia. Within the newest IP linked above, EMRAF calculates that $100 charge base asset in FL earns the corporate a $5.51 return whereas $100 asset in Nova Scotia earns a $3.38 return. Even Beneath Common rated New Mexico permits EMRAF to earn $4.88 on a $100 charge base asset. It is not rocket science to understand that 75% of EMRAF capital investments from 2024 to 2027 shall be spent in Florida via its Tampa Electrical and Peoples Fuel.

Based mostly on knowledge from marketscreener.com and provided by S&P International, Emera is presently valued at a 2023 estimated PE of 15.8x, primarily based on 2023 earnings of USD$2.30 and presently yields 5.7% primarily based on 2023 distribution of $2.07 and a inventory value of USD$36.20 (Cnd$49.60). The desk under lists Canadian and USD earnings and dividend estimates for 2022 to 2025. The impression of the punitive charge actions by Nova Scotia regulators is clear within the under desk. If the 40% fairness ratio is raised this yr, 2025 earnings estimates might get a lift.

Emera Earnings, P/E, Dividend 2022 to 2025 (marketscreener.com, Guiding Mast Investments)

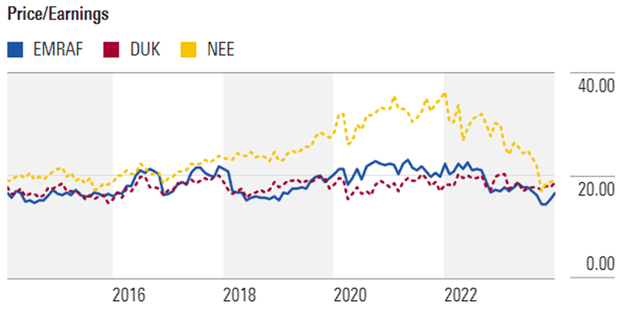

Morningstar charges Emera as 4 Stars and the inventory presently trades 10% under its Honest Worth of USD$40 (Cnd$54). M* calculates EMRAF P/E at 16.1x and gives the next historic chart of P/E comparability of EMRAF to Duke Vitality (DUK) and NextEra Vitality (NEE), two in style utilities additionally with publicity to the Florida regulatory atmosphere. As proven from the Morningstar graphic under, Emera is on the low finish of its historic P/E vary going again to 2014.

Historic P/E Ratio Emera, Duke, NextEra 2014 to 2023 (Morningstar)

Morningstar’s “Bulls Say – Bears Say” gives a concise recap of each side of the funding evaluation and their current evaluate of Emera isn’t any completely different:

Bulls Say

1. The transfer towards regulated operations drives charge base and earnings development certainty.

2. Emera earns regulated returns in many alternative states and provinces, defending its earnings from the impression of 1 antagonistic regulatory ruling.

3. The corporate’s Florida utility operates in a extremely constructive regulatory atmosphere with above common development alternatives.

Bears Say

1. The corporate’s aggressive funding plan will increase regulatory danger, significantly in Nova Scotia.

2. The corporate’s no-moat vitality companies unit brings some commodity danger and money move uncertainty to its regulated portfolio.

3. As with all utilities, rising rates of interest will elevate financing prices and will make the dividend much less engaging for revenue buyers.

Whereas in the long run, I imagine the utility regulatory atmosphere is the single-most important issue for utility buyers, there are dangers which must be monitored. Emera excels in its regulatory atmosphere attributes, however the politicization of charge setting in Nova Scotia has added a priority. As proven above, the discount in allowed returns mixed with a slashed ratio of allowed funding fairness negatively impacts EMRAF’s profitability. The obvious and anticipated result’s the discount in earnings in 2023 and past vs 2022. In response, administration has decreased capital investments in Nova Scotia. The Nova Scotia Utility & Assessment Board is anticipated to evaluate their 2022 charge ruling this yr. The chance to buyers is the Board doesn’t alter its allowed return components and the 22% of EMRAF’s charge base belongings in Nova Scotia continues to underperform. Nonetheless, I imagine this final result is already a think about earnings estimates and share costs. If the allowed return components improves in Nova Scotia, this might supply a optimistic flip for share value valuations as earnings prospects might enhance as properly. As with most all utility alternatives over the short-term, there’s a probability the falling-competitive-interest-rate inventory value rally, which started in October and November of final yr, might fizzle with any charge will increase by the Fed.

Emera inventory value has rebounded from its lows from final October and November, together with its peer utilities, as aggressive rates of interest have eased. In accordance with dividendchannel.com complete return calculator, over the previous 5 years, EMRAF complete return with dividends reinvested has generated 6.11% yearly, in keeping with S&P Utility ETF (XLU) complete annual return of 6.37%. From a yield vantage level, Emera’s 5.7% present and 5.9% ahead estimated 2024 yield is on the upper facet of electrical utility friends. The present yield ought to greater than offset investor objections to a below-utility-average anticipated dividend development charge. It’s also noteworthy the distribution is paid in Canadian {Dollars} that if the US Greenback declines in worth towards the Canadian Greenback, the after-exchange money dividend cost will enhance, including to EMRAF’s already engaging yield.

Based mostly on its regulatory atmosphere, present yield, and valuation, buyers ought to take into account including Emera to their utility portfolio. The yield is considerably above the common for the sector and the present P/E valuation has been on the low finish for the previous 5 years. In accordance with SA calculations, EMRAF’s common yield over the previous 4 years is 4.71% vs 3.43% for the utility sector, making the present 5.7% yield extraordinarily engaging.

If I used to be not a shareholder, the present value, yield, and potential complete return is sufficiently engaging to institute a place. I count on a rocky first half of 2024 with a powerful potential for market dips over the following few months. If the market falls between now and the third qtr., I’ll fortunately add extra EMRAF with any dip under $34, making Emera an chubby funding in my utility portfolio. I view shopping for Emera on the present value as a sexy long-term funding for each revenue and development, and any extra value decline as a long-term cut price.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please concentrate on the dangers related to these shares.

[ad_2]

Source link