[ad_1]

U.S. unemployment shoots as much as 3.9%

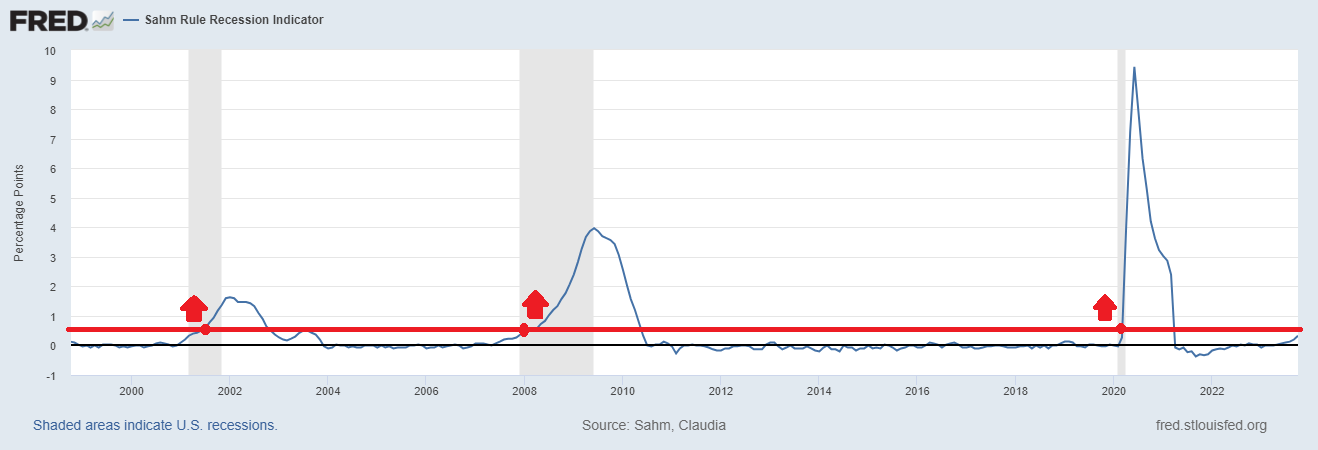

Sahm’s rule suggests potential recession, because the quarterly transferring common of the unemployment charge nears the 0.5% threshold

In the meantime, cryptocurrencies surge as financial indicators fluctuate, prompting hypothesis on their position as safe-haven investments

Unlock the potential of InvestingPro for as much as 55% off this Black Friday and by no means miss out on a market winner once more

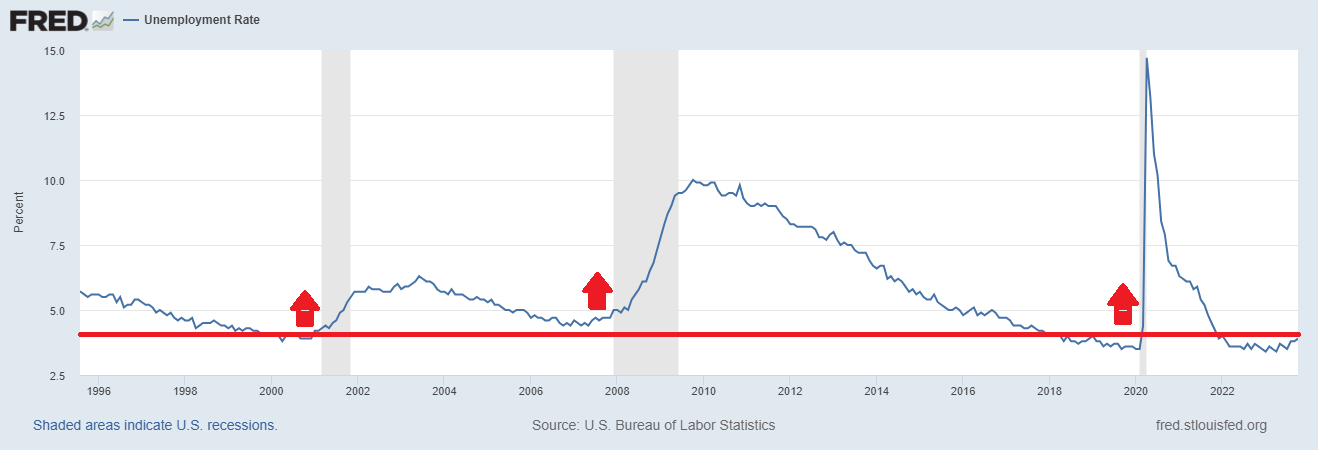

Final week’s U.S. employment information revealed the for October at 3.9 %. Though this determine is traditionally low, it has surpassed the sooner low of three.4 % recorded earlier this yr.

This brings Sahm’s rule to thoughts, because it carefully screens the potential onset of a recession. Created in 2019 based mostly on analysis by Federal Reserve economist Claudia Sahm, this extremely correct indicator states that when the quarterly transferring common (because the month-to-month charge typically fluctuates an excessive amount of) of the unemployment charge rises by 0.5 % from the earlier 12-month low, it indicators that the financial system will very doubtless enter a recession within the subsequent 12 months.

Presently the quarterly transferring common of the unemployment charge has elevated to 0.33 % from the one-year low, nonetheless removed from the 0.5 % threshold that signifies a recession, thus nonetheless inadequate however stays worrisome.

Confirming the indicator, traditionally, any activation of the Sahm rule will immediate unemployment to proceed rising.

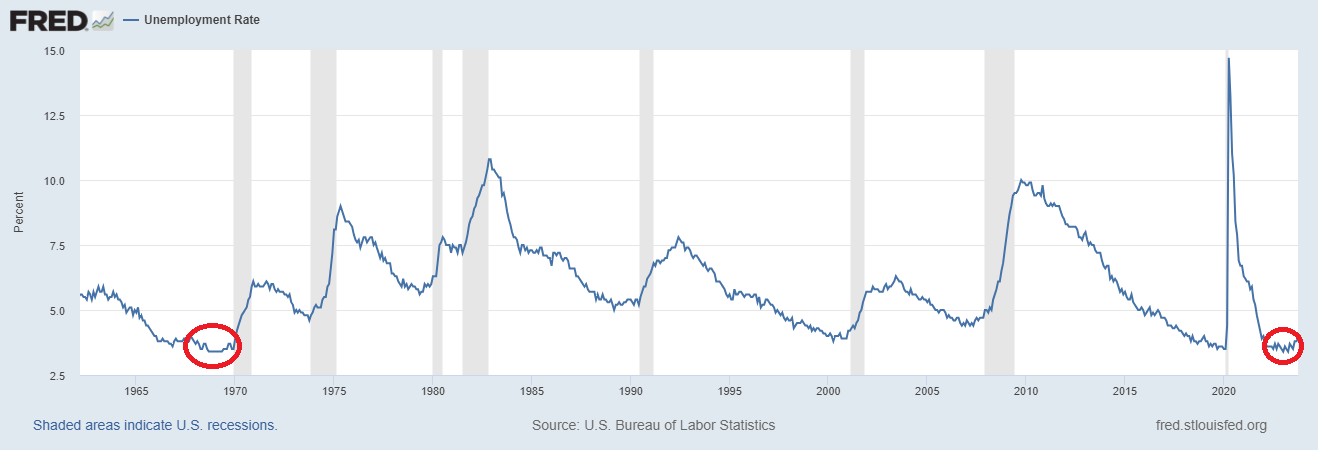

From the graph we will see how unemployment typically reaches a cyclical low, earlier than a recession, after which explodes upward above 4 %, as appears to be taking place over the previous yr. In the present day it’s at 3.9 %, after having been at ranges just like the lows of the previous 50 years.

Might this sign a recession within the coming months?

Presently, the indications current a combined image—think about the hiring charge, which has dipped beneath pre-Covid ranges, juxtaposed with a persistently low layoff charge. Amidst this, client spending development maintains its strong trajectory.

Might Crypto Be the Answer?

Turning consideration to the cryptocurrency panorama, these weeks have confirmed fairly eventful for . It showcased a constructive efficiency of roughly 8 % final week, surging to 52-week highs and surpassing the $37,000 mark.

additionally skilled a rally of greater than 14.5 %. Whereas the cryptocurrency has seen an general rise of over 120% because the starting of the yr, noteworthy peaks occurred in January, March, June, and the current, as illustrated within the chart beneath.

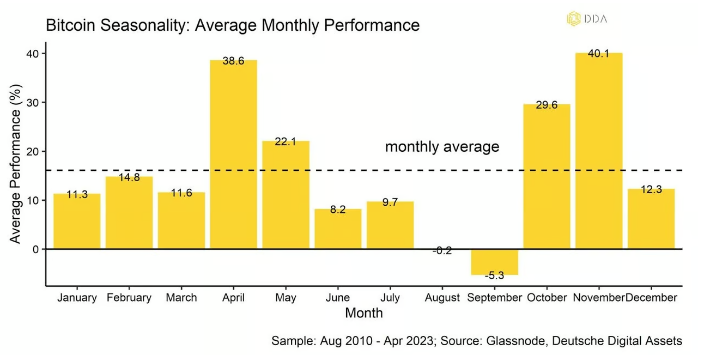

The truth that Bitcoin is now above 52-week highs (now on the highs of the previous 18 months), confirms that November is likely one of the finest performing months

In reality, traditionally talking, Bitcoin has persistently delivered remarkably excessive common returns (+40%). Nevertheless, it is essential to notice that its all-time excessive, just under $69,000, occurred exactly two years in the past. Regardless of a surge of over 100% in 2023, the present downturn is substantial, standing at 45%—exceeding the typical decline of 40.4% since 2016. Given the present worth ranges, a retesting of those highs would not seem imminent.

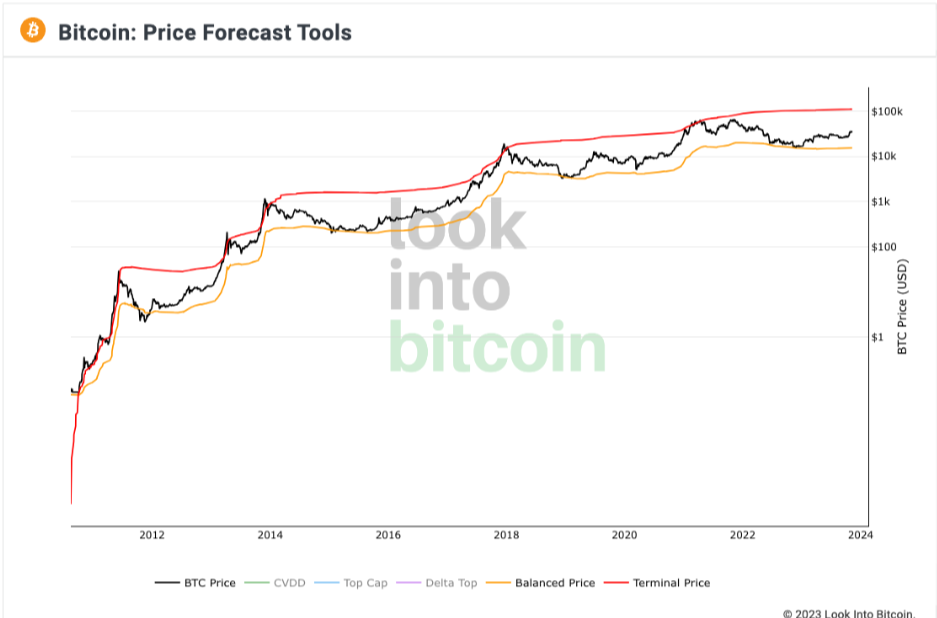

Trying forward, analysts level to the upcoming block halving (Halving) scheduled for April 2024, with a goal of $130,000. This projection is derived from Bitcoin’s “Transferred Value” analyzed by Look Into Bitcoin’s Terminal Value, a metric based mostly on hodler exercise indicated by the division of Coin Days Destroyed by the present provide.

The Terminal Value manifests on the “peak” of every BTC worth cycle, notably touching the trendline (crimson) through the all-time excessive in 2017 and the preliminary peak in April 2021. Notably, the $69,000 mark has not been registered as a “excessive” but, suggesting the potential for a fair increased peak sooner or later.

Is Bitcoin the most effective funding at this level? What do you suppose?

***

Purchase or Promote? Get the reply with InvestingPro for Half of the Value This Black Friday!

Well timed insights and knowledgeable choices are the keys for maximizing revenue potential. This Black Friday, make the neatest funding choice available in the market and save as much as 55% on InvestingPro subscription plans.

Whether or not you are a seasoned dealer or simply beginning your funding journey, this supply is designed to equip you with the knowledge wanted for extra clever and worthwhile buying and selling.

**Disclosure: The creator holds no positions in any of the securities talked about on this report.

[ad_2]

Source link