[ad_1]

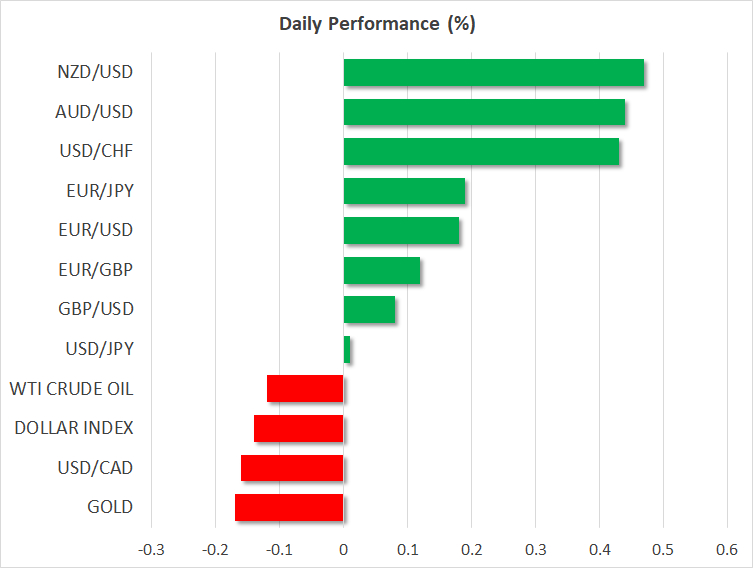

Shares edge larger as Chairman Powell sounds reassuring The market continues to be pushed by fundamentals, reacting to nearly each single piece of knowledge. We stay within the “unhealthy information is sweet information” part because the market yesterday tried to largely ignore the stronger ADP employment report, which has misplaced a few of its predictive potential relating to Friday’s non farm payrolls, and targeted on the weaker ISM companies PMI. Whereas the lower within the headline ISM was respectable, the inventory market most likely bought a bit excited when it drilled down the information and found that the costs paid subindex dropped to the bottom level since March 2020. That is most likely the strongest indication thus far of abating inflationary pressures within the US economic system. Due to this fact, tomorrow’s labour market report is much more essential for sentiment. US inventory indices completed Wednesday’s session within the inexperienced however there may be angst and uncertainty concerning the short-term outlook which may rapidly lead to a sizeable correction if tomorrow’s information fails to level to a weakening labour market. Fed Chairman Powell tried to downplay the significance of the stronger information prints and reassure the market concerning the Fed’s fee minimize aspirations, however it’s apparent that the US financial outlook stays optimistic. This case is fueling hawkish commentary from some Fed officers, which the market doesn’t take pleasure in. On Wednesday, Atlanta Fed Governor Bostic, a 2024 voter, talked concerning the first fee minimize happening within the last quarter of 2024. Eight extra Fed audio system can be on the wires throughout right now’s session masking your complete spectrum of doves and hawks and probably impacting right now’s market sentiment. Oil rallies as euro space inflation eases additional Within the meantime, oil costs proceed to rise with sure funding homes pointing to additional upside. Numerous causes may clarify the present transfer together with geopolitical developments, provide points and the renewed greenback weak point, however some market individuals are pointing to China’s progress choosing up tempo. If that is certainly the case, it may show to be an important improvement in 2024 to date with sturdy implications throughout the globe and particularly the euro space. Yesterday’s euro space combination inflation report confirmed expectations for a weaker print with the core indicator dropping under 3% for the primary time since March 2022. There’s a sturdy perception that the ECB is making ready for its fee minimize announcement in June with the inspiration presumably being laid out at subsequent week’s ECB assembly. Right this moment, the minutes from the final ECB assembly can be launched however they don’t are typically market-moving. Gold reached $2,300, bitcoin underneath stress Gold continued its journey north reaching a brand new all-time excessive above $2,300 earlier right now, benefiting from the renewed greenback weak point. On the flip facet, bitcoin stays underneath stress, matching partly the US inventory markets’ efficiency and making ready for an action-packed Friday session.

[ad_2]

Source link