[ad_1]

VioletaStoimenova

With a market capitalization of $1.29 billion, Enterprise Monetary Companies Corp (NASDAQ:EFSC) shouldn’t be precisely a big financial institution. But it surely’s not a small one, both. In recent times, administration has succeeded in rising the financial institution at a relatively good clip. Rising belongings has been instrumental in pushing up income and income over the previous few years. Relative to earnings and ebook worth, shares of the financial institution are engaging and deposit progress is interesting. Whereas not every little thing in regards to the establishment is ideal, it does look fascinating sufficient to warrant a “purchase” ranking presently.

A stable alternative proper now

In line with the administration staff at Enterprise Monetary Companies, the corporate operates as a monetary holding agency that’s primarily based out of Missouri. Like all different banks on the market, it gives a big selection of companies. It accepts deposits from prospects and lends these deposits out within the type of loans. Examples embrace, however are usually not restricted to, industrial and industrial loans, loans devoted for the acquisition of business actual property, actual property development loans, residential actual property loans, and extra. However the agency does extra than simply this. The corporate additionally has a wealth administration arm that gives companies to people and company prospects and it has another miscellaneous operations as properly.

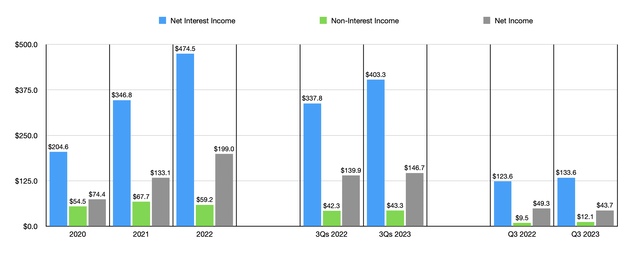

Creator – SEC EDGAR Knowledge

Over the previous few years, administration has completed a reasonably good job of rising the enterprise. Web curiosity earnings, as an example, jumped from $204.6 million in 2020 to $474.5 million in 2022. Non-interest earnings has remained in a reasonably slim vary throughout this window of time. However that has not stopped web income from climbing from $74.4 million to $199 million. Up to now this 12 months, the overall development has been constructive. Non-interest earnings inched up from $42.3 million final 12 months to $43.3 million this 12 months. However the true winner has been web curiosity earnings. It popped from $337.8 million to $403.3 million. And this has helped web income to develop from $139.3 million to $146.7 million.

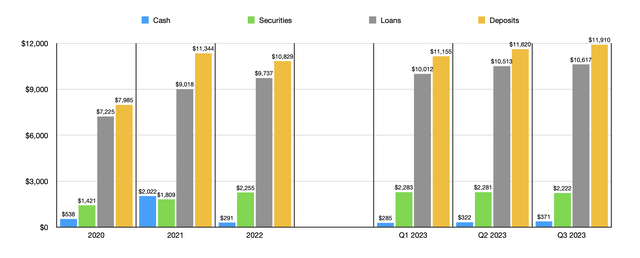

Creator – SEC EDGAR Knowledge

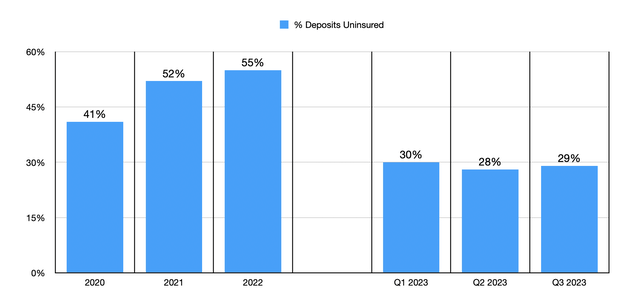

This progress over time has solely been made attainable by a progress in belongings. And a progress in belongings has solely been made attainable by rising deposits. Deposits spiked from $7.99 billion in 2020 to $11.34 billion in 2021. They did then fall to $10.83 billion in 2022. However since then, the financial institution has seen a rebound on this entrance. By the third quarter of 2023, deposits had grown to $11.91 billion. This progress occurred whilst administration made a concerted effort to scale back publicity to uninsured deposits. These managed to fall from 55% of whole deposits on the finish of final 12 months to 29% as of the tip of the newest quarter. That is just under the 30% threshold that I have a tendency to love as a most. In order that’s nice to see.

Creator – SEC EDGAR Knowledge

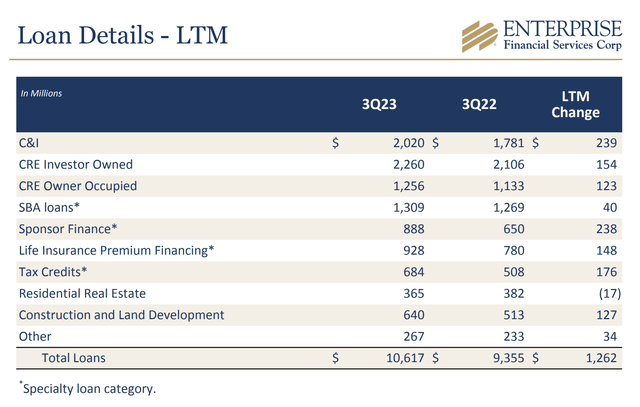

As deposits have grown, loans have adopted go well with. They grew from $7.22 billion in 2020 to $9.74 billion final 12 months. By the tip of the newest quarter, they elevated additional to $10.62 billion. I do perceive that one space that traders have been frightened about in terms of loans has been publicity to workplace properties. The excellent news for shareholders is that solely $483.6 million, or 4.6%, of all loans on the corporate’s books contain workplace actual property. This says so much when you think about that 33.1% of the corporate’s mortgage portfolio is within the type of industrial actual property. One other 19% includes industrial and industrial loans, whereas SBA loans are available third place at 12.3%.

Enterprise Monetary Companies

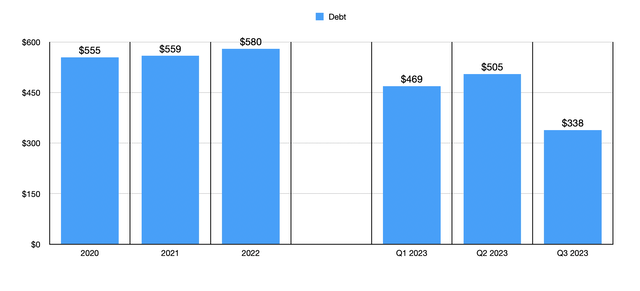

There are another metrics that we needs to be taking note of. As an example, from 2020 to 2022, the worth of securities within the firm’s portfolio expanded from $1.42 billion to $2.25 billion. That quantity has moderated since then and presently sits barely decrease at $2.22 billion. Money, in the meantime, has been on the rise because the finish of final 12 months. At the moment, money and money equivalents totaled $291.4 million. In the present day, that quantity is $370.7 million. What’s actually spectacular is that securities have remained elevated, loans have continued to develop, and money has additionally continued to develop, all whereas debt has dropped. On the finish of 2022, debt totaled $579.5 million. That quantity has since declined to $338.2 million at the moment.

Creator – SEC EDGAR Knowledge

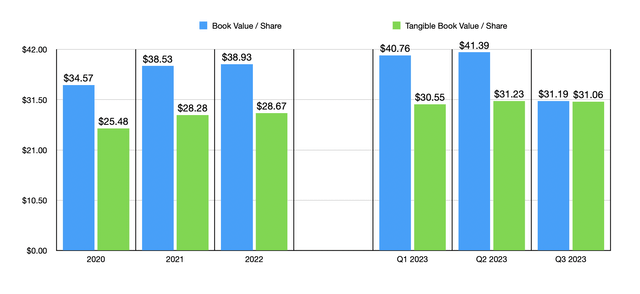

One other constructive factor in regards to the financial institution is that it has succeeded in regularly rising its ebook worth per share. That progress has not all the time been linear. However the basic development is evident. In 2020, ebook worth is $34.57 whereas tangible ebook worth was $25.48. These numbers grew to $38.93 and $28.67, respectively, final 12 months. And that development of gradual progress has continued to this point this 12 months. As of the tip of the third quarter, the ebook worth per share of the corporate stood at $41.19. In the meantime, the tangible ebook worth was at $31.06.

Creator – SEC EDGAR Knowledge

In the case of valuing a financial institution, there are two strategies that I like to make use of. The primary is worth relative to ebook worth. On this case, as of this writing, Enterprise Monetary Companies is buying and selling at a 15.1% low cost to its ebook worth per share and at a 12.7% premium to its tangible ebook worth per share. I’ve seen many banks each above and beneath each of those numbers. I might say that that is par for the course relating to what I’ve seen for a lot of this 12 months.

The opposite method to have a look at the images is thru the lens of earnings. Utilizing final 12 months’s outcomes, the corporate is buying and selling at a worth to earnings a number of of 6.5. That is fairly a bit decrease than what I’ve seen, but it surely’s not the bottom. The common within the area proper now could be round 10.4. So this does point out some upside potential.

Takeaway

All issues thought of, I might say that Enterprise Monetary Companies makes for an fascinating prospect. I do not see any main crimson flags, to be completely sincere. Debt is manageable, uninsured deposit publicity is throughout the vary of what I like, deposits proceed to develop at a pleasant clip, and that has allowed loans and securities to develop as properly. Shares are attractively priced, and whereas the corporate has seen a little bit of weak point on the underside line in the newest quarter, the general development will probably find yourself constructive. When all of these items are added collectively, this makes me really feel assured assigning the financial institution a ‘purchase’ ranking proper now.

[ad_2]

Source link